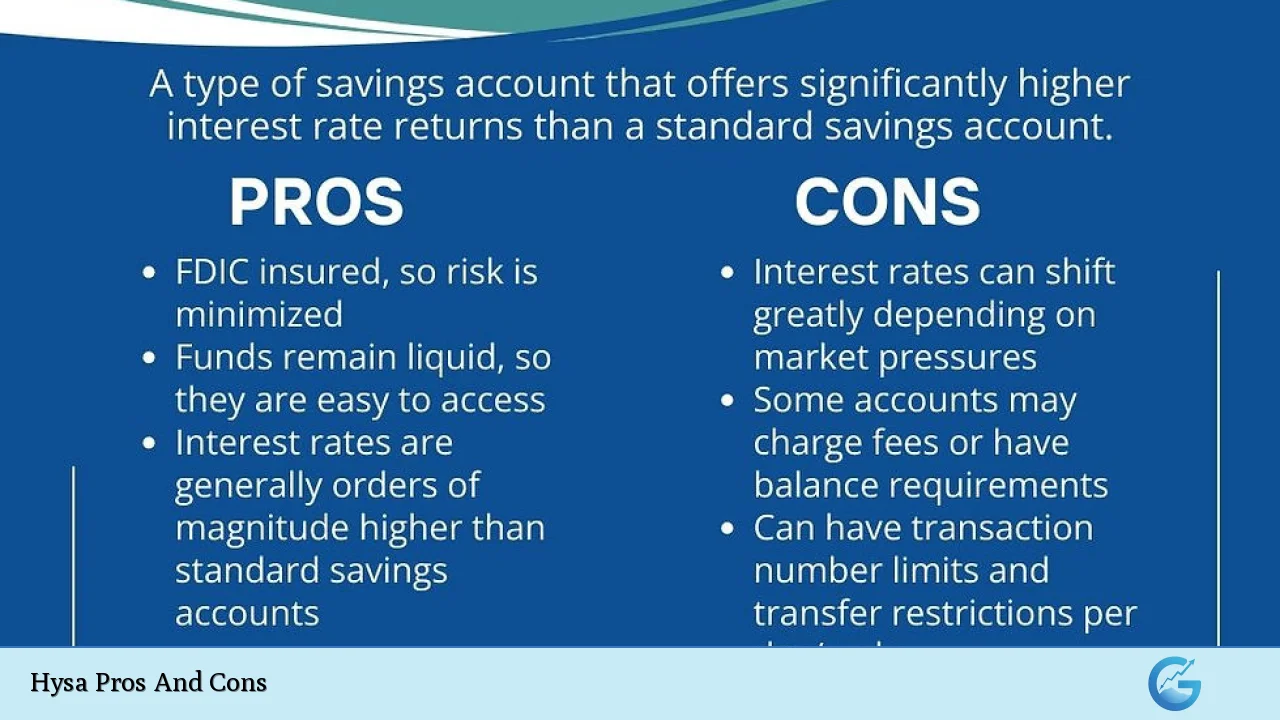

High-Yield Savings Accounts (HYSAs) have gained popularity as a viable option for individuals looking to grow their savings with minimal risk. These accounts typically offer significantly higher interest rates than traditional savings accounts, making them an attractive choice for those wanting to maximize their returns while maintaining easy access to their funds. However, like any financial product, HYSAs come with their own set of advantages and disadvantages that potential investors should carefully consider.

The following sections will delve into the pros and cons of HYSAs, providing a comprehensive overview of their strengths and weaknesses. This information is particularly useful for individuals interested in finance, crypto, forex, and money markets, as it highlights key factors that can influence investment decisions.

| Pros | Cons |

|---|---|

| Higher interest rates compared to traditional savings accounts | Variable interest rates can fluctuate |

| FDIC insurance up to $250,000 | Limited number of withdrawals per month |

| Liquidity and easy access to funds | Potential fees for exceeding withdrawal limits |

| Low-risk investment option | Lower returns compared to other investment vehicles |

| No maintenance fees with certain accounts | Minimum balance requirements may apply |

| Ideal for short-term savings goals and emergency funds | Interest earned is taxable income |

| Accessible online banking features | May lack in-person banking services at online institutions |

Higher Interest Rates Compared to Traditional Savings Accounts

One of the most compelling advantages of HYSAs is their ability to offer higher interest rates than standard savings accounts.

