Home Equity Agreements (HEAs) have emerged as an innovative financial tool, allowing homeowners to tap into their home’s equity without taking on traditional debt. These agreements, also known as home equity investments or shared appreciation agreements, offer a unique way to access cash by selling a portion of your home’s future appreciation to an investor. As with any financial product, HEAs come with their own set of advantages and disadvantages that homeowners must carefully consider before entering into such an arrangement.

| Pros | Cons |

|---|---|

| No monthly payments | Potential loss of future appreciation |

| No interest charges | Large lump-sum repayment |

| Easier qualification process | Limited availability |

| Flexibility in fund usage | Complex terms and conditions |

| Shared risk with investor | Potential for forced sale |

| No impact on credit score | Reduced control over property |

| Potential tax advantages | Higher long-term costs |

| Alternative to traditional lending | Risk of overleveraging |

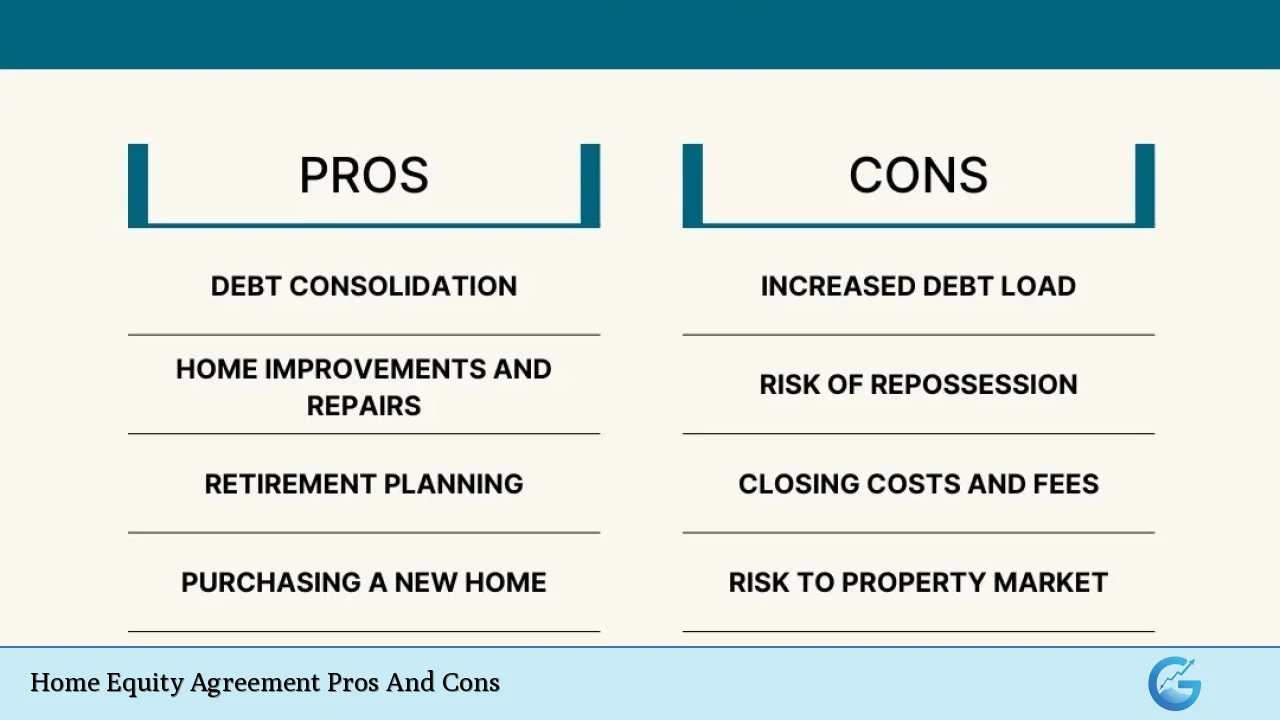

Advantages of Home Equity Agreements

No Monthly Payments

One of the most attractive features of Home Equity Agreements is the absence of monthly payments.

