Goodbudget is a popular budgeting app that employs the envelope budgeting method in a digital format. This approach to financial management has gained traction among individuals and families seeking to gain control over their spending habits and achieve their financial goals. As with any financial tool, Goodbudget comes with its own set of advantages and disadvantages that users should carefully consider before incorporating it into their financial strategy.

| Pros | Cons |

|---|---|

| User-friendly interface | Limited features in free version |

| Envelope budgeting system | Manual transaction entry |

| Syncing across devices | No automatic bank sync in free version |

| Budget sharing capabilities | Learning curve for new users |

| Debt tracking features | Lack of investment tracking |

| Customizable categories | Limited reporting in free version |

| Ad-free experience | Subscription required for advanced features |

| Educational resources | No credit score monitoring |

Advantages of Goodbudget

User-Friendly Interface

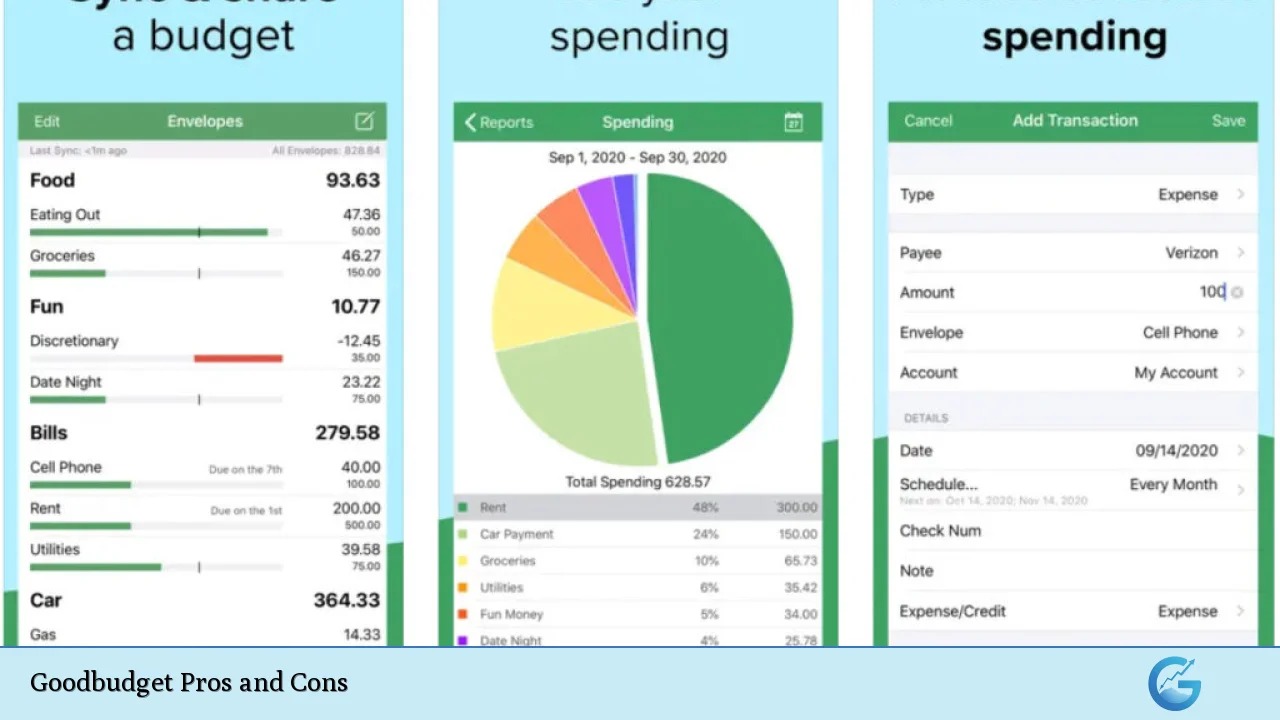

Goodbudget prides itself on offering a clean, intuitive interface that makes budgeting accessible to users of all technical backgrounds. This ease of use is crucial in the world of personal finance, where complexity can often lead to abandonment of good financial habits.

