Index Universal Life (IUL) insurance is a complex financial product that combines life insurance coverage with a cash value component linked to stock market index performance. This type of policy has gained popularity among investors seeking both protection and potential growth, but it comes with its own set of advantages and disadvantages that warrant careful consideration.

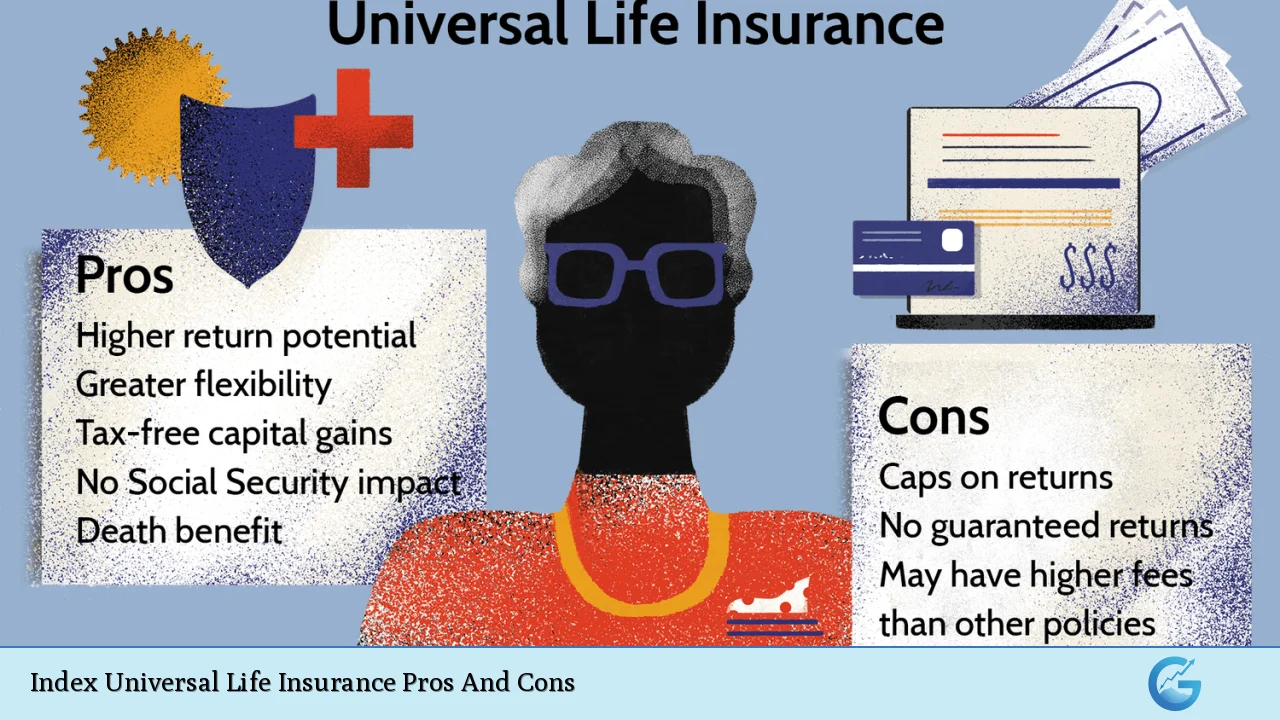

| Pros | Cons |

|---|---|

| Potential for higher returns | Caps on returns |

| Downside protection | Complex structure |

| Tax-deferred growth | High fees and expenses |

| Flexible premiums | No dividends |

| Death benefit | Risk of policy lapse |

| Access to cash value | Potential for reduced death benefit |

| No direct market participation | Lack of transparency |

| Customizable features | Requires active management |

Advantages of Index Universal Life Insurance

Potential for Higher Returns

One of the most attractive features of IUL policies is the potential for higher returns compared to traditional whole life or universal life insurance. The cash value component of an IUL is tied to the performance of a stock market index, such as the S&P 500. This linkage allows policyholders to benefit from market gains without directly investing in stocks.

