High Yield Savings Accounts (HYSAs) have gained significant popularity among savers looking to earn a better return on their deposits compared to traditional savings accounts. These accounts typically offer higher interest rates, often significantly above the national average, making them an attractive option for individuals aiming to grow their savings with minimal risk. However, while HYSAs present many advantages, they also come with certain drawbacks that potential account holders should consider. This article delves into the pros and cons of high yield savings accounts, providing a comprehensive overview for those interested in finance and investment.

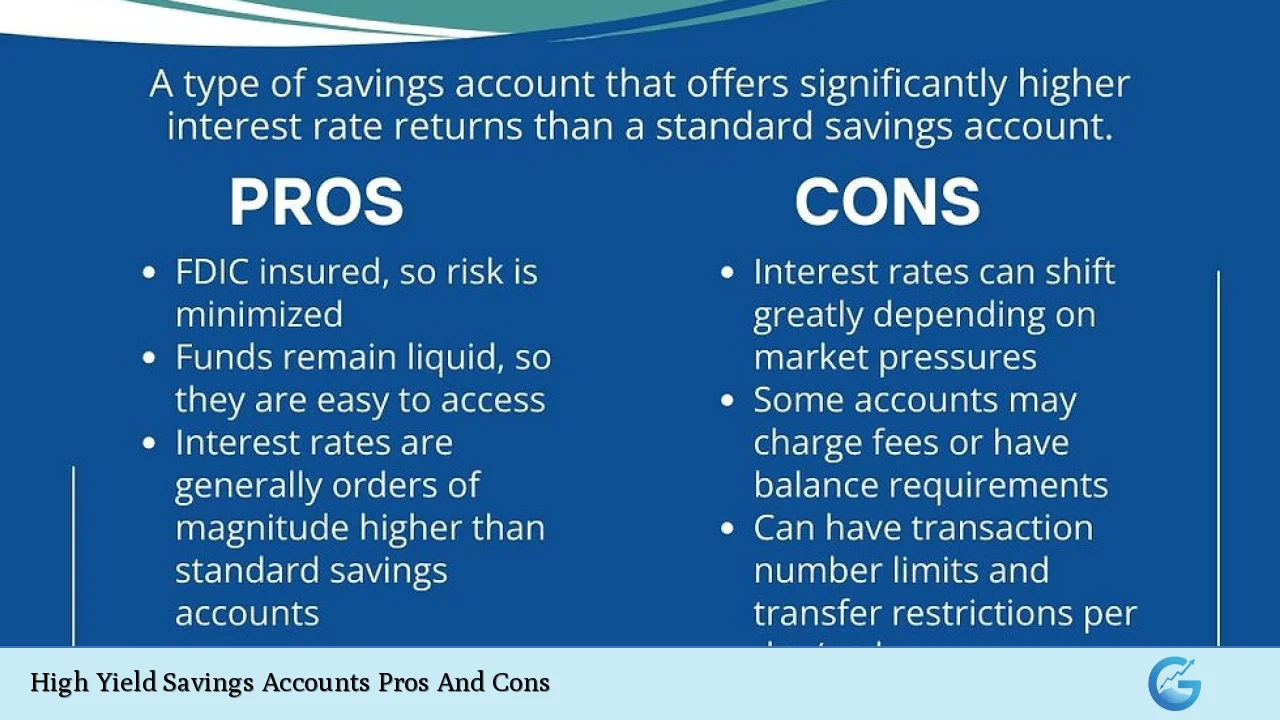

| Pros | Cons |

|---|---|

| Higher interest rates compared to traditional savings accounts. | Interest rates are variable and can fluctuate. |

| FDIC insurance protects your deposits up to $250,000. | Some accounts may have minimum balance requirements. |

| Easy access to funds with online banking features. | Limited transactions per month may apply. |

| No monthly maintenance fees with many providers. | Potential for lower returns compared to riskier investments. |

| Encourages saving due to higher returns. | Some banks may impose withdrawal fees or restrictions. |

Higher Interest Rates Compared to Traditional Savings Accounts

One of the most significant advantages of high yield savings accounts is their ability to offer much higher interest rates than traditional savings accounts.

- Competitive APYs: HYSAs can provide annual percentage yields (APY) that are several times greater than the national average for standard savings accounts.

- Earning Potential: For example, while traditional savings accounts might offer rates around 0.01% APY, HYSAs can offer rates upwards of 4% or more, depending on market conditions.

- Compounding Interest: The interest earned on HYSAs is often compounded daily or monthly, which can significantly enhance the growth of your savings over time.

FDIC Insurance Protects Your Deposits

Another crucial advantage of HYSAs is that they are typically insured by the Federal Deposit Insurance Corporation (FDIC).

- Safety of Funds: This insurance protects deposits up to $250,000 per depositor, per bank, ensuring that your money is safe even if the bank fails.

