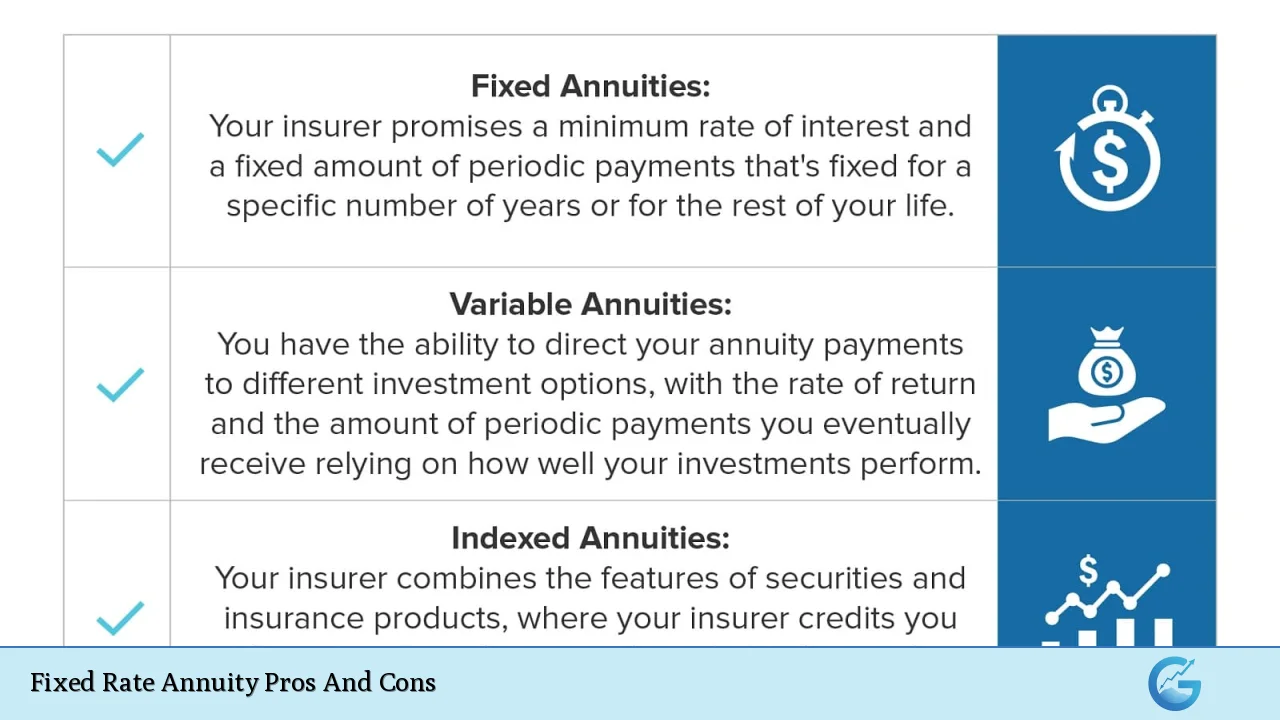

Fixed rate annuities are investment products offered by insurance companies that provide a guaranteed rate of return over a specified period. They are designed primarily for individuals seeking stable income during retirement. As financial markets become increasingly volatile, many investors are looking for ways to secure their retirement savings while ensuring a steady income stream. This article delves into the advantages and disadvantages of fixed rate annuities, providing a comprehensive overview for potential investors.

| Pros | Cons |

|---|---|

| Guaranteed returns on investment | Limited growth potential |

| Predictable income stream | High fees and surrender charges |

| Tax-deferred growth | Inflation risk |

| Low minimum investment requirements | Lack of liquidity |

| Safety and security of principal | Dependence on insurer’s financial strength |

| Flexible payout options | Complexity of terms and conditions |

Guaranteed Returns on Investment

One of the most significant advantages of fixed rate annuities is the guaranteed returns they offer. Unlike stocks or mutual funds, where returns can fluctuate based on market performance, fixed annuities provide a predetermined interest rate for the duration of the contract. This feature makes them particularly appealing to conservative investors who prioritize stability over high returns.

- Predictable income: Investors can plan their finances with certainty, knowing exactly how much they will receive over time.

- Low risk: The guaranteed nature of these investments minimizes exposure to market volatility.

Predictable Income Stream

Fixed rate annuities are designed to provide a reliable income stream, which is especially beneficial for retirees who need consistent cash flow to cover living expenses.

- Lifetime income options: Many fixed annuities offer options for lifetime payouts, ensuring that individuals do not outlive their savings.

- Budgeting ease: Knowing the exact amount of monthly income aids in effective budgeting and financial planning.

Tax-Deferred Growth

Another advantage is that earnings from fixed rate annuities grow on a tax-deferred basis until withdrawal. This means that investors do not pay taxes on interest earned until they start taking distributions.

- Tax efficiency: This feature allows for potentially greater accumulation of wealth over time compared to taxable accounts.

- Retirement planning: Tax deferral can be a strategic advantage in retirement planning, as it allows funds to grow without immediate tax implications.

Low Minimum Investment Requirements

Fixed annuities often have lower minimum investment thresholds compared to other financial products, making them accessible to a broader range of investors.

- Affordability: Many contracts can be initiated with as little as $1,000, allowing individuals to start investing early.

- Encouragement of saving: Lower barriers to entry can motivate individuals to save for retirement more effectively.

