Investing in land can be an appealing option for many investors looking to diversify their portfolios and secure tangible assets. Unlike stocks or bonds, land is a physical asset that can appreciate over time and offer various uses, from agricultural endeavors to commercial development. However, like any investment, it comes with its own set of advantages and disadvantages. This article explores the pros and cons of investing in land, providing a comprehensive overview for potential investors.

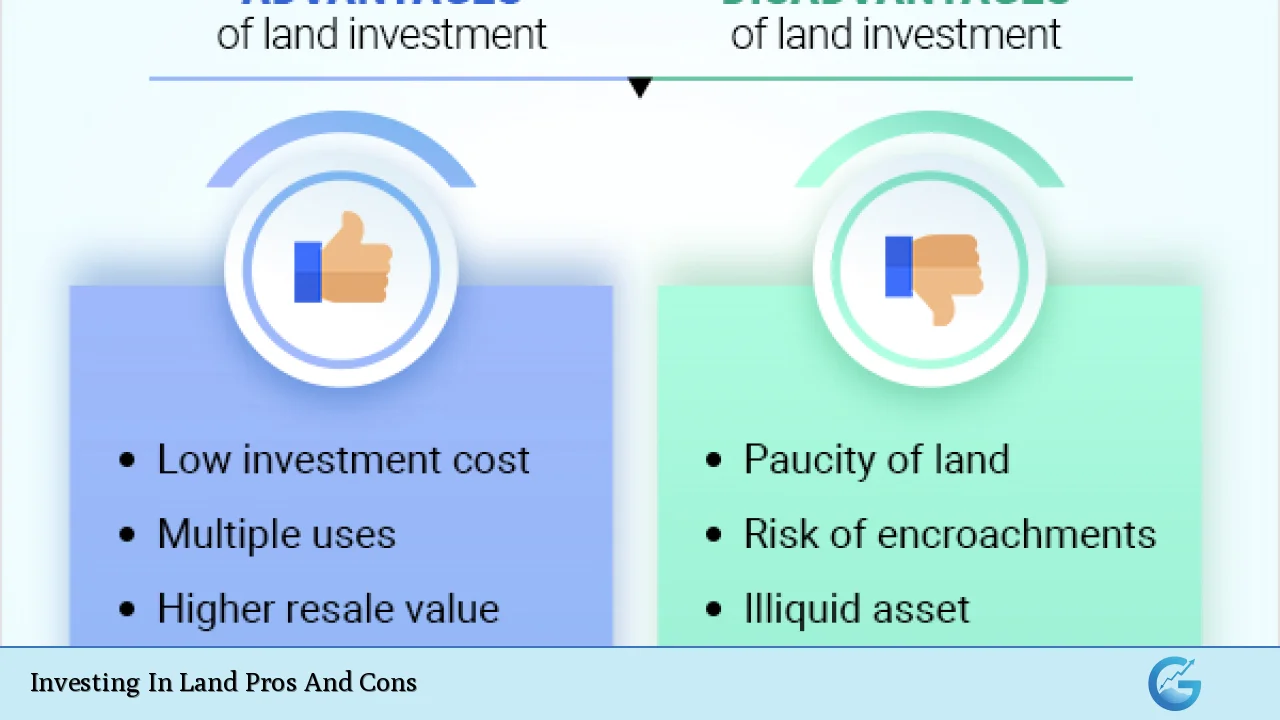

| Pros | Cons |

|---|---|

| Scarcity and Long-Term Appreciation | Illiquidity |

| Tangibility and Security | High Upfront Costs |

| Versatility of Use | Zoning and Regulatory Risks |

| Lower Maintenance Costs | Market Volatility |

| Potential Income Generation | Opportunity Cost |

| Tax Benefits | Speculative Nature |

| Diversification of Portfolio | Lack of Immediate Cash Flow |

| Control and Flexibility over the Asset | Environmental Risks and Liabilities |

Scarcity and Long-Term Appreciation

One of the most compelling reasons to invest in land is its inherent scarcity. As the population grows and urban areas expand, the availability of undeveloped land decreases. This scarcity can lead to significant long-term appreciation in value.

- Limited Supply: Unlike other assets, such as stocks or bonds, land cannot be manufactured. The finite nature of land means that as demand increases, so does its potential value.

- Historical Trends: Historically, land values have appreciated over time, making it a reliable long-term investment.

Illiquidity

While land can appreciate significantly, it is also one of the more illiquid investments available. Selling land can take considerable time and effort.

- Time-Consuming Sales Process: Unlike stocks that can be sold quickly on the market, selling land often requires finding the right buyer and may involve lengthy negotiations.

- Market Conditions: In a slow market, selling land can become even more challenging, potentially forcing sellers to accept lower prices.

Tangibility and Security

Land is a tangible asset that offers a sense of security not found in many other investments.

- Physical Asset: Investors can physically visit and utilize their land, which provides a level of comfort compared to intangible assets like stocks or cryptocurrencies.

- Stability: Land generally retains value better than other asset classes during economic downturns.

High Upfront Costs

Investing in land often requires significant initial capital outlay.

- Purchase Price: The cost of acquiring land can be substantial, especially in desirable locations.

