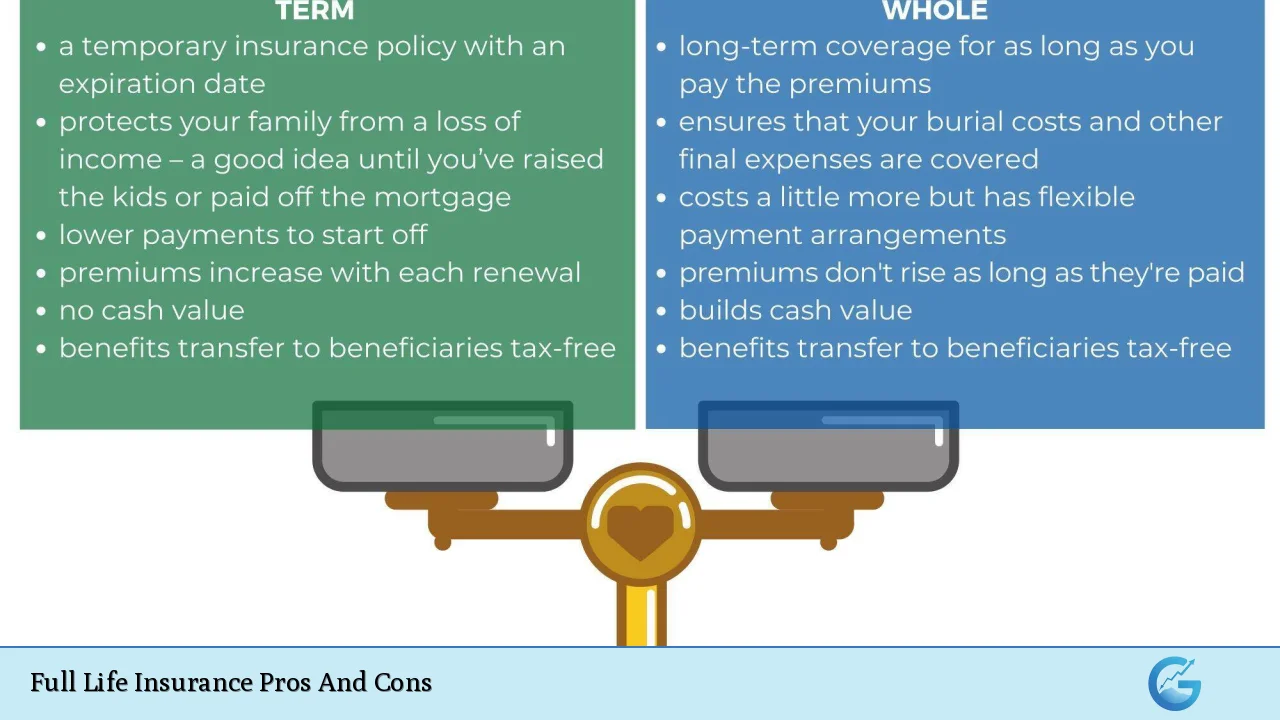

Full life insurance, also known as whole life insurance, is a permanent form of life insurance that provides coverage for the entirety of an individual’s life. Unlike term life insurance, which covers a specific period, full life insurance offers lifelong protection along with a cash value component. This type of policy has become increasingly popular among those seeking long-term financial security and estate planning options.

| Pros | Cons |

|---|---|

| Lifelong coverage | Higher premiums |

| Fixed premiums | Lower initial death benefit |

| Cash value accumulation | Complexity |

| Tax advantages | Slower cash value growth |

| Dividend potential | Less flexibility |

| Estate planning benefits | Opportunity cost |

Advantages of Full Life Insurance

Lifelong Coverage

Full life insurance provides protection that lasts for your entire lifetime, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

This permanent coverage offers peace of mind, knowing that your loved ones will be financially protected no matter how long you live. Unlike term life insurance, which expires after a set period, full life insurance remains in force as long as premiums are paid, eliminating the need to renew or requalify for coverage later in life when health issues might make obtaining insurance more difficult or expensive.

Fixed Premiums

One of the most attractive features of full life insurance is the stability of premiums. Once you purchase a policy, your premium payments remain the same throughout the life of the policy, regardless of changes in your health or age. This predictability allows for easier long-term financial planning and budgeting. As you age and your income potentially increases, the fixed nature of these premiums can make them more affordable relative to your overall financial situation.

Cash Value Accumulation

Full life insurance policies include a savings component known as cash value. A portion of your premium payments goes towards building this cash value, which grows tax-deferred over time. The cash value accumulation offers several benefits:

- Policy loans: You can borrow against the cash value at favorable interest rates.

- Withdrawals: You may be able to make partial withdrawals from the cash value.

- Paid-up additions: Some policies allow you to use the cash value to purchase additional coverage.

- Surrender value: If you decide to terminate the policy, you can receive the accumulated cash value.

This feature essentially combines life insurance protection with a savings vehicle, providing a financial resource you can tap into during your lifetime if needed.

Tax Advantages

Full life insurance offers several tax benefits that make it an attractive option for wealth preservation and transfer:

- Tax-deferred growth: The cash value in your policy grows tax-deferred, meaning you don’t pay taxes on the gains as long as the policy remains in force.

- Tax-free death benefit: The death benefit paid to your beneficiaries is generally income tax-free.

- Estate planning: Full life insurance can be structured to help minimize estate taxes, making it a valuable tool for high-net-worth individuals.

