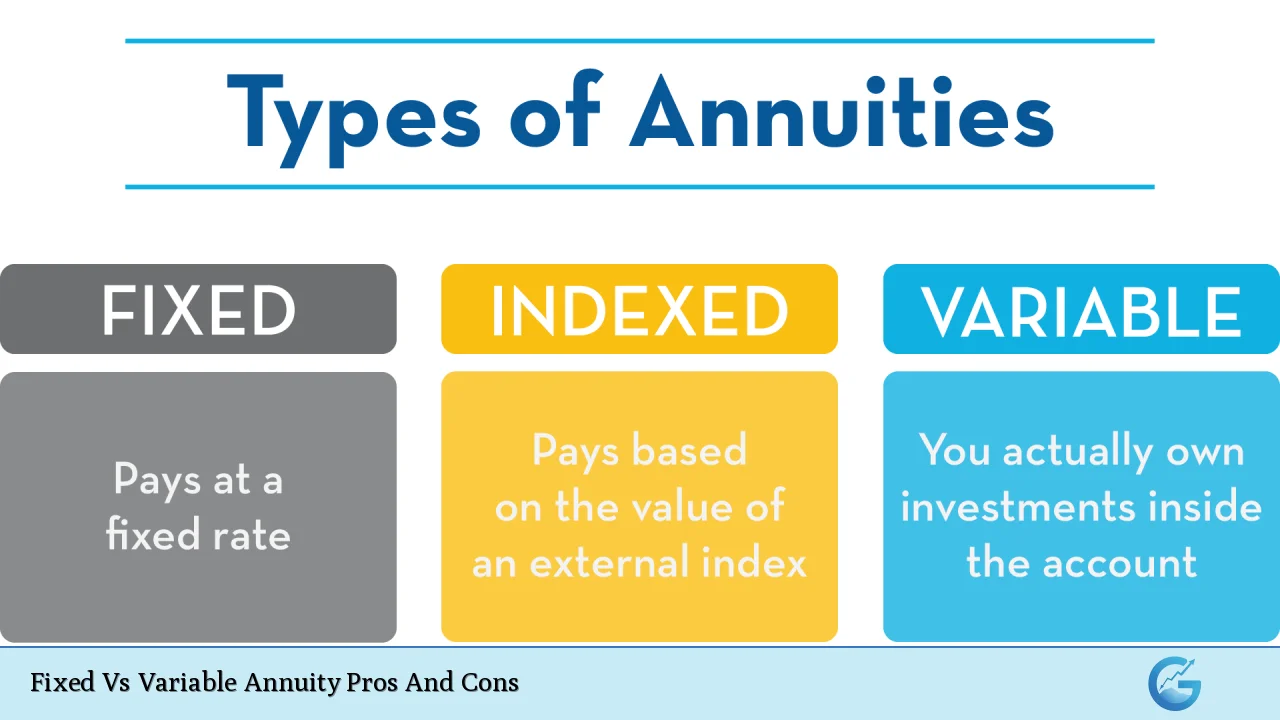

Annuities are financial products designed to provide a steady income stream, primarily for retirees. They come in various forms, with fixed and variable annuities being the two most common types. Understanding the pros and cons of each is crucial for investors looking to secure their financial future. Fixed annuities offer guaranteed returns with lower risk, while variable annuities provide the potential for higher returns but come with increased risk and complexity. This article delves into the advantages and disadvantages of both fixed and variable annuities, helping you make an informed decision.

| Pros | Cons |

|---|---|

| Guaranteed income stream | Potential for lower returns (fixed annuities) |

| Tax-deferred growth | Higher fees (variable annuities) |

| Principal protection (fixed annuities) | No guaranteed returns (variable annuities) |

| Flexibility in investment options (variable annuities) | Complexity and lack of transparency (variable annuities) |

| Death benefit protection | Surrender charges for early withdrawal |

| Predictable payouts (fixed annuities) | Inflation risk (fixed annuities) |

| Protection from creditors | Limited liquidity (both types) |

Guaranteed Income Stream

One of the primary advantages of both fixed and variable annuities is their ability to provide a guaranteed income stream during retirement.

- Fixed Annuities: These contracts guarantee a specific payout amount, ensuring that retirees have a reliable source of income regardless of market conditions.

- Variable Annuities: While these do not guarantee a fixed payout, they can be structured to provide a steady income based on the performance of chosen investments.

This feature is particularly appealing to retirees who prioritize financial stability and predictability in their budget.

Tax-Deferred Growth

Both types of annuities offer tax-deferred growth, allowing your investment to grow without immediate tax implications.

- Fixed Annuities: The interest earned is not taxed until it is withdrawn, which can lead to substantial growth over time.

- Variable Annuities: Similar tax benefits apply; however, the potential for higher returns can significantly enhance your investment’s growth over time.

This tax advantage makes both options attractive for long-term retirement planning.

Principal Protection

Fixed annuities come with a strong safety net in terms of principal protection.

- Fixed Annuities: They guarantee that your initial investment will not decrease in value, making them suitable for conservative investors who want to avoid market risks.

- Variable Annuities: While they do not inherently protect principal, some contracts offer riders that can provide a level of principal protection at an additional cost.

This aspect is crucial for investors concerned about market volatility impacting their retirement savings.

