Income annuities are financial products designed to provide a steady stream of income, typically during retirement. They are contracts between an individual and an insurance company, where the individual pays a lump sum in exchange for regular payments over a specified period or for the rest of their life. This arrangement can offer financial security and predictability, making it appealing to many retirees. However, like any financial instrument, income annuities come with their own set of advantages and disadvantages that potential investors should carefully consider.

| Pros | Cons |

|---|---|

| Guaranteed income for life | High fees and commissions |

| Tax-deferred growth | Limited liquidity |

| Protection against market volatility | Complexity of contracts |

| Customizable payout options | Potential inflation risk |

| Estate planning benefits | Possibility of insurer default |

| Diversification of retirement income sources | Opportunity costs on capital |

Guaranteed Income for Life

One of the most significant advantages of income annuities is the guaranteed income they provide for life. This feature is especially appealing to retirees who want to ensure that they have a reliable source of income that cannot be outlived.

- Peace of Mind: Knowing that you will receive a fixed amount regularly can alleviate financial stress during retirement.

- Budgeting Ease: Fixed payments allow for easier budgeting and planning for expenses.

High Fees and Commissions

Despite their benefits, income annuities often come with high fees and commissions, which can significantly reduce overall returns.

- Sales Commissions: Agents selling annuities may earn commissions ranging from 6% to 10%, which can be built into the cost of the annuity.

- Ongoing Fees: Many annuities have annual fees that can eat into your investment returns over time.

Tax-Deferred Growth

Income annuities offer tax-deferred growth, meaning you do not pay taxes on earnings until you withdraw funds.

- Tax Efficiency: This feature allows your investment to grow without immediate tax implications, potentially increasing your overall retirement savings.

- Strategic Withdrawals: You can plan withdrawals in lower-income years to minimize tax burdens.

Limited Liquidity

A notable disadvantage of income annuities is their limited liquidity. Once you invest in an annuity, accessing your funds can be challenging.

- Surrender Charges: If you need to withdraw money before a specified period, surrender charges may apply, often exceeding 10% of the contract value.

- Locked-In Funds: The funds used to purchase an annuity are typically locked away until the payout period begins, which can be problematic if unexpected expenses arise.

Protection Against Market Volatility

Income annuities provide a hedge against market volatility by offering fixed payments regardless of market conditions.

- Stable Returns: This stability is particularly beneficial during economic downturns when other investments might suffer losses.

- Risk Aversion: For conservative investors or those nearing retirement, this feature can be a crucial factor in their investment strategy.

Complexity of Contracts

Annuity contracts can be highly complex, making them difficult for the average investor to understand fully.

