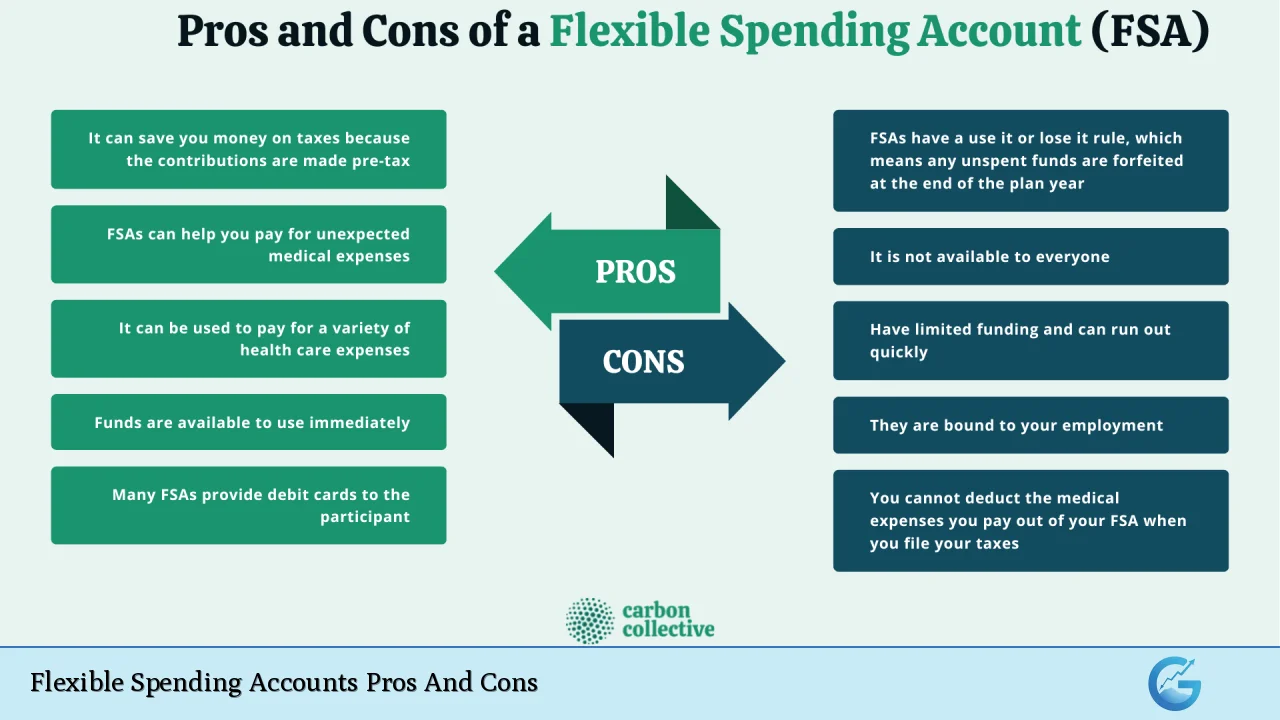

Flexible Spending Accounts (FSAs) are employer-sponsored benefit plans that allow employees to set aside pre-tax dollars for eligible healthcare and dependent care expenses. These accounts provide significant tax advantages, enabling participants to reduce their taxable income while managing out-of-pocket costs effectively. However, FSAs also come with certain limitations and risks that potential users should carefully consider. This article explores the pros and cons of FSAs in detail, helping individuals make informed decisions about their financial planning.

| Pros | Cons |

|---|---|

| Tax savings through pre-tax contributions | Use-it-or-lose-it rule can lead to forfeiture of funds |

| Full annual contribution available at the start of the plan year | Limited flexibility in adjusting contributions once set |

| Reimbursement for a wide range of eligible expenses | Not portable; tied to employment status |

| Potential for employer contributions | Administrative burden of managing claims and receipts |

| Helps budget for predictable healthcare expenses | Limited rollover options for unused funds |

| Immediate access to funds for medical expenses | Certain expenses are ineligible for reimbursement |

| Can cover both healthcare and dependent care costs | Contribution limits can restrict savings potential |

Tax Savings Through Pre-Tax Contributions

One of the most significant advantages of a Flexible Spending Account is the tax savings it offers. Contributions made to an FSA are deducted from your paycheck before taxes are calculated, effectively lowering your taxable income. This means that you pay less in federal income tax, Social Security tax, and often state income tax as well.

- Reduced Tax Liability: By lowering your taxable income, you can save money on your overall tax bill.

- Increased Take-Home Pay: Since you are contributing pre-tax dollars, your take-home pay increases, allowing for more disposable income.

Use-It-or-Lose-It Rule Can Lead to Forfeiture of Funds

Despite the benefits, FSAs come with a notable disadvantage known as the use-it-or-lose-it rule. This regulation stipulates that any unspent funds remaining in your account at the end of the plan year are forfeited.

- Risk of Losing Money: If you overestimate your healthcare needs and do not use all the funds, you risk losing that money entirely.

- Planning Required: Participants must carefully estimate their healthcare expenses for the year to avoid losing contributions.

Full Annual Contribution Available at the Start of the Plan Year

Another advantage is that participants have access to their full annual contribution at the beginning of the plan year. This feature allows individuals to manage larger medical expenses without waiting for their contributions to accumulate.

