Indexed Universal Life (IUL) insurance is a unique financial product that combines life insurance coverage with an investment component linked to a stock market index. This dual nature allows policyholders to build cash value while providing a death benefit. However, it also comes with complexities and risks that potential investors should understand thoroughly. This article delves into the advantages and disadvantages of IUL policies, providing a comprehensive overview for individuals interested in finance, including those involved in crypto, forex, and money markets.

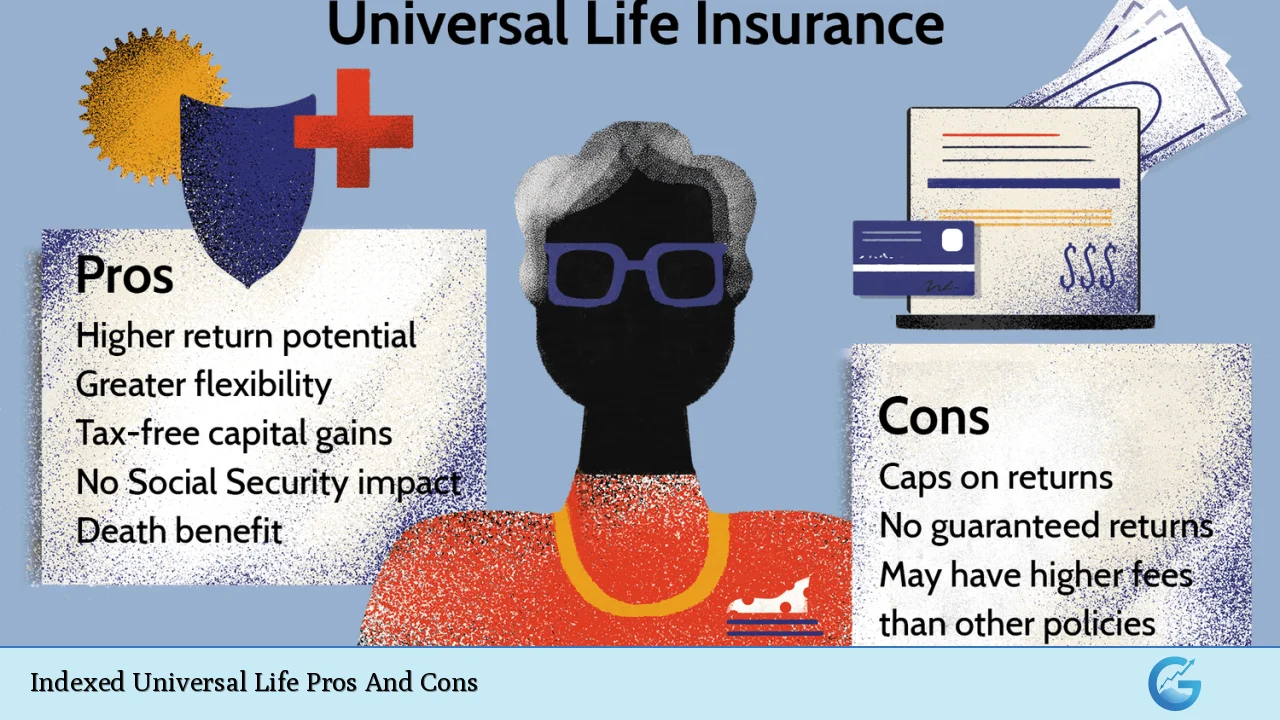

| Pros | Cons |

|---|---|

| Potential for higher returns compared to traditional life insurance policies. | No guaranteed returns; performance is tied to market fluctuations. |

| Flexible premium payments and death benefits. | Complex structure requiring careful management and understanding. |

| Tax-deferred growth of cash value. | Caps on returns limit maximum gains during strong market performance. |

| Downside protection with minimum interest guarantees. | Higher fees compared to other life insurance products can reduce overall returns. |

| Access to cash value through loans or withdrawals. | Loans against cash value can reduce the death benefit if not repaid. |

Potential for Higher Returns

One of the most appealing aspects of Indexed Universal Life insurance is its potential for higher returns on the cash value component compared to traditional whole or universal life insurance policies.

- Market-Linked Growth: IULs are tied to the performance of specific stock market indices, such as the S&P 500. This linkage allows policyholders to benefit from market upswings without directly investing in stocks.

- Crediting Floors: Most IUL policies include a minimum interest rate guarantee, often set at 0% or 1%. This means that even in a poor market year, your cash value will not decrease.

- Participation Rates: Insurance companies typically set participation rates that determine how much of the index’s gain is credited to the cash value. These rates can vary but often range from 50% to 100%, enhancing growth potential.

No Guaranteed Returns

While the potential for higher returns exists, it is crucial to note that these returns are not guaranteed.

- Market Dependency: The performance of an IUL’s cash value is directly tied to market indices. If the index performs poorly, the growth may be minimal or non-existent.

- Risk of Lower Returns: In some cases, especially during prolonged market downturns, the returns on an IUL could be lower than those from fixed-rate life insurance products.

- Investment Risk: Policyholders must accept the risk associated with market fluctuations, which can lead to uncertainty regarding future cash values.

