Flexible Spending Accounts (FSAs) are a popular employee benefit that allows individuals to set aside pre-tax dollars for eligible healthcare and dependent care expenses. They serve as a financial tool designed to help employees manage out-of-pocket costs while providing significant tax advantages. However, like any financial product, FSAs come with their own set of advantages and disadvantages. This article explores the pros and cons of FSAs in detail, helping you make an informed decision about whether this benefit is right for you.

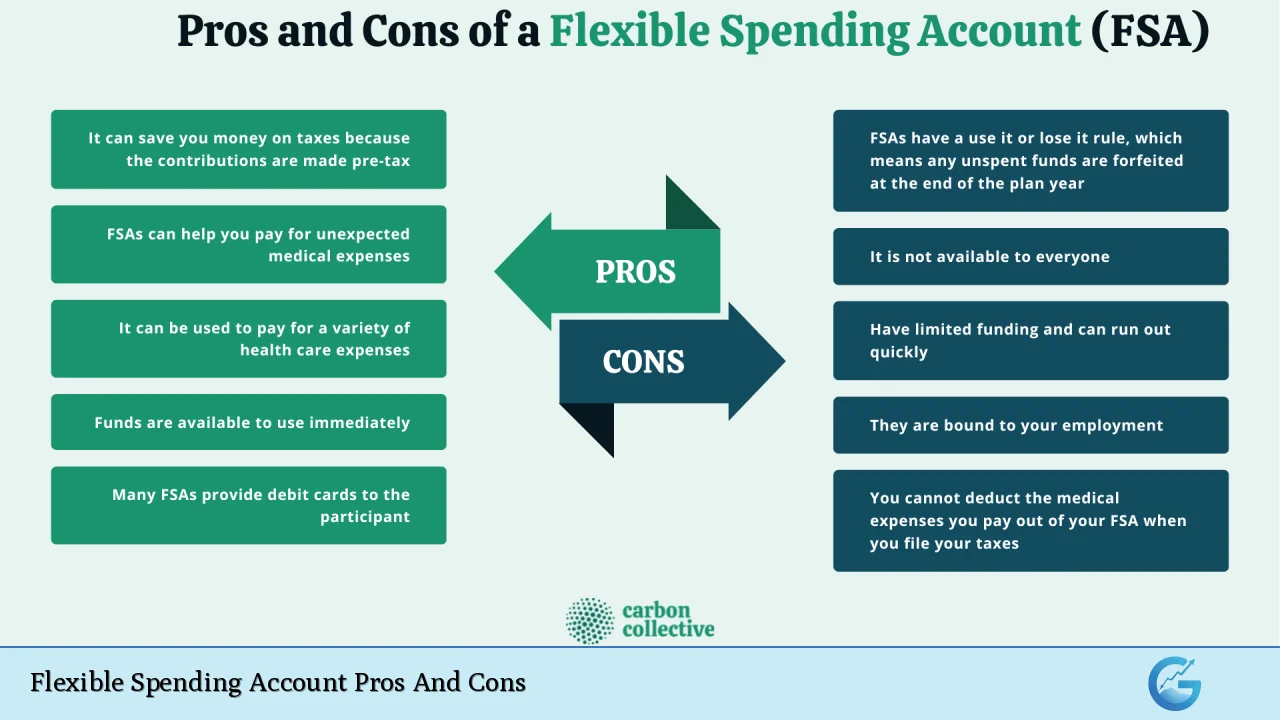

| Pros | Cons |

|---|---|

| Tax savings through pre-tax contributions | Use-it-or-lose-it rule can lead to forfeiture of unspent funds |

| Immediate access to full annual contribution | Limited flexibility in adjusting contribution amounts |

| Covers a wide range of eligible expenses | Not portable; tied to employment status |

| Employer contributions can enhance savings | Administrative tasks can be cumbersome |

| No taxes on qualified reimbursements | Contribution limits set by the IRS may restrict savings potential |

| Convenient access via debit cards for payments | Limited rollover options for unused funds |

Tax Savings Through Pre-Tax Contributions

One of the most significant advantages of an FSA is the tax savings it provides. Contributions to an FSA are deducted from your paycheck before taxes are calculated, effectively lowering your taxable income. This means that employees can save approximately 30% on federal taxes, depending on their tax bracket. For example, if an employee contributes $2,000 to their FSA, they may reduce their taxable income by that amount, resulting in substantial tax savings.

- Increased take-home pay: By reducing taxable income, employees take home more money each pay period.

- Tax-free withdrawals: Funds withdrawn from the FSA for eligible expenses are not subject to income tax, further enhancing overall savings.

Immediate Access to Full Annual Contribution

Unlike Health Savings Accounts (HSAs), where funds accumulate over time, FSAs provide immediate access to the entire pledged annual contribution at the beginning of the plan year. This feature allows employees to utilize their full contribution for eligible expenses right away.

- Financial flexibility: This immediate access can be particularly beneficial for those who anticipate high medical expenses early in the year.

- Ease of budgeting: Knowing that the full amount is available helps with financial planning and managing healthcare costs.

Covers a Wide Range of Eligible Expenses

FSAs can be used for various healthcare-related expenses that may not be covered by standard health insurance plans. This includes:

- Copayments and deductibles

- Prescription medications

- Over-the-counter drugs (with a prescription)

- Medical equipment and supplies

Additionally, Dependent Care FSAs allow funds to be used for daycare and elder care expenses, making them versatile tools for managing both healthcare and dependent care costs.

Employer Contributions Can Enhance Savings

Some employers choose to contribute to their employees’ FSAs as part of their benefits package. This additional contribution is also pre-tax, providing even more savings potential.

