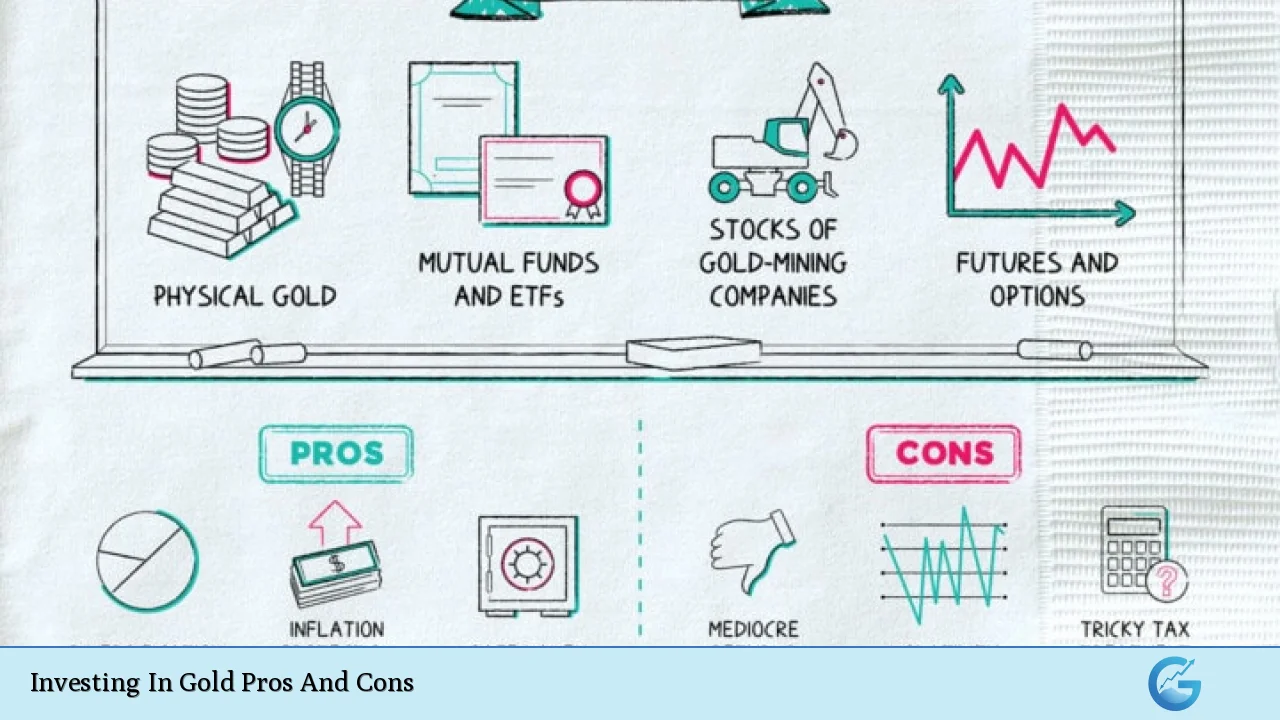

Investing in gold has long been a popular choice for individuals looking to diversify their portfolios and hedge against economic uncertainties. As a tangible asset, gold offers unique benefits that can enhance financial security. However, like any investment, it comes with its own set of risks and disadvantages. This article explores the advantages and disadvantages of investing in gold, providing a comprehensive overview for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Hedge against inflation | Does not generate income |

| Safe haven during economic uncertainty | Storage and insurance costs |

| Portfolio diversification | Price volatility |

| Limited supply increases value over time | Opportunity cost compared to other investments |

| Tangible asset with intrinsic value | Market manipulation risks |

| Tax advantages in certain jurisdictions | Complexity of investment options (ETFs, futures) |

| Historical stability as a store of value | Poor performance during certain market conditions |

| Global demand supports price stability | Lack of liquidity in physical gold markets |

Hedge Against Inflation

Gold is often viewed as a reliable hedge against inflation. When inflation rises, the purchasing power of currency declines, making gold an attractive alternative. Investors turn to gold during inflationary periods to preserve their wealth.

- Gold tends to retain its value over time.

- Historically, gold prices have risen alongside inflation rates.

- It can provide stability in purchasing power when fiat currencies weaken.

Safe Haven During Economic Uncertainty

During times of economic turmoil or geopolitical instability, gold is considered a safe haven asset. Investors flock to gold as a means of protecting their wealth from market fluctuations.

- Gold prices typically rise when stock markets decline.

- It serves as a psychological comfort during crises.

- Central banks often increase their gold reserves during uncertain times.

Portfolio Diversification

Adding gold to an investment portfolio can enhance diversification. Gold has a low correlation with other asset classes like stocks and bonds, which can help mitigate overall portfolio risk.

- It can reduce the volatility of an investment portfolio.

- Gold can act as an insurance policy against market downturns.

- A well-diversified portfolio may include 5-10% allocated to gold.

Limited Supply Increases Value Over Time

Gold is a finite resource; its limited supply contributes to its value. As demand increases and mining becomes more challenging, the scarcity of gold can drive prices higher.

- The difficulty of extracting new gold contributes to its long-term value.

- Increased demand from central banks and investors can push prices upward.

- Historical trends show that gold prices tend to appreciate over time.

Tangible Asset with Intrinsic Value

Unlike stocks or bonds, gold is a tangible asset that holds intrinsic value. This physical quality makes it appealing to many investors who prefer owning something concrete.

