Indexed Universal Life (IUL) insurance is a unique financial product that combines life insurance with an investment component linked to a stock market index. This type of insurance offers policyholders the potential for cash value growth while providing a death benefit, making it an attractive option for those looking to secure their financial future. However, like any financial product, IUL insurance comes with its own set of advantages and disadvantages that potential investors should carefully consider.

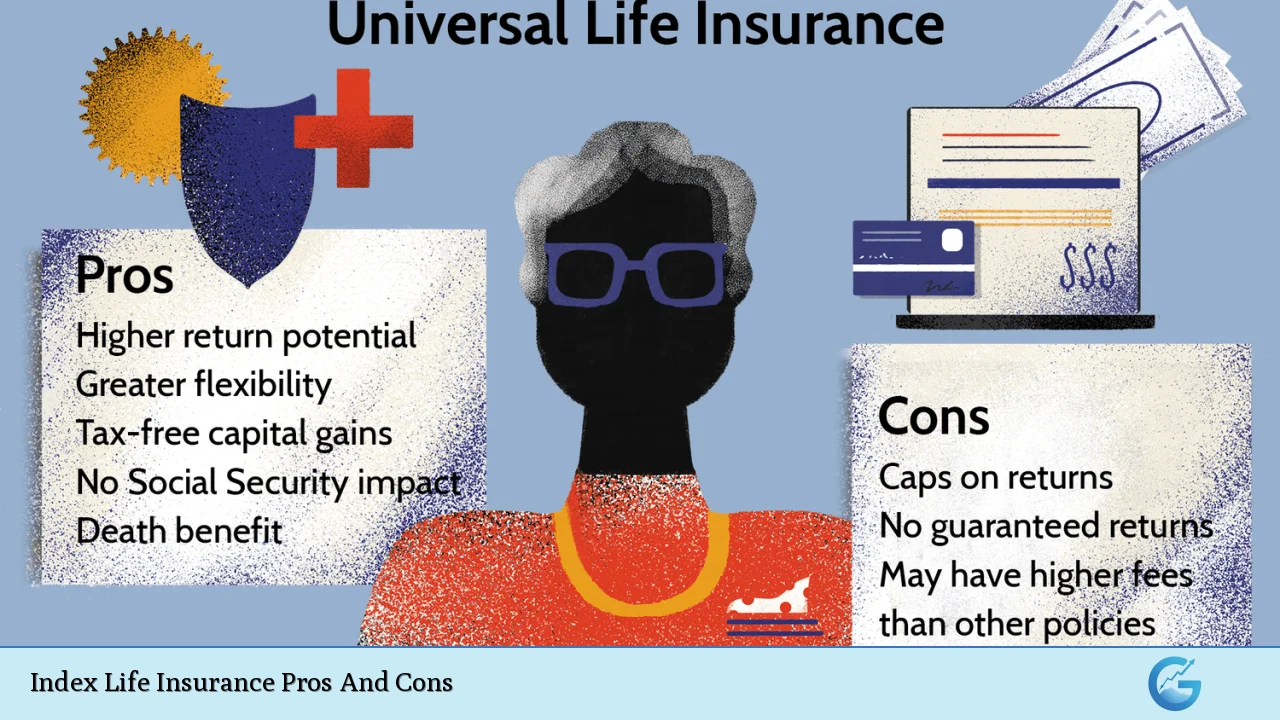

Pros and Cons of Indexed Universal Life Insurance

| Pros | Cons |

|---|---|

| Potential for higher returns linked to market indexes | Caps on returns limit growth potential |

| Flexible premium payments and adjustable death benefits | No guarantees on returns or premiums |

| Tax-deferred growth of cash value | High fees can reduce overall returns |

| Downside protection against market losses | Complex structure can be difficult to understand |

| Access to cash value through loans or withdrawals | Potential for policy lapse if not properly funded |

| No impact on Social Security benefits from withdrawals | Requires active management and monitoring of the policy |

| Can be used as a tax-efficient estate planning tool | May not be suitable for all investors, especially those seeking straightforward investments |

Potential for Higher Returns Linked to Market Indexes

One of the most appealing aspects of Indexed Universal Life insurance is its potential for higher returns compared to traditional whole life or universal life policies. The cash value growth is tied to the performance of a selected market index, such as the S&P 500. This means that when the index performs well, policyholders can benefit from significant cash value increases.

- Market Exposure: IULs provide exposure to stock market gains without directly investing in stocks.

- Crediting Floor: Most policies include a minimum interest rate guarantee, ensuring that even in poor market conditions, the cash value does not decrease.

Caps on Returns Limit Growth Potential

Despite the potential for high returns, IUL policies often come with caps that limit how much growth can occur in a given year.

- Return Limits: If the market index performs exceptionally well, the insurer may impose a cap on the maximum return credited to the policyholder’s account.

- Opportunity Cost: This cap can result in missed opportunities for greater gains during bull markets, as policyholders may not fully capitalize on strong market performance.

Flexible Premium Payments and Adjustable Death Benefits

IUL policies offer significant flexibility in terms of premium payments and death benefits.

