A home warranty is a service contract designed to cover the repair or replacement of major home systems and appliances that may break down due to normal wear and tear. This type of warranty can provide homeowners with peace of mind, especially when unexpected repairs arise. However, like any financial product, home warranties come with their own set of advantages and disadvantages. Understanding these can help homeowners make informed decisions about whether a home warranty is a worthwhile investment.

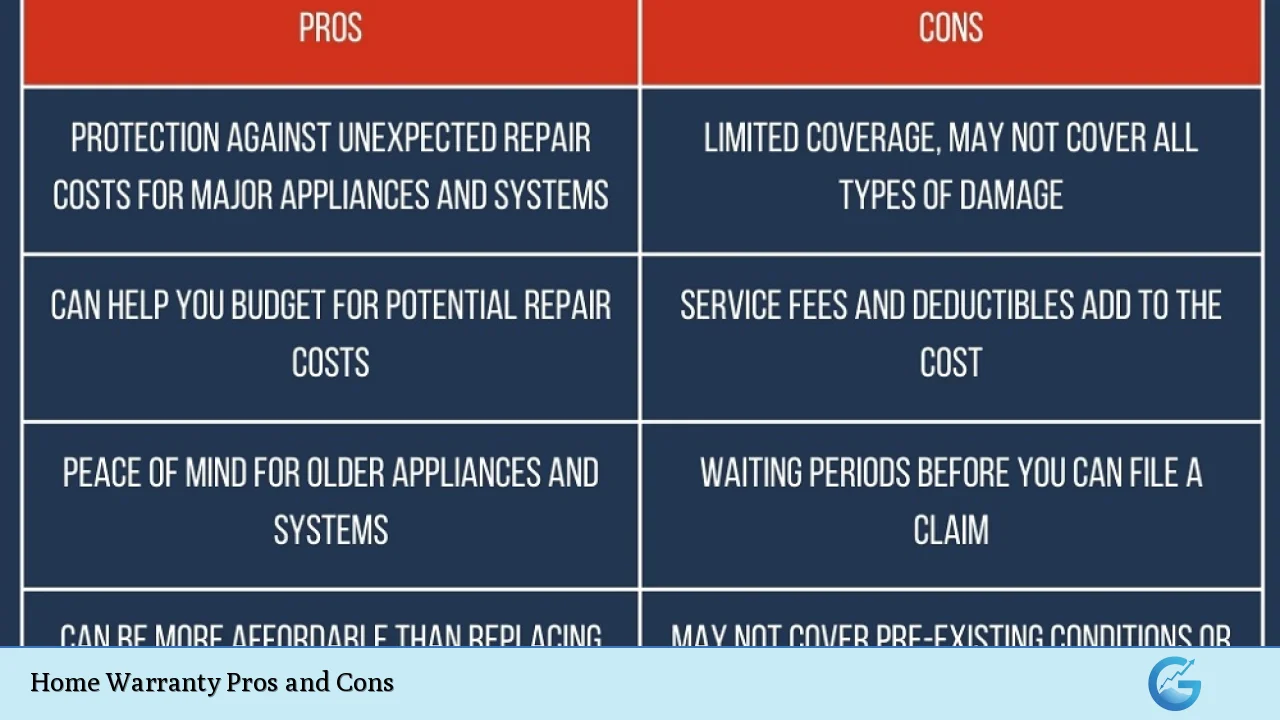

| Pros | Cons |

|---|---|

| Peace of Mind | Limited Coverage |

| Cost Predictability | Service Call Fees |

| Convenience in Repairs | Exclusions and Limitations |

| Increased Home Value | Potential for Ineffective Repairs |

| Coverage for Older Appliances | Not a Substitute for Homeowners Insurance |

| Multiple Coverage Options Available | May Not Cover Pre-Existing Conditions |

| Helps in Selling Homes Faster | Risk of Overlapping Costs with Emergency Fund |

| Access to Qualified Service Providers | Possible Deductibles on Claims |

Peace of Mind

One of the primary advantages of having a home warranty is the peace of mind it provides. Homeowners can rest assured that they are protected against unexpected repair costs associated with major systems and appliances in their homes. This assurance is particularly valuable for those on fixed incomes or with limited savings.

- Predictable Costs: Home warranties typically involve an annual fee, which helps homeowners budget for potential repairs.

- Financial Protection: A home warranty can prevent significant financial strain from unexpected breakdowns.

Limited Coverage

While home warranties offer many benefits, they often come with limitations regarding what is covered.

- Coverage Limits: Many plans have caps on how much they will pay for repairs or replacements, which may not cover the full cost.

- Specific Items Excluded: Common exclusions include damages caused by natural disasters or neglect.

Cost Predictability

Home warranties provide predictable costs that can help homeowners manage their finances more effectively.

- Flat Fees for Services: Most warranties require a service fee for each claim, making it easier to anticipate expenses.

- Annual Premiums: The annual cost allows homeowners to plan their budgets without worrying about sudden large expenses.

Service Call Fees

Despite the predictability in costs, service call fees can add up quickly.

- Additional Charges: Homeowners typically pay a service fee each time they request service, which can range from $50 to $125 depending on the provider.

