Freedom Debt Relief (FDR) is one of the largest debt settlement companies in the United States, offering services aimed at helping individuals manage and reduce their unsecured debts. Founded in 2002, the company has garnered attention for its approach to negotiating with creditors on behalf of clients, often promising significant reductions in total debt. However, potential clients must weigh the benefits against several notable drawbacks. This article provides a comprehensive overview of the advantages and disadvantages of using Freedom Debt Relief, helping you make an informed decision.

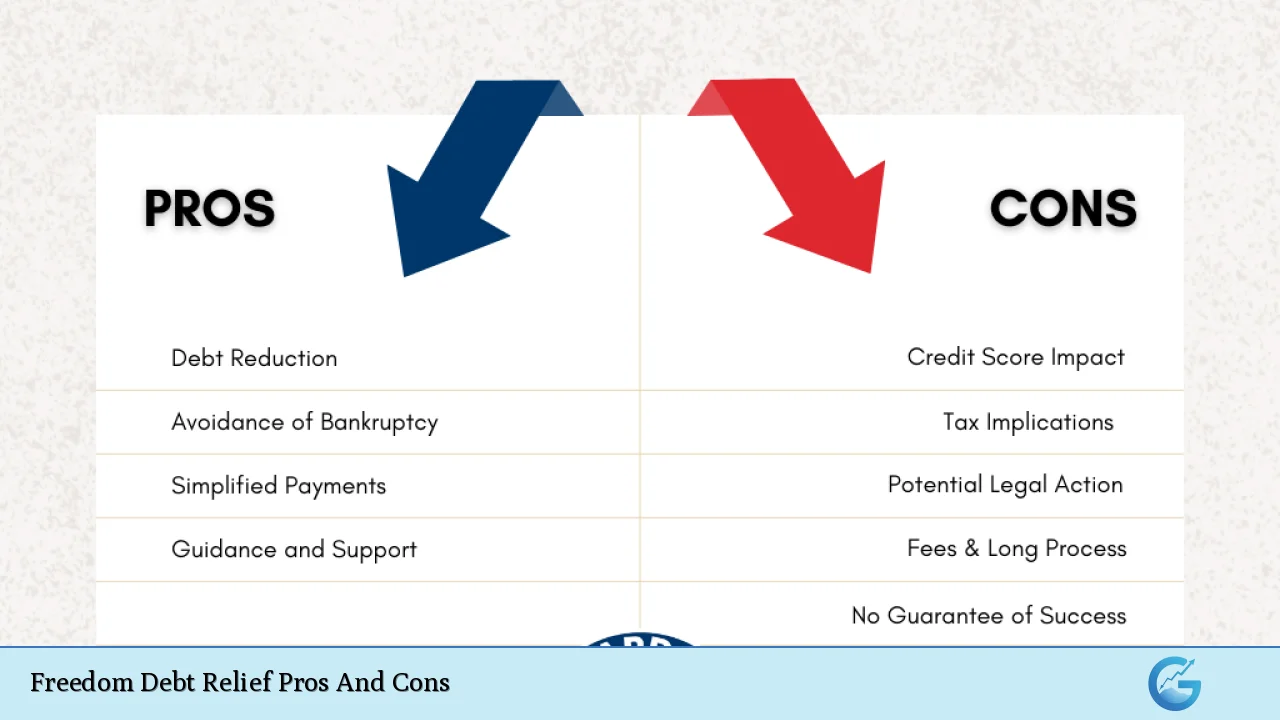

| Pros | Cons |

|---|---|

| Potential to reduce debts by up to 50% | Could significantly damage your credit score |

| Offers legal counsel to eligible clients | Charges fees ranging from 15% to 25% of enrolled debt |

| Simplifies debt management into a single monthly payment | Does not prevent creditors from contacting you during the process |

| Access to an online dashboard for tracking progress | No guarantee of successful settlements with creditors |

| Potentially quicker resolution of debts compared to traditional repayment plans | Requires a minimum amount of unsecured debt to qualify (typically $7,500) |

| Allows for flexible payment options into a dedicated account | The forgiven debt may be considered taxable income by the IRS |

| Free initial consultation and debt evaluation | Customer service complaints and mixed reviews regarding support |

| Possibility of legal representation if creditors take action against you | Risk of falling deeper into debt while waiting for settlements to be negotiated |

