Guaranteed lifetime income annuities are financial products designed to provide individuals with a steady stream of income for the rest of their lives. Typically offered by insurance companies, these annuities require an upfront payment or a series of payments in exchange for guaranteed income that can begin immediately or at a future date. For many retirees, these annuities represent a way to ensure financial security and peace of mind in their later years, particularly as they navigate the complexities of retirement planning and the potential risks associated with outliving their savings.

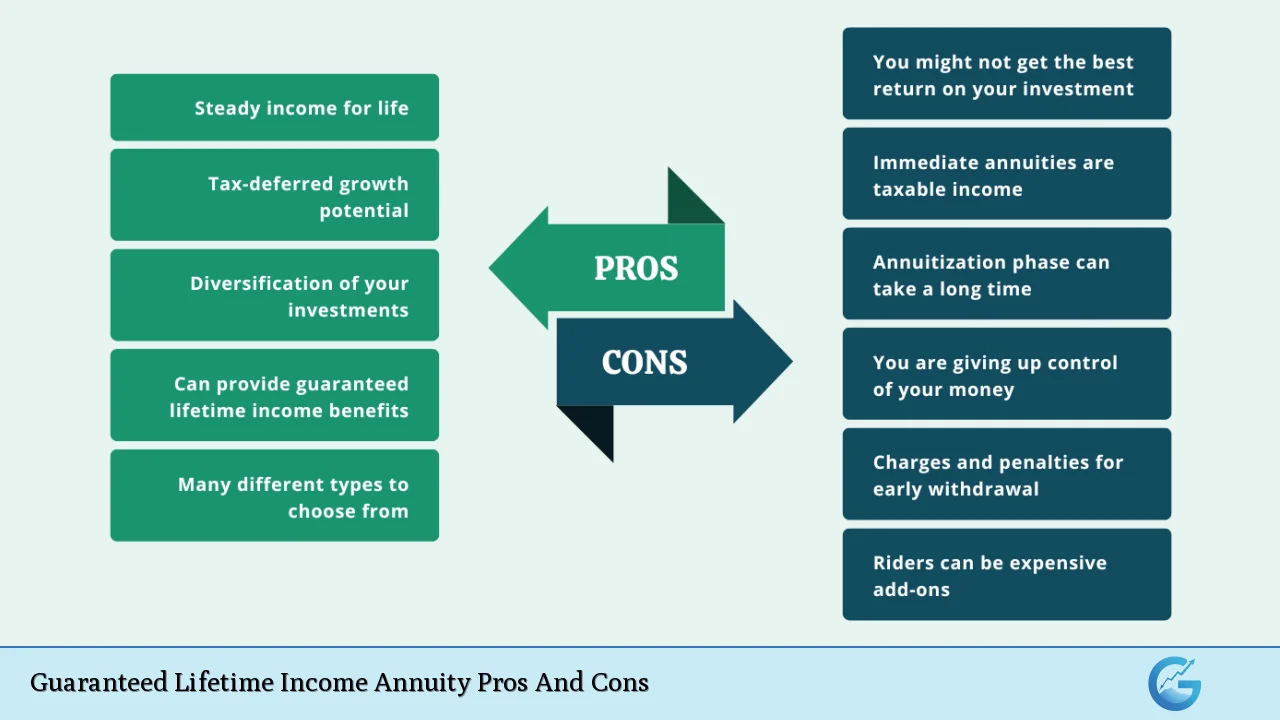

However, while guaranteed lifetime income annuities offer several advantages, they also come with notable disadvantages. Understanding both sides is crucial for anyone considering this investment option. Below is a comprehensive overview of the pros and cons associated with guaranteed lifetime income annuities.

| Pros | Cons |

|---|---|

| Provides a reliable income stream for life | Limited liquidity; funds are often locked in |

| Offers protection against outliving savings | Potentially high fees and commissions |

| Tax-deferred growth on investment | Inflation risk if payments are not indexed |

| Customizable options for beneficiaries | Complex contracts that may be difficult to understand |

| No market risk; stable returns regardless of market performance | Opportunity cost; funds may yield less than other investments |

| Can supplement other retirement income sources | Early withdrawal penalties can apply |

| Peace of mind regarding financial planning in retirement | Potential lack of inheritance for heirs unless structured accordingly |

| Flexibility in payout options (immediate or deferred) | Lack of control over investment choices |

Provides a Reliable Income Stream for Life

One of the primary advantages of guaranteed lifetime income annuities is their ability to provide a stable and predictable income stream for the duration of the policyholder’s life. This feature is particularly appealing to retirees who fear outliving their savings.

- Steady Cash Flow: Annuities can be structured to deliver monthly, quarterly, or annual payments, ensuring that retirees have a consistent source of income.

- Longevity Insurance: By converting a lump sum into an annuity, individuals can mitigate the risk associated with living longer than expected.

Offers Protection Against Outliving Savings

Guaranteed lifetime annuities serve as a form of “longevity insurance,” protecting individuals from the risk of depleting their financial resources during retirement.

- Financial Security: Retirees can enjoy peace of mind knowing that they will receive payments no matter how long they live.

- Budgeting Ease: With predictable income, retirees can more effectively plan their budgets and manage expenses.

