An irrevocable living trust is a powerful estate planning tool that offers significant benefits but also comes with notable drawbacks. This type of trust, once established, cannot be easily modified or revoked, making it a permanent transfer of assets from the grantor to the trust. Understanding the intricacies of irrevocable living trusts is crucial for individuals looking to protect their assets, minimize tax liabilities, and ensure their legacy is preserved according to their wishes.

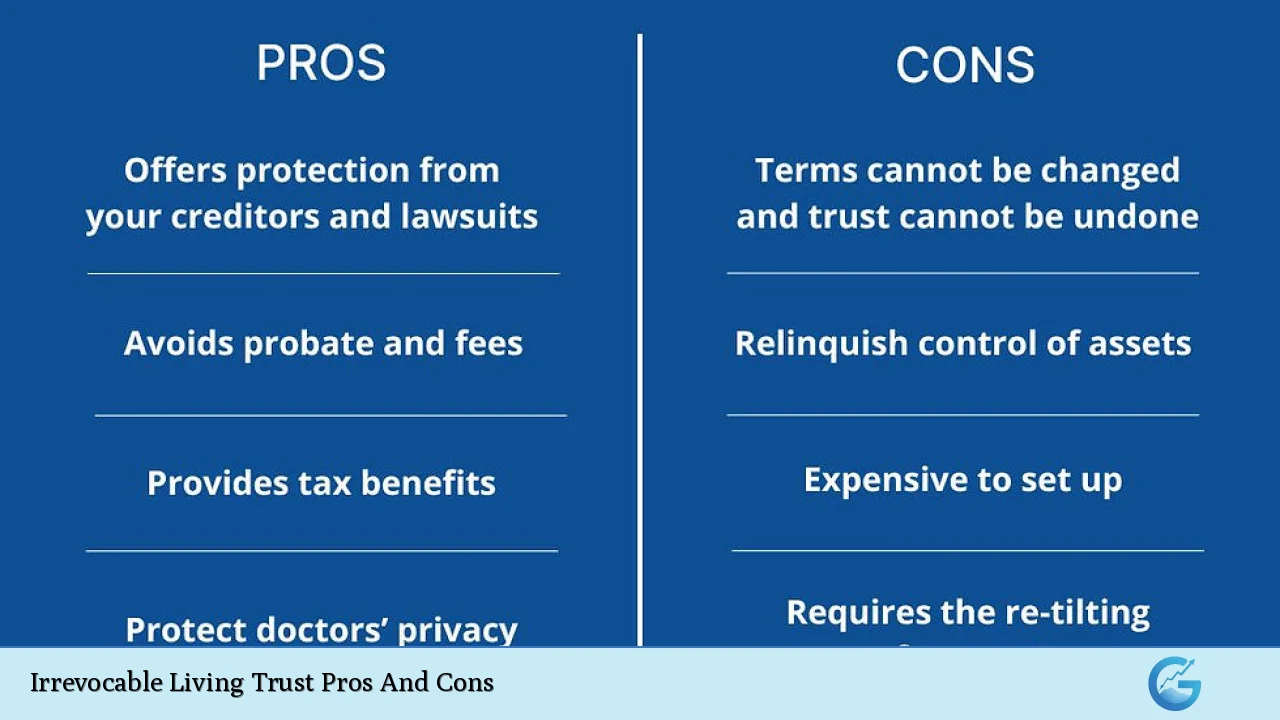

| Pros | Cons |

|---|---|

| Asset Protection | Loss of Control |

| Estate Tax Reduction | Inflexibility |

| Medicaid Planning | Complexity and Cost |

| Creditor Protection | Potential for Family Conflicts |

| Privacy Preservation | Income Tax Implications |

| Charitable Giving Benefits | Limited Access to Trust Assets |

Asset Protection: A Shield for Your Wealth

One of the most compelling advantages of an irrevocable living trust is its robust asset protection capabilities. By transferring assets into the trust, you effectively remove them from your personal ownership, shielding them from potential creditors, lawsuits, and other financial threats. This protection extends beyond your lifetime, ensuring that your beneficiaries can enjoy the assets without the risk of outside interference.

