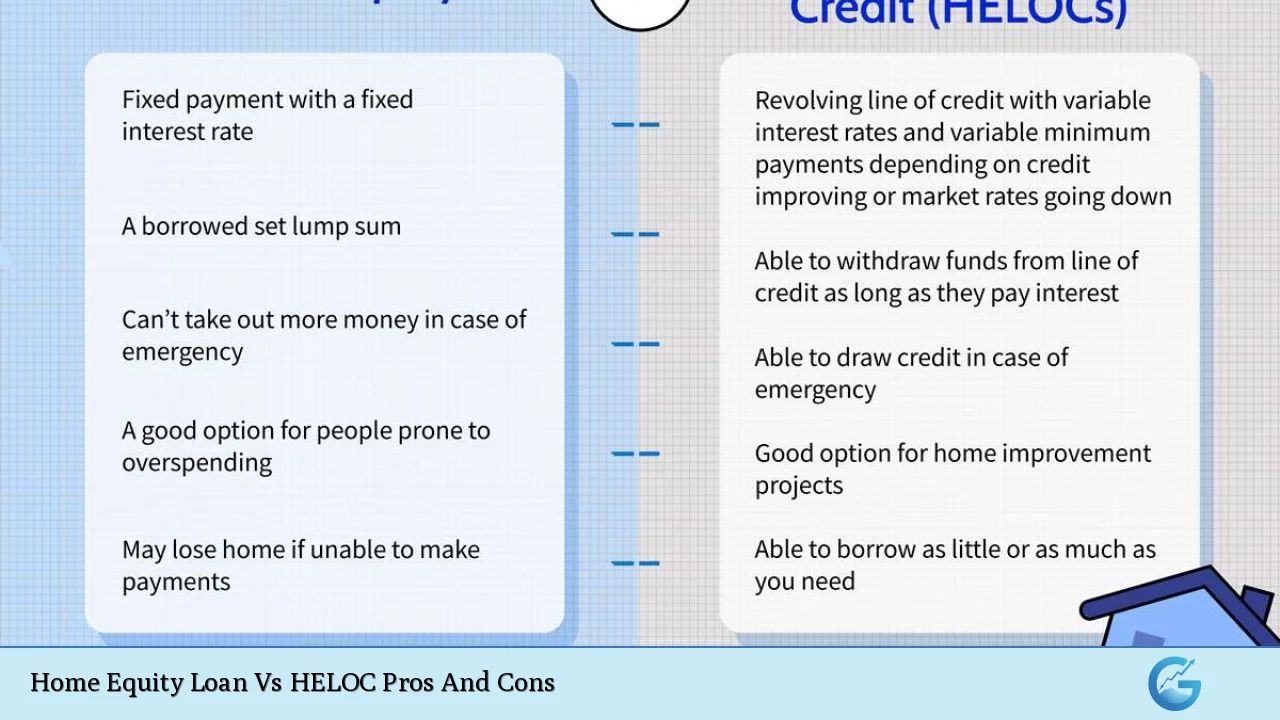

When homeowners seek to leverage their property’s value for financial purposes, they often find themselves weighing the options of a Home Equity Loan against a Home Equity Line of Credit (HELOC). Both financial instruments allow homeowners to borrow against the equity they’ve built in their homes, but they function quite differently and come with their own sets of advantages and disadvantages. Understanding these nuances is crucial for making an informed decision that aligns with your financial goals and circumstances.

| Pros | Cons |

|---|---|

| Fixed interest rates (Home Equity Loan) | Risk of foreclosure |

| Flexible borrowing (HELOC) | Variable interest rates (HELOC) |

| Potential tax benefits | Reduces home equity |

| Lower interest rates compared to unsecured loans | Temptation to overspend |

| Large lump sum available (Home Equity Loan) | Closing costs and fees |

| Interest-only payments during draw period (HELOC) | Potential for balloon payments (HELOC) |

Fixed Interest Rates (Home Equity Loan)

One of the most significant advantages of a Home Equity Loan is the stability provided by fixed interest rates. This feature offers several benefits:

- Predictable monthly payments: Borrowers can budget with confidence, knowing their payment amount will remain constant throughout the loan term.

- Protection against market fluctuations: Fixed rates shield borrowers from potential interest rate hikes in the broader market.