Flexible Premium Payments and Death Benefits

IUL policies offer significant flexibility compared to traditional life insurance options.

- Adjustable Premiums: Policyholders can adjust their premium payments based on their financial situation. This flexibility allows for underpayment or skipped payments without immediate penalties, as long as there is sufficient cash value.

- Customizable Death Benefits: The death benefit can also be adjusted according to changing needs, providing a tailored approach to life insurance coverage.

- Financial Planning Tool: This adaptability makes IULs attractive for individuals with fluctuating incomes or those who anticipate changes in their financial circumstances.

Complex Structure Requiring Careful Management

Despite their advantages, IUL policies come with complexities that require careful consideration and management.

- Understanding Mechanisms: The mechanics behind how cash value grows—such as caps on returns and participation rates—can be intricate. Policyholders need a solid understanding of these elements to make informed decisions.

- Active Monitoring Required: Unlike simpler life insurance products, IULs may require ongoing monitoring and adjustments to ensure optimal performance and alignment with financial goals.

- Professional Guidance Recommended: Given their complexity, consulting with a financial advisor familiar with IULs can help navigate potential pitfalls and maximize benefits.

Tax-Deferred Growth of Cash Value

Another significant advantage of IULs is the tax treatment of their growth.

- Tax-Free Gains: The cash value growth within an IUL is tax-deferred, meaning policyholders do not pay taxes on gains until they withdraw funds.

- Tax-Free Loans: Additionally, policyholders can borrow against their cash value without incurring tax liabilities, provided the policy remains in force.

- Retirement Income Strategy: This feature makes IULs an attractive option for individuals looking for tax-efficient ways to accumulate wealth for retirement or other financial goals.

Caps on Returns Limit Maximum Gains

While IULs offer potential for high returns, they also impose limitations that can restrict overall growth.

- Return Caps: Most IUL policies have caps on the maximum amount of interest that can be credited based on index performance. These caps typically range from 8% to 12%.

- Impact During Bull Markets: In strong bull markets where indices perform exceptionally well, policyholders may miss out on significant gains due to these caps, leading to frustration among investors expecting higher returns.

Higher Fees Compared to Other Life Insurance Products

IUL policies often come with higher fees than traditional life insurance options, which can impact overall profitability.

- Cost Structure Complexity: The fees associated with managing an IUL policy can include cost-of-insurance charges, administrative fees, and surrender charges if the policy is canceled early.

- Effect on Cash Value Growth: These costs can eat into the cash value accumulation, potentially resulting in lower net gains over time compared to simpler products like whole life insurance.

Access to Cash Value Through Loans or Withdrawals

IUL policies provide access to accumulated cash value through loans or withdrawals, offering financial flexibility.

- Loan Options: Policyholders can take out loans against their cash value without tax implications. However, any unpaid loans will reduce the death benefit upon passing away.

- Withdrawal Flexibility: Withdrawals from the cash value are also possible but may incur fees or affect the policy’s status if not managed carefully.

Loans Against Cash Value Can Reduce Death Benefit

While accessing cash value provides flexibility, it also carries risks that must be understood by policyholders.

- Impact on Beneficiaries: If loans are not repaid before death, they will subtract from the total death benefit paid out to beneficiaries. This could leave loved ones with less financial support than anticipated.

- Potential Policy Lapse: Excessive borrowing could lead to insufficient cash value needed to cover premiums, risking policy lapse and loss of coverage altogether if not monitored closely.

In conclusion, Indexed Universal Life insurance presents both compelling advantages and notable drawbacks. It offers potential for higher returns linked to market performance while providing flexible premiums and tax-deferred growth. However, these benefits come with complexities that require careful management and understanding of associated risks. Individuals considering an IUL should weigh these factors against their personal financial goals and consult with knowledgeable advisors when necessary.

Frequently Asked Questions About Indexed Universal Life Pros And Cons

- What is Indexed Universal Life (IUL) insurance?

IUL insurance is a type of permanent life insurance that combines a death benefit with a cash value component linked to stock market indices. - What are the main advantages of an IUL?

The main advantages include potential for higher returns than traditional policies, flexible premiums and death benefits, tax-deferred growth of cash value, and downside protection through minimum interest guarantees. - What are some disadvantages of IUL insurance?

Disadvantages include no guaranteed returns tied to market performance, complex structures requiring active management, capped returns limiting maximum gains during strong markets, and higher fees compared to other life insurance products. - Can you access cash value in an IUL?

Yes, policyholders can access accumulated cash value through loans or withdrawals; however, unpaid loans will reduce the death benefit. - How does taxation work with an IUL?

The growth in cash value is tax-deferred until withdrawn; loans taken against the cash value are typically tax-free as long as the policy remains active. - What happens if you stop paying premiums on an IUL?

If premiums are not paid sufficiently over time and there isn’t enough cash value available to cover costs, the policy may lapse. - Is an IUL suitable for retirement planning?

An IUL can be part of a retirement strategy due to its tax-free income potential; however, it should not be relied upon as the sole retirement plan. - How do participation rates affect my investment in an IUL?

The participation rate determines how much of the index’s gain is credited towards your cash value; lower participation rates mean less growth potential during strong market conditions.