- Competitive APY: Many HYSAs provide annual percentage yields (APYs) ranging from 4% to 5.5%, significantly outperforming the average savings account rate of approximately 0.45%.

- Compounding Interest: Interest on HYSAs is often compounded daily or monthly, allowing your savings to grow more quickly over time.

This higher yield makes HYSAs an excellent choice for individuals looking to maximize their savings without taking on significant risk.

FDIC Insurance Up to $250,000

Another significant benefit of HYSAs is that they are typically insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per bank.

- Safety Assurance: This insurance protects your deposits in the event of a bank failure, providing peace of mind for account holders.

- Joint Accounts: For joint accounts, coverage can extend up to $500,000, making HYSAs a secure option for couples or partners looking to save together.

Liquidity and Easy Access to Funds

HYSAs offer a level of liquidity that makes them appealing for short-term savings needs.

- Quick Withdrawals: Account holders can access their funds relatively easily compared to other investment options like certificates of deposit (CDs), which often have penalties for early withdrawal.

- Online Management: Most HYSAs allow for online banking features that enable easy transfers and account management from anywhere.

This accessibility makes HYSAs ideal for emergency funds or short-term savings goals.

Low-Risk Investment Option

HYSAs are considered low-risk financial products, making them suitable for conservative investors or those new to saving and investing.

- Minimal Risk of Loss: Unlike stocks or mutual funds, which can fluctuate dramatically in value, the principal amount in a HYSA is protected against loss as long as it remains within FDIC insurance limits.

- Stable Growth: While returns on HYSAs may not be as high as more volatile investments, they provide a safe harbor for your cash while still earning interest.

No Maintenance Fees with Certain Accounts

Many financial institutions offer HYSAs without monthly maintenance fees, which can further enhance their attractiveness.

- Cost-Effective Saving: By avoiding fees, account holders can maximize their returns without worrying about deductions from their interest earnings.

- Competitive Options: It’s essential to shop around as some banks may charge fees unless specific balance thresholds are maintained.

Ideal for Short-Term Savings Goals and Emergency Funds

HYSAs serve as an excellent vehicle for building emergency funds or saving for short-term goals.

- Emergency Fund: Financial advisors often recommend keeping three to six months’ worth of expenses in an easily accessible account like a HYSA.

- Short-Term Savings: Whether saving for a vacation or a down payment on a home, HYSAs provide a way to earn interest on funds you plan to use soon without exposing them to market risks.

Accessible Online Banking Features

Most HYSAs come with robust online banking capabilities that enhance user experience.

- Convenient Management: Users can easily transfer money between accounts, check balances, and monitor interest earnings through user-friendly apps or websites.

- Real-Time Updates: Many institutions offer real-time notifications about transactions and interest accruals, keeping account holders informed about their finances.

Variable Interest Rates Can Fluctuate

Despite the attractive rates offered by HYSAs, one significant drawback is that these rates are often variable rather than fixed.

- Market Dependency: The interest rate can change based on market conditions and Federal Reserve policies, which means your returns may decrease if rates fall.

- Promotional Rates: Some banks may initially offer high promotional rates that revert to lower standard rates after a specified period.

This variability can affect long-term planning if you rely on consistent returns from your HYSA.

Limited Number of Withdrawals Per Month

Many financial institutions impose limits on the number of withdrawals or transfers you can make from your HYSA each month.

- Withdrawal Caps: While federal regulations limiting withdrawals were relaxed during the COVID-19 pandemic, many banks continue to enforce restrictions—typically allowing only six convenient transfers per month.

- Fees for Exceeding Limits: Exceeding these limits may result in fees or even conversion of your account type if it becomes habitual.

Understanding these limitations is crucial when considering how frequently you might need access to your funds.

Potential Fees for Exceeding Withdrawal Limits

In addition to withdrawal limits, some banks may charge fees associated with exceeding these limits.