- Customizable Payments: Policyholders can adjust their premium payments based on their financial situation, allowing them to pay more during profitable years and less during tighter financial periods.

- Adjustable Benefits: The death benefit can also be adjusted, providing policyholders with options as their financial needs change.

No Guarantees on Returns or Premiums

A significant drawback of IUL insurance is the lack of guarantees regarding returns and premiums.

- Investment Risk: The cash value growth is contingent upon market performance, meaning there are no assurances that it will meet expectations.

- Variable Costs: Premiums may also increase over time as the cost of insurance rises with age, adding another layer of unpredictability to the policyholder’s financial planning.

Tax-Deferred Growth of Cash Value

The cash value accumulated within an IUL policy grows on a tax-deferred basis.

- Tax Advantages: Policyholders do not pay taxes on gains until they withdraw funds, making it an attractive option for those looking to grow their wealth over time.

- Tax-Free Death Benefit: Additionally, beneficiaries receive the death benefit tax-free, which can be advantageous for estate planning.

High Fees Can Reduce Overall Returns

While IUL policies offer numerous benefits, they often come with high fees that can significantly impact overall returns.

- Cost Structure: Fees associated with IUL policies may include administrative fees, cost of insurance charges, and commissions paid to agents.

- Impact on Returns: These costs can erode the cash value growth over time, making it essential for potential buyers to understand all associated fees before committing.

Downside Protection Against Market Losses

One key advantage of IUL policies is their built-in downside protection.

- Loss Floor: Most IULs have a floor that protects against losses in a down market; typically, this floor is set at 0%, meaning policyholders do not lose cash value even if the underlying index performs poorly.

- Risk Mitigation: This feature makes IULs appealing for conservative investors who want some exposure to equity markets without risking their principal.

Complex Structure Can Be Difficult to Understand

The complexity of IUL policies can be a significant disadvantage for many investors.

- Understanding Terms: Terms like “participation rates,” “caps,” and “spreads” can confuse those unfamiliar with financial products.

- Need for Guidance: Potential buyers often require professional advice to navigate these complexities effectively.

Access to Cash Value Through Loans or Withdrawals

Policyholders have the option to access their cash value through loans or withdrawals.

- Financial Flexibility: This feature allows individuals to use their accumulated cash value for emergencies or other financial needs without incurring taxes if structured correctly.

- Impact on Death Benefit: However, it’s important to note that any loans or withdrawals will reduce the death benefit if not repaid.

Potential for Policy Lapse If Not Properly Funded

One risk associated with IUL policies is the potential for lapse if premiums are not adequately funded.

- Funding Requirements: If a policyholder does not maintain sufficient premiums or if cash value decreases significantly due to poor market performance, there’s a risk that the policy could lapse.

- Monitoring Needed: Regular monitoring and management are necessary to ensure that the policy remains in force and meets its intended goals.

No Impact on Social Security Benefits from Withdrawals

Withdrawals from an IUL policy do not affect Social Security benefits, which can be advantageous for retirees.

- Retirement Planning Tool: This feature allows retirees to supplement their income without jeopardizing their Social Security payments.

Requires Active Management and Monitoring of the Policy

Managing an IUL requires ongoing attention from policyholders.

- Active Involvement Needed: Investors must regularly review their policies and make adjustments as necessary based on performance and changing financial needs.

- Professional Assistance Recommended: Many individuals may benefit from working with financial advisors who specialize in life insurance products to ensure optimal management.

Can Be Used as a Tax-Efficient Estate Planning Tool

IULs serve as effective tools for tax-efficient estate planning.

- Wealth Transfer Benefits: The tax-free nature of death benefits makes them an attractive option for transferring wealth to heirs without incurring significant tax liabilities.

In conclusion, Indexed Universal Life insurance offers a blend of life insurance protection and investment potential that appeals to many investors looking for flexible financial solutions. However, it is crucial to weigh its pros and cons carefully before making a commitment. Understanding how these policies work—along with their associated risks and costs—will empower individuals to make informed decisions that align with their long-term financial goals.

Frequently Asked Questions About Index Life Insurance

- What is Indexed Universal Life insurance?

IUL is a type of permanent life insurance that combines a death benefit with a cash value component linked to a stock market index. - What are the main advantages of IUL?

The main advantages include potential higher returns tied to market performance, flexible premiums, tax-deferred growth, and downside protection against losses. - Are there any risks associated with IUL?

Yes, risks include caps on returns limiting growth potential, high fees that can erode returns, and no guarantees on premiums or returns. - How does tax treatment work with IUL?

The cash value grows tax-deferred until withdrawn, and beneficiaries receive death benefits tax-free. - Can you access your cash value in an IUL?

Yes, policyholders can access their cash value through loans or withdrawals; however, this may reduce the death benefit. - Is IUL suitable for everyone?

No, it may not be suitable for all investors; those seeking straightforward investments might prefer other options. - How do fees impact an IUL?

High fees associated with IUL policies can significantly reduce overall returns; understanding these costs is essential before purchasing. - What should you consider before buying an IUL?

You should consider your investment goals, risk tolerance, fee structures, and whether you need professional guidance.