Group Variable Universal Life Insurance (GVUL) is a unique financial product that combines life insurance with investment opportunities, allowing policyholders to benefit from both a death benefit and the potential for cash value growth. Offered primarily through employer-sponsored plans, GVUL policies provide a more affordable option for individuals seeking permanent life insurance coverage while also allowing them to invest in various financial markets. This dual functionality makes GVUL an attractive choice for many, but it also comes with its own set of advantages and disadvantages.

This article will explore the pros and cons of Group Variable Universal Life Insurance in detail, providing insights that can help you make an informed decision about whether this type of insurance aligns with your financial goals.

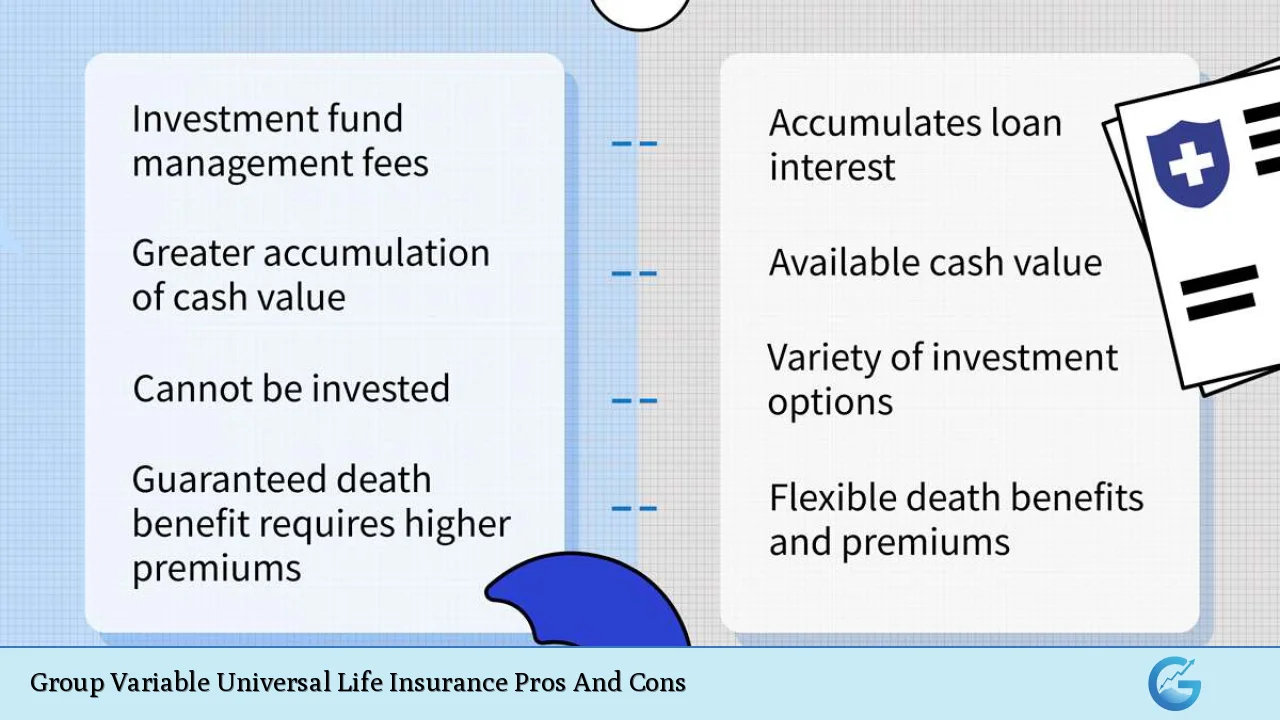

| Pros | Cons |

|---|---|

| Cost-effective compared to individual policies | Risk of losing cash value due to market performance |

| Flexible premium payments | Complexity in understanding policy details |

| Potential for higher returns on cash value investments | Higher fees and charges than traditional policies |

| Portable coverage options available | Coverage may be limited by employer’s plan |

| Tax-deferred growth on cash value | Possible loss of coverage if employment ends without portability |

| Accelerated benefits for terminal illness | Requires careful monitoring of investments and policy performance |

| No medical exams required for enrollment in many cases | May require medical underwriting for increased coverage or additional benefits |

| Access to a variety of investment options | Investment performance can be volatile and uncertain |

Cost-effective Compared to Individual Policies

One of the primary advantages of Group Variable Universal Life Insurance is its cost-effectiveness.