Unlike traditional home equity loans or lines of credit, HEAs do not require homeowners to make regular payments throughout the term of the agreement. This can be particularly beneficial for individuals facing temporary financial difficulties or those looking to improve their cash flow without incurring additional monthly obligations.

- Provides immediate financial relief

- Allows for better budgeting and financial planning

- Ideal for those with irregular income streams

No Interest Charges

HEAs stand out from conventional borrowing methods by not imposing interest charges. Instead of accruing interest over time, the cost of the agreement is tied to the home’s future appreciation. This structure can be advantageous in several ways:

- Eliminates the burden of compounding interest

- Potentially lower overall cost if home appreciation is modest

- Simplifies the repayment structure

Easier Qualification Process

Home Equity Agreements often have more lenient qualification criteria compared to traditional home equity products.

This accessibility can be a significant advantage for homeowners who might not meet the stringent requirements of banks and other lenders. The qualification process typically focuses more on the property’s value and the homeowner’s equity rather than credit scores or income levels.

- Lower credit score requirements (often as low as 500)

- Less emphasis on debt-to-income ratios

- Consideration of alternative income sources

Flexibility in Fund Usage

HEAs generally offer great flexibility in how the funds can be used. Unlike some loans that have specific purposes, such as home improvement loans, the money obtained through a Home Equity Agreement can be used for various purposes at the discretion of the homeowner.

- Debt consolidation

- Business investments

- Education expenses

- Home renovations or repairs

- Emergency funds

Shared Risk with Investor

In a Home Equity Agreement, the investor shares in both the potential gains and losses associated with the property’s value. This shared risk model can provide some peace of mind to homeowners, especially in uncertain real estate markets.

- Investor has a vested interest in the property’s appreciation

- Potential for reduced loss if property value decreases

- Alignment of interests between homeowner and investor

No Impact on Credit Score

Unlike traditional loans, Home Equity Agreements typically do not appear on credit reports and do not affect credit scores. This can be beneficial for homeowners who want to maintain their credit standing while accessing their home equity.

- Preserves credit utilization ratio

- Does not add to debt obligations on credit reports

- Maintains borrowing capacity for future needs

Potential Tax Advantages

While it’s crucial to consult with a tax professional, Home Equity Agreements may offer certain tax benefits compared to traditional loans. The funds received are generally not considered taxable income, which can be advantageous for some homeowners.

- Potential for tax-free cash access

- May not affect income-based benefits or tax brackets

- Possible deductions for certain uses of funds (e.g., home improvements)

Alternative to Traditional Lending

For homeowners who have exhausted traditional borrowing options or are looking for alternative financial solutions, HEAs provide a unique opportunity to access home equity without conventional debt.

- Useful for those who don’t qualify for traditional loans

- Can complement existing mortgage products

- Provides options in a diverse financial landscape

Disadvantages of Home Equity Agreements

Potential Loss of Future Appreciation

Perhaps the most significant drawback of Home Equity Agreements is the potential loss of future home appreciation.

By selling a portion of your home’s future value, you may be giving up substantial gains if your property appreciates significantly over time.

- Can be costly in rapidly appreciating markets

- May reduce long-term wealth accumulation

- Limits the full benefit of property value increases

Large Lump-Sum Repayment

Unlike traditional loans with regular payments, HEAs require a large lump-sum repayment at the end of the term or when the home is sold. This can create significant financial pressure and may necessitate refinancing or selling the home if funds are not available.

- Can be challenging to budget for a large future payment

- May force difficult financial decisions at term end

- Potential for financial stress if home value doesn’t increase as expected

Limited Availability

Home Equity Agreements are not as widely available as traditional home equity products. This limited availability can make it difficult for some homeowners to access this financial tool, depending on their location or property type.

- Not available in all states

- May be restricted to certain types of properties

- Fewer providers compared to traditional lenders

Complex Terms and Conditions

HEAs often come with complex terms and conditions that can be difficult for the average homeowner to fully understand.