- Cost-Benefit Analysis: If repairs are minor or infrequent, the total cost may exceed the benefits received from the warranty.

Convenience in Repairs

A significant advantage of home warranties is the convenience they offer in managing repairs.

- Access to Professionals: Home warranty companies often have networks of pre-screened contractors, saving homeowners time and effort in finding reliable service providers.

- Streamlined Process: The claims process is generally straightforward, allowing homeowners to focus on other priorities while repairs are handled.

Exclusions and Limitations

Home warranties can be riddled with exclusions that may leave homeowners vulnerable.

- Fine Print Issues: Important details about coverage limits and exclusions are often buried in the fine print, leading to misunderstandings when claims are made.

- Specific Brands or Models: Some warranties may only cover certain brands or models, limiting options when replacements are needed.

Increased Home Value

Having a home warranty can enhance the appeal of a property when selling it.

- Attracting Buyers: A home warranty can reassure potential buyers that they will not face unexpected repair costs shortly after purchasing the home.

- Competitive Edge: Homes with warranties may sell faster than those without, particularly in competitive markets.

Potential for Ineffective Repairs

While convenience is a benefit, it can also lead to subpar service quality.

- Repairs Over Replacements: Contractors may opt for cheaper repairs instead of necessary replacements, leading to recurring issues and additional costs later on.

- Quality Control Issues: Not all contractors within warranty networks provide high-quality service, which can result in dissatisfaction among homeowners.

Coverage for Older Appliances

Home warranties are particularly beneficial for homes with older appliances that are more prone to breakdowns.

- Extended Protection: Many warranties cover appliances beyond their manufacturer’s warranty period, providing added security for aging systems.

- Maintenance Support: Homeowners do not need to worry as much about maintaining older appliances since they have coverage if something goes wrong.

Not a Substitute for Homeowners Insurance

It’s crucial to understand that home warranties do not replace homeowners insurance.

- Different Coverage Types: Homeowners insurance covers damage from events like fires or theft, while home warranties focus on mechanical failures due to wear and tear.

- Complementary Protection: Both products serve different purposes and should be considered together for comprehensive protection against various risks.

Multiple Coverage Options Available

Homeowners have flexibility in selecting coverage plans that suit their needs and budgets.

- Variety of Plans: Many providers offer basic plans covering essential systems and appliances as well as comprehensive plans that include additional items like pools or spas.

- Customizable Add-ons: Homeowners can often add specific items to their plans based on personal needs, further tailoring their coverage options.

May Not Cover Pre-Existing Conditions

One common pitfall of home warranties is their treatment of pre-existing conditions.

- Denial Risks: Claims related to issues that existed before purchasing the warranty may be denied, leaving homeowners unprotected against known problems.

- Importance of Maintenance Records: Homeowners must maintain documentation proving regular maintenance to avoid claim denials based on pre-existing conditions.

Helps in Selling Homes Faster

A home warranty can facilitate quicker sales by providing reassurance to potential buyers about future repair costs.

- Increased Buyer Confidence: Buyers feel more secure knowing they have coverage for major systems and appliances after purchase.

- Less Negotiation Stress: Sellers may face fewer negotiations over repair credits if buyers know there’s a warranty in place covering potential issues post-sale.

Risk of Overlapping Costs with Emergency Fund

Investing in a home warranty might not always be financially prudent compared to maintaining an emergency fund.

- Opportunity Cost: Money spent on premiums could potentially earn interest if saved instead.

- Unused Warranty Payments: If no claims are made during the year, homeowners could feel they wasted money on premiums without receiving any benefits in return.

Access to Qualified Service Providers

Home warranties often provide access to vetted professionals who can perform necessary repairs efficiently.

- Reduced Search Time: Homeowners do not need to spend time researching contractors; they simply contact their warranty provider.

- Quality Assurance: Many companies ensure that their network includes licensed and insured professionals who meet specific standards.

In conclusion, while home warranties offer several advantages such as peace of mind, predictable costs, and convenience in managing repairs, they also come with notable disadvantages including limited coverage options and potential additional costs. Homeowners should carefully evaluate their individual circumstances—considering factors such as the age of appliances, existing savings for emergencies, and personal preferences regarding risk management—before deciding whether a home warranty is right for them.

Frequently Asked Questions About Home Warranty

- What is a home warranty?

A home warranty is a service contract that covers repair or replacement costs for major systems and appliances due to normal wear and tear. - How does a home warranty differ from homeowners insurance?

Homeowners insurance protects against damage from unforeseen events like fires or theft, while a home warranty covers mechanical failures. - Are all appliances covered under a home warranty?

No, coverage varies by plan; some items may be excluded or require additional fees. - Can I choose my own contractor?

Many home warranty companies require you to use their network of contractors; check your plan details. - What happens if I don’t use my home warranty?

If no claims are made during the year, you will not recoup your premium costs. - Is there a waiting period before coverage begins?

Yes, most policies have a waiting period (usually 30 days) before coverage starts. - Can I renew my home warranty?

Yes, most providers offer renewal options at the end of your contract term. - What should I do if my claim is denied?

If your claim is denied, review your policy details and consider appealing the decision with supporting documentation.