Home equity loans have become a popular financial tool for homeowners looking to leverage the value of their property. By borrowing against the equity built up in their homes, individuals can access substantial funds for various purposes, from home renovations to debt consolidation. However, like any financial product, home equity loans come with their own set of advantages and disadvantages that potential borrowers should carefully consider. This article will explore the pros and cons of home equity loans in detail, providing a comprehensive understanding for those interested in finance, crypto, forex, and money markets.

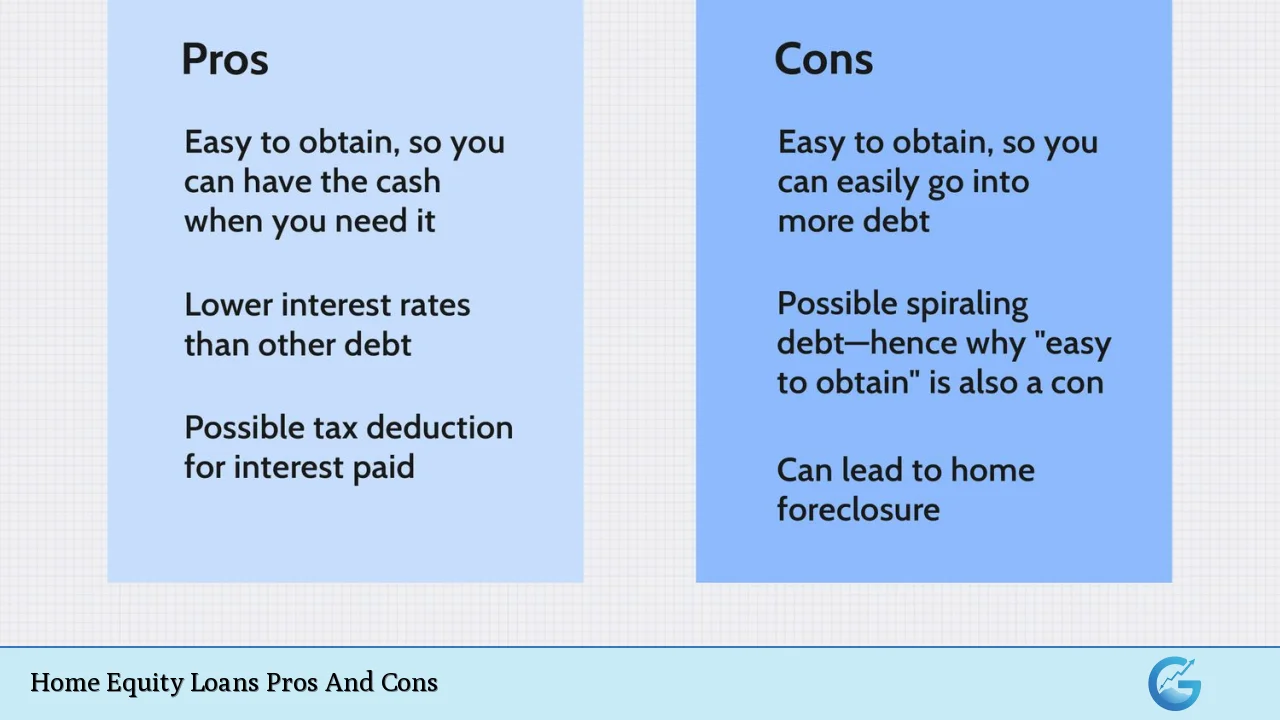

| Pros | Cons |

|---|---|

| Fixed interest rates provide predictable payments. | Risk of foreclosure if payments are missed. |

| Lower interest rates compared to unsecured loans. | Requires a minimum equity stake (typically 20%). |

| Flexible use of funds for various expenses. | Upfront costs and closing fees can be high. |

| Potential tax deductions on interest paid. | Longer processing times compared to personal loans. |

| Extended repayment periods can lower monthly payments. | Market fluctuations can lead to negative equity. |

| Larger borrowing amounts possible. | Debt accumulation risk if not managed properly. |

Fixed Interest Rates Provide Predictable Payments

One of the most significant advantages of home equity loans is that they typically come with fixed interest rates. This means that the interest rate remains constant throughout the life of the loan, allowing borrowers to plan their finances with certainty.

- Predictable monthly payments make budgeting easier.

- Stability against market fluctuations ensures that borrowers are not affected by rising interest rates.

Risk of Foreclosure if Payments Are Missed

While fixed rates provide stability, the use of your home as collateral introduces significant risk. If you fail to make your loan payments, the lender has the right to foreclose on your property.

- Foreclosure can lead to loss of your home, which is often a person’s most valuable asset.

- Long-lasting damage to credit scores can occur, making future borrowing more difficult.

