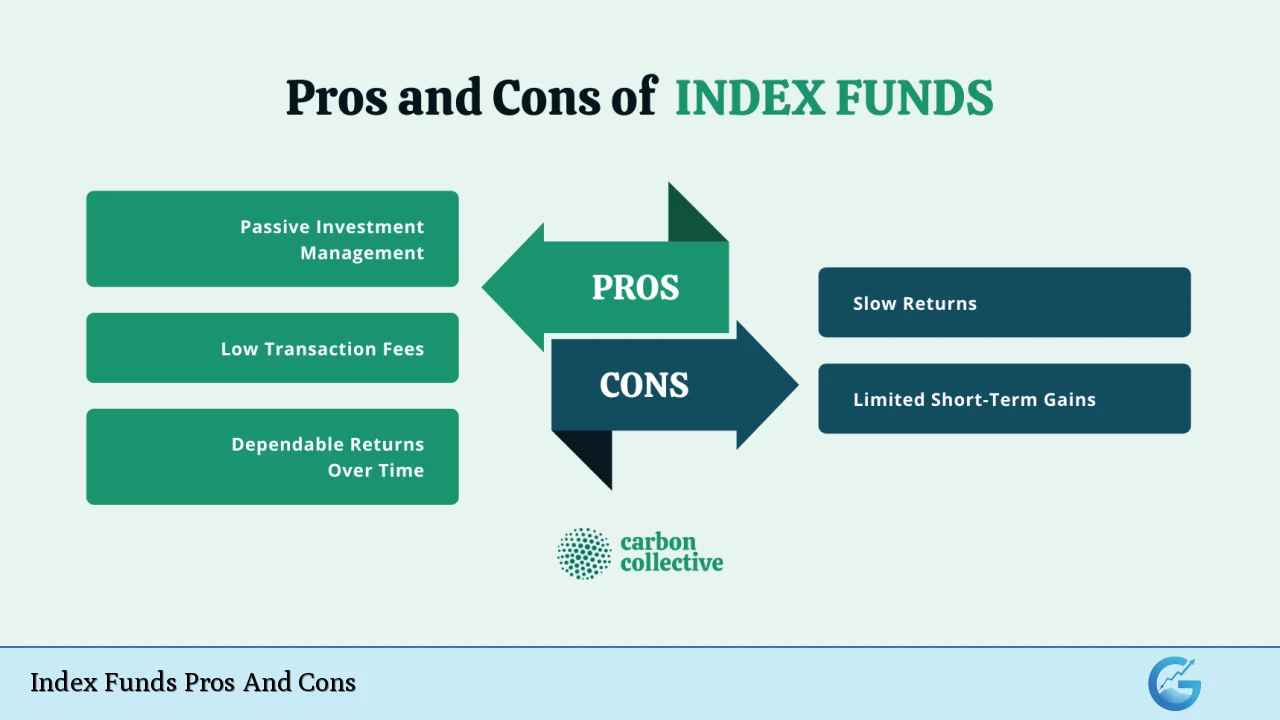

Index funds have become increasingly popular among investors seeking a simple, cost-effective way to diversify their portfolios and gain exposure to broad market segments. These passively managed investment vehicles aim to replicate the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite. By understanding the advantages and disadvantages of index funds, investors can make informed decisions about whether these investment products align with their financial goals and risk tolerance.

| Pros | Cons |

|---|---|

| Low costs and fees | Limited upside potential |

| Broad diversification | Lack of flexibility |

| Passive management | No downside protection |

| Transparency | Tracking error |

| Tax efficiency | Overexposure to large-cap stocks |

| Consistent performance | No active risk management |

| Ease of use | Limited exposure to niche markets |

| Lower turnover | Potential for overcrowding |

Advantages of Index Funds

Low Costs and Fees

One of the most significant benefits of index funds is their low expense ratios. Because index funds are passively managed, they don’t require expensive fund managers to make investment decisions. This cost savings is typically passed on to investors, allowing more of their money to work for them. The average expense ratio for index funds is significantly lower than that of actively managed funds, often ranging from 0.03% to 0.20% per year.

- Lower management fees

- Reduced transaction costs

- Higher net returns for investors

Broad Diversification

Index funds offer instant diversification by holding a broad array of stocks or bonds within a specific index. This reduces the risk of any single investment negatively impacting your overall portfolio and provides exposure to various sectors and industries. For example, an S&P 500 index fund gives investors exposure to 500 of the largest U.S. companies across multiple sectors.

- Reduced company-specific risk

- Exposure to multiple sectors and industries

- Lower overall portfolio volatility

Passive Management

Index funds follow a passive investment strategy, which means they aim to replicate the performance of their benchmark index rather than trying to outperform it. This approach eliminates the need for frequent trading and reduces the impact of human emotion on investment decisions.

- Elimination of manager bias

- Consistent adherence to investment strategy

- Reduced risk of underperformance due to poor stock selection

Transparency

Investors in index funds always know what they own, as the fund’s holdings are typically disclosed daily and mirror the composition of the underlying index. This transparency allows investors to make informed decisions about their portfolio allocation and avoid potential conflicts of interest that may arise with actively managed funds.

- Clear understanding of fund holdings

- Easy to track fund performance against benchmark

- Reduced risk of style drift

Tax Efficiency

Index funds tend to be more tax-efficient than actively managed funds due to their lower turnover rates. Less frequent trading means fewer capital gains distributions, which can result in lower tax liabilities for investors holding these funds in taxable accounts.

- Fewer taxable events

- Lower capital gains distributions

- Potential for higher after-tax returns

Consistent Performance

While index funds won’t outperform their benchmark index, they also avoid the risk of significant underperformance that can occur with actively managed funds. Over long periods, index funds have consistently outperformed the majority of actively managed funds in their respective categories.

