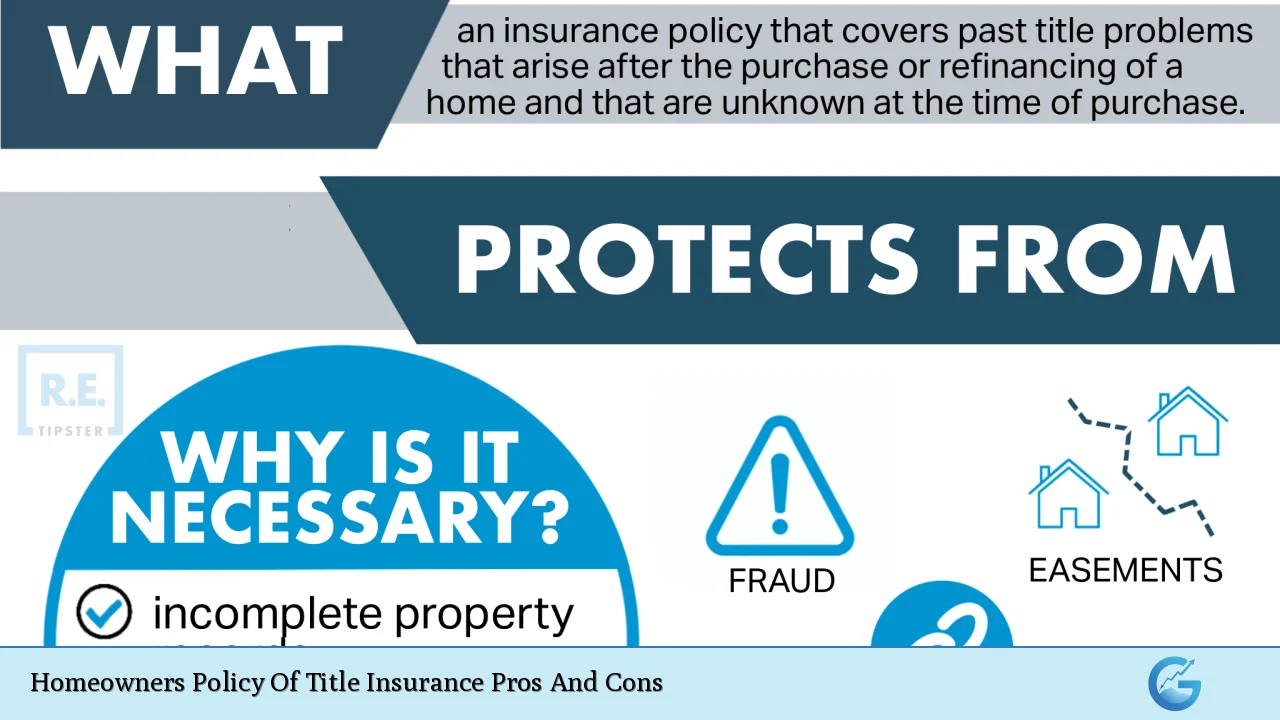

A Homeowners Policy of Title Insurance serves as a safeguard for property owners against potential defects in the title of their real estate. Unlike traditional homeowners insurance, which protects against physical damage and liability, title insurance focuses on legal ownership of the property. It provides coverage for issues that may arise from past ownership claims, liens, or other encumbrances that could affect the owner’s rights to their property. This policy is particularly relevant in today’s complex real estate market, where financial investments are significant and the risks associated with title defects can lead to substantial losses.

Understanding the advantages and disadvantages of a Homeowners Policy of Title Insurance is crucial for anyone involved in real estate transactions or property investments. Below is a comprehensive overview of the pros and cons associated with this type of insurance.

| Pros | Cons |

|---|---|

| Offers financial protection against title defects | Can be costly upfront |

| Continuous coverage for as long as you own the property | Limited to past issues, not future risks |

| Covers legal fees associated with title disputes | May seem unnecessary for short-term ownership |

| Facilitates smoother real estate transactions | Not all title issues are covered |

| Protects heirs and beneficiaries after death | Complex policy language can be confusing |

| Increased peace of mind for homeowners | Potential for overlapping coverage with other insurances |

| Encourages thorough title searches by insurers | Exclusions may limit perceived value of the policy |

Offers Financial Protection Against Title Defects

One of the primary advantages of a Homeowners Policy of Title Insurance is its ability to provide financial protection against various title defects. These defects may include:

- Unpaid liens: If previous owners left unpaid debts secured by the property, you could be held responsible.

- Ownership disputes: Conflicting claims to property ownership can arise, leading to costly legal battles.

- Fraudulent activity: Instances of forgery or identity theft related to property transactions can jeopardize your ownership rights.

This financial protection means that if a covered issue arises, the insurance company typically covers legal fees and any financial losses incurred.

Continuous Coverage for As Long as You Own the Property

Another significant benefit is that the Homeowners Policy provides continuous coverage. This means:

- Lifetime protection: As long as you own the property, you remain insured against past issues that could surface later.

- Inheritance security: The policy extends coverage to heirs, ensuring they are protected from any claims arising from previous ownership disputes.

This ongoing protection offers peace of mind, particularly in cases where properties change hands multiple times.

Covers Legal Fees Associated with Title Disputes

Title insurance not only protects against financial loss but also covers legal expenses related to defending your title. This includes:

- Litigation costs: If a claim is made against your title, the insurer typically covers attorney fees and court costs.

- Settlement costs: In situations where disputes are settled out of court, your policy may cover those expenses.

This aspect can significantly reduce the financial burden on homeowners faced with unexpected legal challenges.

