Investment annuities are financial products that provide a way to accumulate funds for retirement while offering various income options during retirement. They are often marketed as a solution for individuals seeking stable income streams and protection against market volatility. However, like any investment vehicle, annuities come with their own set of advantages and disadvantages that potential investors must carefully consider.

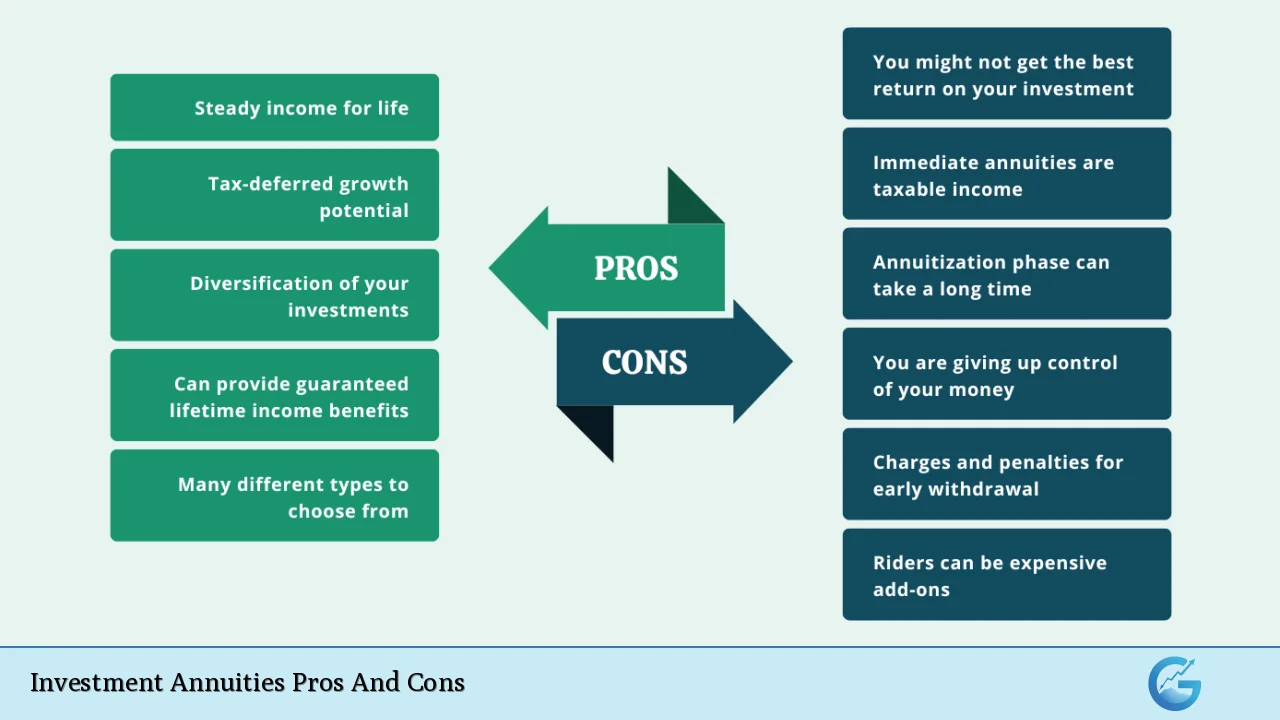

| Pros | Cons |

|---|---|

| Guaranteed income for life | Limited access to your money |

| Tax-deferred growth | High fees and commissions |

| Protection from market volatility | Complexity and lack of transparency |

| Diverse investment options available | Potential for lower returns compared to other investments |

| Death benefits for beneficiaries | Irreversibility of contracts |

| Inflation protection options | Possible insurer default risk |

Guaranteed Income for Life

One of the most significant advantages of annuities is the ability to provide a guaranteed income stream for life. This feature is particularly appealing for retirees who are concerned about outliving their savings.

- Steady Payments: Annuities can offer regular payments that can last as long as the annuitant lives, providing financial security in retirement.

- Longevity Risk Mitigation: By converting a lump sum into a predictable income, annuities help mitigate the risk of longevity, ensuring that retirees do not exhaust their savings.

Tax-Deferred Growth

Another compelling benefit of annuities is their tax-deferred growth potential.

- No Annual Taxes: Investors do not pay taxes on the earnings until they withdraw funds, allowing the investment to grow more quickly than it would in a taxable account.

- Flexible Contributions: Unlike traditional retirement accounts, there are no annual contribution limits on non-qualified annuities, allowing for greater flexibility in saving.

Protection from Market Volatility

Annuities can provide a level of protection from market downturns, which is especially beneficial during volatile economic periods.

- Fixed Annuities: These products guarantee a minimum interest rate, ensuring that the principal remains intact regardless of market conditions.

- Indexed Annuities: These can offer returns linked to a stock market index but with built-in protections against losses, allowing investors to benefit from market gains without risking their principal.

Diverse Investment Options Available

Annuities come in various forms, allowing investors to choose products that align with their financial goals and risk tolerance.