- Reliable returns relative to the benchmark

- Avoidance of manager underperformance risk

- Long-term outperformance of active strategies

Ease of Use

Index funds are straightforward investment vehicles that require minimal research and monitoring. This simplicity makes them ideal for both novice and experienced investors who prefer a hands-off approach to investing.

- Simple investment selection process

- Reduced need for ongoing research and analysis

- Suitable for various investor types and skill levels

Lower Turnover

Index funds typically have lower portfolio turnover rates compared to actively managed funds. This reduced trading activity can lead to lower transaction costs and improved tax efficiency.

- Reduced trading costs

- Lower impact on market prices

- Improved long-term returns

Disadvantages of Index Funds

Limited Upside Potential

Because index funds are designed to match, not beat, the performance of their benchmark index, they offer limited potential for outsized returns. Investors seeking higher returns may need to look elsewhere or complement their portfolio with other investment options.

- No opportunity to outperform the market

- Potential for lower returns in certain market conditions

- Limited ability to capitalize on market inefficiencies

Lack of Flexibility

Index funds follow a strict set of rules based on the underlying index, which means they cannot adjust holdings in response to market changes. This lack of flexibility can be a disadvantage in volatile markets or during economic downturns.

- Inability to avoid poorly performing stocks in the index

- No defensive positioning during market downturns

- Limited ability to capitalize on short-term market opportunities

No Downside Protection

During market downturns, index funds will decline in value along with their benchmark index. Unlike actively managed funds, index funds cannot take defensive positions or move to cash to protect against losses.

- Full exposure to market volatility

- Potential for significant losses during bear markets

- No ability to implement risk management strategies

Tracking Error

While index funds aim to replicate the performance of their benchmark index, they may not always achieve perfect tracking. Factors such as fees, trading costs, and cash holdings can lead to slight deviations from the index’s performance.

- Potential for underperformance relative to the benchmark

- Impact of fund expenses on returns

- Challenges in replicating certain indexes accurately

Overexposure to Large-Cap Stocks

Many popular indexes, such as the S&P 500, are market-cap weighted, which means they give more weight to larger companies. This can result in overexposure to a small number of large-cap stocks, potentially limiting diversification benefits.

- Concentration risk in top holdings

- Reduced exposure to small and mid-cap stocks

- Potential for underperformance when large-caps lag

No Active Risk Management

Index funds do not employ active risk management strategies, which can be a disadvantage during periods of market stress or when certain sectors or companies face significant challenges.

- Inability to avoid troubled companies or sectors

- No protection against systemic risks

- Limited ability to adapt to changing market conditions

Limited Exposure to Niche Markets

While index funds offer broad market exposure, they may not provide access to certain niche or specialized market segments. Investors seeking exposure to specific themes or emerging trends may need to look beyond traditional index funds.

- Limited access to emerging markets or sectors

- Difficulty in targeting specific investment themes

- Potential missed opportunities in specialized areas

Potential for Overcrowding

As index investing has grown in popularity, concerns have arisen about the potential impact on market efficiency and price discovery. Some argue that the increased flow of money into index funds could lead to overvaluation of index constituents and market distortions.

- Potential impact on market efficiency

- Risk of creating asset bubbles in index constituents

- Challenges for price discovery in less liquid markets

In conclusion, index funds offer numerous advantages for investors seeking a low-cost, diversified approach to investing. Their passive management style, broad market exposure, and consistent performance make them an attractive option for many investors. However, it’s essential to consider the limitations of index funds, such as their lack of flexibility and inability to outperform the market.

Investors should carefully weigh the pros and cons of index funds in the context of their overall investment strategy, financial goals, and risk tolerance. For many, a combination of index funds and other investment vehicles may provide the optimal balance between cost-effectiveness, diversification, and the potential for enhanced returns. As with any investment decision, it’s advisable to consult with a financial professional to determine the most appropriate approach for your individual circumstances.

Frequently Asked Questions About Index Funds Pros And Cons

- Are index funds suitable for all types of investors?

Index funds can be suitable for many investors, particularly those seeking low-cost, diversified exposure to broad market segments. However, they may not be ideal for investors looking to outperform the market or those requiring more specialized investment strategies. - How do index funds compare to actively managed funds in terms of performance?

Over long periods, index funds have generally outperformed the majority of actively managed funds in their respective categories. This is primarily due to their lower fees and consistent exposure to the market. - Can index funds protect against market downturns?

Index funds do not offer protection against market downturns, as they are designed to track the performance of their benchmark index. During market declines, index funds will typically lose value in line with the broader market. - Are there any tax advantages to investing in index funds?

Index funds tend to be more tax-efficient than actively managed funds due to their lower turnover rates. This can result in fewer capital gains distributions and potentially lower tax liabilities for investors holding these funds in taxable accounts. - How do index funds impact market efficiency?

The growing popularity of index funds has raised concerns about their potential impact on market efficiency and price discovery. Some argue that increased flows into index funds could lead to overvaluation of index constituents and market distortions. - Can index funds be used for short-term investing?

While index funds are typically considered long-term investments, they can be used for shorter-term strategies. However, their passive nature and broad market exposure may not be ideal for investors seeking to capitalize on short-term market movements. - How do index funds perform in different market conditions?

Index funds will generally perform in line with their benchmark index across various market conditions. They may underperform during periods when active managers can successfully identify opportunities or avoid troubled sectors. - Are there any alternatives to traditional market-cap weighted index funds?

Yes, there are alternatives such as equal-weighted index funds, factor-based index funds, and smart beta strategies that offer different approaches to indexing. These alternatives may address some of the limitations of traditional market-cap weighted index funds.