Facilitates Smoother Real Estate Transactions

Having a Homeowners Policy can streamline real estate transactions in several ways:

- Title searches: Insurers conduct thorough title searches before issuing policies, which helps identify potential issues early.

- Closing efficiency: With title insurance in place, buyers and sellers can proceed with confidence, reducing delays during closing.

This efficiency is particularly beneficial in competitive markets where time is often of the essence.

Protects Heirs and Beneficiaries After Death

The policy’s provisions extend beyond the original owner. It ensures that:

- Heirs are covered: If an owner passes away, their heirs retain coverage against any claims related to past ownership issues.

- Trust arrangements: Owners can transfer titles into trusts without losing coverage, providing additional security for estate planning.

This feature underscores the importance of title insurance in long-term asset management and legacy planning.

Increased Peace of Mind for Homeowners

Investing in a Homeowners Policy of Title Insurance offers psychological benefits as well:

- Confidence in ownership: Knowing you are protected against potential claims fosters a sense of security.

- Reduced anxiety: Homeowners can focus on enjoying their property rather than worrying about unforeseen legal complications.

This peace of mind is invaluable, especially for first-time homebuyers navigating complex transactions.

Can Be Costly Upfront

Despite its many advantages, one notable drawback is the cost associated with obtaining a Homeowners Policy. Factors influencing this cost include:

- Property value: Higher-valued properties typically incur higher premiums.

- State regulations: Costs vary by state due to differing regulations governing title insurance.

For some buyers, especially those on tight budgets, this upfront expense may seem burdensome.

Limited to Past Issues, Not Future Risks

A significant limitation of title insurance is its retrospective nature. It primarily covers issues that existed before your purchase but does not protect against:

- Future claims: Any new liens or claims arising after you acquire the property will not be covered.

- Zoning changes: Changes in local zoning laws or ordinances that affect property use are generally excluded from coverage.

Homeowners must remain vigilant about potential future risks even with a policy in place.

May Seem Unnecessary for Short-Term Ownership

For individuals who plan to own a property only briefly—such as house flippers or temporary residents—title insurance might appear unnecessary. Considerations include:

- Cost vs. benefit: The expense may outweigh potential benefits if ownership is short-lived.

- Alternative options: Some may opt for temporary coverage solutions instead of full policies.

This perspective underscores the importance of evaluating personal circumstances when deciding on title insurance.

Not All Title Issues Are Covered

While title insurance provides extensive coverage, not all potential issues are included. Common exclusions encompass:

- Boundary disputes: Issues arising from neighboring properties or boundary lines may not be covered unless additional endorsements are purchased.

- Certain types of liens: Some liens may fall outside standard policy coverage depending on state regulations.

Understanding these exclusions is vital for homeowners to gauge their actual risk exposure effectively.

Complex Policy Language Can Be Confusing

The intricacies involved in understanding title insurance policies can pose challenges. Some complexities include:

- Legal jargon: Policies often contain technical language that may confuse average homeowners.

- Varied terms across states: Different states have unique regulations affecting how policies are written and interpreted.

This complexity necessitates careful review and possibly professional assistance when navigating policy details.

Potential for Overlapping Coverage with Other Insurances

Homeowners should also consider whether their existing insurance policies overlap with title insurance coverage. For example:

- Homeowners insurance vs. title insurance: While homeowners insurance covers physical damage and liability, it does not address ownership disputes.

- Mortgage protection plans: These plans might offer some overlapping protections regarding foreclosure risks but do not substitute for title insurance.

Understanding these overlaps can help homeowners avoid unnecessary expenditures on multiple policies covering similar risks.

Exclusions May Limit Perceived Value of the Policy

Finally, while title insurance offers numerous benefits, its perceived value can be diminished by exclusions present in policies. Common exclusions include:

- Pre-existing conditions known to the owner: If an owner was aware of a defect before purchasing insurance, it typically won’t be covered.

- Future encumbrances or changes in law: Any developments post-policy issuance are generally excluded from coverage.

These exclusions highlight why it’s essential for buyers to thoroughly understand what their policy entails before committing financially.

In conclusion, a Homeowners Policy of Title Insurance presents both significant advantages and notable disadvantages. It provides essential protection against past ownership issues while offering peace of mind and facilitating smoother transactions. However, potential costs and limitations regarding future risks must be carefully considered by prospective homeowners. Ultimately, understanding these factors will empower individuals to make informed decisions about safeguarding their real estate investments effectively.

Frequently Asked Questions About Homeowners Policy Of Title Insurance

- What does a Homeowners Policy of Title Insurance cover?

A Homeowners Policy covers financial losses due to defects in the property’s title, such as unpaid liens or fraudulent claims. - How long does a Homeowners Policy last?

The policy remains effective as long as you own the property or pass it on to heirs. - Is it necessary to have a Homeowners Policy?

While not legally required, it is highly recommended for protecting your investment against potential legal issues. - What are common exclusions in Title Insurance?

Common exclusions include boundary disputes and future claims arising after purchase. - How much does a Homeowners Policy typically cost?

The cost varies based on property value and state regulations but generally involves a one-time premium at closing. - Can I get Title Insurance if I refinance my home?

Yes, lenders often require new title insurance when refinancing to protect their interests. - What happens if I don’t purchase Title Insurance?

If you choose not to purchase it and a claim arises related to your property’s title, you could face significant financial loss. - How does Title Insurance differ from regular homeowners insurance?

Title Insurance protects against past issues related to ownership rights, while homeowners insurance covers physical damage and liability risks.