- Transaction Fees: Each transaction beyond the allowed number may incur a fee that could diminish the benefits of having a HYSA in the first place.

- Account Conversion Risks: If you consistently exceed withdrawal limits, your bank might convert your HYSA into a checking account or close it altogether.

It’s essential to read the terms and conditions carefully before opening an account.

Lower Returns Compared to Other Investment Vehicles

While HYSAs offer better returns than traditional savings accounts, they generally yield less than other investment options such as stocks or bonds.

- Investment Alternatives: Historically, stock market investments have provided average annual returns around 10%, far exceeding even the highest APYs offered by HYSAs.

- Long-Term Growth Considerations: For those focused on long-term wealth accumulation, relying solely on HYSAs may not be sufficient; diversifying into other investment vehicles could be necessary for achieving substantial growth over time.

Minimum Balance Requirements May Apply

Some high-yield savings accounts require maintaining a minimum balance either to open the account or avoid monthly fees.

- Account Accessibility: If you cannot meet these minimums due to fluctuations in your finances, you might incur fees that negate some benefits of having a HYSA.

- Comparison Shopping: It’s crucial to compare different banks’ offerings since some may have more favorable terms regarding minimum balances than others.

Interest Earned Is Taxable Income

Interest earned on HYSAs is considered taxable income by the IRS.

- Tax Implications: This means that while you may earn higher interest compared to traditional accounts, you will also owe taxes on those earnings at your marginal tax rate.

- Net Returns Consideration: After accounting for taxes, the effective yield from your HYSA could be significantly lower than advertised rates—especially if you fall into a higher tax bracket.

Understanding this aspect is vital when calculating overall returns from your HYSA investments.

May Lack In-Person Banking Services at Online Institutions

Many high-yield savings accounts are offered by online banks that do not have physical branches.

- Limited Personal Interaction: This can be inconvenient if you prefer face-to-face customer service or need assistance with complex banking issues.

- Reliance on Digital Platforms: While online banking offers convenience and often better rates due to lower overhead costs, it requires comfort with digital platforms and technology.

Choosing an institution that aligns with your banking preferences is essential when selecting a HYSA provider.

In conclusion, High-Yield Savings Accounts present numerous advantages such as higher interest rates, safety through FDIC insurance, liquidity for easy access to funds, and low-risk investment opportunities. However, potential investors must also consider disadvantages including variable interest rates, withdrawal limits, possible fees for exceeding those limits, lower long-term returns compared to other investments, minimum balance requirements, tax implications on earned interest income, and potential lack of in-person banking services at online institutions.

Ultimately, understanding both sides will help individuals make informed decisions regarding whether a HYSA fits into their broader financial strategy.

Frequently Asked Questions About Hysa Pros And Cons

- What is a High-Yield Savings Account (HYSA)?

A HYSA is a deposit account that offers significantly higher interest rates than traditional savings accounts while providing liquidity and safety through FDIC insurance. - What are the main advantages of using an HYSA?

The primary advantages include higher interest rates compared to standard savings accounts, FDIC insurance coverage up to $250,000 per depositor per bank, easy access to funds, low risk of loss on principal amounts. - Are there any disadvantages associated with HYSAs?

Yes; disadvantages include variable interest rates that can fluctuate based on market conditions and potential transaction limits that restrict withdrawals. - How does taxation work with an HYSA?

The interest earned in an HYSA is considered taxable income by the IRS and must be reported when filing taxes. - Can I withdraw money from my HYSA anytime?

You can withdraw money; however, many banks impose limits on the number of withdrawals allowed each month. - Do all HYSAs require minimum balances?

No; while some do have minimum balance requirements or fees associated with maintaining those balances, many institutions offer options without such stipulations. - How do I choose the right HYSA?

Consider factors such as interest rates offered by different banks, any applicable fees or minimum balance requirements, FDIC insurance status of the institution. - Is it safe to keep large amounts in an HYSA?

If within FDIC insurance limits ($250K per depositor), it is generally considered safe; however larger amounts may require spreading across multiple banks.