- Immediate Access: You can use the entire amount elected for qualified expenses right away, which is particularly beneficial for those facing significant medical costs early in the year.

Limited Flexibility in Adjusting Contributions Once Set

On the downside, once you decide on your contribution amount during open enrollment, it is generally locked in for that entire year.

- Inflexibility: You cannot change your contribution unless you experience a qualifying life event (e.g., marriage, birth of a child).

- Potential Financial Strain: If unexpected expenses arise or your financial situation changes, you may find yourself constrained by your initial election.

Reimbursement for a Wide Range of Eligible Expenses

FSAs cover a broad spectrum of eligible medical and dependent care expenses, making them versatile financial tools.

- Diverse Coverage: You can use FSA funds for copayments, deductibles, prescription medications, and certain over-the-counter items.

- Dependent Care Costs: A Dependent Care FSA allows you to set aside funds for childcare expenses, which can ease financial burdens for working parents.

Not Portable; Tied to Employment Status

A significant drawback is that FSAs are not portable; they are tied to your employment.

- Loss Upon Job Change: If you leave your job or are terminated, any remaining funds in your FSA typically cannot be accessed unless you elect COBRA continuation coverage.

- Job Security Concerns: This lack of portability may deter individuals who frequently change jobs or face job insecurity.

Potential for Employer Contributions

Some employers may choose to contribute additional funds to employees’ FSAs as part of their benefits package.

- Enhanced Savings: Employer contributions can increase the total amount available for medical or dependent care expenses without additional cost to employees.

- Encourages Participation: Knowing that employers may contribute can motivate employees to enroll in an FSA.

Administrative Burden of Managing Claims and Receipts

Managing an FSA involves certain administrative tasks that some participants may find cumbersome.

- Claims Process: Participants need to submit claims along with receipts for reimbursement, which can be time-consuming.

- Record Keeping: Keeping track of eligible expenses and maintaining proper documentation adds an extra layer of responsibility.

Helps Budget for Predictable Healthcare Expenses

FSAs can help individuals budget effectively for predictable healthcare costs throughout the year.

- Expense Planning: By estimating annual healthcare costs and setting aside funds accordingly, participants can manage their finances better.

- Reduced Financial Stress: Knowing that funds are available specifically for healthcare needs can alleviate anxiety about unexpected medical bills.

Limited Rollover Options for Unused Funds

While some employers allow a limited rollover or grace period for unused FSA funds, these options are not universally available.

- Rollover Limitations: Typically, only a small amount (e.g., $610 as of 2024) may be carried over into the next plan year.

- Grace Periods: Employers may offer a grace period (up to 2.5 months) after the plan year ends to use remaining funds; however, this is not guaranteed.

Immediate Access to Funds for Medical Expenses

Participants benefit from immediate access to their full annual contribution amount at any time during the plan year.

- Timely Reimbursements: This feature allows individuals facing unexpected medical expenses to receive reimbursement quickly without waiting.

- Financial Flexibility: Immediate access enhances financial flexibility when dealing with urgent healthcare needs.

Certain Expenses Are Ineligible for Reimbursement

While FSAs cover many healthcare-related costs, there are restrictions on what qualifies for reimbursement.

- Ineligible Items: Common exclusions include cosmetic procedures and health insurance premiums.

- Awareness Required: Participants must familiarize themselves with IRS guidelines on eligible expenses to avoid denied claims.

Contribution Limits Can Restrict Savings Potential

FSAs have annual contribution limits set by the IRS, which can restrict how much individuals can save through these accounts.

- Contribution Caps: For 2024, the maximum contribution limit is $3,200 for health care FSAs and $5,000 for dependent care FSAs.

- Impact on Large Families or High Medical Needs: Families with extensive medical needs may find these limits insufficient compared to their actual expenses.

In conclusion, Flexible Spending Accounts offer several advantages that can lead to significant tax savings and help manage out-of-pocket healthcare costs effectively. However, potential users must weigh these benefits against inherent limitations such as the use-it-or-lose-it rule and lack of portability. Understanding both sides will empower individuals to make informed decisions about whether an FSA fits into their broader financial strategy.

Frequently Asked Questions About Flexible Spending Accounts Pros And Cons

- What is a Flexible Spending Account (FSA)?

A Flexible Spending Account (FSA) allows employees to set aside pre-tax dollars from their paychecks to cover eligible healthcare or dependent care expenses. - What are the main advantages of using an FSA?

The primary advantages include tax savings through pre-tax contributions and immediate access to full annual contributions at the start of the plan year. - What are common disadvantages associated with FSAs?

The most notable disadvantages include the use-it-or-lose-it rule and limited flexibility in changing contribution amounts once set. - Can I carry over unused FSA funds?

Some employers allow limited carryover options or grace periods; however, this varies by employer. - Are there contribution limits for FSAs?

Yes, there are annual contribution limits set by the IRS; as of 2024, it is $3,200 for health care FSAs. - What types of expenses can I cover with an FSA?

You can use FSA funds for various eligible medical costs including copayments, deductibles, prescription medications, and certain dependent care costs. - If I leave my job, what happens to my FSA?

If you leave your job, typically any remaining funds in your FSA will be forfeited unless you elect COBRA continuation coverage. - Do employers contribute to FSAs?

Some employers choose to contribute additional funds into employee FSAs as part of their benefits package.