The intricacies of how appreciation is calculated, what constitutes a triggering event for repayment, and other details can be confusing and may lead to unexpected outcomes.

- Requires careful review and potentially legal advice

- May include hidden costs or fees

- Difficult to compare across different providers

Potential for Forced Sale

Some Home Equity Agreements include clauses that could force the sale of the home under certain circumstances. This potential loss of control over one’s property can be a significant risk for homeowners.

- May be triggered by default on other obligations

- Could be activated if the homeowner fails to maintain the property

- Might limit long-term housing security

Reduced Control Over Property

Entering into an HEA often means giving up some control over your property. Investors may place restrictions on how you can use or modify your home, potentially limiting your ability to make changes or improvements.

- May require approval for major renovations

- Could restrict renting out the property

- Might limit ability to take out additional loans against the property

Higher Long-Term Costs

While HEAs don’t accrue interest in the traditional sense, the cost of sharing future appreciation can be substantial, especially in markets with strong property value growth. Over time, this can result in higher overall costs compared to traditional financing options.

- Potential for significant payouts in appreciating markets

- Costs increase with longer holding periods

- May exceed interest costs of traditional loans in some scenarios

Risk of Overleveraging

The ease of accessing funds through an HEA, combined with the lack of monthly payments, can lead some homeowners to overleverage their property. This can create financial vulnerability and reduce overall equity.

- May encourage taking on more debt than is prudent

- Can lead to a false sense of financial security

- Potentially reduces long-term financial flexibility

Frequently Asked Questions About Home Equity Agreement Pros And Cons

- What is the typical term length for a Home Equity Agreement?

Home Equity Agreements typically have terms ranging from 10 to 30 years. The specific length can vary by provider and individual agreement terms. - Can I pay off a Home Equity Agreement early?

Yes, most HEAs allow for early repayment. However, the terms for early repayment, including any potential fees or the method of calculating the investor’s share, should be carefully reviewed in the agreement. - How is the home’s appreciation calculated in an HEA?

Appreciation is usually calculated as the difference between the home’s value at the start of the agreement and its value at the end or sale. The specific method and any adjustments should be clearly outlined in the agreement terms. - Are there minimum credit score requirements for Home Equity Agreements?

While HEAs generally have more lenient credit requirements than traditional loans, most providers have a minimum credit score requirement. This can range from 500 to 620, depending on the company. - How much equity do I need to qualify for a Home Equity Agreement?

Most HEA providers require homeowners to have at least 20-30% equity in their home after the agreement. Some may require higher equity percentages, especially for larger investments. - Can I get a Home Equity Agreement on an investment property?

Some HEA providers offer agreements for investment properties, while others restrict their products to primary residences. It’s important to check with individual providers for their specific policies. - What happens if my home decreases in value during the HEA term?

If your home decreases in value, you typically still owe the original investment amount, but the investor’s share of appreciation would be zero. Some agreements may include provisions for sharing in the depreciation as well. - Are there any restrictions on how I can use the funds from a Home Equity Agreement?

Generally, HEAs offer flexibility in how you use the funds. However, some agreements may have restrictions or require disclosure of intended use. Always review the specific terms of your agreement.

In conclusion, Home Equity Agreements offer a unique alternative to traditional home equity borrowing, with distinct advantages and disadvantages. They provide homeowners with a way to access their home’s equity without incurring monthly payments or interest charges, and often with more lenient qualification requirements. However, these benefits come at the cost of potentially significant long-term expenses, reduced control over one’s property, and the complexity of agreement terms.

Homeowners considering an HEA should carefully weigh these pros and cons against their financial goals and circumstances.

It’s crucial to thoroughly understand the terms of the agreement, consider the potential long-term implications, and possibly consult with financial and legal professionals before entering into such an arrangement. While HEAs can be a valuable tool for some, they are not suitable for everyone and should be approached with careful consideration of both the immediate benefits and the long-term financial impact.