Guaranteed Universal Life Insurance (GUL) is a type of permanent life insurance designed to provide lifelong coverage with a guaranteed death benefit. It combines features of both term and whole life insurance, offering a unique blend of affordability and security. With GUL, policyholders can enjoy fixed premium payments while ensuring that their beneficiaries will receive a specified death benefit upon their passing, as long as premiums are paid on time. This insurance product is particularly appealing to those looking for a cost-effective way to secure their family’s financial future without the complexities associated with other types of permanent life insurance.

Pros and Cons Overview

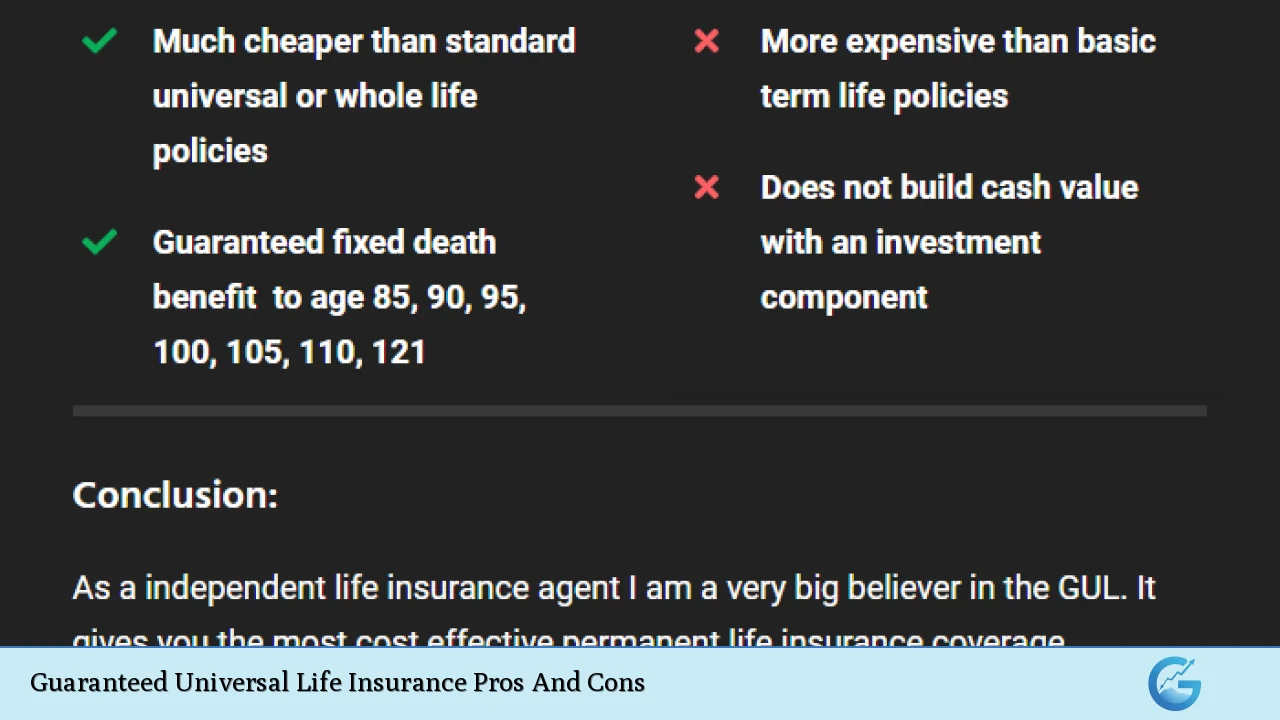

| Pros | Cons |

|---|---|

| Guaranteed death benefit for beneficiaries | Minimal cash value accumulation |

| Fixed premium payments throughout the policy | Higher cost compared to term life insurance |

| Flexibility in premium payment schedules | Risk of policy lapse due to missed payments |

| No market risk affecting the death benefit | Less flexibility in adjusting coverage amounts |

| Affordable permanent coverage option | Potential for increased premiums if coverage extends beyond maturity age |

Guaranteed Death Benefit for Beneficiaries

One of the most significant advantages of GUL is the guaranteed death benefit. This feature ensures that as long as the policyholder continues to pay their premiums, their beneficiaries will receive a predetermined amount upon their death, regardless of when that occurs.

- Provides peace of mind knowing loved ones are financially protected.

- Ideal for estate planning, covering debts, or leaving an inheritance.

- Offers stability and financial security during uncertain times.

Fixed Premium Payments Throughout the Policy

GUL policies come with fixed premiums, which means that the amount paid will not change over the life of the policy. This predictability makes budgeting easier for policyholders.

- Simplifies financial planning and management.

- Protects against inflation-related increases in premium costs.

- Ensures consistent coverage without unexpected financial burdens.