Dividend Potential

Many full life insurance policies are “participating,” meaning they have the potential to earn dividends. While not guaranteed, dividends can provide additional value to policyholders in several ways:

- Cash payments

- Reduced premium payments

- Increased cash value

- Purchase of additional coverage (paid-up additions)

These dividends can significantly enhance the overall return on your policy over time, potentially offsetting some of the higher costs associated with full life insurance.

Estate Planning Benefits

Full life insurance can play a crucial role in estate planning strategies:

- Providing liquidity: The death benefit can provide immediate cash to pay estate taxes or other expenses, preventing the need to sell assets at inopportune times.

- Equalizing inheritances: It can be used to provide equal inheritances to heirs when other assets (like a business) are left to specific individuals.

- Charitable giving: Policies can be structured to benefit charitable organizations while still providing for heirs.

Disadvantages of Full Life Insurance

Higher Premiums

The most significant drawback of full life insurance is its cost.

Premiums for full life policies are substantially higher than those for term life insurance, often 5 to 15 times more expensive for the same death benefit amount. This higher cost is due to several factors:

- Lifelong coverage

- Guaranteed cash value accumulation

- Administrative expenses

- Agent commissions

The higher premiums can strain budgets, especially for younger individuals or families with other financial priorities such as saving for retirement or children’s education.

Lower Initial Death Benefit

Due to the higher premiums and the cash value component, full life insurance typically provides a lower initial death benefit compared to term life insurance for the same premium amount. This means that individuals needing a large amount of coverage, such as young families with significant financial obligations, may find it challenging to obtain adequate protection through full life insurance alone.

Complexity

Full life insurance policies are more complex than term life insurance, often involving various components and options that can be difficult for policyholders to fully understand. This complexity includes:

- Cash value calculations

- Dividend options

- Policy loans and withdrawals

- Surrender charges

- Riders and additional benefits

The intricacy of these policies can make it challenging for consumers to make informed decisions and compare different options effectively.

Slower Cash Value Growth

While the cash value component of full life insurance is often touted as an investment feature, it typically grows at a slower rate compared to other investment vehicles. Several factors contribute to this slower growth:

- A portion of premiums goes towards the cost of insurance and administrative expenses

- Conservative investment strategies employed by insurance companies

- Fees and charges associated with policy management

Individuals seeking higher returns might find better opportunities in dedicated investment accounts or products.

Less Flexibility

Full life insurance policies are designed as long-term financial products, which can result in less flexibility for policyholders. This lack of flexibility manifests in several ways:

- Difficulty in adjusting coverage: Changing the death benefit or other policy features can be complicated and may require additional underwriting.

- Surrender charges: Canceling the policy in the early years often incurs significant penalties.

- Limited investment options: Unlike variable life insurance, traditional full life policies offer limited control over how the cash value is invested.

Opportunity Cost

The higher premiums associated with full life insurance represent a significant opportunity cost. The additional money spent on premiums could potentially be invested in other vehicles that offer higher returns or greater flexibility. This opportunity cost is particularly relevant for younger individuals who have a longer investment horizon and may benefit more from a strategy combining term life insurance with dedicated investments.

Conclusion

Full life insurance offers a unique combination of lifelong protection and financial benefits that can be valuable for certain individuals and financial situations. Its guaranteed coverage, fixed premiums, and cash value accumulation provide stability and potential tax advantages that appeal to many seeking long-term financial security. However, the higher costs, complexity, and potential opportunity costs make it crucial for individuals to carefully assess their financial goals and needs before committing to a full life insurance policy.

Ultimately, the decision to purchase full life insurance should be made as part of a comprehensive financial plan, taking into account individual circumstances, long-term objectives, and alternative investment opportunities.

For some, the peace of mind and estate planning benefits of full life insurance will outweigh the costs, while others may find that a combination of term life insurance and separate investments better suits their needs. Consulting with a qualified financial advisor can help in navigating these complex decisions and ensuring that your life insurance strategy aligns with your overall financial goals.

Frequently Asked Questions About Full Life Insurance Pros And Cons

- Is full life insurance worth the higher cost compared to term life insurance?

The value depends on individual needs and financial goals. Full life insurance can be worth it for those seeking lifelong coverage, cash value accumulation, and estate planning benefits. However, for many, a combination of term insurance and separate investments may be more cost-effective. - Can I access the cash value of my full life insurance policy?

Yes, you can typically access the cash value through policy loans or withdrawals. However, this may reduce the death benefit and could have tax implications if not managed properly. - What happens if I stop paying premiums on my full life insurance policy?

If you stop paying premiums, the policy may lapse, or the insurer might use the cash value to cover premiums temporarily. Some policies offer a reduced paid-up option, allowing you to keep a lower amount of coverage without further premium payments. - Are the dividends on full life insurance policies guaranteed?

No, dividends are not guaranteed and depend on the insurance company’s financial performance. However, many established insurers have consistent dividend payment histories. - Can I convert a term life insurance policy to a full life policy?

Many term policies offer a conversion option, allowing you to switch to a full life policy without additional underwriting. The terms and availability of this option vary by insurer and policy. - How does the cash value growth in full life insurance compare to other investments?

Cash value growth in full life insurance is generally more conservative and slower than many other investment options. It offers stability and tax advantages but may underperform more aggressive investment strategies over the long term. - Is full life insurance a good option for estate planning?

Full life insurance can be an excellent tool for estate planning, providing liquidity for estate taxes and allowing for wealth transfer to heirs. It’s particularly useful for high-net-worth individuals facing potential estate tax liabilities. - Can I use my full life insurance policy as collateral for a loan?

Yes, many lenders accept the cash value of a full life insurance policy as collateral for loans. This can provide a low-interest borrowing option, but it’s important to understand the potential risks to your policy and death benefit.