The concept of a flat rate income tax has gained significant attention in recent years, especially among policymakers and economists. A flat tax system proposes that all taxpayers pay the same percentage of their income, regardless of how much they earn. Advocates argue that this approach simplifies the tax code, promotes fairness, and can stimulate economic growth. However, critics contend that it disproportionately burdens lower-income individuals and could lead to reduced government revenue. This article explores the advantages and disadvantages of a flat rate income tax in detail, providing insights for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Simplicity in tax calculation | Regressive nature affecting low-income earners |

| Increased transparency and compliance | Potential loss of government revenue |

| Encouragement of economic growth | Equity concerns regarding wealth distribution |

| Reduction in tax evasion | Implementation challenges and complexities |

| Lower administrative costs | Limited deductions may disadvantage some taxpayers |

| Uniformity fosters fairness perceptions | Risk of increased income inequality over time |

| Stimulation of investment and savings | Potential for less funding for social services |

Simplicity in Tax Calculation

One of the most compelling advantages of a flat rate income tax is its simplicity.

- Ease of Understanding: Taxpayers only need to apply a single rate to their taxable income, eliminating the confusion associated with multiple tax brackets.

- Reduced Compliance Burden: With fewer rules and regulations to navigate, individuals and businesses can save time and money on tax preparation.

- Streamlined Administration: Governments can reduce costs associated with tax collection and enforcement due to simpler calculations.

Regressive Nature Affecting Low-Income Earners

Despite its simplicity, a flat tax is often criticized for being regressive.

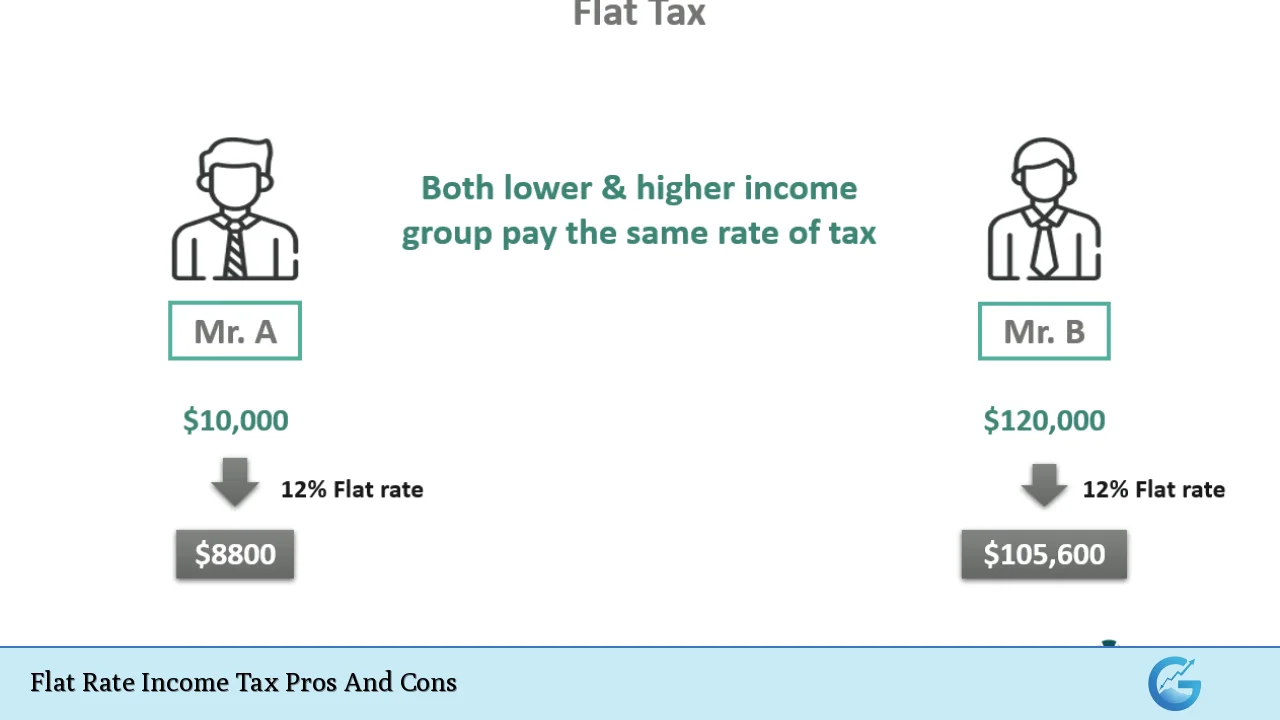

- Higher Relative Burden: Lower-income earners pay the same percentage as high-income earners, which can represent a larger portion of their disposable income.

- Impact on Living Standards: This structure may make it more difficult for low-income individuals to meet their basic needs compared to a progressive system where higher earners contribute more.

- Example: Under a flat tax rate of 15%, an individual earning $20,000 would pay $3,000 in taxes, while someone earning $200,000 would pay $30,000. Although the absolute amounts differ significantly, the lower earner’s tax represents 15% of their income, which can be burdensome.

Increased Transparency and Compliance

Flat taxes are lauded for enhancing transparency within the taxation system.

- Clear Expectations: Taxpayers know exactly what they owe without hidden fees or complicated deductions.

- Boosted Public Confidence: Simplified systems can increase trust in government institutions as citizens see their contributions clearly.