Flexibility in Premium Payment Schedules

Another advantage is the flexibility in premium payment schedules that GUL offers. Policyholders can choose how long they want to pay premiums, allowing them to tailor their financial commitments according to their circumstances.

- Options may include paying premiums for a limited number of years or until a certain age.

- Allows individuals to align payments with income fluctuations or financial goals.

- Can help manage cash flow effectively.

No Market Risk Affecting the Death Benefit

GUL policies are designed to be not affected by market fluctuations. Unlike other investment-linked insurance products, the death benefit remains stable regardless of economic conditions.

- Provides assurance during volatile market periods.

- Helps maintain the value of the death benefit without risk exposure.

- Offers a straightforward approach to life insurance without investment complexities.

Affordable Permanent Coverage Option

Compared to whole life insurance, GUL is generally more affordable while still providing permanent coverage. This affordability makes it an attractive option for individuals seeking long-term protection without high costs.

- Lower initial premiums compared to whole life policies.

- Suitable for those who want lifelong coverage but have budget constraints.

- Allows individuals to secure necessary protection without excessive financial strain.

Minimal Cash Value Accumulation

One of the primary disadvantages of GUL is its minimal cash value accumulation. Unlike whole life insurance, which builds significant cash value over time, GUL focuses primarily on providing a death benefit.

- Limited ability to borrow against the policy or withdraw funds.

- Not suitable for those looking for an investment component within their life insurance.

- Cash value growth is negligible, making it less appealing for savings purposes.

Higher Cost Compared to Term Life Insurance

While GUL is more affordable than whole life insurance, it remains more expensive than term life insurance. This can be a disadvantage for those who only need coverage for a specific period.

- May not be cost-effective if lifelong coverage isn’t necessary.

- Individuals might find better value in term policies if they only need temporary protection.

- Premiums can be significantly higher than those found in term life options.

Risk of Policy Lapse Due to Missed Payments

GUL policies require timely premium payments; otherwise, there is a risk of policy lapse. If payments are missed, the policy may terminate, leading to loss of coverage and benefits.

- Missing just one payment can jeopardize the entire policy.

- Unlike other permanent policies that may have cash reserves to cover missed payments, GUL lacks this feature.

- Policyholders must remain diligent about payment schedules to avoid losing coverage.

Less Flexibility in Adjusting Coverage Amounts

Another drawback is that GUL offers less flexibility in adjusting coverage amounts compared to other types of universal life insurance. Once established, changes can be limited or difficult.

- Policyholders may find it challenging to adapt their coverage as financial needs change over time.

- Limited options for increasing or decreasing death benefits after the policy is issued.

- May not accommodate significant life changes such as marriage or having children easily.

Potential for Increased Premiums if Coverage Extends Beyond Maturity Age

While GUL policies typically have set maturity ages (often between 90 and 121), there can be potential increases in premiums if coverage extends beyond this age.

- If you outlive your expected lifespan, you may face significantly higher premiums to maintain coverage.

- This uncertainty can create financial strain later in life if health issues arise.

- Policyholders should carefully consider their longevity and health when choosing maturity ages.

In summary, Guaranteed Universal Life Insurance offers several advantages such as guaranteed death benefits, fixed premiums, and affordability compared to whole life policies. However, it also presents notable disadvantages including minimal cash value accumulation and risks associated with missed premium payments. Understanding these pros and cons is crucial for anyone considering GUL as part of their financial planning strategy.

Frequently Asked Questions About Guaranteed Universal Life Insurance

- What is Guaranteed Universal Life Insurance?

Guaranteed Universal Life Insurance (GUL) provides lifelong coverage with fixed premiums and guaranteed death benefits. - How does GUL differ from whole life insurance?

GUL typically has lower premiums than whole life insurance but offers minimal cash value accumulation. - Can I adjust my premium payments with GUL?

While GUL allows some flexibility in payment schedules, it does not permit adjustments once established. - What happens if I miss a premium payment?

Missing a payment can lead to policy lapse, resulting in loss of coverage and benefits. - Is GUL suitable for estate planning?

Yes, GUL can effectively cover estate taxes and provide financial security for beneficiaries. - How does market performance affect my GUL policy?

Market performance does not impact GUL since it focuses solely on providing a guaranteed death benefit. - What are typical maturity ages for GUL policies?

Maturity ages usually range from 90 to 121 years old. - Is Guaranteed Universal Life Insurance worth it?

It depends on individual circumstances; it’s beneficial for those needing lifelong coverage without investment components.

In conclusion, Guaranteed Universal Life Insurance serves as an effective solution for individuals seeking affordable lifetime protection with predictable costs. However, potential buyers should weigh these benefits against the limitations inherent in this type of policy before making a decision. Understanding both sides will empower individuals to make informed choices about their financial futures and ensure they select the best products suited to their needs.