Investing in gold has long been a favored strategy among investors seeking to safeguard their wealth and diversify their portfolios. Gold is often viewed as a reliable store of value, particularly during times of economic uncertainty, inflation, or geopolitical turmoil. Its intrinsic value and historical significance as a medium of exchange make it an appealing asset for many. However, like any investment, gold comes with its own set of advantages and disadvantages that potential investors must carefully consider.

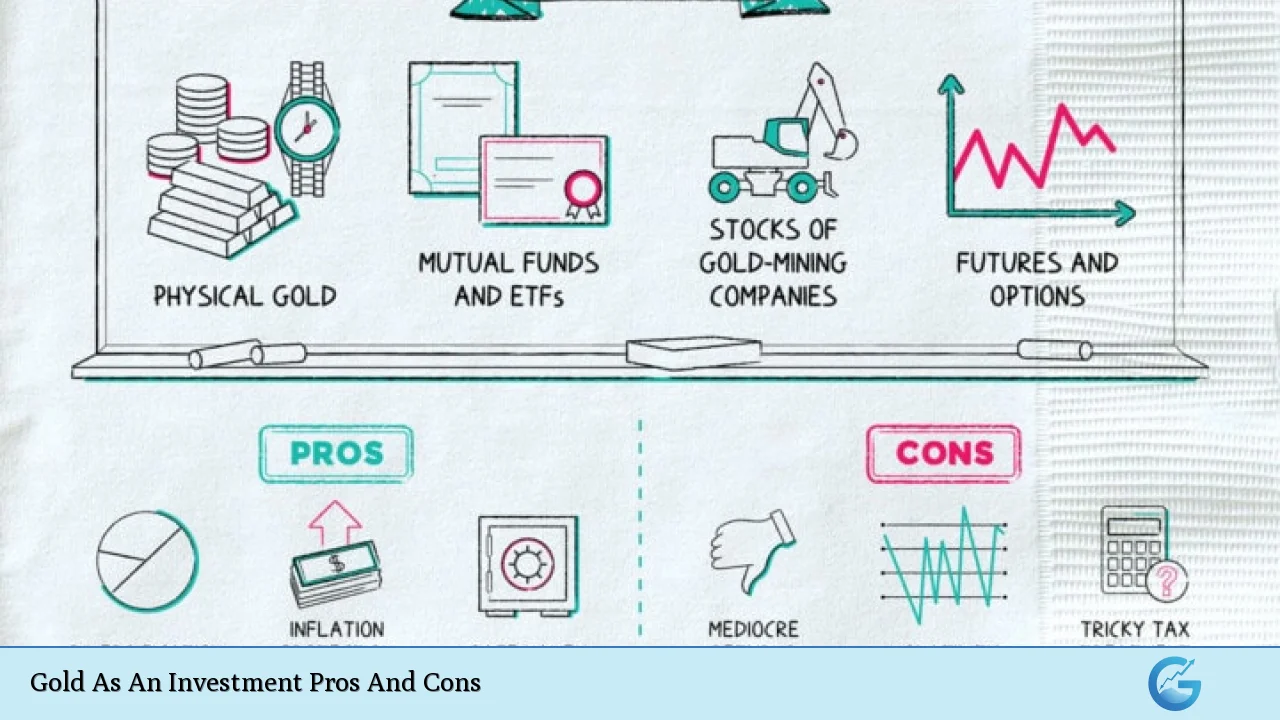

The following table summarizes the key pros and cons of investing in gold:

| Pros | Cons |

|---|---|

| Hedge against inflation | Does not generate passive income |

| Safe-haven asset during economic uncertainty | Storage and insurance costs for physical gold |

| Diversification benefits in a portfolio | Price volatility in the short term |

| Limited supply enhances value stability | Capital gains tax implications |

| Tangible asset with intrinsic value | Potential performance lag compared to other investments |

| Global liquidity and demand for gold | Complexities in trading gold futures or mining stocks |

Hedge Against Inflation

One of the most significant advantages of investing in gold is its ability to act as a hedge against inflation. As inflation rises, the purchasing power of currency declines, leading investors to seek assets that can maintain their value. Gold has historically shown resilience during inflationary periods, often increasing in price as the cost of living rises. This characteristic makes it an attractive option for investors looking to preserve their wealth over time.

- Gold retains purchasing power: Unlike cash, which can lose value due to inflation, gold tends to hold its worth.

- Historical performance: Over the long term, gold prices have generally outpaced inflation rates.

Safe-Haven Asset During Economic Uncertainty

Gold is widely regarded as a safe-haven asset, meaning that during times of economic instability or geopolitical tensions, investors flock to gold for security. This behavior often drives up the price of gold when other investments falter.

- Protection during crises: In financial downturns or political unrest, gold often appreciates as investors seek stability.

- Historical trends: During past recessions and crises, such as the 2008 financial crisis, gold prices surged while stock markets plummeted.

Diversification Benefits in a Portfolio

Including gold in an investment portfolio can provide diversification benefits. Gold typically exhibits low correlation with other asset classes like stocks and bonds, which can help mitigate risks associated with market volatility.

- Risk management: By adding gold to a portfolio, investors can reduce overall risk and enhance returns during market fluctuations.

- Balanced exposure: Financial advisors often recommend allocating 5-10% of a portfolio to gold for optimal diversification.

