Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are two popular financial tools designed to help individuals manage healthcare costs. Both accounts offer tax advantages, but they differ significantly in terms of structure, eligibility, and benefits. Understanding the pros and cons of each can empower individuals to make informed decisions based on their unique financial situations and healthcare needs.

| Pros | Cons |

|---|---|

| Tax advantages (triple tax benefit for HSAs) | HSAs require enrollment in a High Deductible Health Plan (HDHP) |

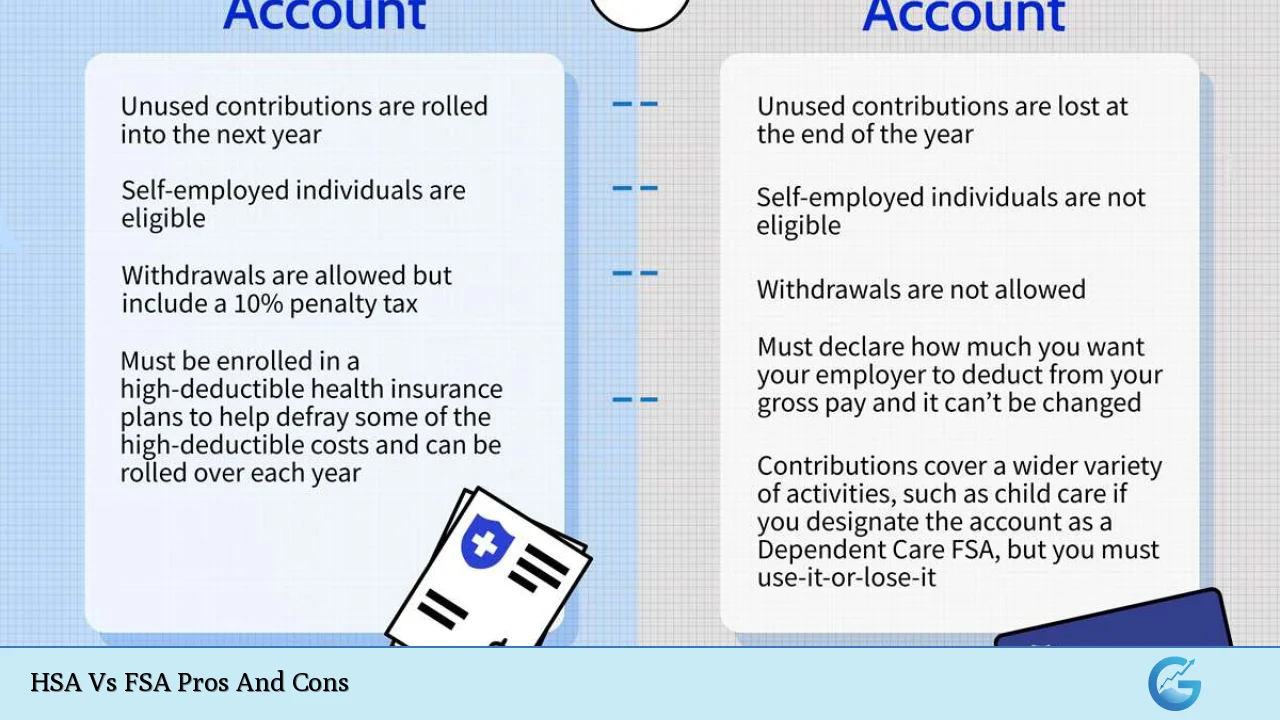

| Funds roll over year to year (HSAs) | FSAs have a “use it or lose it” policy |

| Higher contribution limits for HSAs | FSAs are employer-owned and less flexible |

| Portability of HSAs; funds remain with the employee | Limited investment options with FSAs |

| Potential for long-term savings and investment growth with HSAs | Immediate access to full annual contribution in FSAs may encourage overspending |

| Eligibility for self-employed individuals with HSAs | Complex eligibility rules for HSAs can be confusing |

| Both accounts reduce taxable income | Contribution limits can restrict savings potential in FSAs |

| HSAs can be used for a wider range of medical expenses | Limited purpose FSAs are needed to maintain HSA eligibility if other FSAs are present |

Tax Advantages

Both HSAs and FSAs provide significant tax benefits, making them attractive options for managing healthcare expenses.

HSA Advantages

- Triple Tax Benefit: Contributions to an HSA are made with pre-tax dollars, reducing taxable income. Additionally, any interest or investment earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Employer Contributions: Employers can contribute to employees’ HSAs, further enhancing tax savings.

FSA Advantages

- Pre-Tax Contributions: Similar to HSAs, contributions to an FSA reduce taxable income. This can lead to substantial savings over time.

Disadvantages

- Limited Growth Potential: Unlike HSAs, FSAs do not allow funds to grow through investments; they are strictly cash accounts.

