Fractional ownership is an investment model that allows multiple individuals to share ownership of a high-value asset, such as real estate, yachts, or even art. This approach democratizes access to expensive investments, enabling individuals who may not have the financial means to purchase these assets outright to participate in ownership. While fractional ownership presents unique opportunities for diversification and reduced financial burden, it also comes with its own set of challenges and limitations. This article explores the pros and cons of fractional ownership in detail, providing a comprehensive overview for potential investors.

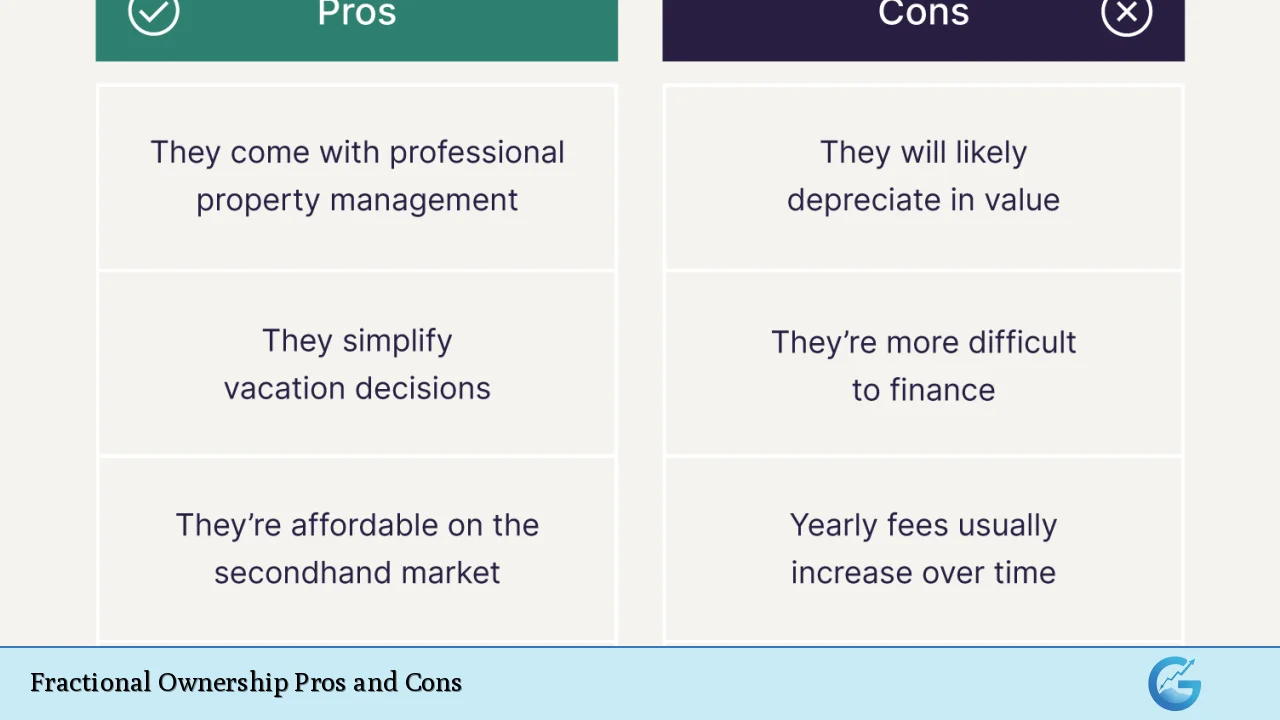

| Pros | Cons |

|---|---|

| Lower financial commitment | Limited control over asset management |

| Access to premium assets | Potential for illiquidity |

| Shared costs and responsibilities | Complex exit strategies |

| Diversification opportunities | Possible conflicts with co-owners |

| Professional management services | Limited personal use of the asset |

| Potential for appreciation and rental income | Diminished returns compared to full ownership |

Lower Financial Commitment

One of the primary advantages of fractional ownership is the lower financial commitment required from each investor. This model allows individuals to invest in high-value assets without needing to pay the full price upfront. For example, instead of purchasing an entire vacation home, an investor can buy a fraction of it, significantly reducing their initial investment.

- Affordability: Investors can participate in markets that would otherwise be inaccessible due to high entry costs.

- Reduced Risk: By investing smaller amounts, individuals can mitigate their financial exposure while still gaining access to lucrative investments.

Access to Premium Assets

Fractional ownership opens doors to premium assets that might be financially unattainable for individual investors. This includes luxury real estate, high-end vehicles, or valuable collectibles.

- High-Value Investments: Investors can own a share in properties or items that appreciate over time, allowing them to benefit from potential capital gains.

- Diverse Asset Classes: Fractional ownership can apply across various sectors, including real estate, art, and even shares in businesses.

Shared Costs and Responsibilities

Another significant advantage is the shared costs and responsibilities associated with owning a high-value asset. This arrangement alleviates the burden on individual owners.

- Cost Distribution: Expenses such as maintenance, property taxes, and insurance are divided among all owners, making it more affordable.