- Lower Premiums: GVUL policies are typically offered at lower rates than individual life insurance policies because they are purchased in bulk through employers.

- Employer Contributions: In some cases, employers may cover part or all of the premium costs, making it an affordable option for employees.

This affordability allows individuals to secure life insurance coverage that might otherwise be too expensive if purchased individually.

Flexible Premium Payments

GVUL policies offer significant flexibility regarding premium payments.

- Adjustable Payments: Policyholders can often adjust their premium payments based on their financial situation, allowing them to pay more during profitable months and less during tighter financial periods.

- Payment Frequency Options: Many GVUL plans allow for monthly, quarterly, or annual payment options, providing further customization based on personal cash flow needs.

This flexibility can be particularly beneficial for individuals who experience variable income levels or those who want to align their insurance costs with their overall financial strategy.

Potential for Higher Returns on Cash Value Investments

GVUL policies allow policyholders to allocate a portion of their premiums into investment accounts, which can lead to potentially higher returns compared to traditional whole life policies.

- Investment Choices: Policyholders can choose from various investment options, including stocks, bonds, and mutual funds, enabling them to tailor their investment strategy according to their risk tolerance and financial goals.

- Growth Potential: If the investments perform well, the cash value of the policy can grow significantly over time, providing additional financial resources that can be accessed through loans or withdrawals.

This potential for growth makes GVUL an appealing option for those looking to combine life insurance with investment opportunities.

Portable Coverage Options Available

Another significant advantage of GVUL is its portability feature.

- Continued Coverage: If an employee leaves their job or retires, many GVUL policies allow them to continue their coverage by paying premiums directly to the insurance provider.

- Retirement Security: This feature ensures that individuals do not lose their life insurance protection when transitioning between jobs or entering retirement, providing peace of mind during significant life changes.

Having portable coverage is crucial for maintaining long-term financial security without needing to reapply for new policies or undergo medical examinations again.

Tax-deferred Growth on Cash Value

GVUL policies offer tax advantages that can enhance overall financial planning strategies.

- Tax-deferred Accumulation: The cash value growth within a GVUL policy is tax-deferred, meaning policyholders do not pay taxes on the gains until they withdraw funds.

- Tax-free Death Benefit: The death benefit paid out to beneficiaries is generally income tax-free, which can provide substantial financial relief during difficult times.

These tax benefits make GVUL an effective tool for long-term wealth accumulation and estate planning.

Accelerated Benefits for Terminal Illness

Many GVUL policies include provisions that allow policyholders diagnosed with terminal illnesses to access a portion of their death benefit early.

- Financial Support During Illness: This feature can provide critical financial support during challenging times when medical expenses may be high and income may be reduced due to inability to work.

- Peace of Mind: Knowing that funds are available in case of severe health issues can alleviate stress and allow individuals to focus on recovery rather than finances.

This aspect highlights the compassionate design of GVUL products tailored to meet the needs of policyholders facing serious health challenges.

Risk of Losing Cash Value Due to Market Performance

Despite its advantages, one notable disadvantage of GVUL is the risk associated with market fluctuations impacting cash value growth.

- Investment Risks: Unlike whole life insurance policies that guarantee a minimum cash value growth, GVUL relies on market performance. Poor investment choices or economic downturns can lead to decreased cash value or even losses.

- Volatility Concerns: Policyholders must be prepared for potential volatility in their investments and understand that their cash value could fluctuate significantly over time.

This risk necessitates careful consideration and monitoring by policyholders who may not have experience managing investments effectively.

Complexity in Understanding Policy Details

GVUL policies can be complex due to their combination of life insurance and investment components.

- Understanding Terms: Policyholders must navigate various terms related to investments, fees, and benefits, which can be overwhelming without prior knowledge or experience in finance.