- Peace of Mind: Knowing that your savings are protected can provide peace of mind for account holders, making HYSAs a secure option for saving.

Easy Access to Funds with Online Banking Features

High yield savings accounts often come with robust online banking features that enhance accessibility.

- Convenience: Most HYSAs are offered by online banks, which provide user-friendly interfaces and mobile apps for easy account management.

- Instant Transfers: You can easily transfer money between your HYSA and other accounts, facilitating quick access to your funds when needed.

No Monthly Maintenance Fees with Many Providers

Many high yield savings accounts do not charge monthly maintenance fees.

- Cost-Effective Saving: This means you can maximize your earnings without worrying about fees eating into your interest.

- Promotional Offers: Some banks may also offer promotional bonuses for opening an account or maintaining a certain balance.

Encourages Saving Due to Higher Returns

The higher interest rates associated with HYSAs can motivate individuals to save more effectively.

- Goal-Oriented Saving: HYSAs are ideal for setting aside money for specific goals like vacations, emergencies, or large purchases due to their enhanced earning potential.

- Financial Discipline: The prospect of earning more on saved funds encourages users to keep their money in the account longer instead of spending it impulsively.

Interest Rates Are Variable and Can Fluctuate

Despite their advantages, one significant drawback of high yield savings accounts is that their interest rates are variable.

- Market Dependence: The rates can change based on economic conditions and Federal Reserve decisions, meaning your earnings could decrease unexpectedly.

- Uncertainty in Returns: This variability can make it difficult to predict how much interest you will earn over time compared to fixed-rate investments.

Some Accounts May Have Minimum Balance Requirements

Many high yield savings accounts require account holders to maintain a minimum balance.

- Potential Barriers: If you fail to meet this requirement, you may face fees or a reduction in your interest rate.

- Financial Planning Needed: It’s essential to consider whether you can comfortably maintain the required balance without impacting your financial flexibility.

Limited Transactions Per Month May Apply

HYSAs often come with restrictions on the number of withdrawals or transfers you can make each month.

- Regulatory Limits: Although the Federal Reserve lifted its six-per-month limit on certain types of withdrawals in 2020, many banks still impose their own limits to discourage excessive withdrawals from savings.

- Impact on Liquidity: This limitation could be problematic if you need quick access to your funds for emergencies or unexpected expenses.

Potential for Lower Returns Compared to Riskier Investments

While HYSAs offer safety and liquidity, they typically do not provide returns as high as riskier investment options like stocks or mutual funds.

- Opportunity Cost: By choosing a HYSA over potentially higher-yielding investments, you may miss out on greater long-term growth opportunities.

- Short-Term Focus: HYSAs are best suited for short-term saving goals rather than long-term wealth accumulation strategies.

Some Banks May Impose Withdrawal Fees or Restrictions

Certain financial institutions may charge fees for excessive withdrawals or impose other restrictions on account access.

- Fee Structure Awareness: It’s crucial to understand the fee structure before opening an account as these costs can diminish your overall earnings.

- Account Terms Review: Always review the terms and conditions carefully to avoid unpleasant surprises later on.

In conclusion, high yield savings accounts present a compelling option for individuals looking to earn more on their deposits while maintaining easy access and security. They are particularly beneficial for short-term saving goals and emergency funds due to their competitive interest rates and FDIC insurance. However, potential account holders should remain aware of the variable nature of interest rates, transaction limits, and possible fees associated with these accounts. By weighing these pros and cons carefully against personal financial goals and circumstances, individuals can make informed decisions about whether a high yield savings account aligns with their saving strategies.

Frequently Asked Questions About High Yield Savings Accounts

- What is a high yield savings account?

A high yield savings account is a type of deposit account that offers significantly higher interest rates than traditional savings accounts, allowing savers to earn more on their deposits. - Are high yield savings accounts safe?

Yes, most high yield savings accounts are insured by the FDIC up to $250,000 per depositor per bank, providing security for your deposits. - How do I choose a high yield savings account?

When choosing an HYSA, consider factors such as interest rates, fees, minimum balance requirements, and accessibility features like online banking. - Can I access my money easily from a high yield savings account?

Yes, most HYSAs allow easy access through online banking; however, some may have limits on withdrawals per month. - What are the typical interest rates for high yield savings accounts?

The interest rates vary but can be several times higher than traditional savings accounts; currently ranging from 3% to 5% APY depending on market conditions. - Do high yield savings accounts have monthly fees?

Many high yield savings accounts do not charge monthly maintenance fees; however, it’s important to check individual bank policies. - Can I use a high yield savings account for long-term investments?

No, HYSAs are better suited for short-term goals; they typically do not provide returns comparable to riskier investments like stocks or bonds. - What happens if I exceed my withdrawal limit?

If you exceed the withdrawal limit set by your bank, you may incur fees or have restrictions placed on your account until the next statement period.