- Management Relief: Many fractional ownership arrangements include professional management services that handle day-to-day operations, freeing investors from these responsibilities.

Diversification Opportunities

Fractional ownership allows investors to diversify their portfolios by spreading their investments across multiple assets rather than concentrating their wealth in one area.

- Risk Mitigation: By owning fractions of different properties or assets, investors can reduce the risk associated with market fluctuations or specific asset performance.

- Broader Market Access: Investors can participate in various markets without needing substantial capital for each investment.

Professional Management Services

In many fractional ownership scenarios, professional management companies oversee the asset. This can be particularly beneficial for real estate investments.

- Expertise: Professional managers bring experience and knowledge that can enhance the value of the investment through effective management strategies.

- Time Savings: Investors do not need to dedicate personal time to managing the asset, allowing them to focus on other priorities.

Potential for Appreciation and Rental Income

Investors in fractional ownership not only stand to benefit from appreciation but may also receive rental income if the asset generates revenue.

- Income Generation: Properties can be rented out when not in personal use, providing additional cash flow for owners.

- Capital Gains: Over time, fractional owners may benefit from increases in property values or other assets they hold shares in.

Limited Control Over Asset Management

Despite its advantages, fractional ownership comes with significant drawbacks. One major concern is the limited control over asset management.

- Collective Decision-Making: Decisions regarding the asset often require consensus among all owners, which can lead to complications if opinions differ.

- Management Dependency: Investors may find themselves reliant on a management company or other co-owners for critical decisions about the asset’s future.

Potential for Illiquidity

Fractional ownership can lead to issues with liquidity. Selling a fractional share is often more complicated than selling an entire property or asset.

- Market Limitations: The market for fractional shares may be limited, making it difficult to find buyers when an owner wishes to sell their stake.

- Longer Exit Strategies: Exiting a fractional investment can take time and effort compared to traditional investments where liquidity is higher.

Complex Exit Strategies

Exiting a fractional ownership arrangement can be complex due to various factors involved in co-owned investments.

- Legal Considerations: The process may involve legal agreements that dictate how shares can be sold or transferred among co-owners.

- Potential Losses: If an investor needs to exit quickly but cannot find a buyer for their share, they may incur significant losses or have to wait until market conditions improve.

Possible Conflicts with Co-Owners

Conflicts among co-owners can arise due to differing opinions on how best to manage or utilize the shared asset.

- Disagreements on Usage: Co-owners may have conflicting schedules or preferences regarding how often they wish to use the property or how it should be maintained.

- Financial Disputes: If one owner fails to meet their financial obligations (such as maintenance fees), it could strain relationships among all owners involved.

Limited Personal Use of the Asset

While fractional ownership allows access to premium assets, it often comes with restrictions on personal use compared to full ownership.

- Scheduled Access: Owners typically have allocated time slots during which they can use the property or asset, which may not align with personal schedules.

- Shared Enjoyment: The enjoyment of using an asset like a vacation home is shared among multiple owners, potentially reducing individual satisfaction compared to sole ownership.

Diminished Returns Compared to Full Ownership

Investors may experience diminished returns when compared directly with full ownership scenarios due to shared profits and expenses.

- Profit Sharing: Any income generated from rental activities or appreciation must be divided among all co-owners, potentially leading to lower individual returns than if one owned the entire asset outright.

- Management Fees: Professional management services might charge fees that eat into overall profits from the investment.

In conclusion, fractional ownership presents both compelling advantages and notable disadvantages. It democratizes access to high-value assets while allowing for shared responsibilities and lower financial commitments. However, potential investors must carefully consider issues related to control, liquidity, exit strategies, and interpersonal dynamics among co-owners before committing their resources. Understanding these factors will enable informed decision-making in this evolving investment landscape.

Frequently Asked Questions About Fractional Ownership

- What is fractional ownership?

Fractional ownership is a model where multiple individuals share ownership of a high-value asset like real estate or luxury items. - What are the main benefits of fractional ownership?

The key benefits include lower financial commitment, access to premium assets, shared costs and responsibilities, diversification opportunities, professional management services, and potential income generation. - What are some drawbacks of fractional ownership?

Drawbacks include limited control over management decisions, potential illiquidity when selling shares, complex exit strategies, possible conflicts with co-owners regarding usage and finances. - How does liquidity work in fractional ownership?

Liquidity tends to be lower than full ownership; selling a fraction of an asset may require finding a buyer within a limited market. - Can I customize my share of a property?

No; customization typically requires consensus among all co-owners which can lead to disagreements. - Is there potential for profit in fractional ownership?

Yes; however profits are shared among all co-owners which may reduce individual returns compared to sole ownership. - How are expenses handled in fractional ownership?

Expenses such as maintenance and taxes are typically divided among all owners based on their share percentage. - What types of assets are commonly fractionally owned?

Commonly fractionally owned assets include real estate properties (residential and commercial), yachts, aircrafts, art pieces, and collectibles.