Key benefits include:

- Protection from personal creditors

- Safeguarding assets from business liabilities

- Shielding wealth from potential divorce settlements

However, it’s important to note that this protection is not absolute. Transfers made with the intent to defraud creditors can be challenged and potentially reversed. Additionally, assets must be in the trust for a certain period before full protection takes effect, known as the “look-back” period in some jurisdictions.

Estate Tax Reduction: Minimizing the Tax Burden

For high-net-worth individuals, estate tax reduction is often a primary motivation for establishing an irrevocable living trust. By removing assets from your taxable estate, you can significantly reduce or even eliminate estate taxes, allowing more of your wealth to pass to your beneficiaries.

Advantages in estate tax planning include:

- Reduction of the taxable estate value

- Potential elimination of estate taxes for estates under the federal exemption limit

- Utilization of generation-skipping transfer tax exemptions

It’s crucial to work with experienced tax professionals and estate planning attorneys to structure the trust properly and maximize tax benefits. The ever-changing landscape of tax laws requires ongoing monitoring and potential adjustments to trust strategies.

Medicaid Planning: Preserving Assets for Long-Term Care

Irrevocable living trusts can play a vital role in Medicaid planning, especially for individuals concerned about the high costs of long-term care. By transferring assets to an irrevocable trust well in advance of needing care, you may be able to protect those assets while still qualifying for Medicaid benefits.

Key considerations for Medicaid planning with irrevocable trusts:

- Assets must be transferred at least five years before applying for Medicaid (the “look-back” period)

- Careful structuring is required to ensure the trust complies with Medicaid regulations

- The trust must be truly irrevocable to be effective for Medicaid planning purposes

It’s important to balance the need for Medicaid planning with the potential loss of control over assets and the impact on your current financial situation. Consulting with elder law attorneys and financial advisors specializing in Medicaid planning is crucial to navigate this complex area effectively.

Loss of Control: The Price of Protection

The most significant drawback of an irrevocable living trust is the loss of control over the assets placed in the trust. Once you transfer assets into an irrevocable trust, you relinquish ownership and control, and the terms of the trust become extremely difficult to modify or revoke.

Implications of this loss of control include:

- Inability to change beneficiaries or distribution terms without beneficiary consent

- Loss of direct access to trust assets for personal use

- Potential difficulties in adapting to changing financial circumstances or family dynamics

This loss of flexibility can be particularly challenging if your financial situation or family relationships change significantly after the trust is established. Careful consideration and thorough planning are essential before committing to an irrevocable trust structure.

Complexity and Cost: Navigating the Intricacies

Establishing and maintaining an irrevocable living trust involves a level of complexity and cost that can be prohibitive for some individuals. The initial setup requires careful planning, often involving attorneys, accountants, and financial advisors, which can result in significant upfront costs.

Ongoing considerations include:

- Annual tax filings for the trust

- Potential need for professional trust management

- Costs associated with any necessary legal modifications or interpretations of trust terms

While these costs can be substantial, they should be weighed against the potential benefits in asset protection, tax savings, and estate planning efficiency. For high-net-worth individuals or those with complex financial situations, the long-term advantages often outweigh the initial and ongoing expenses.

Privacy Preservation: Keeping Your Affairs Confidential

An often-overlooked advantage of irrevocable living trusts is the privacy they afford. Unlike wills, which become public record during probate, the terms and distributions of an irrevocable trust remain private, shielding your financial affairs and beneficiaries from public scrutiny.

Benefits of this privacy include:

- Protection of beneficiaries from unwanted attention or solicitation

- Maintaining family confidentiality in wealth transfers

- Reducing the risk of challenges to asset distributions

This privacy can be particularly valuable for high-profile individuals or those concerned about potential conflicts among beneficiaries. However, it’s important to note that while the trust itself remains private, certain trust activities may still require public filings or disclosures.

