Certificates of Deposit (CDs) are financial products offered by banks and credit unions that allow individuals to deposit money for a fixed term at a fixed interest rate. They are often seen as a safe investment option, appealing to conservative investors who prioritize security over high returns. However, like any financial instrument, investing in CDs comes with its own set of advantages and disadvantages. This article will explore the pros and cons of investing in CDs, providing a comprehensive overview for individuals interested in finance, cryptocurrency, forex, and money markets.

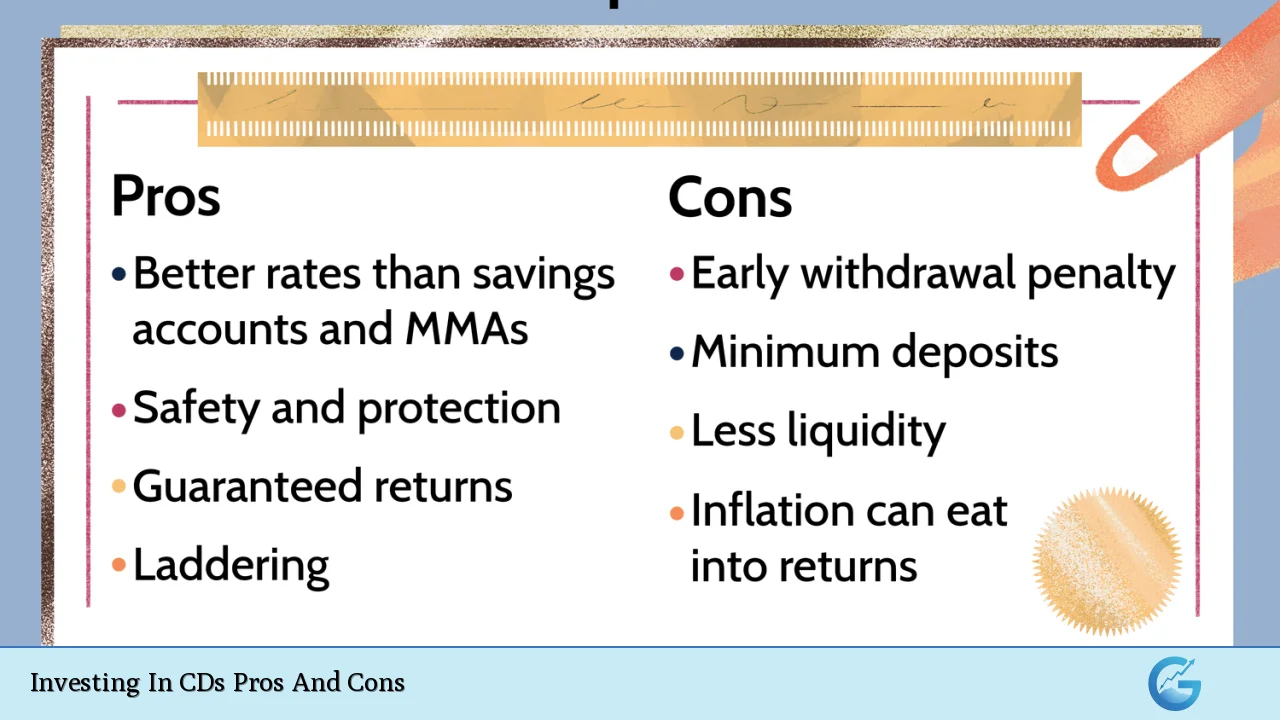

| Pros | Cons |

|---|---|

| Safety and Security | Less Liquidity |

| Higher Interest Rates than Savings Accounts | Inflation Risk |

| Predictable Returns | Opportunity Cost |

| FDIC Insurance Protection | Early Withdrawal Penalties |

| Diversification Options with CD Ladders | Limited Growth Potential |

| No Management Required | Tax Implications on Interest Earned |

| Flexible Terms Available | Reinvestment Risk at Maturity |

Safety and Security

One of the primary advantages of investing in CDs is their safety and security.

- Guaranteed principal: Your initial investment is protected, making it an ideal choice for risk-averse investors.

- Fixed interest rate: The interest rate remains constant throughout the term, allowing for predictable earnings.

- FDIC insurance: In the United States, CDs offered by federally insured banks are protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, providing an added layer of security.

Less Liquidity

While CDs offer safety, they come with a significant drawback regarding liquidity.

- Access to funds: Once your money is deposited into a CD, it is generally locked until maturity. This can be problematic if unexpected expenses arise.

- Early withdrawal penalties: If you need to access your funds before the maturity date, you may incur penalties that can diminish your returns.

Higher Interest Rates than Savings Accounts

CDs typically offer higher interest rates compared to traditional savings accounts.

- Competitive rates: Many banks provide attractive rates on CDs to encourage deposits, particularly during times of rising interest rates.

- Fixed returns: Unlike savings accounts where rates can fluctuate, CDs guarantee a fixed return over the investment period.

