A Home Equity Line of Credit (HELOC) is a financial product that allows homeowners to borrow against the equity in their property. It functions as a revolving line of credit, similar to a credit card, but with the added security of using your home as collateral. Before diving into this financial tool, it’s crucial to understand its advantages and disadvantages.

| Pros | Cons |

|---|---|

| Flexible borrowing | Variable interest rates |

| Lower interest rates than credit cards | Risk of foreclosure |

| Interest may be tax-deductible | Potential for overspending |

| Only pay interest on what you use | Reduces home equity |

| Large credit limits possible | Fees and closing costs |

| Can be used for various purposes | Complex terms and conditions |

Advantages of HELOCs

Flexible Borrowing

One of the most significant advantages of a HELOC is its flexibility. Unlike a traditional loan where you receive a lump sum, a HELOC allows you to:

• Draw funds as needed during the draw period

• Borrow up to your credit limit multiple times

• Choose when and how much to borrow

This flexibility can be particularly beneficial for long-term projects or when you’re unsure of the total costs upfront.

For instance, if you’re renovating your home, you can access funds as different stages of the project require, rather than borrowing the entire amount at once.

Lower Interest Rates

HELOCs typically offer lower interest rates compared to unsecured forms of credit, such as credit cards or personal loans. This is because the loan is secured by your home, reducing the lender’s risk. The interest rates on HELOCs are often tied to the prime rate, which can result in favorable terms when market rates are low.

• HELOCs may offer rates several percentage points lower than credit cards

• Lower rates can lead to significant savings on large borrowing amounts

• Some lenders offer introductory rates that can be even lower for an initial period

Potential Tax Benefits

While tax laws can change, historically, the interest paid on a HELOC may be tax-deductible if the funds are used for home improvements. This potential tax advantage can make a HELOC an attractive option for financing home renovations or upgrades.

It’s crucial to consult with a tax professional to understand the current tax implications, as rules regarding HELOC interest deductibility have become more stringent in recent years.

Pay Interest Only on What You Use

Unlike a home equity loan where you receive a lump sum and start paying interest on the entire amount immediately, with a HELOC, you only pay interest on the amount you’ve actually borrowed. This feature can result in lower initial payments and better cash flow management.

• Interest is calculated only on the outstanding balance

• You can make interest-only payments during the draw period

• Ability to pay down the principal at any time to reduce interest charges

Large Credit Limits

Depending on the equity in your home, HELOCs can provide access to substantial amounts of credit. Lenders typically allow you to borrow up to 80-85% of your home’s value, minus the outstanding mortgage balance.

• Higher borrowing limits compared to unsecured credit options

• Potential for six-figure credit lines for homes with significant equity

• Ability to access large sums without refinancing your primary mortgage

Versatile Usage

HELOCs offer versatility in how you can use the funds. While it’s advisable to use them for purposes that add value or provide long-term benefits, there are generally no restrictions on how you allocate the money.

Common uses include:

• Home improvements and renovations

• Debt consolidation

• Education expenses

• Emergency funds

• Business investments

Disadvantages of HELOCs

Variable Interest Rates

One of the primary drawbacks of HELOCs is their variable interest rates. While this can be advantageous when rates are low, it also means your payments can increase if interest rates rise.

• Rates typically adjust with the prime rate

• Monthly payments can become unpredictable

• Potential for significant payment increases in a rising rate environment

Borrowers should be prepared for the possibility of higher payments and consider their ability to manage increased costs over the life of the HELOC.

Risk of Foreclosure

Perhaps the most serious risk associated with a HELOC is the potential loss of your home. Since your property secures the line of credit, failure to make payments can result in foreclosure.

• Your home is used as collateral for the loan

• Missed payments can lead to default and potential foreclosure

• Economic downturns or personal financial setbacks can increase this risk

Potential for Overspending

The ease of access to funds through a HELOC can lead to overspending. The revolving nature of the credit line might tempt some borrowers to use it for non-essential expenses or to live beyond their means.

• Easy access to large sums can encourage unnecessary spending

• Interest-only payments during the draw period can mask the true cost of borrowing

• Risk of accumulating more debt than you can comfortably repay

Reduces Home Equity

As you borrow against your home’s equity, you’re reducing the ownership stake in your property. This can have several implications:

• Less equity available for future borrowing needs

• Potential difficulty in selling or refinancing if property values decline

• Reduced financial cushion in case of economic downturns

Fees and Closing Costs

While HELOCs often have lower upfront costs compared to home equity loans, they still come with various fees and closing costs that can add up:

• Application and appraisal fees

• Annual maintenance fees

• Inactivity fees if the line isn’t used

• Early termination fees if the HELOC is closed within a certain period

It’s important to carefully review and compare the fee structures of different HELOC offers, as these costs can significantly impact the overall value of the credit line.

Complex Terms and Conditions

HELOCs can have complex terms and conditions that may be difficult for some borrowers to fully understand. These can include:

• Draw periods and repayment periods with different rules

• Rate caps and floors that affect interest calculations

• Minimum draw requirements

• Balloon payments at the end of the repayment period

Understanding these terms is crucial for managing the HELOC effectively and avoiding unexpected financial challenges.