- Gold can be held in various forms such as coins, bars, or jewelry.

- Its aesthetic appeal adds another layer of value.

- Physical ownership provides a sense of security for some investors.

Tax Advantages in Certain Jurisdictions

In some regions, investing in gold can offer tax benefits. For example, capital gains taxes on gold may be lower than those on other investments.

- Certain retirement accounts allow for tax-deferred growth on gold investments.

- Tax policies vary by country and should be considered when investing.

- Understanding local regulations can enhance investment strategies.

Historical Stability as a Store of Value

Gold has been used as a form of currency and a store of value for thousands of years. Its historical significance adds to its credibility as an investment.

- Gold has maintained its purchasing power over centuries.

- It is often seen as a safeguard against currency devaluation.

- Historical data supports its role as a stable investment during crises.

Global Demand Supports Price Stability

The global demand for gold is driven by various factors including jewelry production, industrial applications, and investment purposes. This widespread demand helps stabilize prices.

- Countries like India and China have significant cultural ties to gold.

- Central banks worldwide continue to purchase gold for reserves.

- Increased global interest supports long-term price stability.

Does Not Generate Income

One significant disadvantage of investing in physical gold is that it does not generate any income or dividends. Unlike stocks or bonds that provide regular returns, holding gold means missing out on potential earnings from other investments.

- Investors must rely solely on price appreciation for returns.

- This lack of income can be detrimental during periods of low price growth.

- Opportunity costs arise when funds could have been invested elsewhere for returns.

Storage and Insurance Costs

Owning physical gold comes with additional costs related to storage and insurance. Safeguarding assets requires secure storage solutions which can add up over time.

- Safe deposit boxes or specialized vaults incur fees.

- Insurance policies are necessary to protect against theft or loss.

- These costs can erode overall returns on investment.

Price Volatility

While gold is generally considered stable, it is not immune to price volatility. Various factors such as market sentiment and geopolitical events can lead to significant price fluctuations.

- Short-term price swings can be unpredictable.

- Investors should be prepared for potential downturns in value.

- Timing the market for optimal entry points can be challenging.

Opportunity Cost Compared to Other Investments

Investing in gold may lead to opportunity costs if other asset classes outperform it over time. While it serves as a hedge against inflation, there are periods when stocks or real estate may yield higher returns.

- Investors may miss out on lucrative opportunities elsewhere.

- Historical performance data shows varying returns across different asset classes.

- A balanced approach considers the potential trade-offs involved.

Market Manipulation Risks

The gold market is susceptible to manipulation by large players or institutions. This risk can affect pricing and market stability, leading to potential losses for individual investors.

- Awareness of market dynamics is crucial for investors.

- Regulatory oversight varies by country and may not always protect investors.

- Understanding the risks associated with market manipulation is essential for informed decision-making.

Complexity of Investment Options (ETFs, Futures)

Investing in gold involves various options such as ETFs (Exchange-Traded Funds), futures contracts, or mining stocks. Each option comes with its own complexities and risks that investors must navigate carefully.

- ETFs offer liquidity but may lack the tangible benefits of physical gold.

- Futures trading requires knowledge of derivatives markets and carries higher risks.

- Selecting the right investment vehicle depends on individual goals and risk tolerance.

Poor Performance During Certain Market Conditions

There are times when gold underperforms compared to other investments. For example, during strong bull markets in equities, gold may lag behind in returns.

- Investors should assess market conditions before allocating funds to gold.

- Historical data indicates periods where equities outperform precious metals significantly.

- Timing the entry into the gold market is crucial for maximizing returns.

Lack of Liquidity in Physical Gold Markets

While trading paper assets like ETFs offers liquidity, physical gold can be less liquid. Selling physical assets often requires finding buyers willing to pay fair prices.

- The resale process for physical gold can be cumbersome compared to securities.

- Market conditions may affect how quickly one can liquidate assets.

- Understanding local markets is essential for effective selling strategies.

In conclusion, investing in gold presents both advantages and disadvantages that must be carefully weighed by potential investors. While it offers unique benefits such as serving as a hedge against inflation and providing portfolio diversification, it also comes with challenges like lack of income generation and storage costs.

As with any investment decision, it’s crucial for individuals to conduct thorough research and consider their financial goals before incorporating gold into their portfolios. A balanced approach that includes an understanding of both the strengths and weaknesses associated with investing in gold will help investors make informed decisions that align with their overall financial strategies.

Frequently Asked Questions About Investing In Gold Pros And Cons

- Is investing in physical gold worth it?

Investing in physical gold can provide security during economic downturns but lacks income generation compared to other assets. - How does inflation affect the value of gold?

Gold typically retains its value during inflationary periods as it serves as a hedge against declining purchasing power. - What are the best ways to invest in gold?

The best ways include purchasing physical bullion, investing in ETFs, or buying shares in mining companies. - Are there tax implications when investing in gold?

Yes, tax implications vary by jurisdiction; some regions offer favorable capital gains treatment for precious metals. - What are the risks associated with investing in gold?

The main risks include price volatility, storage costs, lack of income generation, and potential market manipulation. - Can I lose money investing in gold?

Yes, like any investment, there is potential for loss if market conditions change unfavorably. - How much should I invest in gold?

A common recommendation is 5–10% of your overall portfolio should be allocated to precious metals like gold. - Is it better to invest in physical gold or ETFs?

This depends on individual preferences; physical gold offers tangibility while ETFs provide liquidity without storage concerns.