- Long-term planning: The consistent nature of payments facilitates more accurate long-term financial planning.

However, it’s important to note that while fixed rates offer stability, they may be higher than initial variable rates offered by HELOCs, potentially resulting in higher overall costs if interest rates remain low or decrease.

Flexible Borrowing (HELOC)

HELOCs shine when it comes to flexibility in borrowing. This adaptability manifests in several ways:

- Draw as needed: Borrowers can access funds up to their credit limit as required, rather than receiving a lump sum.

- Pay interest only on what’s used: Unlike a Home Equity Loan, HELOC borrowers only pay interest on the amount they’ve actually withdrawn.

- Revolving credit: Similar to a credit card, as you repay the principal, that credit becomes available again during the draw period.

This flexibility can be particularly advantageous for those undertaking long-term projects with uncertain costs or for those who want a financial safety net without immediately incurring interest on the full amount.

Potential Tax Benefits

Both Home Equity Loans and HELOCs may offer tax advantages, although these benefits have become more limited since the Tax Cuts and Jobs Act of 2017. Key points to consider:

- Interest deductibility: Interest may be tax-deductible if the loan is used to buy, build, or substantially improve the home that secures the loan.

- Limitations: Deductions are capped, and the total of your first mortgage and home equity debt cannot exceed $750,000 (or $375,000 if married filing separately).

- Consult a tax professional: Tax laws are complex and subject to change, so it’s crucial to consult with a tax advisor for personalized guidance.

While tax benefits can make these loans more attractive, they should not be the sole reason for choosing a Home Equity Loan or HELOC, as the financial implications extend far beyond potential tax advantages.

Lower Interest Rates Compared to Unsecured Loans

Both Home Equity Loans and HELOCs typically offer lower interest rates compared to unsecured loans, such as personal loans or credit cards. This advantage stems from:

- Secured nature: Using your home as collateral reduces the lender’s risk, allowing them to offer more favorable rates.

- Potential for significant savings: Over the life of the loan, the lower interest rate can result in substantial savings, especially for large borrowing amounts.

- Improved debt consolidation opportunities: Lower rates make these options attractive for consolidating higher-interest debts.

While the lower rates are appealing, it’s crucial to remember that your home is at risk if you default on the loan, a serious consideration that doesn’t apply to unsecured borrowing options.

Large Lump Sum Available (Home Equity Loan)

Home Equity Loans provide borrowers with a single, large disbursement of funds, which can be advantageous in several scenarios:

- Major home renovations: Ideal for significant projects with well-defined costs.

- Debt consolidation: Allows for immediate payoff of multiple high-interest debts.

- Large one-time expenses: Suitable for major life events like weddings or funding education.

While the lump sum can be beneficial for substantial, one-time needs, it’s important to carefully consider whether you truly need the entire amount, as you’ll be paying interest on the full sum from day one.

Interest-Only Payments During Draw Period (HELOC)

HELOCs often feature an initial draw period during which borrowers can make interest-only payments, offering several advantages:

- Lower initial payments: This can be helpful for managing cash flow in the short term.

- Flexibility in repayment: Borrowers can choose to pay more than the interest to reduce the principal.

- Extended access to funds: The draw period typically lasts 5-10 years, providing long-term access to credit.

However, it’s crucial to prepare for the repayment period when both principal and interest payments will be required, potentially resulting in a significant increase in monthly payments.

Risk of Foreclosure

The most serious risk associated with both Home Equity Loans and HELOCs is the potential for foreclosure:

- Secured by your home: Failure to repay can result in the loss of your property.

- Secondary lien: In case of default, the primary mortgage holder has first claim, potentially leaving little equity for the second lien holder.

- Long-term commitment: These loans often have terms of 10-30 years, requiring careful consideration of long-term financial stability.

This risk underscores the importance of careful budgeting and ensuring that you can comfortably manage the payments over the entire loan term, even if your financial situation changes.

Variable Interest Rates (HELOC)

While HELOCs offer flexibility, their variable interest rates can pose challenges:

- Potential for increased payments: As market rates rise, so do your interest payments.

- Budgeting uncertainty: Fluctuating rates make it harder to predict future payments.