- Increased financial support: Employer contributions can significantly boost the total amount available for eligible expenses.

- Attractive benefits package: Employers offering FSAs with contributions may attract and retain talent more effectively.

No Taxes on Qualified Reimbursements

Another advantage of FSAs is that reimbursements for qualified medical expenses are not subject to taxation. This means that employees can effectively use pre-tax dollars to cover out-of-pocket costs without incurring additional tax liability.

- Maximized purchasing power: Employees can stretch their healthcare dollars further by using tax-free funds for necessary expenses.

Convenient Access via Debit Cards for Payments

Many FSAs provide participants with debit cards linked directly to their accounts. This feature simplifies the payment process for eligible expenses, allowing users to pay directly without needing reimbursement claims or extensive paperwork.

- Streamlined transactions: Using a debit card reduces administrative hassle and speeds up payment at the point of service.

- User-friendly experience: The convenience of immediate payment enhances overall satisfaction with the FSA.

Use-It-or-Lose-It Rule Can Lead to Forfeiture of Unspent Funds

Despite their many advantages, one of the most significant drawbacks of FSAs is the “use-it-or-lose-it” rule. If employees do not use all the funds in their account by the end of the plan year (or during any applicable grace period), they forfeit any remaining balance back to their employer.

- Risk of losing money: This rule can deter individuals from contributing larger amounts if they are uncertain about their healthcare needs throughout the year.

- Planning challenges: Employees must carefully estimate their expected medical expenses to avoid losing unspent funds.

Limited Flexibility in Adjusting Contribution Amounts

Once employees elect their annual contribution amount during open enrollment, it typically remains fixed for the entire year unless they experience a qualifying life event (e.g., marriage or childbirth). This lack of flexibility can pose challenges if an individual’s financial situation or healthcare needs change unexpectedly.

- Difficulty adapting: Employees may find themselves locked into a contribution amount that no longer aligns with their needs or financial capabilities.

- Potential over-contribution: Individuals may contribute more than necessary if they cannot adjust their election mid-year, leading to unused funds and forfeiture risks.

Not Portable; Tied to Employment Status

FSAs are employer-sponsored accounts, meaning that if an employee leaves their job or changes employers, they generally lose access to any remaining funds unless they opt for COBRA continuation coverage. This lack of portability can be a concern for those who frequently change jobs or face job insecurity.

- Job changes impact finances: Losing access to FSA funds upon leaving employment can create financial strain during transitions between jobs.

- Limited long-term planning: Employees cannot rely on FSAs as a long-term savings strategy due to this inherent lack of portability.

Administrative Tasks Can Be Cumbersome

Managing an FSA involves certain administrative responsibilities, such as keeping track of receipts, submitting claims for reimbursement, and ensuring that all expenses meet IRS eligibility guidelines. Some individuals find this process burdensome and time-consuming.

- Increased workload: The need for meticulous record-keeping can detract from the perceived benefits of having an FSA.

- Potential errors: Mismanagement or oversight in tracking expenses could lead to denied claims or unexpected out-of-pocket costs.

Contribution Limits Set by the IRS May Restrict Savings Potential

The IRS imposes annual contribution limits on FSAs, which may restrict how much individuals can set aside each year. For 2024, these limits are $3,200 for healthcare FSAs and $5,000 for dependent care FSAs.

- Savings constraints: High medical costs may exceed these limits, leaving some individuals unable to cover all necessary expenses through pre-tax contributions alone.

- Need for additional planning: Employees may need alternative strategies alongside FSAs to adequately manage higher healthcare expenditures.

Limited Rollover Options for Unused Funds

While some employers offer limited rollover options or grace periods allowing employees additional time to use unspent funds from their FSA accounts (up to $640), many still adhere strictly to the use-it-or-lose-it rule.

- Rollover restrictions: Limited rollover options mean that careful planning is essential to avoid losing money at year-end.

- Grace period complexities: Understanding specific employer policies regarding grace periods or rollovers adds another layer of complexity when managing an FSA effectively.

In conclusion, Flexible Spending Accounts offer numerous advantages including tax savings, immediate access to funds, and coverage for various eligible expenses. However, potential users must also consider significant drawbacks such as forfeiture risks associated with unused funds and limited flexibility in adjusting contributions. By weighing these pros and cons carefully against personal financial situations and healthcare needs, individuals can make informed decisions about whether an FSA aligns with their financial goals.

Frequently Asked Questions About Flexible Spending Accounts (FSA)

- What is a Flexible Spending Account (FSA)?

An FSA is an employer-sponsored benefit allowing employees to set aside pre-tax dollars for eligible healthcare and dependent care expenses. - How do I enroll in an FSA?

You typically enroll during your employer’s open enrollment period or after a qualifying life event. - What happens if I don’t use all my FSA funds?

You will lose any unspent funds at the end of the plan year due to the “use-it-or-lose-it” rule. - Can I change my FSA contribution mid-year?

You cannot change your contribution unless you experience a qualifying life event. - Are there limits on how much I can contribute?

Yes, there are annual contribution limits set by the IRS ($3,200 for healthcare FSAs in 2024). - What kind of expenses can I use my FSA funds for?

You can use FSA funds for eligible medical expenses like copayments, prescriptions, and certain dependent care costs. - Can my employer contribute to my FSA?

Yes, some employers choose to contribute additional funds into employees’ FSAs. - What should I do if I have leftover funds at year-end?

If your employer offers it, utilize any grace period or rollover options available; otherwise, you will lose those funds.