The concept of a flat tax rate, where a single tax rate is applied to all income levels, has been a topic of extensive debate among economists, policymakers, and the public. Advocates argue that it simplifies the tax system, promotes fairness, and boosts economic growth. Critics, however, contend that it disproportionately burdens lower-income individuals and could lead to significant revenue losses for governments. This article explores the advantages and disadvantages of flat tax systems, providing a comprehensive overview for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Simplicity in tax calculations | Regressive nature affecting lower-income earners |

| Increased compliance and reduced evasion | Potential loss of government revenue |

| Encouragement of economic growth | Elimination of deductions may hurt certain taxpayers |

| Fairness in tax obligations | Challenges in public services funding |

| Transparency in tax liabilities | Resistance from progressive tax advocates |

| Reduction in administrative costs | Limited flexibility for taxpayers with unique situations |

| Encouragement of investment and entrepreneurship | Potential negative impact on social equity programs |

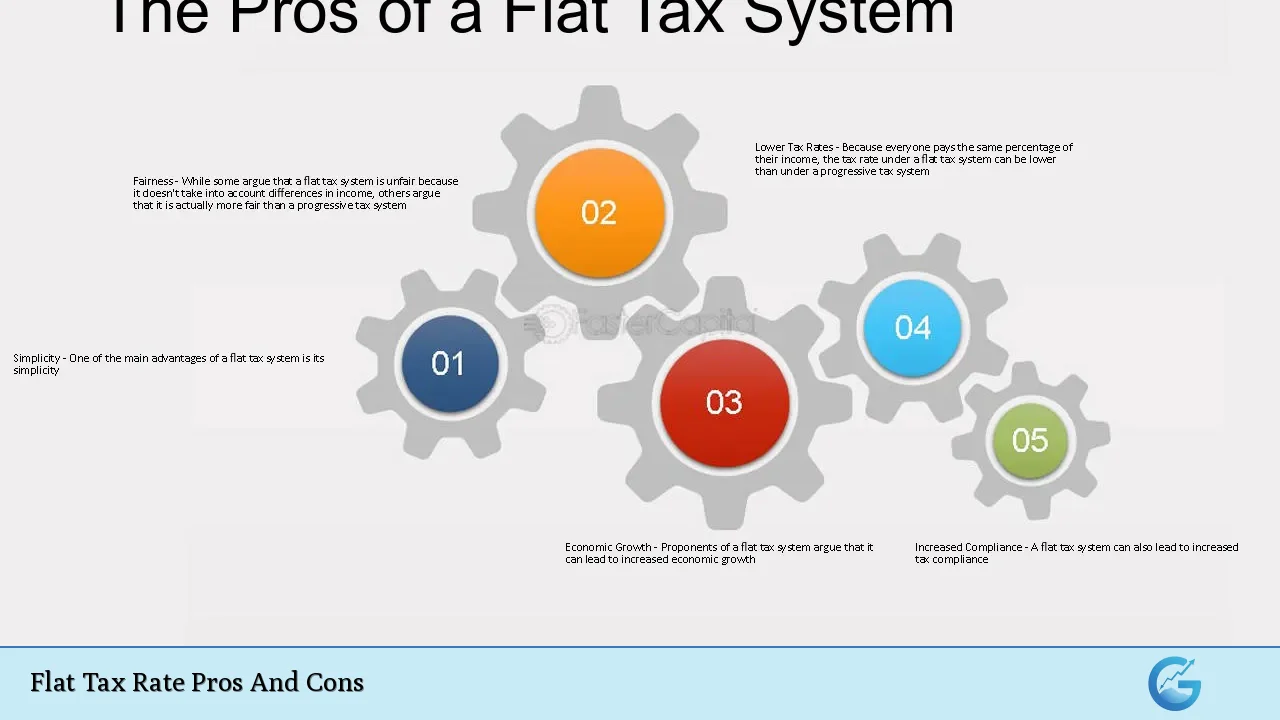

Simplicity in Tax Calculations

One of the most significant advantages of a flat tax system is its simplicity.

- Ease of Understanding: Taxpayers only need to apply a single rate to their income, eliminating the complexities associated with multiple tax brackets.

- Reduced Errors: The straightforward nature of flat taxes can lead to fewer mistakes in tax filings.