Flexibility in Investment Options

Variable annuities stand out due to their flexibility in investment choices.

- Variable Annuities: Investors can allocate funds among various subaccounts that resemble mutual funds, allowing them to tailor their investment strategy based on risk tolerance and market outlook.

This flexibility can lead to potentially higher returns compared to fixed options but requires more active management and understanding of market dynamics.

Death Benefit Protection

Both fixed and variable annuities typically offer death benefits, providing peace of mind to policyholders.

- Death Benefit Feature: In the event of the policyholder’s death before payouts begin, beneficiaries receive a predetermined amount or the total premiums paid, which can be crucial for estate planning.

This feature ensures that loved ones are financially protected even if the policyholder passes away unexpectedly.

Predictable Payouts

Fixed annuities are particularly known for their predictable payouts.

- Fixed Annuities: Payments remain consistent throughout the payout period, making it easier for retirees to plan their finances without worrying about fluctuations in income.

- Variable Annuities: Although they can be structured for predictable payouts, these amounts may vary based on investment performance, introducing uncertainty into financial planning.

This predictability is a significant advantage for those who prefer stable income streams during retirement.

Potential for Lower Returns (Fixed Annuities)

While fixed annuities offer safety and predictability, they often come with lower potential returns compared to variable options.

- Fixed Annuity Returns: The interest rates are typically lower than what might be achieved through equity investments or other higher-risk assets.

This limitation can hinder long-term growth, especially in environments where inflation outpaces interest earnings.

Higher Fees (Variable Annuities)

Variable annuities can be costly due to various fees associated with their management and features.

- Cost Structure: These fees may include mortality and expense risk charges, administrative fees, and fees for optional riders.

Investors must carefully evaluate these costs against potential benefits to determine if a variable annuity aligns with their financial goals.

No Guaranteed Returns (Variable Annuities)

The lack of guaranteed returns is one of the most significant drawbacks of variable annuities.

- Market Dependency: The value of a variable annuity fluctuates based on the performance of selected investments. This means that during market downturns, payouts could decrease significantly or even result in losses.

Investors must be comfortable with this risk when considering variable options as part of their retirement strategy.

Complexity and Lack of Transparency (Variable Annuities)

Variable annuities are often criticized for their complexity and lack of transparency regarding fees and investment options.

- Understanding Contracts: Many investors find it challenging to navigate the intricacies of variable contracts due to numerous features and riders available.

This complexity can lead to confusion about actual costs and potential returns, making it essential for investors to conduct thorough research or consult financial advisors before committing.

Surrender Charges for Early Withdrawal

Both fixed and variable annuities often impose surrender charges if funds are withdrawn before a specified period.

- Withdrawal Penalties: These charges can significantly reduce the amount available if immediate access to funds is needed.

Understanding these penalties is crucial when evaluating liquidity needs against long-term investment goals.

Inflation Risk (Fixed Annuities)

While fixed annuities provide stable income, they carry an inflation risk that can erode purchasing power over time.

- Impact of Inflation: If inflation rates exceed the fixed interest rate offered by the annuity, retirees may find their purchasing power diminished as costs rise.

Investors should consider whether additional strategies are necessary to mitigate this risk over an extended retirement period.

Protection from Creditors

An important benefit of both types of annuities is protection from creditors in many states.

- Legal Safeguards: Funds within an annuity contract are often exempt from creditor claims during bankruptcy or lawsuits.

This feature can provide additional security for individuals concerned about potential financial liabilities in the future.

Limited Liquidity

Both fixed and variable annuities typically offer limited liquidity compared to other investment vehicles like stocks or bonds.

- Accessing Funds: Once invested in an annuity, accessing funds may require waiting until maturity or facing penalties.

This limitation should be carefully considered by investors who may need quick access to cash in emergencies or changing financial situations.

In conclusion, choosing between fixed and variable annuities involves weighing various factors including risk tolerance, desired income stability, potential growth opportunities, and personal financial goals. Fixed annuities offer security through guaranteed returns but may lag behind in growth potential. Conversely, variable annuities provide opportunities for higher returns at increased risk but come with complexities that require careful consideration. Understanding these pros and cons will empower investors to make informed decisions aligned with their long-term financial objectives.

Frequently Asked Questions About Fixed Vs Variable Annuity Pros And Cons

- What is a fixed annuity?

A fixed annuity is a type of insurance product that guarantees a specific return on investment over time. - What is a variable annuity?

A variable annuity allows investors to allocate funds among various subaccounts that fluctuate based on market performance. - What are the main advantages of fixed annuities?

The main advantages include guaranteed returns, predictable payouts, and lower risk compared to variable options. - What are the main disadvantages of variable annuities?

The disadvantages include higher fees, no guaranteed returns, and greater complexity. - Can I lose money with an annuity?

You can lose money with variable annuities if investments perform poorly; however, fixed annuities protect your principal. - Are there tax benefits associated with both types?

Yes, both types allow tax-deferred growth until withdrawals are made. - How do surrender charges work?

Surrender charges apply if you withdraw funds before a specified period; these charges reduce your total withdrawal amount. - Which type of annuity is better for retirement planning?

This depends on individual preferences; conservative investors may prefer fixed while those seeking growth might favor variable.