In conclusion, HELOCs offer a flexible and potentially cost-effective way to access the equity in your home. They can be valuable tools for financing large expenses or managing cash flow. However, the risks associated with variable rates, potential for overspending, and using your home as collateral should not be underestimated. Careful consideration of your financial situation, future plans, and ability to manage the line of credit responsibly is essential before deciding to open a HELOC. As with any significant financial decision, it’s advisable to consult with financial advisors and compare offers from multiple lenders to ensure you’re making the best choice for your circumstances.

Frequently Asked Questions About HELOC Pros and Cons

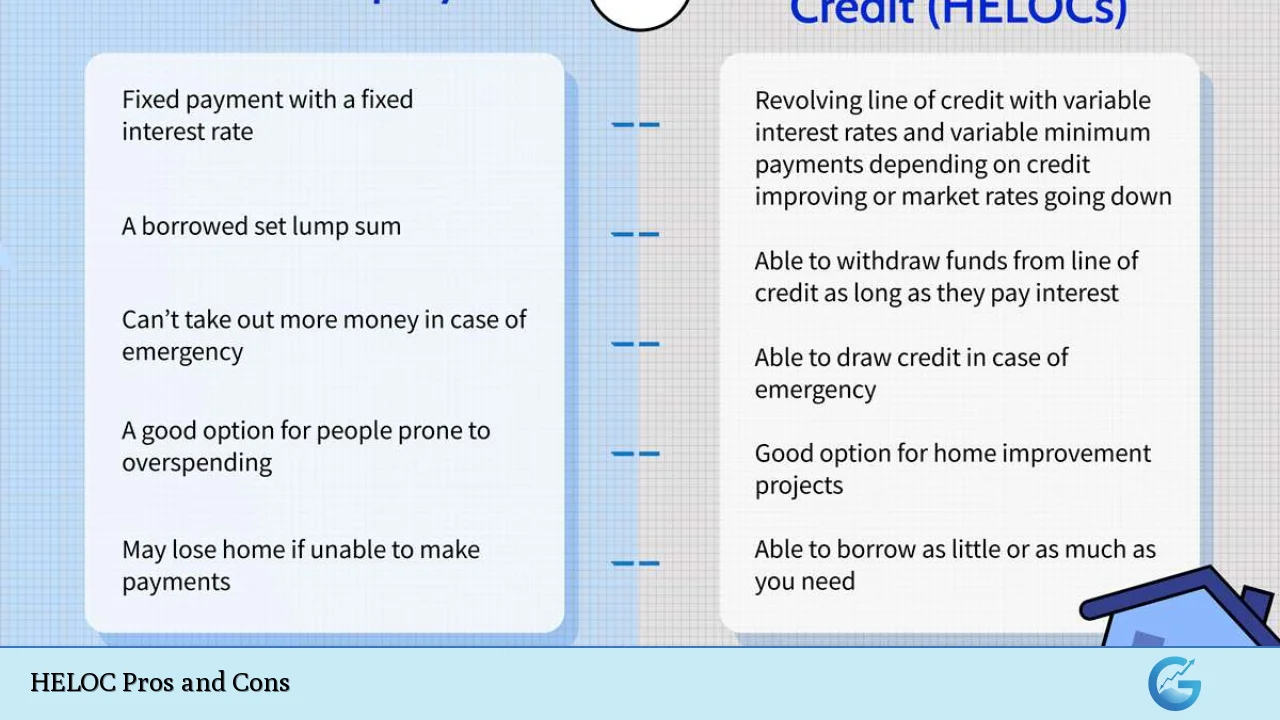

- How does a HELOC compare to a home equity loan?

A HELOC offers flexible, revolving credit with variable rates, while a home equity loan provides a lump sum with fixed rates. HELOCs typically have lower initial costs but more unpredictable payments. - Can I lose my home with a HELOC?

Yes, since a HELOC uses your home as collateral, failing to make payments can result in foreclosure. It’s crucial to borrow responsibly and have a solid repayment plan. - Are HELOC interest rates always variable?

While most HELOCs have variable rates, some lenders offer options to convert portions of the balance to fixed rates. Check with individual lenders for specific offerings. - How much can I borrow with a HELOC?

Typically, you can borrow up to 80-85% of your home’s value minus your outstanding mortgage balance. The exact amount depends on your credit score, income, and lender policies. - Is HELOC interest tax-deductible?

HELOC interest may be tax-deductible if the funds are used for home improvements. However, tax laws change, so consult a tax professional for current rules. - What happens when the draw period ends?

After the draw period, you enter the repayment period where you can no longer borrow and must repay the outstanding balance, often with fully amortizing payments including principal and interest. - Can I use a HELOC for anything?

While you can use HELOC funds for various purposes, it’s advisable to use them for value-adding investments or necessary expenses due to the risk involved in using your home as collateral. - How do HELOC rates compare to credit card rates?

HELOC rates are typically much lower than credit card rates because they’re secured by your home. However, this also means your home is at risk if you default on payments.