Safety and Security of Principal

Investors in fixed rate annuities benefit from the safety and security provided by insurance companies. These products are often backed by state regulations that require insurers to maintain sufficient reserves.

- Principal protection: Investors can feel secure knowing their initial investment is protected against market downturns.

- Regulatory oversight: Insurance companies are subject to strict regulatory standards, which adds an additional layer of security.

Flexible Payout Options

Fixed rate annuities offer various payout options tailored to meet individual needs. Investors can choose how and when they want to receive their money.

- Customization: Options may include lump-sum payments or regular monthly distributions, allowing flexibility based on personal circumstances.

- Strategic withdrawals: Investors can plan withdrawals according to their financial needs in retirement.

Limited Growth Potential

Despite their many advantages, fixed rate annuities come with significant drawbacks. One major disadvantage is their limited growth potential compared to other investment vehicles like stocks or mutual funds.

- Low returns: The guaranteed interest rates are often lower than what one might earn through more aggressive investments, particularly in a rising market.

- Teaser rates: Some contracts may offer attractive initial rates that drop significantly after a few years, leaving investors with lower returns than expected.

High Fees and Surrender Charges

Fixed rate annuities can come with various fees that may diminish overall returns. These include surrender charges if funds are withdrawn before the end of the contract term.

- Costly penalties: Withdrawals made during the surrender period can incur hefty fees, which may deter access to funds when needed most.

- Management fees: Some contracts have ongoing management fees that further reduce net returns over time.

Inflation Risk

A significant concern with fixed rate annuities is their vulnerability to inflation. While they provide stable income, this income does not typically adjust for inflation over time.

- Erosion of purchasing power: Fixed payments may lose value in real terms as living costs rise, potentially impacting long-term financial security.

- Limited inflation protection options: Few fixed annuity contracts offer inflation protection features, making them less appealing in an inflationary environment.

Lack of Liquidity

Fixed rate annuities are generally illiquid investments. Once funds are committed, accessing them before the contract matures can be challenging and costly.

- Access limitations: Most contracts allow only limited withdrawals (often up to 10% per year) without incurring penalties.

- Long-term commitment: Investors must be prepared to lock away their money for extended periods, which may not suit everyone’s financial situation or needs.

Dependence on Insurer’s Financial Strength

Investors must consider the financial stability of the insurance company issuing the fixed annuity. The guarantees provided by these products depend heavily on the insurer’s ability to meet its obligations.

- Credit risk: If an insurance company faces financial difficulties or bankruptcy, it may struggle to honor its contractual commitments.

- Research necessary: Investors should thoroughly research an insurer’s ratings and financial health before committing funds to ensure reliability and security.

Complexity of Terms and Conditions

Fixed rate annuities often come with complex terms and conditions that can confuse investors. Understanding all aspects of the contract is crucial before making a commitment.

- Need for diligence: Potential investors should carefully review all terms related to fees, withdrawal limits, and payout structures before signing any agreements.

- Consultation recommended: Engaging with a financial advisor can help clarify complex details and ensure informed decision-making regarding these products.

In conclusion, fixed rate annuities present both compelling advantages and notable disadvantages for investors seeking stable retirement income. They offer guaranteed returns, predictable income streams, tax-deferred growth, low minimum investments, safety of principal, and flexible payout options. However, potential downsides include limited growth potential, high fees and surrender charges, inflation risk, lack of liquidity, dependence on insurer stability, and complexity in terms and conditions.

Individuals considering fixed rate annuities should weigh these factors carefully against their personal financial goals and risk tolerance. Consulting with a financial advisor is advisable to navigate these decisions effectively and align them with broader investment strategies tailored to individual needs.

Frequently Asked Questions About Fixed Rate Annuity Pros And Cons

- What are the primary benefits of fixed rate annuities?

The main benefits include guaranteed returns, predictable income streams during retirement, tax-deferred growth on earnings, low minimum investment requirements, safety of principal from market fluctuations, and flexible payout options. - What are the main drawbacks associated with fixed rate annuities?

The primary drawbacks include limited growth potential compared to other investments, high fees and surrender charges for early withdrawals, inflation risk due to fixed payments not adjusting over time, lack of liquidity preventing easy access to funds, dependence on the insurer’s financial strength for guarantees, and complexity in understanding contract terms. - How do fixed rate annuities compare with other retirement investment options?

Fixed rate annuities provide stability and guaranteed returns but typically offer lower growth potential than stocks or mutual funds. They are often used as part of a diversified retirement strategy alongside other investment vehicles. - Are there any tax advantages associated with fixed rate annuities?

Yes, earnings grow tax-deferred until withdrawal. This allows investors to accumulate more wealth over time compared to taxable accounts where earnings would be taxed annually. - What should I consider before purchasing a fixed rate annuity?

You should evaluate your long-term financial goals, assess your risk tolerance regarding market fluctuations versus guaranteed income needs, understand all fees involved with the product including surrender charges, and research the financial strength ratings of the issuing insurance company. - Can I access my money easily if I invest in a fixed rate annuity?

No; fixed rate annuities generally have restrictions on withdrawals during the surrender period. Accessing funds early may incur significant penalties. - How does inflation impact fixed rate annuity payouts?

Payouts from fixed rate annuities remain constant; therefore inflation can erode purchasing power over time if costs rise while payments stay unchanged. - Is it advisable to consult a financial advisor regarding fixed rate annuities?

Yes; consulting a financial advisor can help you understand complex terms associated with these products and ensure they align with your overall retirement strategy.