A Home Equity Line of Credit (HELOC) is a financial product that allows homeowners to borrow against the equity in their homes. This type of credit functions similarly to a credit card, providing a revolving line of credit that can be accessed as needed, typically at lower interest rates compared to other forms of borrowing. As home values rise, many homeowners find themselves in a position to leverage this equity for various financial needs, such as home improvements, debt consolidation, or unexpected expenses. However, while HELOCs can offer significant advantages, they also come with inherent risks and disadvantages that must be carefully considered.

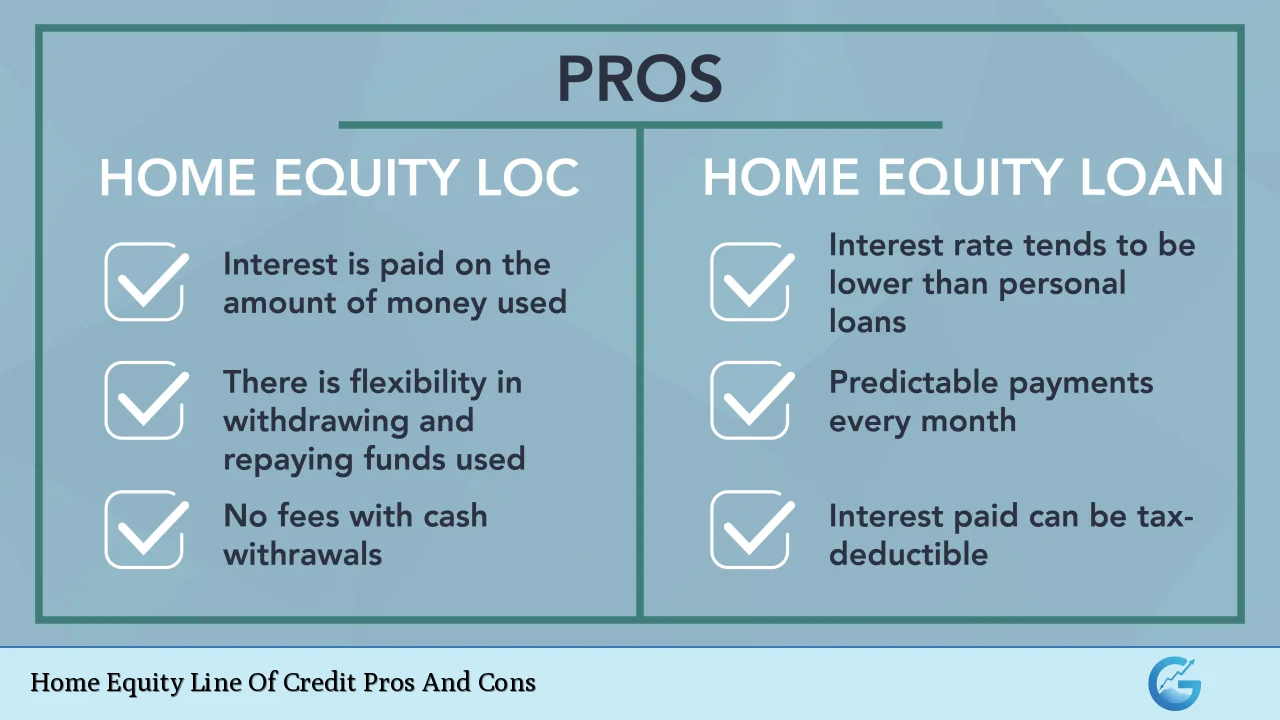

| Pros | Cons |

|---|---|

| Lower interest rates compared to unsecured loans | Variable interest rates can lead to unpredictable payments |

| Flexibility to borrow as needed | Your home is collateral, risking foreclosure if you default |

| Potential tax-deductible interest | Fees and closing costs can add up |

| Long draw and repayment periods | Risk of overspending due to easy access to funds |

| Only pay interest on the amount borrowed | Diminished equity cushion if home values decline |

| Can improve cash flow management | Potential for balloon payments at the end of the draw period |

| Access to larger amounts than personal loans | Requires good credit for favorable terms |

| Simplified budgeting with interest-only payments initially | Market fluctuations can affect repayment ability over time |

Lower Interest Rates Compared to Unsecured Loans

One of the most appealing aspects of a HELOC is its lower interest rates compared to unsecured loans such as personal loans or credit cards. Because a HELOC is secured by your home, lenders are willing to offer more favorable rates. This can make it an attractive option for homeowners looking to finance significant expenses without incurring high-interest debt.

- Interest rates are generally lower than those for credit cards or personal loans.

- Potential savings on interest payments can be substantial over time.

- Introductory offers may provide even lower rates during the initial period.

Flexibility to Borrow as Needed

HELOCs offer remarkable flexibility, allowing borrowers to withdraw funds as needed during the draw period. This feature makes them ideal for ongoing projects or expenses that may not require an immediate lump sum.

- Access funds anytime within the credit limit.

- Only borrow what you need, minimizing unnecessary debt.