Lower Interest Rates Compared to Unsecured Loans

Home equity loans generally offer lower interest rates than unsecured loans or credit cards because they are secured by your property. This makes them an attractive option for those needing substantial funds.

- Lower overall borrowing costs can save money over time.

- Access to larger amounts than might be available through other forms of credit.

Requires a Minimum Equity Stake (Typically 20%)

To qualify for a home equity loan, homeowners usually need to have at least 20% equity in their home. This requirement can be a barrier for new homeowners or those who have not built significant equity.

- Limited access for many borrowers, especially first-time buyers.

- Potential delays in obtaining funds while waiting to build equity.

Flexible Use of Funds for Various Expenses

Home equity loans offer flexibility in how the borrowed funds can be used. Homeowners can utilize these loans for various purposes, such as:

- Home renovations and improvements, which can increase property value.

- Debt consolidation to pay off high-interest credit cards or loans.

- Education expenses or other significant personal expenditures.

Upfront Costs and Closing Fees Can Be High

Despite their advantages, home equity loans often come with substantial upfront costs. These may include application fees, appraisal fees, and closing costs that can add up quickly.

- Closing costs typically range from 2% to 5% of the loan amount.

- Higher initial expenses may deter some borrowers from proceeding.

Potential Tax Deductions on Interest Paid

Interest paid on home equity loans may be tax-deductible if the funds are used for qualified home improvements. This can provide additional financial relief for homeowners.

- Tax savings can enhance affordability, making it easier to manage loan payments.

- Consultation with a tax advisor is recommended to understand eligibility and implications fully.

Longer Processing Times Compared to Personal Loans

Obtaining a home equity loan often takes longer than securing a personal loan due to the necessary evaluations and approvals involved in mortgage lending.

- Processing times can exceed one month, which may not be ideal for urgent financial needs.

- Borrowers should plan accordingly, especially if they require immediate funds.

Extended Repayment Periods Can Lower Monthly Payments

Home equity loans typically offer longer repayment terms—often up to 30 years—which can lead to lower monthly payments compared to shorter-term loans.

- More manageable monthly payments allow for better cash flow management.

- Flexibility in repayment terms helps borrowers tailor their financial plans according to their needs.

Market Fluctuations Can Lead to Negative Equity

A significant risk associated with home equity loans is the potential for negative equity. If property values decline, homeowners may owe more than their homes are worth.

- Being underwater on a mortgage complicates selling or refinancing options.

- Market downturns pose risks, particularly if combined with job loss or other financial difficulties.

Larger Borrowing Amounts Possible

Home equity loans allow homeowners to borrow substantial amounts based on their home’s value. This is particularly beneficial for significant expenses that require larger sums of money.

- Accessing five- and six-figure sums makes it easier to finance major projects or investments.

- Potentially higher borrowing limits compared to personal loans or credit cards.

Debt Accumulation Risk If Not Managed Properly

While home equity loans provide access to cash, they also carry the risk of accumulating debt if not managed wisely. Borrowers may be tempted to take on more debt than they can afford.

- Careful budgeting and planning are essential before taking out a loan.

- Overspending can lead to financial strain, especially if unexpected expenses arise.

In summary, home equity loans present both compelling advantages and notable risks. They offer fixed interest rates, lower borrowing costs compared to unsecured options, and flexibility in fund usage. However, potential borrowers must weigh these benefits against risks such as foreclosure, high upfront costs, and market fluctuations that could lead to negative equity.

Frequently Asked Questions About Home Equity Loans

- What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity in their property, providing a lump sum of cash that must be repaid over time at fixed interest rates. - How much can I borrow with a home equity loan?

The amount you can borrow typically depends on your home’s value minus any outstanding mortgage debt; lenders usually allow borrowing up to 80% of your home’s appraised value. - Are there tax benefits associated with home equity loans?

If used for qualified improvements on your primary residence, the interest paid on a home equity loan may be tax-deductible; consult a tax advisor for specifics. - What happens if I cannot repay my home equity loan?

If you fail to make payments, you risk foreclosure on your property since it serves as collateral for the loan. - How long does it take to get approved for a home equity loan?

The approval process can take several weeks due to necessary evaluations; expect at least one month from application submission to fund disbursement. - Can I use a home equity loan for anything?

You can use the funds from a home equity loan for various purposes including renovations, debt consolidation, education expenses, or emergencies. - What are typical closing costs associated with home equity loans?

Closing costs usually range from 2% to 5% of the total loan amount and may include appraisal fees and application charges. - Is it possible to refinance a home equity loan?

Yes, you can refinance a home equity loan; however, this may depend on current market conditions and your financial situation at that time.

In conclusion, understanding both the pros and cons of home equity loans is crucial for making informed financial decisions. By weighing these factors carefully, homeowners can determine whether this financing option aligns with their needs and long-term financial goals.