- Additional Expenses: Beyond the purchase price, investors may face costs related to surveys, title insurance, property taxes, and legal fees.

Versatility of Use

Land offers various potential uses that can adapt to changing market demands.

- Development Opportunities: Depending on zoning laws, investors can develop land for residential, commercial, agricultural, or recreational purposes.

- Future Potential: Land can be held for future development or sold to developers at a premium once it appreciates in value.

Zoning and Regulatory Risks

The versatility of land is accompanied by risks related to zoning laws and regulations.

- Changing Regulations: Local governments may change zoning laws that affect how the land can be used, potentially diminishing its value or utility.

- Compliance Costs: Investors may incur costs related to obtaining permits or complying with new regulations if they wish to develop the land.

Lower Maintenance Costs

Compared to developed properties, raw land typically incurs lower maintenance costs.

- Minimal Upkeep: Land does not require ongoing repairs or tenant management like residential or commercial properties do.

- Cost Efficiency: This makes it a more cost-effective option for long-term investment compared to properties that require constant attention.

Market Volatility

Land investments are subject to market fluctuations that can impact their value significantly.

- Economic Factors: Changes in economic conditions can lead to swings in demand for land, affecting prices unpredictably.

- Local Market Dynamics: Factors such as population growth or decline in specific areas can also influence property values dramatically.

Potential Income Generation

Investing in land can provide opportunities for income generation through various avenues.

- Leasing Options: Agricultural lands can be leased to farmers or developed into commercial properties that generate rental income.

- Diversified Income Streams: Investors may also consider developing recreational facilities or leasing for events as additional income sources.

Opportunity Cost

The capital tied up in land investment could potentially yield higher returns elsewhere.

- Alternative Investments: Investors should consider what returns they might achieve by investing their capital in stocks or other assets instead of land.

- Long-Term Commitment: Land investments often require a long-term commitment before realizing significant returns.

Tax Benefits

Owning land may provide various tax advantages depending on jurisdictional regulations.

- Deductions Available: Investors might benefit from deductions related to property taxes or depreciation on improvements made to the property.

- Tax Strategies: Utilizing tax benefits effectively can enhance overall returns on investment over time.

Speculative Nature

Investing in raw land often carries speculative risks that investors must consider carefully.

- Uncertain Returns: While historically appreciating, there is no guarantee that a particular parcel of land will increase in value as expected due to market dynamics or economic shifts.

- Investment Horizon: Investors should be prepared for potential long holding periods without guaranteed returns on investment.

Lack of Immediate Cash Flow

Unlike rental properties that generate regular income, raw land typically does not provide immediate cash flow.

- Ongoing Costs Without Income: Property taxes and maintenance costs must still be paid even if the land does not generate income immediately.

- Financial Planning Required: Investors need to plan their finances carefully to cover these costs while waiting for appreciation or development opportunities.

Control and Flexibility Over the Asset

Owning land gives investors control over how they choose to use their asset compared to other investments where they have limited influence over management decisions.

- Decision-Making Power: Investors can decide whether to develop the property themselves or hold it for future appreciation based on market conditions.

- Adaptability: This flexibility allows investors to pivot strategies based on changing economic landscapes or personal financial goals.

Environmental Risks and Liabilities

Investors must also consider potential environmental risks associated with owning land.

- Natural Disasters: Land is susceptible to environmental issues such as flooding or wildfires which could impact its value significantly.

- Liability Concerns: If someone gets injured on your property, you could face legal liabilities unless proper insurance coverage is maintained.

Investing in land presents both opportunities and challenges for prospective investors. Understanding these pros and cons allows individuals to make informed decisions about whether this asset class aligns with their financial goals and risk tolerance.

Frequently Asked Questions About Investing In Land Pros And Cons

- What are the main benefits of investing in land?

The primary benefits include long-term appreciation potential, lower maintenance costs compared to properties, diversification opportunities within an investment portfolio, and tax advantages. - Is investing in raw land risky?

Yes, investing in raw land carries risks such as illiquidity, market volatility, regulatory changes affecting zoning laws, and speculative nature regarding future value increases. - How does liquidity affect my ability to sell land?

Land is generally illiquid; selling it quickly often requires lowering the price significantly due to limited buyer interest compared to more liquid assets like stocks. - Can I generate income from my investment in raw land?

Yes, you can generate income by leasing agricultural lands or developing commercial properties; however, this often requires upfront investment for development. - What should I consider before purchasing land?

You should evaluate location factors, zoning regulations, potential development plans, ongoing costs like taxes and insurance, as well as your financial goals. - Are there tax benefits associated with owning land?

Yes, owning land may offer tax deductions related to property taxes and depreciation; consult with a tax professional for specific advice. - How do market conditions impact my investment?

The demand for land fluctuates based on economic conditions; understanding local market dynamics helps assess when to buy or sell. - What are common pitfalls when investing in land?

Common pitfalls include failing to conduct thorough due diligence on zoning laws and environmental risks as well as underestimating ongoing holding costs.

In summary, while investing in land offers numerous advantages such as appreciation potential and lower maintenance requirements, it also presents significant challenges including illiquidity and regulatory risks. Careful consideration of these factors will help investors navigate this unique asset class effectively.