- Streamlined Processes: Both individuals and businesses benefit from simplified tax preparation and filing processes.

This simplicity can enhance taxpayer satisfaction and reduce the anxiety associated with tax season.

Increased Compliance and Reduced Evasion

Flat taxes tend to foster higher compliance rates among taxpayers.

- Less Incentive for Evasion: With a uniform rate, there are fewer loopholes to exploit, making it harder for individuals to evade taxes.

- Greater Transparency: A clear understanding of tax obligations can lead to increased public trust in the system.

- Lower Administrative Burden: Tax authorities can allocate resources more efficiently when dealing with fewer complexities in the tax code.

This increased compliance can potentially lead to higher overall tax revenues.

Encouragement of Economic Growth

Proponents argue that a flat tax can stimulate economic activity.

- Incentives for Work and Investment: By reducing the overall tax burden, individuals may feel more motivated to work harder or invest their earnings.

- Attracting Businesses: A flat tax system can be appealing to businesses looking for a predictable taxation environment.

- Boosting Disposable Income: With lower taxes, individuals have more disposable income to spend or invest, which can stimulate economic growth.

These factors contribute to a more dynamic economy that encourages entrepreneurship and innovation.

Fairness in Tax Obligations

Advocates claim that flat taxes promote fairness by treating all taxpayers equally.

- Equal Contribution: Everyone pays the same percentage of their income, which some view as a more equitable approach than progressive taxation.

- Reduction of Special Interests: A simplified system reduces the influence of lobbyists seeking special deductions or exemptions that benefit specific groups.

This perceived fairness can enhance public support for the tax system as a whole.

Transparency in Tax Liabilities

Flat taxes offer greater transparency compared to progressive systems.

- Clear Expectations: Taxpayers know exactly how much they owe without needing to navigate complex rules regarding deductions or credits.

- Predictable Revenue Streams: Governments can more easily forecast revenues based on a single rate applied across the board.

This transparency fosters accountability and trust between taxpayers and government entities.

Reduction in Administrative Costs

The administrative efficiency associated with flat taxes is another notable benefit.

- Lower Compliance Costs: Individuals and businesses spend less time and money on tax preparation due to simplified regulations.

- Streamlined Government Operations: Tax authorities can reduce staffing needs and operational costs associated with managing complex tax codes.

These savings can be redirected towards essential public services or infrastructure projects.

Encouragement of Investment and Entrepreneurship

A flat tax system is often seen as favorable for investment activities.

- Increased Capital Formation: Lower taxes encourage individuals and businesses to reinvest their earnings rather than pay them out as taxes.

- Fostering Innovation: Entrepreneurs may be more willing to take risks when they know their earnings will not be heavily taxed at higher rates as they grow their businesses.

This environment can lead to job creation and enhanced economic vitality over time.

Regressive Nature Affecting Lower-Income Earners

Despite its advantages, the flat tax system has significant drawbacks, particularly its regressive nature.

- Higher Burden on Low-Income Individuals: Since everyone pays the same percentage regardless of income level, lower-income earners may find themselves disproportionately affected by taxation compared to wealthier individuals.

- Potential Increase in Income Inequality: Critics argue that this system exacerbates existing disparities by placing a heavier financial burden on those who are already struggling financially.

For example, under a flat tax rate of 10%, an individual earning $20,000 would pay $2,000 in taxes, while someone earning $200,000 would pay $20,000. Although both pay 10%, the impact on disposable income is far greater for the lower earner.

Potential Loss of Government Revenue

Transitioning to a flat tax could result in significant revenue losses for governments.

- Lower Rates May Not Compensate for Losses: Critics suggest that while lower rates might stimulate economic activity, they could also lead to decreased overall revenue if high-income earners are no longer contributing as much as they would under a progressive system.

- Funding Public Services at Risk: Reduced revenues may necessitate cuts in essential services such as education, healthcare, and infrastructure projects.

This potential loss raises concerns about whether governments can maintain adequate funding levels without increasing other forms of taxation or incurring debt.

Elimination of Deductions May Hurt Certain Taxpayers

A flat tax often involves eliminating various deductions that exist within progressive systems.