- Higher Compliance Rates: The straightforward nature may encourage more individuals to file taxes accurately and on time.

Potential Loss of Government Revenue

Critics argue that transitioning to a flat tax could lead to reduced government revenue.

- Dependence on Wealthy Taxpayers: If high-income individuals benefit disproportionately from lower rates, overall tax revenue may decline.

- Initial Revenue Declines: The shift might result in temporary revenue losses as systems adjust and taxpayers exploit new loopholes.

- Funding Challenges for Public Services: A decrease in revenue could adversely affect essential services like education and healthcare.

Encouragement of Economic Growth

Proponents assert that flat taxes can stimulate economic growth by encouraging work and investment.

- Incentives for Labor: With a uniform rate, individuals may feel less penalized for earning more, motivating them to work harder or pursue higher-paying jobs.

- Investment Opportunities: Businesses might invest more in growth initiatives if they face lower overall taxation.

- Long-term Growth Potential: By fostering an environment conducive to entrepreneurship, flat taxes could lead to job creation over time.

Equity Concerns Regarding Wealth Distribution

The equity implications of a flat tax system raise significant concerns among critics.

- Disproportionate Benefits for High Earners: Wealthier individuals often benefit more from lower rates compared to their lower-income counterparts who struggle with fixed expenses.

- Erosion of Social Safety Nets: As revenues decline, funding for welfare programs may diminish, exacerbating inequality issues.

- Potential for Greater Wealth Disparities: Over time, if wealth concentration increases among high earners due to favorable taxation conditions, social mobility could decline.

Reduction in Tax Evasion

A flat tax structure may help reduce instances of tax evasion.

- Less Incentive for Evasion: With everyone taxed at the same rate, there is less motivation for individuals to hide income or manipulate deductions.

- Simplified Reporting Processes: The straightforward nature can make it easier for both taxpayers and authorities to track earnings accurately.

Implementation Challenges and Complexities

While theoretically appealing, implementing a flat tax poses several challenges.

- Political Resistance: Shifting from a progressive system to a flat one often faces significant opposition from groups concerned about equity and fairness.

- Transition Costs: The initial phase of implementing a flat tax could incur costs related to education and adjustment for taxpayers accustomed to progressive structures.

Lower Administrative Costs

Flat taxes can lead to reduced administrative costs associated with tax collection.

- Fewer Resources Required: Governments can allocate fewer resources towards managing complex tax codes and compliance measures.

- Efficiency Gains: Streamlined processes allow for quicker processing times for both taxpayers and government agencies involved in collection efforts.

Limited Deductions May Disadvantage Some Taxpayers

While simplicity is an advantage, it also means fewer deductions are available under a flat tax system.

- Loss of Popular Deductions: Many taxpayers rely on deductions such as mortgage interest or charitable contributions; limiting these could lead to dissatisfaction among voters.

- Impact on Specific Demographics: Families or individuals who previously benefited from deductions may find themselves paying more under a flat rate structure without compensatory measures in place.

Risk of Increased Income Inequality Over Time

The long-term effects of a flat tax could contribute to widening income inequality if not managed carefully.

- Wealth Concentration Risks: If the wealthy continue accumulating wealth at faster rates due to lower effective taxation rates, economic disparities may grow more pronounced over generations.

- Social Mobility Challenges: As wealth becomes concentrated among fewer individuals or families, opportunities for others may diminish significantly over time.

Stimulation of Investment and Savings

A flat tax regime is often seen as beneficial for encouraging savings and investments among taxpayers.

- Higher Disposable Income: With lower taxes on earnings, individuals have more disposable income which they can choose to invest or save rather than spend on taxes.

- Investment Incentives: Businesses are likely encouraged by lower overall taxation rates which can lead them to invest more heavily in expansion efforts or new projects that create jobs and stimulate economic activity.

In conclusion, while the concept of a flat rate income tax presents several compelling advantages such as simplicity, transparency, and potential economic growth stimulation, it also carries significant drawbacks including regressive impacts on low-income earners and potential revenue losses. Policymakers must weigh these pros and cons carefully when considering reforms to the current taxation system. The balance between fostering economic growth while ensuring equitable contributions from all citizens remains a critical challenge in modern fiscal policy debates.

Frequently Asked Questions About Flat Rate Income Tax

- What is a flat rate income tax?

A flat rate income tax is a system where all taxpayers pay the same percentage of their income regardless of how much they earn. - How does a flat tax affect low-income earners?

The flat tax can disproportionately burden low-income earners since they pay the same percentage as higher-income individuals. - What are the potential benefits of implementing a flat tax?

Benefits include simplified calculations, increased compliance rates, reduced administrative costs, and potential economic growth. - Can a flat tax system generate enough revenue?

The effectiveness in generating revenue depends on various factors including how many high-income earners were previously avoiding taxes under progressive systems. - Does a flat tax promote investment?

A flat tax may encourage investment by providing individuals and businesses with more disposable income after taxes. - What are some challenges associated with implementing a flat tax?

Challenges include political resistance from those concerned about equity issues and potential initial revenue losses during transition periods. - How does a flat tax compare with progressive taxation?

A progressive taxation system imposes higher rates on higher incomes whereas a flat tax applies the same rate across all income levels. - Are there any exemptions under a flat tax system?

This varies by proposal; some may include exemptions for low-income earners or specific deductions while others advocate for no exemptions at all.