- Cash value growth can exceed that of traditional life insurance products

- Opportunity to participate in market upswings

- Potential for outpacing inflation over the long term

Downside Protection

While IUL policies offer the opportunity for growth, they also provide a level of protection against market downturns.

Most IUL policies come with a guaranteed minimum interest rate, often set at 0% or 1%.

This feature ensures that even if the linked index performs poorly, the policyholder’s cash value won’t decrease due to market losses.

- Guaranteed floor protects against negative returns

- Preservation of principal in down markets

- Reduced volatility compared to direct stock market investments

Tax-Deferred Growth

IUL policies offer tax advantages similar to other permanent life insurance products. The cash value grows on a tax-deferred basis, meaning policyholders don’t pay taxes on the gains as long as the money remains in the policy. This tax-deferred status can lead to significant compounding benefits over time.

- No annual taxes on cash value growth

- Potential for tax-free loans from the policy

- Tax-free death benefit for beneficiaries

Flexible Premiums

Unlike traditional whole life insurance, IUL policies often offer flexibility in premium payments. Policyholders may have the option to adjust their premium payments within certain limits, allowing for adaptability to changing financial circumstances.

- Ability to increase or decrease premium payments

- Option to use cash value to cover premiums

- Potential for premium holidays during financial hardships

Death Benefit

At its core, an IUL policy provides a death benefit to the policyholder’s beneficiaries. This feature ensures that loved ones receive financial protection in the event of the insured’s death. The death benefit is typically paid out tax-free, providing a significant advantage over other investment vehicles.

- Financial security for beneficiaries

- Tax-free payout to heirs

- Option for increasing death benefit over time

Access to Cash Value

IUL policies allow policyholders to access their cash value through loans or withdrawals. This feature provides a source of liquidity that can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected costs.

- Policy loans often available at competitive interest rates

- Potential for tax-free withdrawals up to the basis

- Flexibility to use cash value for various financial needs

No Direct Market Participation

Unlike variable universal life insurance, IUL policies do not directly invest in the stock market. Instead, the insurance company uses the premium payments to purchase options on the chosen index. This approach eliminates the risk of direct market losses while still providing upside potential.

- Reduced exposure to market volatility

- No need for policyholder to manage investments

- Simplified approach to capturing market gains

Customizable Features

Many IUL policies offer a range of riders and customizable features that allow policyholders to tailor their coverage to their specific needs. These may include long-term care riders, critical illness coverage, or return of premium options.

- Ability to add additional protection features

- Customization to meet individual financial goals

- Potential for comprehensive financial planning solution

Disadvantages of Index Universal Life Insurance

Caps on Returns

While IUL policies offer the potential for higher returns, they also come with caps that limit the upside.

These caps, typically ranging from 8% to 14%, mean that policyholders may not fully benefit from strong market performance.

In years when the linked index significantly outperforms, the policyholder’s returns will be limited to the cap rate.

- Limited participation in strong market years

- Caps may be adjusted downward by the insurer

- Potential for underperformance compared to direct index investing

Complex Structure

IUL policies are inherently complex financial products that can be difficult for the average consumer to fully understand. The combination of insurance coverage, cash value growth, and index-linked performance creates a multifaceted product that requires careful analysis.

- Challenging to compare with other investment options

- Difficulty in projecting long-term performance

- Risk of misunderstanding policy features and limitations

High Fees and Expenses

One of the most significant drawbacks of IUL policies is the high cost structure. These policies typically come with various fees and charges, including mortality and expense charges, administrative fees, and cost of insurance.

These expenses can significantly erode the cash value growth, especially in the early years of the policy.

- Higher premiums compared to term life insurance

- Substantial surrender charges in early years

- Ongoing fees that impact overall returns

No Dividends

Unlike some traditional whole life insurance policies, IUL policies do not pay dividends. This means that policyholders miss out on the potential additional returns that dividend-paying policies can offer.

