A fixed-rate mortgage (FRM) is a popular choice among homebuyers and investors due to its predictable nature. With this type of mortgage, the interest rate remains constant throughout the life of the loan, which typically ranges from 10 to 30 years. This stability allows borrowers to plan their finances without worrying about fluctuating payments. However, like any financial product, fixed-rate mortgages come with their own set of advantages and disadvantages that potential homeowners should carefully consider. This article explores the pros and cons of fixed-rate mortgages in detail, helping you make an informed decision.

| Pros | Cons |

|---|---|

| Predictability in monthly payments | Higher initial interest rates compared to adjustable-rate mortgages |

| Protection against rising interest rates | Lack of flexibility if market rates drop |

| Simplicity in budgeting | Potential early repayment penalties |

| Long-term stability for homeowners | May not be suitable for short-term homeowners |

| No surprises in payment amounts | Possible higher overall interest costs over time |

Predictability in Monthly Payments

One of the most significant advantages of a fixed-rate mortgage is the predictability it offers. Borrowers know exactly how much they will pay each month for the duration of their loan term. This consistency makes it easier to budget for other expenses, such as utilities and maintenance costs.

- Stable budgeting: Knowing your monthly payment allows for better financial planning.

- No surprises: Homeowners can avoid the stress associated with fluctuating payments.

Protection Against Rising Interest Rates

Fixed-rate mortgages provide a safeguard against rising interest rates. Once you lock in a rate, you are protected from any future increases that might occur during your loan term.

- Long-term security: If market interest rates rise, your rate remains unchanged, potentially saving you money.

- Peace of mind: Homeowners can plan their finances without worrying about sudden increases in mortgage payments.

Simplicity in Budgeting

The simplicity of fixed-rate mortgages is another appealing aspect. With a fixed rate, homeowners do not have to track changes in interest rates or worry about how these fluctuations will affect their payments.

- Easy calculations: Borrowers can easily calculate their total payment over time.

- Less financial stress: Homeowners can focus on other aspects of their finances without constantly monitoring interest rates.

Long-Term Stability for Homeowners

For those planning to stay in their homes for an extended period, fixed-rate mortgages offer long-term stability. This stability can be particularly beneficial during times of economic uncertainty.

- Ideal for long-term planning: Homeowners can make long-term plans without worrying about changing mortgage costs.

- Better investment strategy: Stability allows homeowners to invest more confidently in other areas.

No Surprises in Payment Amounts

With a fixed-rate mortgage, there are no surprises regarding payment amounts. Borrowers can rest assured that their monthly payment will remain the same throughout the life of the loan.

- Financial predictability: This predictability helps families manage their budgets effectively.

- Avoiding unexpected costs: Homeowners are less likely to face sudden financial burdens due to rising mortgage payments.