- Replenish available credit as you pay down the principal.

Potential Tax-Deductible Interest

Interest paid on a HELOC may be tax-deductible if the funds are used for home improvements. This potential tax benefit can enhance the overall value of taking out a HELOC.

- Tax deductions can reduce overall borrowing costs.

- Consult with a tax professional to understand eligibility requirements.

Long Draw and Repayment Periods

HELOCs typically feature extended draw periods (often up to 10 years) followed by repayment periods that can last up to 20 years. This structure allows borrowers ample time to access and repay funds.

- Extended access provides flexibility in managing cash flow.

- Long repayment terms help spread out monthly payments, making them more manageable.

Only Pay Interest on the Amount Borrowed

During the draw period, borrowers only pay interest on the amount they have drawn from their line of credit. This feature can significantly lower initial monthly payments compared to traditional loans.

- Lower initial payments ease financial strain during early borrowing stages.

- Encourages responsible borrowing, as only necessary amounts are drawn.

Can Improve Cash Flow Management

A HELOC can serve as an effective tool for managing cash flow, especially during times of financial uncertainty. The ability to access funds quickly without reapplying helps homeowners navigate unexpected expenses more easily.

- Quick access provides peace of mind in emergencies.

- Helps avoid high-interest debts, such as credit card balances.

Risk of Variable Interest Rates

While HELOCs offer lower initial rates, they typically come with variable interest rates that fluctuate based on market conditions. This variability can lead to increased monthly payments over time, making budgeting difficult.

- Payments can increase unexpectedly, impacting financial planning.

- Borrowers should prepare for potential rate hikes, especially in rising rate environments.

Your Home Is Collateral

A significant disadvantage of HELOCs is that they are secured by your home. If you fail to make payments, you risk foreclosure, which could result in losing your property.

- Defaulting on payments puts your home at risk.

- Borrowers must assess their ability to repay before taking out a HELOC.

Fees and Closing Costs Can Add Up

While HELOCs may have lower interest rates, they often come with various fees and closing costs that can accumulate quickly. These costs should be factored into any decision regarding borrowing against home equity.

- Initial costs may include appraisal fees, application fees, and closing costs.

- Ongoing fees, such as annual maintenance or inactivity fees, can add up over time.

Risk of Overspending Due to Easy Access

The convenience of having a revolving line of credit can tempt borrowers into spending more than they originally intended. This risk is particularly pronounced for individuals who may struggle with self-control regarding financial management.

- Easy access may encourage unnecessary purchases, leading to higher debt levels.

- Borrowers should establish strict budgets when using a HELOC.

Diminished Equity Cushion If Home Values Decline

Using a HELOC reduces the amount of equity you have in your home. If property values decline, you could end up owing more than your home is worth—a situation known as being “underwater.”

- Market fluctuations can significantly impact equity levels.

- Homeowners should consider market conditions before borrowing against equity.

Potential for Balloon Payments at the End of the Draw Period

At the end of the draw period, borrowers may face balloon payments if they have not adequately prepared for the transition into repayment mode. This sudden increase in payment amounts can catch many off guard.

- Borrowers should plan ahead for potential payment increases.

- Understanding loan terms is crucial for effective financial planning.

Requires Good Credit for Favorable Terms

To qualify for a HELOC with favorable terms, borrowers typically need a good credit score and solid financial history. Those with lower scores may face higher interest rates or difficulty securing a line of credit altogether.

- Creditworthiness impacts borrowing capacity, affecting loan terms.

- Potential borrowers should review their credit reports before applying.

In conclusion, while a Home Equity Line of Credit offers numerous advantages such as lower interest rates and flexibility in borrowing, it also poses significant risks including variable payment structures and potential loss of one’s home due to foreclosure. Homeowners considering this option must weigh these pros and cons carefully and ensure they have a solid understanding of their financial habits and market conditions before proceeding with a HELOC application.

Frequently Asked Questions About Home Equity Line Of Credit Pros And Cons

- What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that allows homeowners to borrow against their home’s equity as needed. - What are the main benefits of using a HELOC?

The main benefits include lower interest rates compared to unsecured loans, flexibility in borrowing amounts, and potential tax-deductible interest. - What are the risks associated with HELOCs?

The primary risks include variable interest rates leading to unpredictable payments and the potential loss of your home if you default on repayments. - How do I determine how much I can borrow?

Your borrowing capacity is typically based on your home’s appraised value minus any outstanding mortgage balances. - Can I use a HELOC for purposes other than home improvements?

Yes, funds from a HELOC can be used for various expenses like debt consolidation or education costs. - What happens at the end of the draw period?

The loan transitions into a repayment phase where you must start repaying both principal and interest; this may result in higher monthly payments. - Are there any fees associated with obtaining a HELOC?

Yes, there may be application fees, appraisal fees, closing costs, and ongoing maintenance fees. - How does my credit score affect my ability to get a HELOC?

A good credit score is essential for qualifying for favorable terms; lower scores may lead to higher rates or denial.