- Simple navigation between different sections of the app

- Clear visual representations of budget allocations

- Easy-to-understand graphs and charts for financial overview

The app’s straightforward design encourages consistent use, which is key to successful budgeting. By removing barriers to entry, Goodbudget increases the likelihood that users will stick with their budgeting plans long-term.

Envelope Budgeting System

At the core of Goodbudget’s functionality is the digital envelope budgeting system, a modern take on the traditional method of allocating cash to physical envelopes.

- Virtual envelopes for different spending categories

- Ability to set spending limits for each category

- Visual representation of remaining funds in each envelope

This system helps users to:

- Prioritize spending

- Avoid overspending in specific categories

- Make more mindful financial decisions

The envelope system is particularly effective for those who struggle with impulse spending or have difficulty visualizing their budget allocations. By providing a clear, compartmentalized view of finances, Goodbudget helps users develop a more disciplined approach to money management.

Syncing Across Devices

In today’s mobile-first world, the ability to access financial information across multiple devices is crucial. Goodbudget offers seamless syncing capabilities that enhance its utility for users.

- Real-time updates across smartphones, tablets, and computers

- Consistent user experience across all platforms

- Ability to input transactions on-the-go

This feature is especially beneficial for:

- Couples managing shared finances

- Individuals who switch between devices throughout the day

- Users who prefer to review their finances on a larger screen at home

The syncing functionality ensures that users always have access to the most up-to-date version of their budget, regardless of which device they’re using. This consistency is vital for maintaining accurate financial records and making informed spending decisions.

Budget Sharing Capabilities

Goodbudget recognizes that financial management is often a collaborative effort, especially for couples and families. The app’s budget sharing features facilitate transparent and cooperative financial planning.

- Ability to share budgets with partners or family members

- Collaborative input on financial goals and spending limits

- Shared visibility into transactions and envelope balances

Benefits of budget sharing include:

- Improved financial communication between partners

- Increased accountability for shared financial goals

- Streamlined management of household finances

By promoting open dialogue about money matters, Goodbudget’s sharing capabilities can help strengthen financial relationships and reduce conflicts related to spending habits.

Debt Tracking Features

For many users, debt management is a crucial aspect of their financial journey. Goodbudget incorporates debt tracking features that help users visualize their progress towards becoming debt-free.

- Dedicated envelopes for debt payments

- Progress tracking for debt reduction goals

- Visualization of debt payoff timelines

These features support users in:

- Prioritizing debt repayment

- Staying motivated through visual progress indicators

- Making informed decisions about allocating extra funds to debt reduction

The inclusion of debt tracking within the budgeting app provides a holistic view of one’s financial situation, encouraging a balanced approach to spending, saving, and debt repayment.

Disadvantages of Goodbudget

Limited Features in Free Version

While Goodbudget offers a free version, it comes with significant limitations that may frustrate users looking for a more comprehensive budgeting solution without cost.

- Restricted to 10 regular envelopes and 10 annual envelopes

- Limited to one account

- Only one year of transaction history

These restrictions can be problematic for:

- Users with complex budgeting needs

- Those managing multiple financial accounts

- Individuals who need extensive historical data for analysis

The limitations of the free version may push users towards the paid subscription, which can be an unexpected expense for those seeking a no-cost budgeting solution.

Manual Transaction Entry

One of the most significant drawbacks of Goodbudget is its reliance on manual transaction entry, particularly in the free version.

- Users must input each transaction manually

- Increased risk of errors or omissions

- Time-consuming process, especially for frequent transactions

This manual approach can lead to:

- Incomplete financial records if users forget to log transactions

- Delayed updates to budget status

- Reduced likelihood of consistent app usage due to the effort required

For users accustomed to automated financial tracking, the manual entry requirement of Goodbudget may be a significant deterrent, potentially impacting the accuracy and usefulness of their budgeting efforts.

No Automatic Bank Sync in Free Version

The absence of automatic bank syncing in the free version of Goodbudget is a notable limitation, especially when compared to other budgeting apps in the market.