Charitable Giving Benefits: Leaving a Lasting Legacy

Irrevocable living trusts offer unique advantages for individuals looking to incorporate charitable giving into their estate plans. By establishing a charitable trust, you can support your favorite causes while potentially enjoying tax benefits and ensuring your philanthropic legacy continues beyond your lifetime.

Key charitable trust structures include:

- Charitable Remainder Trusts (CRTs): Provide income to you or your beneficiaries for a set period, with the remainder going to charity

- Charitable Lead Trusts (CLTs): Generate income for charity for a set period, with the remainder going to your beneficiaries

These structures can offer significant income tax deductions, capital gains tax avoidance, and estate tax benefits while fulfilling your charitable objectives. However, the complexity of these trusts requires careful planning and ongoing management to ensure compliance with IRS regulations and maximization of benefits.

Income Tax Implications: A Double-Edged Sword

While irrevocable living trusts can offer estate tax benefits, their income tax treatment requires careful consideration. Depending on how the trust is structured, it may be treated as a separate taxable entity, potentially subjecting trust income to higher tax rates than individual income tax brackets.

Key income tax considerations include:

- Grantor trusts vs. non-grantor trusts and their differing tax treatments

- Potential for compressed tax brackets on trust income

- Strategies for distributing income to beneficiaries in lower tax brackets

Navigating these income tax implications requires ongoing collaboration with tax professionals to ensure the trust structure aligns with your overall financial and estate planning goals.

Conclusion: Weighing the Balance

Irrevocable living trusts offer a powerful set of tools for asset protection, estate planning, and tax management. However, the decision to establish such a trust should not be taken lightly. The permanent nature of these trusts, combined with their complexity and potential drawbacks, requires careful consideration and expert guidance.

For many high-net-worth individuals, the benefits of asset protection, estate tax reduction, and legacy planning outweigh the loss of control and complexity. Others may find the inflexibility and ongoing management requirements too restrictive. Ultimately, the decision to establish an irrevocable living trust should be based on a comprehensive analysis of your financial situation, long-term goals, and family dynamics.

As with any significant financial decision, consulting with a team of experienced professionals, including estate planning attorneys, tax advisors, and financial planners, is crucial to navigating the complexities of irrevocable living trusts and ensuring they align with your overall wealth management strategy.

Frequently Asked Questions About Irrevocable Living Trust Pros And Cons

- Can an irrevocable living trust be changed after it’s established?

While extremely difficult, changes can sometimes be made through judicial modification, decanting, or with the unanimous consent of all beneficiaries. However, these processes are complex and not guaranteed to succeed. - How does an irrevocable living trust affect my ability to qualify for Medicaid?

Assets in a properly structured irrevocable trust may not be counted for Medicaid eligibility after a five-year look-back period. This can help protect assets while allowing you to qualify for long-term care benefits. - Are there any situations where creditors can access assets in an irrevocable living trust?

While generally protected, assets can potentially be reached if the trust was funded to defraud creditors or if certain retained powers exist. Proper structuring and timing are crucial for maximum protection. - How does an irrevocable living trust impact my income taxes?

Depending on the trust’s structure, it may be taxed as a separate entity or the income may flow through to the grantor. Non-grantor trusts reach the highest tax bracket at much lower income levels than individuals. - Can I serve as the trustee of my own irrevocable living trust?

While possible in some cases, serving as your own trustee can undermine the trust’s asset protection and tax benefits. It’s generally advisable to appoint an independent trustee. - How does an irrevocable living trust compare to a revocable living trust for estate planning?

Irrevocable trusts offer stronger asset protection and potential tax benefits but less flexibility. Revocable trusts provide more control but fewer protections and tax advantages. - What happens to the assets in an irrevocable living trust after I die?

The assets are distributed according to the trust’s terms, typically avoiding probate and maintaining privacy. The trustee manages this process based on the instructions in the trust document. - Are there any alternatives to irrevocable living trusts for asset protection?

Alternatives include limited liability companies (LLCs), family limited partnerships (FLPs), and certain types of insurance policies. Each has its own pros and cons and may be used in conjunction with trusts.