Rollover Rules

The ability to carry over funds from one year to the next is a crucial factor in choosing between an HSA and an FSA.

HSA Advantages

- Indefinite Rollover: Unused funds in an HSA roll over indefinitely, allowing account holders to save for future medical expenses without the pressure of spending down their balance.

FSA Disadvantages

- Use It or Lose It: Most FSAs operate under a “use it or lose it” policy, meaning any unspent funds at the end of the plan year may be forfeited unless the employer offers a grace period or limited rollover options.

Contribution Limits

Contribution limits play a significant role in determining which account might be more beneficial based on individual financial situations.

HSA Advantages

- Higher Contribution Limits: For 2024, individuals can contribute up to $4,150 and families up to $8,300 into an HSA. These limits are generally higher than those of FSAs.

FSA Disadvantages

- Lower Contribution Limits: In 2024, the maximum contribution limit for an FSA is $3,200. This lower cap may restrict savings potential for those with higher anticipated medical expenses.

Portability

Portability refers to whether account holders can retain their accounts when changing jobs or health plans.

HSA Advantages

- Employee Ownership: HSAs are owned by the individual, meaning that funds remain with the employee even if they switch jobs or health plans. This feature enhances long-term financial planning.

FSA Disadvantages

- Employer Ownership: FSAs are tied to the employer. If an employee leaves their job, they typically lose access to any remaining FSA funds unless they have incurred eligible expenses before leaving.

Investment Opportunities

The potential for investment growth is another critical factor distinguishing HSAs from FSAs.

HSA Advantages

- Investment Growth Potential: Many HSAs offer investment options similar to retirement accounts. This allows account holders to invest their contributions in stocks, bonds, or mutual funds, potentially increasing their savings over time.

FSA Disadvantages

- No Investment Options: FSAs do not allow for investment growth; funds must be used within the plan year without any opportunity for compounding interest.

Eligibility Requirements

Eligibility criteria can significantly impact which account individuals can open and contribute to.

HSA Advantages

- Self-Employment Eligibility: Self-employed individuals can open HSAs if they meet HDHP requirements, providing them with a valuable tool for managing healthcare costs.

FSA Advantages

- Broader Accessibility: FSAs are available regardless of health plan type. Employees can participate in an FSA even if they do not have insurance through their employer.

Disadvantages

- Complexity of HSA Eligibility: To qualify for an HSA, individuals must be enrolled in a qualified HDHP. This requirement can complicate eligibility compared to FSAs.

Immediate Access vs. Long-Term Planning

The accessibility of funds plays a crucial role in how individuals manage their healthcare expenses throughout the year.

FSA Advantages

- Immediate Availability: Employees have access to their entire annual election amount at the beginning of the plan year. This feature allows for upfront payment of anticipated medical costs without waiting for contributions to accumulate.

HSA Disadvantages

- Gradual Access: With HSAs, account holders can only withdraw what they have contributed so far. This limitation may pose challenges if significant medical expenses arise early in the year before sufficient contributions have been made.

Conclusion

In conclusion, both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer valuable benefits for managing healthcare costs. However, they come with distinct advantages and disadvantages that cater to different financial situations and healthcare needs.

HSAs provide greater flexibility, higher contribution limits, and potential long-term growth through investments. They are particularly beneficial for individuals who anticipate needing funds for future medical expenses or who wish to save on taxes over time. On the other hand, FSAs offer immediate access to funds and broader eligibility but come with restrictions that may limit their effectiveness as a long-term financial tool.

Ultimately, choosing between an HSA and an FSA—or utilizing both if eligible—requires careful consideration of personal health needs, financial goals, and employment circumstances. By understanding the strengths and weaknesses of each option, individuals can make informed decisions that align with their overall financial strategies.

Frequently Asked Questions About HSA Vs FSA

- Can I have both an HSA and an FSA?

You cannot contribute to a traditional health care FSA while also contributing to an HSA; however, you may have a limited purpose FSA alongside your HSA. - What happens to unused funds in my FSA?

If you do not use your entire balance by the end of the plan year (or grace period), you will lose those funds unless your employer offers a rollover option. - Are contributions to HSAs tax-deductible?

Yes, contributions made to an HSA are tax-deductible from your taxable income. - What types of expenses can I pay with my HSA?

You can use your HSA funds for qualified medical expenses such as doctor visits, prescription medications, dental care, and vision services. - Can I use my HSA funds after retirement?

Yes! After age 65, you can use your HSA funds without penalty for non-medical expenses; however, you will owe income tax on those withdrawals. - What is the maximum contribution limit for HSAs in 2024?

The maximum contribution limit is $4,150 for individual coverage and $8,300 for family coverage. - If I switch jobs, what happens to my HSA?

Your HSA remains yours even if you change jobs; you keep all accumulated funds. - Can my employer contribute to my FSA?

Yes, employers may choose to contribute additional amounts into employees’ FSAs.