Limited Supply Enhances Value Stability

Gold’s finite supply contributes to its long-term value stability. Unlike fiat currencies that can be printed at will by governments, gold’s availability is limited by natural resources and mining capabilities.

- Scarcity factor: As demand increases and supply remains constant or declines, the price of gold is likely to rise.

- Intrinsic value: Gold’s scarcity adds to its appeal as a reliable investment option over time.

Tangible Asset with Intrinsic Value

Investing in physical gold provides the advantage of owning a tangible asset. Unlike stocks or bonds that exist only on paper, physical gold can be held and stored securely.

- Psychological comfort: Many investors feel more secure owning physical assets rather than intangible securities.

- Versatile uses: Beyond investment purposes, gold is used in various industries including jewelry and electronics, which supports its demand.

Global Liquidity and Demand for Gold

Gold enjoys global liquidity; it can be easily bought or sold across international markets. This widespread acceptance enhances its attractiveness as an investment vehicle.

- Universal acceptance: Gold is recognized worldwide as a valuable asset, making it easy to trade regardless of location.

- Market demand: The consistent demand for gold from central banks and investors contributes to its liquidity and stability.

Does Not Generate Passive Income

One notable disadvantage of investing in gold is that it does not produce any passive income. Unlike stocks that pay dividends or bonds that yield interest, the only way to profit from gold is through capital appreciation when selling it at a higher price than purchased.

- No cash flow: Investors seeking regular income from their investments may find gold unsuitable for their needs.

- Long-term holding required: To realize gains from gold investments, one must often hold onto them for extended periods until market conditions are favorable.

Storage and Insurance Costs for Physical Gold

Investing in physical gold entails additional costs related to storage and insurance. Safeguarding tangible assets can become expensive over time, especially if one opts for secure storage facilities or bank safety deposit boxes.

- Ongoing expenses: The costs associated with storing and insuring physical gold can erode potential profits from price appreciation.

- Convenience vs. cost: While some investors prefer physical ownership for security reasons, they must weigh these costs against potential returns.

Price Volatility in the Short Term

While gold is generally considered stable over the long term, it can experience significant price fluctuations in the short term. These swings can be influenced by various factors including market sentiment, economic data releases, and geopolitical events.

- Market sensitivity: Gold prices may react sharply to news events or changes in monetary policy that affect investor sentiment.

- Investment timing challenges: Timing purchases or sales based on short-term price movements can be risky and difficult for investors.

Capital Gains Tax Implications

Investors should be aware of the tax implications associated with selling gold. In many jurisdictions, profits from selling physical gold are subject to capital gains tax, which can significantly impact net returns on investment.

- Tax considerations: Understanding local tax laws regarding capital gains on precious metals is crucial for effective financial planning.

- Potentially higher rates: In some regions, capital gains on collectibles like gold may be taxed at higher rates than standard investments.

Potential Performance Lag Compared to Other Investments

Gold may not perform as well as other asset classes such as stocks or real estate over certain periods. This potential performance lag can be particularly pronounced during bull markets when equities are surging.

- Opportunity cost: Investors holding significant portions of their portfolios in gold may miss out on higher returns available through other investments during strong market performances.

- Long-term perspective needed: To realize the benefits of investing in gold, one must adopt a long-term view rather than seeking immediate gains.

Complexities in Trading Gold Futures or Mining Stocks

Investing in alternatives like gold futures or mining stocks introduces additional complexities and risks compared to straightforward physical ownership. These instruments require more sophisticated knowledge of market dynamics and trading strategies.

- Higher risk profile: Futures trading involves leverage which can amplify losses if not managed properly; similarly, mining stocks are subject to operational risks beyond just commodity prices.

- Requires expertise: Navigating these markets effectively demands a deeper understanding of both financial markets and specific industry factors influencing mining operations.

In conclusion, investing in gold offers both advantages and disadvantages that require careful consideration by potential investors. While it serves as an effective hedge against inflation and provides diversification benefits within a portfolio, it also comes with challenges such as lack of passive income generation and potential storage costs.

As with any investment decision, individuals should assess their financial goals, risk tolerance, and overall investment strategy before committing funds to this precious metal. By understanding both the strengths and weaknesses associated with investing in gold, investors can make informed decisions that align with their long-term financial objectives.

Frequently Asked Questions About Gold As An Investment

- What are the main benefits of investing in gold?

Gold acts as a hedge against inflation, provides portfolio diversification, serves as a safe haven during economic uncertainty, and has intrinsic value. - Is investing in physical gold better than ETFs?

This depends on individual preferences; physical gold offers tangible ownership but incurs storage costs while ETFs provide liquidity without direct ownership. - How much should I invest in gold?

Financial advisors typically recommend allocating 5-10% of your investment portfolio to gold for optimal diversification. - Does gold generate income?

No, unlike stocks or bonds that pay dividends or interest, profits from investing in gold come solely from capital appreciation. - What are the risks associated with investing in gold?

The risks include price volatility, storage costs for physical assets, capital gains taxes upon sale, and potential performance lag compared to equities. - How does geopolitical instability affect gold prices?

Gold prices often rise during geopolitical tensions as investors seek safe-haven assets amidst uncertainty. - Can I lose money by investing in gold?

Yes, like any investment, there are risks involved; if purchased at high prices without subsequent appreciation or if sold during downturns. - What types of products are available for investing in gold?

You can invest through physical bullion (coins/bars), ETFs that track the price of gold, mutual funds focused on precious metals or shares in mining companies.