- Variable Annuities: These allow for investment in various subaccounts similar to mutual funds, potentially leading to higher returns.

- Fixed and Indexed Annuities: Offer more conservative options with guaranteed returns or limited exposure to market performance.

Death Benefits for Beneficiaries

Many annuities include death benefits, which can provide financial support to beneficiaries after the annuitant’s death.

- Beneficiary Protection: The death benefit ensures that the investment does not simply disappear upon death and can provide heirs with a financial legacy.

- Peace of Mind: Knowing that loved ones will receive financial support can be an important consideration for many investors.

Inflation Protection Options

Some annuities offer inflation protection features that help maintain purchasing power over time.

- Escalating Payments: Certain contracts may increase payouts over time to keep pace with inflation, providing additional security against rising living costs.

- Cost-of-Living Adjustments (COLAs): These adjustments can help ensure that income remains sufficient throughout retirement.

Limited Access to Your Money

Despite their benefits, one major drawback of annuities is the limited access to funds once invested.

- Surrender Charges: Many contracts impose penalties for early withdrawals during a specified surrender period, which can last several years.

- Liquidity Issues: Once you start receiving payments, accessing additional funds may be restricted or incur significant fees.

High Fees and Commissions

Annuities often come with high fees that can diminish overall returns.

- Management Fees: Variable annuities typically charge annual fees ranging from 1% to 2%, which can significantly impact long-term growth.

- Sales Commissions: Agents may earn substantial commissions on the sale of annuities, leading to conflicts of interest and higher costs for consumers.

Complexity and Lack of Transparency

The structure and terms of annuities can be complex and difficult to understand.

- Difficult Terms: Many investors find it challenging to navigate the various types of annuities and their associated features.

- Potential Misunderstandings: Lack of clarity regarding fees, penalties, and payout structures can lead to poor investment decisions.

Potential for Lower Returns Compared to Other Investments

Annuities may not always provide competitive returns when compared to traditional investments such as stocks or mutual funds.

- Capped Gains on Indexed Annuities: While these products offer some protection against losses, they often cap potential gains at a certain percentage.

- Fixed Annuity Returns: Typically lower than what might be achieved through riskier investments, limiting overall growth potential.

Irreversibility of Contracts

Once an investor commits to an annuity contract, reversing that decision is usually not an option.

- Long-Term Commitment: Investors must be prepared for a long-term commitment as changing or exiting an annuity can incur significant penalties.

- Limited Flexibility: The inability to adjust terms or withdraw funds without penalty can be frustrating for investors who experience changing financial circumstances.

Possible Insurer Default Risk

Investing in an annuity carries the risk that the issuing insurance company may default on its obligations.

- Financial Stability Concerns: If an insurer faces financial difficulties or bankruptcy, policyholders may lose their invested capital or face reduced payouts.

- State Protections: While many states offer some level of protection through guaranty associations, these limits may not cover all losses in case of insurer failure.

In conclusion, investment annuities present both compelling advantages and notable disadvantages. They can offer guaranteed income, tax-deferred growth, and protection from market volatility. However, investors must also consider issues such as limited liquidity, high fees, complexity, and potential lower returns.

Before deciding whether an annuity is suitable for your financial strategy—especially in the context of broader investments in finance markets like crypto or forex—it’s wise to consult with a qualified financial advisor who can help navigate these complexities based on individual financial goals and circumstances.

Frequently Asked Questions About Investment Annuities Pros And Cons

- What are the main advantages of investing in an annuity?

The main advantages include guaranteed income for life, tax-deferred growth, protection from market volatility, diverse investment options, death benefits for beneficiaries, and inflation protection. - What are some common disadvantages associated with annuities?

Common disadvantages include limited access to funds due to surrender charges, high fees and commissions that reduce overall returns, complexity in understanding terms and conditions, potential lower returns compared to other investments, irreversibility once purchased, and risks related to insurer defaults. - How do taxes work with investment annuities?

Annuity earnings grow tax-deferred until withdrawal; at that point, they are taxed as ordinary income. This tax treatment differs from other investment accounts where capital gains taxes may apply. - Can I withdraw money from my annuity at any time?

No; most annuities have surrender periods during which withdrawals incur penalties. After this period ends, you may withdraw funds but could still face tax implications. - Are there different types of annuities?

Yes; common types include fixed annuities (guaranteed returns), variable annuities (returns tied to market performance), indexed annuities (linked to stock indices), and immediate vs. deferred payment options. - What should I consider before purchasing an annuity?

You should evaluate your financial goals, risk tolerance, fee structures associated with different products, potential return rates compared to other investments, and whether you need liquidity. - Is it wise to consult a financial advisor before buying an annuity?

Yes; consulting a financial advisor is crucial as they can provide personalized advice based on your unique financial situation and help you understand complex product features. - What happens if the insurance company issuing my annuity goes bankrupt?

If an insurance company goes bankrupt, state guaranty associations may provide some protection up to certain limits; however, this may not cover all losses incurred.