The choice between Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) is a significant consideration for individuals navigating healthcare costs and tax advantages. Both account types offer unique benefits and limitations, making them suitable for different financial situations and health care needs. Understanding the pros and cons of each can empower individuals to make informed decisions that align with their financial goals and healthcare requirements.

| Pros | Cons |

|---|---|

| Tax advantages through pre-tax contributions. | FSA funds are subject to “use it or lose it” rules. |

| HSAs offer a triple tax advantage: contributions, growth, and withdrawals are tax-free. | HSAs require enrollment in a High Deductible Health Plan (HDHP). |

| Funds in HSAs roll over year to year without limits. | FSAs are employer-owned, meaning you lose access if you change jobs. |

| HSAs can be invested for potential growth over time. | Contribution limits for FSAs are lower compared to HSAs. |

| Immediate access to FSA funds for the entire contribution amount at the start of the year. | Limited flexibility in changing contribution amounts during the plan year for FSAs. |

Tax Advantages

Both FSAs and HSAs provide significant tax benefits that can reduce overall healthcare costs.

FSA Tax Benefits

- Contributions are made with pre-tax dollars, reducing taxable income.

- Withdrawals for qualified medical expenses are also tax-free.

- Employers may also contribute to an employee’s FSA, enhancing tax savings.

HSA Tax Benefits

- HSAs offer a triple tax advantage: contributions are tax-deductible, account growth is tax-free, and withdrawals for qualified medical expenses are tax-free.

- Funds can be invested, allowing for potential growth over time, which can be particularly beneficial as a long-term savings strategy.

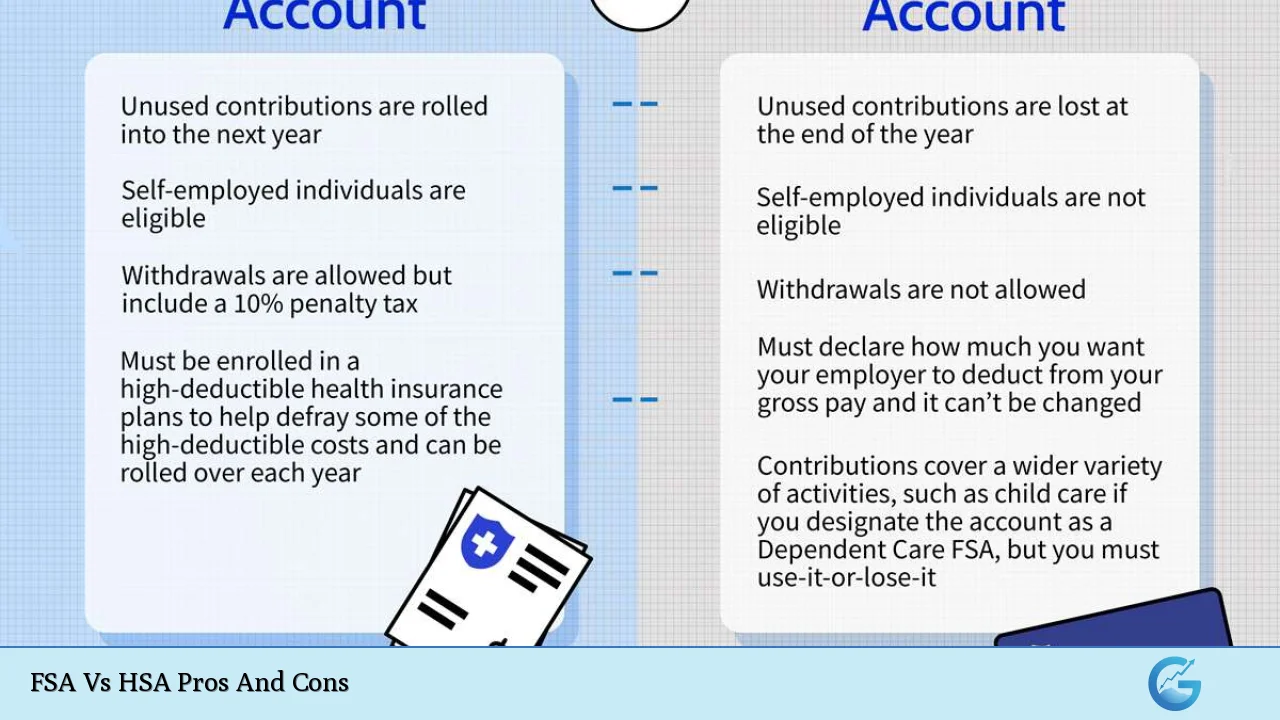

Use It or Lose It vs. Rollover Flexibility

A significant difference between FSAs and HSAs lies in how funds can be used or rolled over.

FSA Limitations

- FSAs typically operate under a “use it or lose it” rule. If you do not use your funds by the end of the plan year, you may forfeit any remaining balance unless your employer offers a grace period or rollover option.

- This creates pressure to spend the funds within a limited timeframe, which may lead to unnecessary purchases.