- Lack of additional income stream from dividends

- Potentially lower overall returns compared to dividend-paying policies

- No opportunity for dividend reinvestment

Risk of Policy Lapse

If the cash value of an IUL policy becomes insufficient to cover the ongoing costs and fees, there is a risk that the policy could lapse. This risk is particularly pronounced if the policyholder reduces or stops premium payments, or if the policy underperforms expectations.

- Potential loss of coverage if cash value is depleted

- Need for ongoing monitoring of policy performance

- Risk of increased premiums to maintain coverage

Potential for Reduced Death Benefit

When policyholders take loans or withdrawals from their IUL policy, it can reduce the death benefit available to beneficiaries. This reduction in coverage may compromise the original purpose of the life insurance policy.

- Loans and withdrawals impact the death benefit

- Potential for inadequate coverage for beneficiaries

- Complexity in balancing cash value access and death benefit preservation

Lack of Transparency

The complex nature of IUL policies often leads to a lack of transparency in how returns are calculated and how various fees impact performance. This opacity can make it challenging for policyholders to fully understand the true cost and potential returns of their policy.

- Difficulty in understanding policy illustrations

- Potential for misrepresentation by sales agents

- Challenges in comparing IUL policies across different insurers

Requires Active Management

To maximize the benefits of an IUL policy, policyholders often need to actively manage their coverage. This may involve adjusting premium payments, monitoring index performance, and making decisions about loans or withdrawals.

The need for ongoing management can be time-consuming and may require professional guidance.

- Regular review of policy performance necessary

- Potential need for professional financial advice

- Risk of suboptimal outcomes without proper management

In conclusion, Index Universal Life Insurance offers a unique combination of life insurance protection and potential for cash value growth linked to market performance. While it provides benefits such as downside protection, tax advantages, and flexibility, it also comes with significant drawbacks including high costs, complexity, and limitations on returns. Potential policyholders should carefully consider their financial goals, risk tolerance, and long-term needs before committing to an IUL policy. Consulting with a qualified financial advisor can help in navigating the complexities of this product and determining if it aligns with one’s overall financial strategy.

Frequently Asked Questions About Index Universal Life Insurance Pros And Cons

- How does an IUL policy differ from a traditional universal life policy?

An IUL policy links cash value growth to a stock market index, while traditional universal life offers a fixed interest rate. IULs have the potential for higher returns but also come with more complexity and risk. - Can I lose money in an IUL policy?

While the indexed portion of an IUL is protected against market losses, high fees and poor performance can erode cash value. There’s also a risk of policy lapse if the cash value becomes insufficient to cover ongoing costs. - Are IUL policies a good alternative to 401(k)s or IRAs?

IULs should not be considered direct alternatives to qualified retirement plans. They offer different benefits and drawbacks, and are generally more expensive. It’s often advisable to max out traditional retirement accounts before considering an IUL. - How are returns calculated in an IUL policy?

Returns are based on the performance of the linked index, subject to caps and participation rates set by the insurer. The specific calculation method can vary between policies and insurers. - What happens if I can’t pay the premiums on my IUL policy?

If premiums are missed, the policy may use the cash value to cover costs. If the cash value is depleted, the policy could lapse. Some policies offer a grace period or flexible premium options to help prevent lapse. - Can I change the death benefit amount in an IUL policy?

Many IUL policies allow for adjustments to the death benefit, either increasing or decreasing it. However, changes may require underwriting and can affect the policy’s costs and cash value growth. - Are there any tax implications when taking loans from an IUL policy?

Policy loans are generally tax-free as long as the policy remains in force. However, if the policy lapses with an outstanding loan, it could result in taxable income. - How do IUL policies perform in a low interest rate environment?

In low interest rate environments, IUL policies may struggle to provide significant returns due to lower cap rates. However, they still offer downside protection compared to direct market investments.