Potential to Reduce Debts by Up to 50%

One of the most appealing aspects of Freedom Debt Relief is its potential to significantly lower your total debt. The company negotiates with creditors to settle debts for less than what is owed, often achieving reductions between 10% and 50%. This can provide substantial financial relief for individuals struggling with overwhelming debt.

- Savings on Total Debt: Many clients report being able to settle their debts for significantly less than their original balances.

- Faster Resolution: Compared to traditional repayment methods, which can take years, FDR aims to resolve debts within 24 to 48 months.

Could Significantly Damage Your Credit Score

While the potential savings are enticing, it is crucial to understand that participating in a debt settlement program can have severe implications for your credit score.

- Delinquent Accounts: As part of the program, clients are advised to stop making payments on their debts, leading to accounts being marked as delinquent.

- Long-Term Impact: These delinquencies can remain on your credit report for up to seven years, making it challenging to secure loans or credit in the future.

Offers Legal Counsel to Eligible Clients

Freedom Debt Relief distinguishes itself from other debt settlement companies by providing legal counsel as part of its services. This can be particularly beneficial if creditors escalate collection efforts or threaten legal action.

- Legal Representation: Clients may receive representation from affiliated attorneys who specialize in debt settlement.

- Protection Against Lawsuits: Having legal support can help mitigate risks associated with creditor lawsuits during the negotiation process.

Charges Fees Ranging from 15% to 25% of Enrolled Debt

While Freedom Debt Relief does not charge upfront fees, clients should be aware that they will incur costs once settlements are reached.

- Percentage Fees: The fees charged typically range from 15% to 25% of the total enrolled debt, which can add up significantly depending on the amount owed.

- Impact on Savings: In some cases, the fees may outweigh the savings achieved through settlements, potentially leaving clients in a worse financial position than before.

Simplifies Debt Management into a Single Monthly Payment

FDR simplifies the process of managing multiple debts by consolidating payments into a single monthly deposit into a dedicated account.

- Ease of Management: Clients only need to track one payment instead of juggling multiple creditors and due dates.

- Automated Process: Once enough funds accumulate in the dedicated account, FDR negotiates with creditors on behalf of the client.

Does Not Prevent Creditors from Contacting You During the Process

Despite enrolling in a debt settlement program, clients may still face persistent calls and letters from creditors seeking payment.

- Ongoing Collection Efforts: Creditors are not prohibited from contacting clients during negotiations, which can lead to stress and anxiety.

- Potential Legal Action: There is also a risk that creditors may pursue legal action while negotiations are ongoing.

Access to an Online Dashboard for Tracking Progress

Freedom Debt Relief provides clients with access to an online dashboard where they can monitor their progress throughout the program.

- Transparency: Clients can view their escrow account balance and track settlements as they occur.

- Educational Resources: The dashboard also offers educational materials that can help clients better understand their financial situation.

No Guarantee of Successful Settlements with Creditors

While FDR aims to negotiate favorable settlements, there is no guarantee that all debts will be settled successfully.

- Creditor Discretion: Some creditors may refuse settlement offers or demand higher payments than anticipated.

- Risk of Non-settlement: If negotiations fail, clients may still be responsible for paying back their full debt amounts along with accrued interest and fees.

Potentially Quicker Resolution of Debts Compared to Traditional Repayment Plans

For individuals seeking a faster way out of debt, Freedom Debt Relief may offer quicker resolutions than traditional repayment plans.