- Manual balance updates required

- Potential for discrepancies between app and actual account balances

- Increased time investment for maintaining accurate records

This lack of automation can result in:

- Outdated financial information

- Missed transactions or duplicate entries

- Reduced real-time visibility into financial status

Without automatic bank syncing, users may find it challenging to maintain an up-to-date and accurate picture of their finances, potentially leading to misguided budgeting decisions.

Learning Curve for New Users

While Goodbudget strives for simplicity, the envelope budgeting system and the app’s unique features can present a learning curve for new users, especially those unfamiliar with this budgeting method.

- Initial setup process can be time-consuming

- Understanding envelope allocation may require practice

- Adapting to manual tracking can be challenging for some users

Potential hurdles include:

- Difficulty in determining appropriate envelope categories

- Confusion about how to handle unexpected expenses

- Adjusting to the discipline required for regular manual updates

The learning curve associated with Goodbudget may discourage some users from fully adopting the system, potentially limiting its effectiveness as a budgeting tool.

Lack of Investment Tracking

For users looking for a comprehensive financial management solution, Goodbudget’s lack of investment tracking features is a significant drawback.

- No integration with investment accounts

- Unable to track stock portfolios or retirement accounts

- Limited view of overall financial health

This limitation affects:

- Users seeking a holistic view of their finances

- Individuals actively managing investments alongside their budget

- Those wanting to align budgeting with long-term financial goals

The absence of investment tracking means that users must rely on separate tools to manage this aspect of their finances, potentially leading to a fragmented approach to financial management.

Frequently Asked Questions About Goodbudget Pros and Cons

- Is Goodbudget suitable for cryptocurrency users?

Goodbudget does not offer specific features for tracking cryptocurrencies. Users would need to manually create envelopes and track crypto transactions, which may not be ideal for active traders. - How does Goodbudget compare to forex trading platforms in terms of financial management?

Goodbudget is primarily a personal budgeting tool and does not offer forex trading capabilities. Forex traders would need to use separate platforms for trading and use Goodbudget solely for personal expense tracking. - Can Goodbudget help with managing money market investments?

While Goodbudget can be used to track money allocated to investments, it doesn’t provide specific tools for money market management. Users would need to manually update their investment values within the app. - Does Goodbudget offer any features for tracking stock market investments?

Goodbudget does not have built-in features for tracking stock market investments. Users interested in monitoring their stock portfolio alongside their budget would need to use a separate investment tracking tool. - Is there a way to integrate Goodbudget with other financial apps for a more comprehensive view?

Goodbudget does not offer direct integrations with other financial apps. Users would need to manually input data from other sources to maintain a comprehensive financial overview. - How secure is Goodbudget for storing sensitive financial information?

Goodbudget uses encryption to protect user data and does not store bank login information. However, as with any financial app, users should exercise caution and follow best practices for digital security. - Can Goodbudget help with tax planning and preparation?

While Goodbudget can track expenses that may be relevant for taxes, it is not designed as a tax planning tool. Users would need to export their data and use it in conjunction with dedicated tax software or consult with a tax professional. - Is Goodbudget suitable for small business owners?

Goodbudget is primarily designed for personal and household budgeting. Small business owners may find its features limited for business financial management and may need to consider more robust accounting software options.

In conclusion, Goodbudget offers a unique approach to personal finance management through its digital envelope system. Its strengths lie in its user-friendly interface, collaborative features, and the discipline it encourages in budgeting. However, the limitations of its free version, reliance on manual input, and lack of investment tracking features may deter some users, particularly those seeking a more automated or comprehensive financial management solution.

For individuals and families looking to gain better control over their spending and develop healthier financial habits, Goodbudget can be an excellent tool. Its pros often outweigh its cons for those who appreciate a hands-on approach to budgeting and are willing to invest time in regular financial tracking. However, for users deeply involved in investments, cryptocurrencies, or complex financial portfolios, Goodbudget may need to be supplemented with additional tools to provide a complete picture of their financial health.

Ultimately, the decision to use Goodbudget should be based on individual financial goals, preferences for manual versus automated tracking, and willingness to engage regularly with a budgeting app. As with any financial tool, it’s essential to evaluate how well it aligns with personal needs and financial management styles before fully committing to its use.