Inflation Risk

One of the significant disadvantages of CDs is their susceptibility to inflation.

- Erosion of purchasing power: If inflation rates exceed the interest earned on your CD, your real return could be negative. For example, if you earn 2% on a CD but inflation is 3%, your purchasing power decreases.

- Long-term impact: Over extended periods, this risk can significantly affect the value of your investments.

Predictable Returns

CDs provide predictable returns that can aid in financial planning.

- Steady income stream: Investors know exactly how much they will earn by the end of the term without worrying about market volatility.

- Budgeting benefits: This predictability makes it easier for individuals to plan their finances around expected income from their investments.

Opportunity Cost

Investing in CDs may lead to missed opportunities elsewhere.

- Lower potential returns: While CDs are safe, they generally offer lower returns than stocks or mutual funds. This can be a disadvantage during bull markets when equities outperform fixed-income investments.

- Tied-up capital: Money invested in CDs cannot be easily redirected towards potentially higher-yielding investments without incurring penalties.

FDIC Insurance Protection

The FDIC insurance on CDs provides peace of mind for investors.

- Risk mitigation: Knowing that your investment is insured up to certain limits reduces anxiety about bank failures or economic downturns.

- Trust in institutions: This insurance encourages individuals to invest with confidence in traditional banking institutions.

Early Withdrawal Penalties

A significant con associated with CDs is the penalties for early withdrawal.

- Loss of interest: Withdrawing funds before maturity typically results in losing some or all accrued interest, which can negate any benefits gained from investing in a CD.

- Potential principal loss: In some cases, particularly with brokered CDs, you might even lose part of your principal if you withdraw early under unfavorable market conditions.

Diversification Options with CD Ladders

Investors can enhance their liquidity while still benefiting from higher rates through CD ladders.

- Staggered maturity dates: By investing in multiple CDs with varying terms (e.g., 6 months, 1 year, 2 years), investors can access portions of their funds at regular intervals while still earning competitive interest rates on longer-term deposits.

- Flexibility and growth potential: This strategy allows for better cash flow management while maintaining exposure to higher yields over time.

Limited Growth Potential

CDs are not designed for aggressive growth strategies.

- Cap on returns: The fixed nature of CDs means that they will not capitalize on market gains like stocks or other investments might during bullish periods.

- Long-term wealth building limitations: For those seeking significant wealth accumulation over time, relying solely on CDs may not be sufficient.

No Management Required

CDs are often considered “set it and forget it” investments due to their simplicity.

- Minimal effort needed: Once you have chosen your CD and made your deposit, there’s no need for ongoing management or monitoring.

- Ideal for busy investors: This makes them an excellent option for those who prefer low-maintenance investments without the need for constant attention or adjustment based on market conditions.

Tax Implications on Interest Earned

Interest earned on CDs is subject to taxation, which can impact overall returns.

- Taxable income: The interest accrued must be reported as income during tax season, potentially affecting your tax bracket and overall tax liability.

- Planning necessary: Investors should consider these implications when deciding how much money to allocate toward CDs versus other investment vehicles that might offer tax advantages (e.g., retirement accounts).

Flexible Terms Available

CDs come with various terms and conditions tailored to different investor needs.

- Short-term and long-term options: Investors can choose from terms ranging from a few months to several years based on their financial goals and liquidity needs.

- Customizable strategies: This flexibility allows investors to align their investments with personal timelines and financial objectives effectively.

In conclusion, investing in Certificates of Deposit presents both opportunities and challenges. While they offer safety, predictable returns, and higher interest rates compared to traditional savings accounts, they also come with limitations such as less liquidity and potential inflation risks. Understanding these pros and cons allows investors to make informed decisions that align with their financial goals and risk tolerance. As always, it’s crucial to assess individual circumstances before committing funds to any investment vehicle.

Frequently Asked Questions About Investing In CDs Pros And Cons

- What are the main benefits of investing in CDs?

The main benefits include safety due to FDIC insurance, predictable returns at fixed interest rates, and higher yields compared to traditional savings accounts. - What risks should I consider before investing in a CD?

The primary risks include inflation eroding purchasing power, early withdrawal penalties if funds are needed before maturity, and opportunity costs associated with locking up capital. - Can I access my money easily if I invest in a CD?

No, accessing funds before maturity typically incurs penalties; therefore, it’s essential only to invest money that you won’t need immediately. - How does inflation affect my CD investment?

If inflation exceeds your CD’s interest rate during its term, the real value of your returns could decline over time. - What is a CD ladder strategy?

A CD ladder involves purchasing multiple CDs with staggered maturity dates so that some funds become available periodically while still earning higher interest rates. - Are there any tax implications for earning interest on a CD?

Yes, interest earned on CDs is considered taxable income and must be reported when filing taxes. - What happens when my CD matures?

You will receive your principal back along with any accrued interest; you may also have options to renew or withdraw funds. - Is investing in CDs suitable for everyone?

No; while they are suitable for conservative investors seeking safety and predictability, those looking for high growth potential may find better options elsewhere.