- Accelerated Timeline: Many clients find that they can resolve their debts within two to four years through FDR’s negotiation efforts.

- Focused Approach: By prioritizing negotiations over ongoing payments, FDR aims to expedite the settlement process.

Requires a Minimum Amount of Unsecured Debt to Qualify

To enroll in Freedom Debt Relief’s program, individuals must have a minimum amount of unsecured debt—typically around $7,500.

- Eligibility Criteria: This requirement can exclude those with lower levels of debt who might still benefit from assistance.

- Limited Scope: FDR primarily works with unsecured debts such as credit cards and personal loans but does not assist with secured loans or federal student loans.

Allows for Flexible Payment Options into a Dedicated Account

FDR offers flexibility in how clients make payments into their dedicated account used for settling debts.

- Customized Payment Plans: Clients work with FDR to determine an affordable monthly payment based on their financial situation.

- Adjustable Contributions: If necessary, clients have some leeway in adjusting their contributions without facing severe penalties.

The Forgiven Debt May Be Considered Taxable Income by the IRS

A critical consideration for anyone using Freedom Debt Relief is that forgiven debt could be treated as taxable income by the IRS.

- IRS Implications: If a creditor forgives part of your debt, you may receive IRS Form 1099-C indicating cancellation of debt income.

- Tax Liability Risks: This could lead to unexpected tax liabilities unless you qualify for insolvency exemptions under IRS rules.

Free Initial Consultation and Debt Evaluation

Freedom Debt Relief provides potential clients with a free initial consultation and evaluation of their financial situation.

- No Obligation Assessment: This allows individuals to understand their options without any financial commitment upfront.

- Personalized Recommendations: During this consultation, FDR assesses your debts and may suggest alternative solutions tailored to your needs.

Customer Service Complaints and Mixed Reviews Regarding Support

Despite its many offerings, Freedom Debt Relief has faced criticism regarding its customer service quality.

- Service Issues: Numerous reviews highlight dissatisfaction with customer support responsiveness and effectiveness during critical times in the program.

- Impact on Client Experience: Poor customer service can exacerbate stress levels during an already challenging period in clients’ financial lives.

Risk of Falling Deeper into Debt While Waiting for Settlements

One significant risk associated with using Freedom Debt Relief is that clients may fall deeper into debt while waiting for negotiations with creditors.

- Accumulating Interest and Fees: As accounts become delinquent during negotiations, interest rates and late fees may continue accruing, increasing total liabilities.

- Financial Instability Risks: This situation can lead individuals into further financial distress if not managed carefully throughout the process.

In conclusion, while Freedom Debt Relief offers several advantages such as potential savings on total debt and access to legal counsel, it also presents significant risks including damage to credit scores and high fees. Individuals considering this option should carefully evaluate both sides before committing. Understanding these pros and cons will enable you to make an informed decision about whether Freedom Debt Relief aligns with your financial goals and circumstances.

Frequently Asked Questions About Freedom Debt Relief

- What types of debts does Freedom Debt Relief handle?

Freedom Debt Relief primarily deals with unsecured debts like credit cards and personal loans but does not work with secured loans or federal student loans. - How much do I need in unsecured debt to qualify?

The minimum amount required is typically around $7,500 in unsecured debt. - Will my credit score be affected?

Yes, participating in a debt settlement program usually results in a significant drop in your credit score due to missed payments. - Are there any upfront fees?

No upfront fees are charged; however, you will incur fees after settlements are reached. - How long does it take to settle my debts?

The average timeline for resolving debts through Freedom Debt Relief is between 24 and 48 months. - Can I still be contacted by creditors during this process?

Yes, creditors may continue contacting you while negotiations are ongoing. - Is forgiven debt taxable?

Yes, forgiven debt might be considered taxable income by the IRS unless you qualify for specific exemptions. - What happens if my creditor refuses a settlement?

If a creditor refuses a settlement offer, you may still be responsible for paying back your full balance along with any accrued interest.