- Market vulnerability: Economic changes can significantly impact your borrowing costs.

To mitigate this risk, some lenders offer rate caps or the option to convert a portion of the balance to a fixed rate, features worth exploring when considering a HELOC.

Reduces Home Equity

Both Home Equity Loans and HELOCs decrease the equity you’ve built in your home:

- Increased leverage: You’re essentially increasing your mortgage debt.

- Potential negative equity: If property values decline, you could owe more than your home is worth.

- Reduced financial flexibility: Less equity means less of a financial cushion for future needs.

It’s important to weigh the immediate benefits of accessing your equity against the long-term impact on your overall financial picture and homeownership goals.

Temptation to Overspend

The accessibility of funds, especially with a HELOC, can lead to overspending:

- Easy access: The revolving nature of a HELOC can make it tempting to use for non-essential expenses.

- Debt cycle: Using home equity for everyday expenses can lead to a cycle of increasing debt.

- False sense of wealth: Access to a large credit line may create an illusion of greater financial means.

Disciplined use is crucial. It’s advisable to have a clear plan for the funds and to avoid using home equity for discretionary spending or to finance a lifestyle beyond your means.

Closing Costs and Fees

Both Home Equity Loans and HELOCs come with various costs that can impact the overall value of borrowing:

- Appraisal fees: To determine the current value of your home.

- Application fees: Charges for processing your loan application.

- Annual fees: Some HELOCs charge yearly maintenance fees.

- Closing costs: Similar to those incurred with a primary mortgage.

These costs can add up, potentially making smaller loans less cost-effective. It’s important to calculate the total cost of borrowing, including these fees, when comparing options.

Potential for Balloon Payments (HELOC)

Some HELOCs are structured with balloon payments at the end of the draw or repayment period:

- Sudden large payment: A significant lump sum may be due at the end of the loan term.

- Refinancing pressure: Borrowers may need to refinance to manage the balloon payment.

- Financial strain: The large payment can be challenging if not properly planned for.

Understanding the full repayment structure of a HELOC is crucial. If a balloon payment is part of the terms, ensure you have a strategy in place to manage it when it comes due.

In conclusion, both Home Equity Loans and HELOCs offer unique advantages and come with significant responsibilities. The choice between them depends on your specific financial needs, risk tolerance, and long-term financial goals. Careful consideration of these pros and cons, along with a thorough assessment of your financial situation and consultation with financial advisors, is essential to making an informed decision that aligns with your overall financial strategy.

Frequently Asked Questions About Home Equity Loan Vs HELOC Pros And Cons

- How much equity do I need to qualify for a Home Equity Loan or HELOC?

Most lenders require at least 15-20% equity in your home. This means your loan-to-value ratio (including your primary mortgage) should not exceed 80-85% of your home’s value. - Can I have both a Home Equity Loan and a HELOC simultaneously?

Yes, it’s possible to have both, but it depends on your home’s equity and your lender’s policies. Keep in mind that this would further leverage your home and increase your financial obligations. - Are there prepayment penalties for Home Equity Loans or HELOCs?

Some lenders may charge prepayment penalties, especially for HELOCs closed within a certain period. It’s important to review the terms carefully and ask about any potential penalties before signing. - How does a HELOC affect my credit score?

A HELOC can impact your credit score similarly to a credit card. It’s reported as a revolving account, and your credit utilization ratio on the HELOC can affect your score. - Can I use a Home Equity Loan or HELOC for investment purposes?

Yes, you can use these for investments, but it’s considered risky. The potential returns should be carefully weighed against the risk of losing your home if the investment fails and you can’t repay the loan. - What happens to my HELOC if my home value decreases?

If your home value decreases significantly, the lender may reduce your credit limit or freeze your HELOC. In extreme cases, they might even require immediate repayment of some of the balance. - Are interest rates typically higher for a Home Equity Loan or a HELOC?

Generally, Home Equity Loans have higher initial interest rates than HELOCs. However, HELOC rates are variable and could potentially exceed fixed Home Equity Loan rates over time. - Can I refinance a Home Equity Loan or HELOC?

Yes, both can typically be refinanced. Options include refinancing into a new Home Equity Loan or HELOC, or potentially rolling the balance into a cash-out refinance of your primary mortgage.