Tax-Deferred Growth on Investment

Another significant benefit is that the money invested in a guaranteed lifetime income annuity grows tax-deferred until it is withdrawn.

- Tax Efficiency: This allows individuals to potentially accumulate more wealth over time compared to taxable accounts.

- Strategic Withdrawals: Retirees can manage their tax brackets more effectively by controlling when they withdraw funds.

Customizable Options for Beneficiaries

Many annuities offer options that allow policyholders to designate beneficiaries who will receive benefits after their death.

- Death Benefits: Some contracts include provisions that ensure beneficiaries receive a payout if the annuitant passes away before receiving total payments equal to their investment.

- Spousal Benefits: Options exist for spousal continuance, allowing surviving spouses to receive ongoing payments.

No Market Risk; Stable Returns Regardless of Market Performance

Guaranteed lifetime income annuities are not subject to market fluctuations, providing stability in uncertain economic conditions.

- Risk Aversion: For conservative investors or those nearing retirement, this feature offers reassurance against volatile market conditions.

- Predictable Returns: Individuals can count on fixed payouts without worrying about stock market performance affecting their income.

Limited Liquidity; Funds Are Often Locked In

Despite their advantages, one major drawback is that once funds are invested in an annuity, they are typically not accessible without incurring penalties.

- Access Issues: In emergencies or unexpected expenses, accessing cash from an annuity can be challenging.

- Surrender Charges: Early withdrawals may incur significant fees that reduce the overall value of the investment.

Potentially High Fees and Commissions

Annuities can come with various fees that may diminish returns over time.

- Cost Structure: Many contracts include management fees, surrender charges, and commissions paid to agents.

- Transparency Concerns: The complexity of fee structures can make it difficult for investors to fully understand what they are paying for.

Inflation Risk If Payments Are Not Indexed

While guaranteed payments provide stability, they often do not account for inflation unless specifically structured to do so.

- Purchasing Power Erosion: Fixed payments may lose value over time due to inflation, impacting retirees’ ability to maintain their standard of living.

- Indexed Options: Some products offer inflation protection but typically at higher costs or reduced initial payouts.

Complex Contracts That May Be Difficult to Understand

The intricacies involved in annuity contracts can be daunting for potential investors.

- Understanding Terms: Different types of annuities come with varying terms and conditions that require careful consideration.

- Need for Professional Guidance: Many individuals benefit from consulting financial advisors to navigate these complexities effectively.

Opportunity Cost; Funds May Yield Less Than Other Investments

Investing in an annuity means potentially missing out on higher returns from other investment vehicles such as stocks or mutual funds.

- Growth Limitations: Fixed returns may not keep pace with market growth over time.

- Diversification Loss: Committing significant assets to an annuity could limit diversification opportunities within a broader investment strategy.

Early Withdrawal Penalties Can Apply

Accessing funds before reaching a certain age or before the contract’s terms allow can result in penalties.

- 10% Penalty Tax: Withdrawals made prior to age 59½ may incur additional tax penalties.

- Surrender Charges: Many contracts impose surrender charges if funds are withdrawn within a specific timeframe after purchase.

Potential Lack of Inheritance for Heirs Unless Structured Accordingly

Without proper structuring, heirs may not receive any benefits from an annuity after the owner’s death.

- No Death Benefit Options: Unless specifically included in the contract, remaining funds may not be passed on to beneficiaries.

- Planning Considerations: Individuals must consider how much they wish to leave behind when purchasing an annuity and choose accordingly.

Lack of Control Over Investment Choices

Investors typically cannot dictate how their money is invested within an annuity product.

- Fixed Returns Only: Many guaranteed lifetime income products offer fixed returns without options for growth through equity investments.

- Investment Restrictions: This lack of control can be limiting for those who prefer more active management of their portfolios.

In conclusion, guaranteed lifetime income annuities present both compelling advantages and significant drawbacks. They offer retirees peace of mind through reliable income streams and protection against longevity risk but come with challenges such as limited liquidity and potential high costs. As with any financial decision, it is crucial for individuals to carefully assess their personal circumstances and consult with financial advisors before committing to an annuity product.

Frequently Asked Questions About Guaranteed Lifetime Income Annuity Pros And Cons

- What is a guaranteed lifetime income annuity?

A guaranteed lifetime income annuity is a financial product that provides regular payments for life in exchange for an upfront premium. - What are the main advantages of purchasing an annuity?

The main advantages include guaranteed lifelong income, tax-deferred growth, and protection against outliving your savings. - What are common disadvantages associated with these products?

The common disadvantages include high fees, limited liquidity, inflation risk, and potential lack of inheritance for heirs. - Can I access my money if I need it?

Accessing funds from an annuity can be challenging due to surrender charges and early withdrawal penalties. - How does inflation affect my annuity payments?

If your payments are not indexed for inflation, their purchasing power may decrease over time. - Are there any tax implications I should be aware of?

Earnings grow tax-deferred until withdrawal, but withdrawals are taxed as ordinary income and may incur penalties if taken early. - Can I customize my annuity contract?

Yes, many contracts offer customization options such as beneficiary designations and payout structures. - Should I consult a financial advisor before purchasing an annuity?

Yes, consulting a financial advisor can help you understand your options and determine if an annuity aligns with your financial goals.