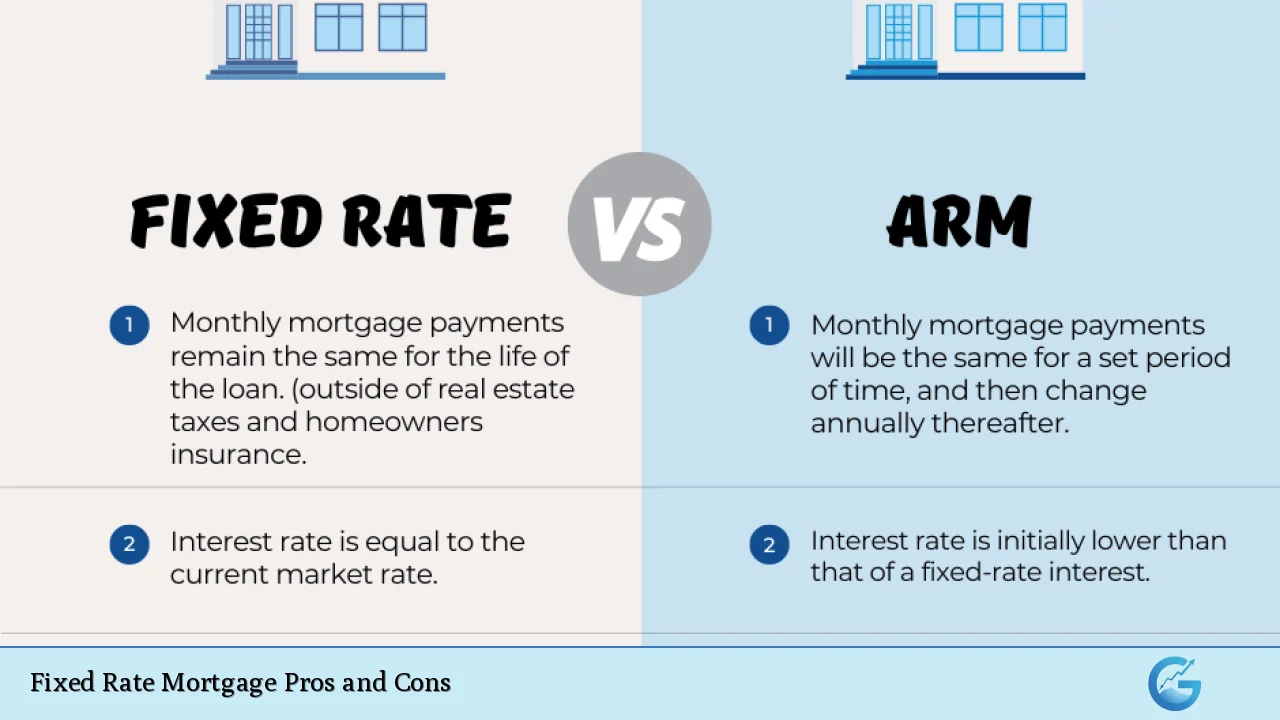

Higher Initial Interest Rates Compared to Adjustable-Rate Mortgages

One major disadvantage of fixed-rate mortgages is that they often come with higher initial interest rates compared to adjustable-rate mortgages (ARMs). This can lead to higher monthly payments at the outset.

- Increased financial burden: Higher initial payments may strain budgets, especially for first-time homebuyers who may already be financially stretched.

- Cost considerations: Over time, these higher rates can lead to significantly more paid in interest compared to lower initial ARM rates.

Lack of Flexibility if Market Rates Drop

Another downside is that if market interest rates decrease after you secure your fixed rate, you will not benefit from these lower rates unless you refinance your mortgage.

- Missed opportunities: Homeowners could end up paying more than necessary if they cannot refinance without incurring penalties.

- Refinancing costs: The process of refinancing can involve fees and additional closing costs, which may negate any potential savings from lower rates.

Potential Early Repayment Penalties

Many fixed-rate mortgages come with early repayment penalties if you decide to pay off your loan before its term ends.

- Financial implications: These penalties can deter homeowners from refinancing or selling their properties early.

- Long-term commitment: Borrowers must be prepared for a long-term commitment when choosing this type of mortgage.

May Not Be Suitable for Short-Term Homeowners

Fixed-rate mortgages are generally better suited for individuals who plan to stay in one place for several years. If you anticipate moving within a few years, an ARM might be more advantageous due to its lower initial rates.

- Higher overall costs: Short-term homeowners may end up paying more due to higher initial payments without benefiting from long-term stability.

- Market fluctuations: If market conditions change favorably after securing a fixed rate, short-term homeowners may miss out on potential savings offered by variable rates.

Possible Higher Overall Interest Costs Over Time

While fixed-rate mortgages provide stability, they often result in higher overall interest costs over the life of the loan compared to other options like ARMs.

- Longer repayment periods: The longer repayment terms associated with fixed-rate mortgages mean that borrowers could pay significantly more in interest over time than they would with an ARM or shorter-term loan.

- Cost-benefit analysis required: Potential borrowers should carefully analyze whether the benefits of stability outweigh the potential costs associated with higher interest payments.

In conclusion, fixed-rate mortgages offer numerous advantages that appeal to many homebuyers and investors, particularly those seeking predictability and long-term stability. However, they also come with notable disadvantages that require careful consideration. It is essential for potential borrowers to assess their financial situation, future plans, and market conditions before committing to a fixed-rate mortgage. Understanding both sides will empower individuals to make informed decisions aligned with their financial goals and circumstances.

Frequently Asked Questions About Fixed Rate Mortgages

- What is a fixed-rate mortgage?

A fixed-rate mortgage is a home loan where the interest rate remains constant throughout the entire term of the loan. - What are the main advantages of a fixed-rate mortgage?

The main advantages include predictable monthly payments, protection against rising interest rates, and simplicity in budgeting. - Are there any disadvantages to fixed-rate mortgages?

Yes, disadvantages include higher initial interest rates compared to adjustable-rate mortgages and potential early repayment penalties. - How long do fixed-rate mortgages typically last?

Fixed-rate mortgages typically last between 10 and 30 years. - Can I refinance my fixed-rate mortgage?

Yes, but refinancing may involve fees and could incur early repayment penalties depending on your current mortgage terms. - Is a fixed-rate mortgage suitable for short-term homeowners?

No, it may not be suitable as it typically results in higher costs for those who plan on moving within a few years. - How do I choose between a fixed-rate and an adjustable-rate mortgage?

Your choice should depend on your financial situation, risk tolerance, and how long you plan to stay in your home. - What happens when my fixed-rate term ends?

Once your term ends, your rate usually converts to your lender’s standard variable rate unless you refinance or secure a new deal.