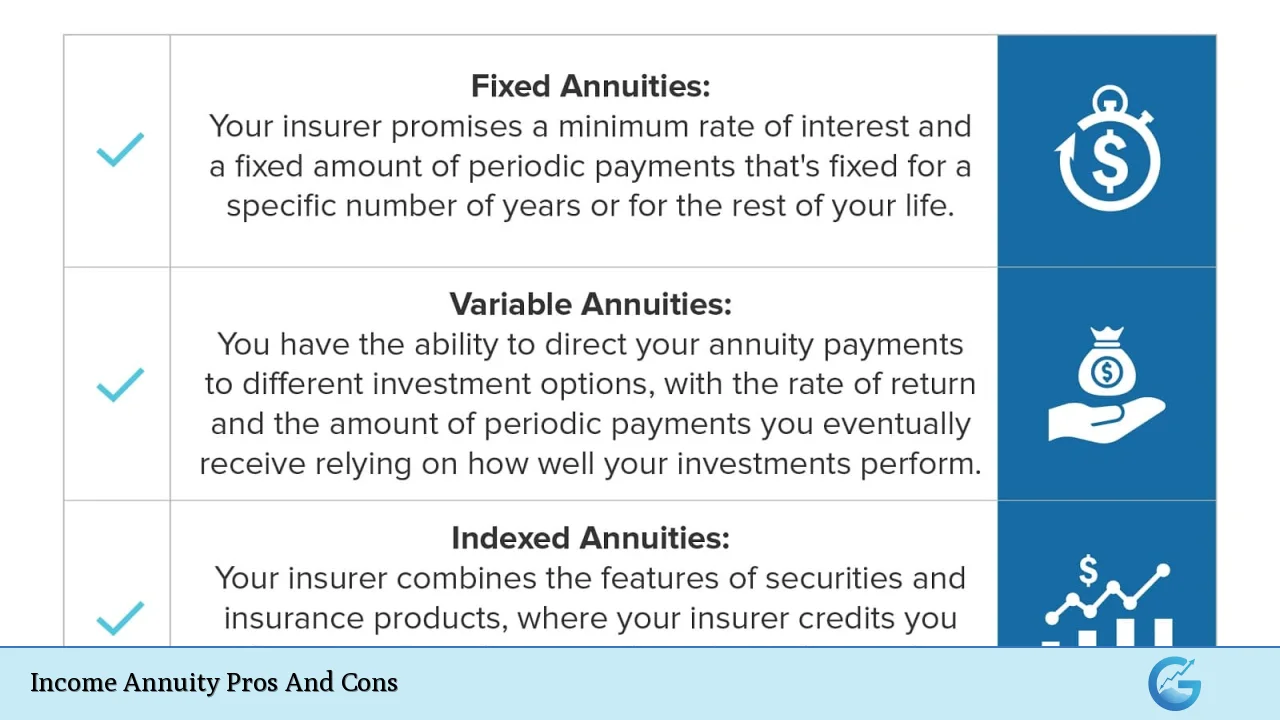

- Variety of Options: Different types of annuities (fixed, variable, indexed) come with various features and terms that may confuse potential buyers.

- Hidden Fees: The complexity can also obscure understanding regarding fees and penalties associated with the contract.

Customizable Payout Options

Income annuities offer various payout options tailored to individual needs.

- Lifetime Payments: Individuals can choose lifetime payouts, ensuring they receive income as long as they live.

- Joint Life Options: Some contracts allow for joint life payouts, providing income for both partners in a marriage until both have passed away.

Potential Inflation Risk

While income annuities provide stable payments, they may not keep pace with inflation over time.

- Fixed Payments: If inflation rises significantly, the purchasing power of fixed payments may diminish, impacting long-term financial security.

- Inflation Riders: Some products offer inflation protection features but often at the cost of lower initial payouts.

Estate Planning Benefits

Income annuities can play a role in estate planning by providing predictable income streams that can benefit heirs under certain conditions.

- Beneficiary Designations: Many contracts allow you to name beneficiaries who may receive remaining payments after your death.

- Legacy Planning: This feature can help ensure that loved ones are financially supported even after your passing.

Possibility of Insurer Default

The security offered by income annuities is contingent on the financial health of the issuing insurance company.

- Insurance Company Risk: If the insurer faces financial difficulties or defaults, there may be limited recourse for recovering funds.

- State Guaranty Associations: While many states have protections in place through guaranty associations, these limits may not cover all invested amounts.

Diversification of Retirement Income Sources

Incorporating income annuities into a retirement portfolio can enhance diversification by adding a layer of guaranteed income alongside other investments such as stocks and bonds.

- Risk Management: This diversification helps mitigate risks associated with relying solely on volatile market investments for retirement income.

- Holistic Financial Strategy: Combining different types of retirement accounts and products can create a more robust financial plan tailored to individual needs.

Opportunity Costs on Capital

Investing in an income annuity means tying up capital that could potentially earn higher returns elsewhere.

- Alternative Investments: Funds locked into an annuity cannot be invested in potentially higher-yielding assets like stocks or real estate during favorable market conditions.

- Long-Term Commitment: The long-term nature of annuities may result in missed opportunities for growth if market conditions change favorably after purchase.

In conclusion, while income annuities present several compelling advantages—such as guaranteed lifetime income and tax-deferred growth—they also come with significant drawbacks like high fees and limited liquidity. Understanding these pros and cons is essential for anyone considering an investment in an income annuity. As with any financial decision, it is advisable to consult with a qualified financial advisor to determine whether an income annuity aligns with your overall retirement strategy and financial goals.

Frequently Asked Questions About Income Annuity Pros And Cons

- What is an income annuity?

An income annuity is a contract between an individual and an insurance company where the individual pays a lump sum upfront in exchange for regular payments over time. - What are the main benefits of purchasing an income annuity?

The primary benefits include guaranteed lifetime income, tax-deferred growth, and protection against market volatility. - What are some drawbacks associated with income annuities?

Drawbacks include high fees and commissions, limited liquidity, complexity in understanding contracts, and potential inflation risk. - Can I access my money from an income annuity before the payout period?

You may access funds through withdrawals or surrenders; however, surrender charges may apply if done before a specified period. - How do I choose between different types of income annuities?

Selecting an appropriate type depends on your financial goals, risk tolerance, desired payout structure, and whether you want inflation protection. - Are there risks involved with purchasing an income annuity?

Yes, risks include potential insurer default and opportunity costs associated with locking up capital that could earn higher returns elsewhere. - How does inflation affect my income from an annuity?

If your payments are fixed, rising inflation could reduce your purchasing power over time unless your contract includes inflation protection features. - Is it advisable to consult a financial advisor before buying an income annuity?

Yes, consulting a financial advisor is recommended to ensure that an income annuity aligns with your overall financial strategy.