- Need for Financial Literacy: Individuals considering GVUL should have a solid understanding of how these products work or seek assistance from knowledgeable advisors who can explain the intricacies involved.

This complexity may deter some potential buyers who prefer simpler insurance products without the added layers of investment management.

Higher Fees and Charges Than Traditional Policies

GVUL policies often come with higher fees compared to standard life insurance products.

- Administrative Costs: These fees may include administrative charges, mortality costs, and investment management fees that accumulate over time and reduce overall returns on cash value investments.

- Impact on Returns: Higher fees can eat into the potential gains from investments within the policy, making it essential for buyers to evaluate whether the benefits outweigh these costs before committing.

Understanding these fees is crucial for ensuring that policyholders do not face unexpected costs that could diminish their returns or overall satisfaction with the product.

Coverage May Be Limited by Employer’s Plan

While GVUL offers flexibility and affordability through employer sponsorship, it also has limitations based on what each employer offers.

- Coverage Amounts: Employers may set caps on coverage amounts available through their plans. This limitation might not meet every individual’s needs based on personal circumstances or family requirements.

- Limited Customization Options: Some employers may offer standard plans without much room for customization. This lack of choice could prevent employees from tailoring their coverage as needed based on personal preferences or financial goals.

Understanding these limitations is vital when evaluating whether a GVUL plan meets your specific needs as part of your overall financial strategy.

Possible Loss of Coverage if Employment Ends Without Portability

If an employee leaves a job where they hold a GVUL policy without portable options included in their plan, they risk losing coverage altogether.

- Job Transition Risks: Losing employment means losing access to employer-sponsored benefits like GVUL unless specific portability provisions are included in the plan.

- Reapplication Challenges: If coverage is lost, reapplying for individual life insurance later may come with higher premiums due to age or health changes since initial enrollment.

This aspect underscores the importance of understanding your employer’s specific offerings regarding portability before committing to a GVUL policy as part of your long-term planning strategy.

Requires Careful Monitoring of Investments and Policy Performance

The investment component within GVUL necessitates ongoing attention from policyholders.

- Active Management Needed: To maximize returns and minimize risks associated with market fluctuations, investors must actively manage their chosen subaccounts within the policy.

- Regular Reviews Required: Regularly reviewing performance metrics ensures alignment with personal goals while also adjusting strategies as needed based on changing market conditions.

This requirement may not appeal to everyone; those who prefer hands-off approaches might find traditional whole life policies more suitable given their guaranteed returns without active management needs.

In conclusion, Group Variable Universal Life Insurance presents both compelling advantages and noteworthy disadvantages. It offers cost-effective premiums combined with flexible payment options and potential high returns through investments while providing essential death benefits. However, prospective buyers must carefully consider risks related to market performance volatility alongside complexities tied into understanding such products fully before making decisions affecting long-term financial security.

Frequently Asked Questions About Group Variable Universal Life Insurance

- What is Group Variable Universal Life Insurance?

A type of permanent life insurance offered through employers that combines life coverage with investment options. - What are the main benefits?

The main benefits include lower premiums compared to individual policies, flexible payment options, potential high returns on investments, tax-deferred growth, and portability. - Are there any risks?

The primary risks involve market volatility affecting cash value growth and complexity in understanding policy details. - Can I keep my coverage if I change jobs?

This depends on whether your employer’s plan includes portability options; otherwise, you may lose your coverage. - What happens if my investments perform poorly?

Poor performance could lead to reduced cash value or even losses within your policy. - Do I need a medical exam?

No medical exams are often required for initial enrollment; however, increased coverage might necessitate underwriting. - How does tax treatment work?

The cash value grows tax-deferred until withdrawn; death benefits are typically paid out tax-free. - Is this type of insurance suitable for everyone?

No; it’s best suited for those comfortable managing investments actively while seeking both life coverage and growth potential.

In summary, Group Variable Universal Life Insurance provides a unique blend of benefits tailored towards individuals looking for both protection and investment opportunities within one product. Understanding its pros and cons will empower you as you navigate your financial journey effectively.