HSA Advantages

- HSAs allow funds to roll over indefinitely from year to year. There is no expiration on unused balances, making them an excellent option for individuals looking to save for future medical expenses.

- This rollover capability encourages long-term savings and investment opportunities.

Portability and Ownership

The ownership structure of these accounts affects their portability when changing jobs or retirement.

FSA Ownership

- FSAs are owned by employers. If you leave your job, you typically lose access to any unspent funds in your FSA.

- This lack of portability can be a disadvantage for those who change jobs frequently.

HSA Ownership

- HSAs are individually owned accounts. They remain with you regardless of employment status, allowing you to carry your savings into new jobs or retirement.

- This portability makes HSAs a more attractive option for long-term financial planning.

Contribution Limits

Each account type has different contribution limits set by the IRS, which can impact how much you can save annually.

FSA Contribution Limits

- For 2024, the contribution limit for an FSA is $3,200 per year. While this is beneficial, it is significantly lower than HSA limits.

- Employers may set lower limits based on their specific plans.

HSA Contribution Limits

- In contrast, HSAs have higher contribution limits: $4,150 for individuals and $8,300 for families in 2024.

- This higher limit allows individuals to save more money on a pre-tax basis, making HSAs particularly appealing for those anticipating higher medical expenses.

Immediate Access vs. Gradual Accumulation

The way funds are accessed varies between FSAs and HSAs.

Immediate Access with FSAs

- Employees have immediate access to their entire annual contribution amount at the beginning of the plan year. This feature can be advantageous for those expecting significant medical expenses early in the year.

Gradual Accumulation with HSAs

- With HSAs, individuals only have access to funds that have been deposited into their accounts. As contributions are made throughout the year, access grows incrementally.

- This structure encourages saving but may require careful planning if immediate expenses arise before sufficient contributions have been made.

Investment Opportunities

Investment potential is another key differentiator between FSAs and HSAs.

FSA Limitations on Investments

- FSAs do not offer investment options; they function strictly as cash accounts. This means that any funds contributed will not grow beyond their initial amount through investments.

HSA Investment Potential

- HSAs often allow account holders to invest their balances once they exceed a certain threshold (typically around $1,000). This capability can lead to substantial growth over time if invested wisely.

- The ability to invest HSA funds makes them an attractive option for those looking to build wealth while preparing for future healthcare costs.

Eligibility Requirements

Eligibility criteria differ significantly between FSAs and HSAs.

FSA Eligibility

- FSAs are available through employers regardless of the type of health insurance plan employees have. Anyone employed at a company offering an FSA can participate.

HSA Eligibility

- To qualify for an HSA, individuals must be enrolled in a High Deductible Health Plan (HDHP). This requirement may limit options for some employees who prefer traditional health plans with lower deductibles.

Risks and Concerns

Both account types come with inherent risks that users should consider before enrolling.

Risks Associated with FSAs

- The primary risk involves the “use it or lose it” policy that can lead to forfeiting unused funds at the end of the plan year.

- Additionally, since FSAs are employer-owned accounts, losing employment means losing access to those funds as well.

Risks Associated with HSAs

- Individuals must manage their healthcare expenses carefully due to potentially high out-of-pocket costs associated with HDHPs before reaching deductibles.

- There may also be fees associated with maintaining an HSA account depending on the provider chosen.

Closing Thoughts

Choosing between an FSA and an HSA involves evaluating personal financial situations alongside healthcare needs. Each option presents distinct advantages and disadvantages that cater to different lifestyles and preferences.

Ultimately, understanding these differences enables individuals to leverage these accounts effectively while maximizing tax benefits and preparing financially for healthcare costs. As healthcare continues evolving alongside economic conditions, making informed decisions regarding these accounts will remain essential in managing personal finances effectively.

Frequently Asked Questions About FSA Vs HSA

- What is the main difference between an FSA and an HSA?

The primary difference is that HSAs require enrollment in a High Deductible Health Plan (HDHP), while FSAs do not have such restrictions. - Can I contribute to both an FSA and an HSA?

You cannot contribute to both at the same time unless one is a limited-purpose FSA designed specifically for dental and vision expenses. - What happens if I don’t use my FSA funds?

If you don’t use your FSA funds by the end of the plan year, you will likely lose any remaining balance unless your employer offers a grace period or rollover option. - Are HSA contributions tax-deductible?

Yes, contributions made to an HSA are tax-deductible, providing immediate tax benefits. - Can I invest my HSA funds?

Yes, many HSA providers allow account holders to invest their balances once they reach a certain threshold. - What happens to my HSA if I change jobs?

Your HSA remains yours even if you change jobs; it is not tied to your employer. - Is there a limit on how much I can contribute to my HSA?

Yes, there are annual contribution limits set by the IRS; in 2024, it’s $4,150 for individuals and $8,300 for families. - Can I withdraw from my HSA at any time?

You can withdraw from your HSA at any time as long as it’s used for qualified medical expenses without incurring taxes or penalties.