- Impact on Charitable Giving and Homeownership: The removal of deductions for charitable contributions or mortgage interest could disincentivize these activities among taxpayers who previously benefited from them.

- Disproportionate Effects on Specific Groups: Certain demographics may find themselves at a disadvantage without these deductions; for instance, families relying on mortgage interest deductions may face higher effective taxation under a flat system.

This change could alter personal financial strategies significantly for many households.

Challenges in Public Services Funding

The shift towards a flat tax raises concerns about sustaining funding for public services.

- Dependence on Economic Growth for Revenue Stability: If economic growth does not keep pace with expectations post-flat tax implementation, governments may struggle financially.

- Increased Pressure on Other Taxes: To compensate for lost revenue from income taxes, governments might resort to raising sales taxes or property taxes—potentially leading to further inequities.

These challenges necessitate careful consideration by policymakers when evaluating the feasibility of adopting a flat tax system.

Resistance from Progressive Tax Advocates

The introduction of a flat tax often faces opposition from those who support progressive taxation models.

- Concerns Over Equity: Advocates for progressive taxation argue that it ensures wealthier individuals contribute a fairer share towards public goods based on their ability to pay.

- Political Feasibility Issues: Implementing a flat tax could encounter significant political hurdles due to entrenched interests advocating for maintaining or expanding progressive systems.

This resistance underscores the complexity involved in reforming existing taxation structures within any jurisdiction.

Limited Flexibility for Taxpayers with Unique Situations

A one-size-fits-all approach like a flat tax may not accommodate all taxpayers effectively.

- Diverse Financial Situations Ignored: Individuals with unique financial circumstances—such as medical expenses or caregiving responsibilities—may find themselves disadvantaged under an inflexible structure.

- Lack of Tailored Solutions: The absence of deductions means that taxpayers cannot adjust their liabilities based on personal situations—potentially leading some households into financial distress during difficult times.

This limitation highlights the need for nuanced approaches when designing effective taxation systems that consider varied taxpayer needs.

Potential Negative Impact on Social Equity Programs

Lastly, transitioning away from progressive taxation could undermine social equity initiatives aimed at supporting vulnerable populations.

- Funding Cuts for Welfare Programs: Reduced government revenues might necessitate cuts in welfare programs designed to assist low-income families or marginalized communities—potentially exacerbating poverty levels across society.

- Long-Term Social Consequences: Without adequate support systems funded through progressive taxation mechanisms, societal inequality may worsen over time—a concern echoed by many social justice advocates today.

This potential outcome raises ethical questions about prioritizing simplicity over equity within fiscal policy discussions surrounding flat taxes.

In conclusion, while the flat tax rate presents several compelling advantages such as simplicity and potential economic growth stimulation, it also carries significant disadvantages including regressivity and potential revenue loss risks that cannot be overlooked. Policymakers must weigh these factors carefully when considering changes to existing taxation frameworks—balancing efficiency against equity concerns—to ensure sustainable fiscal health moving forward into an increasingly complex economic landscape shaped by globalization trends affecting finance markets worldwide.

Frequently Asked Questions About Flat Tax Rate Pros And Cons

- What is a flat tax?

A flat tax is an income tax system where all taxpayers pay the same percentage rate regardless of their income level. - What are the main advantages of a flat tax?

The primary benefits include simplicity in calculations, increased compliance rates due to reduced evasion opportunities, and potential stimulation of economic growth. - How does a flat tax affect low-income earners?

A major criticism is that it disproportionately burdens low-income earners since they pay the same percentage as wealthier individuals. - Can implementing a flat tax lead to revenue loss?

Yes, transitioning could result in decreased overall government revenue if high-income earners contribute less than they would under progressive systems. - What happens to deductions under a flat tax?

A flat tax typically eliminates many deductions available in progressive systems which might negatively impact certain taxpayers. - Why do some people oppose flat taxes?

Opposition stems from concerns about equity; critics argue it favors wealthier individuals while placing heavier burdens on those with lower incomes. - How does transparency improve with a flat tax?

A single rate simplifies understanding taxpayer obligations leading to greater accountability within government entities. - Are there any long-term social implications associated with adopting a flat-tax model?

If implemented without careful consideration of equity issues, it could undermine funding for social programs aimed at supporting vulnerable populations.