The Isle of Man, a self-governing British Crown Dependency, has established itself as a prominent offshore financial center, offering a robust regulatory framework for various financial services, including brokerage activities. This article provides an in-depth exploration of the Isle of Man Broker License, its requirements, benefits, and application process.

| License Type | Regulatory Body | Key Requirements |

|---|---|---|

| Financial Services License (Class 2 – Investment Business) | Isle of Man Financial Services Authority (IOMFSA) | – Minimum capital requirement – Fit and proper management – Robust compliance and risk management systems – Physical presence in the Isle of Man |

Understanding the Isle of Man Broker License

The Isle of Man Broker License falls under the broader category of Financial Services Licenses regulated by the Isle of Man Financial Services Authority (IOMFSA). Specifically, brokerage activities are typically covered under Class 2 – Investment Business licenses.

Key Features:

- Allows for a wide range of investment activities

- Recognized internationally for its high regulatory standards

- Provides access to European and global markets

- Offers tax neutrality benefits

Brokers operating under this license can engage in various activities, including dealing in investments, arranging deals in investments, managing investments, and providing investment advice.

Application Process and Requirements

Obtaining an Isle of Man Broker License involves a rigorous application process designed to ensure that only fit and proper entities enter the market.

Application Steps:

- Pre-application meeting with the IOMFSA

- Submission of detailed application form and supporting documents

- Payment of application fees

- IOMFSA review and due diligence

- Approval or rejection of the application

Key Requirements:

- Incorporation of a company in the Isle of Man

- Minimum paid-up share capital (typically £100,000 for Class 2 licenses)

- Appointment of at least two Isle of Man resident directors

- Establishment of a physical office in the Isle of Man

- Robust compliance and anti-money laundering (AML) procedures

- Comprehensive business plan and financial projections

- Professional indemnity insurance

Applicants must demonstrate their financial soundness, competence, and integrity throughout the application process. The IOMFSA conducts thorough background checks on key personnel and shareholders to ensure they meet the fit and proper person criteria.

Benefits of an Isle of Man Broker License

Obtaining a broker license in the Isle of Man offers numerous advantages for financial services firms:

- Reputable Jurisdiction: The Isle of Man is recognized globally as a well-regulated financial center, enhancing credibility with clients and partners.

- Tax Efficiency: The Isle of Man offers a favorable tax regime, including 0% corporate tax rate for most businesses.

- Access to Markets: Licensees can access European and international markets, benefiting from the Isle of Man’s strategic location and relationships.

- Robust Regulatory Framework: The IOMFSA’s stringent oversight provides investor protection and maintains market integrity.

- Business-Friendly Environment: The Isle of Man government actively supports the financial services sector, offering various incentives and support services.

Compliance and Ongoing Obligations

Holding an Isle of Man Broker License comes with significant ongoing compliance responsibilities:

Key Compliance Areas:

- Regular reporting to the IOMFSA

- Maintaining adequate capital and liquidity

- Ongoing adherence to AML and counter-terrorist financing (CTF) regulations

- Continuous professional development for key staff

- Annual audits and submission of financial statements

Brokers must also stay updated with regulatory changes and implement necessary adjustments to their operations promptly. The IOMFSA conducts periodic on-site inspections to ensure compliance with all regulatory requirements.

Challenges and Considerations

While the Isle of Man Broker License offers numerous benefits, potential applicants should be aware of certain challenges:

- High Initial Costs: The application process and setup requirements can be expensive, including capital requirements and professional fees.

- Stringent Regulatory Oversight: Ongoing compliance can be resource-intensive and requires dedicated staff and systems.

- Limited Local Market: The Isle of Man’s small population means that most business must come from international clients.

- Reputational Risks: Operating in an offshore jurisdiction may raise concerns for some clients or partners unfamiliar with the Isle of Man’s regulatory standards.

Future Outlook and Trends

The Isle of Man continues to evolve its regulatory framework to maintain its competitive edge in the global financial services landscape:

- Increasing focus on fintech and digital assets

- Enhanced emphasis on environmental, social, and governance (ESG) factors

- Continued alignment with international regulatory standards

- Potential expansion of license types to accommodate new financial products and services

Brokers considering the Isle of Man should stay informed about these developments and how they might impact their business strategies.

Conclusion

The Isle of Man Broker License offers a compelling proposition for financial services firms seeking a reputable offshore base with access to global markets. While the application process and ongoing compliance requirements are rigorous, the benefits of operating in a well-regulated, tax-efficient jurisdiction can be substantial. As with any significant business decision, thorough research and professional advice are essential when considering an Isle of Man Broker License.

FAQs

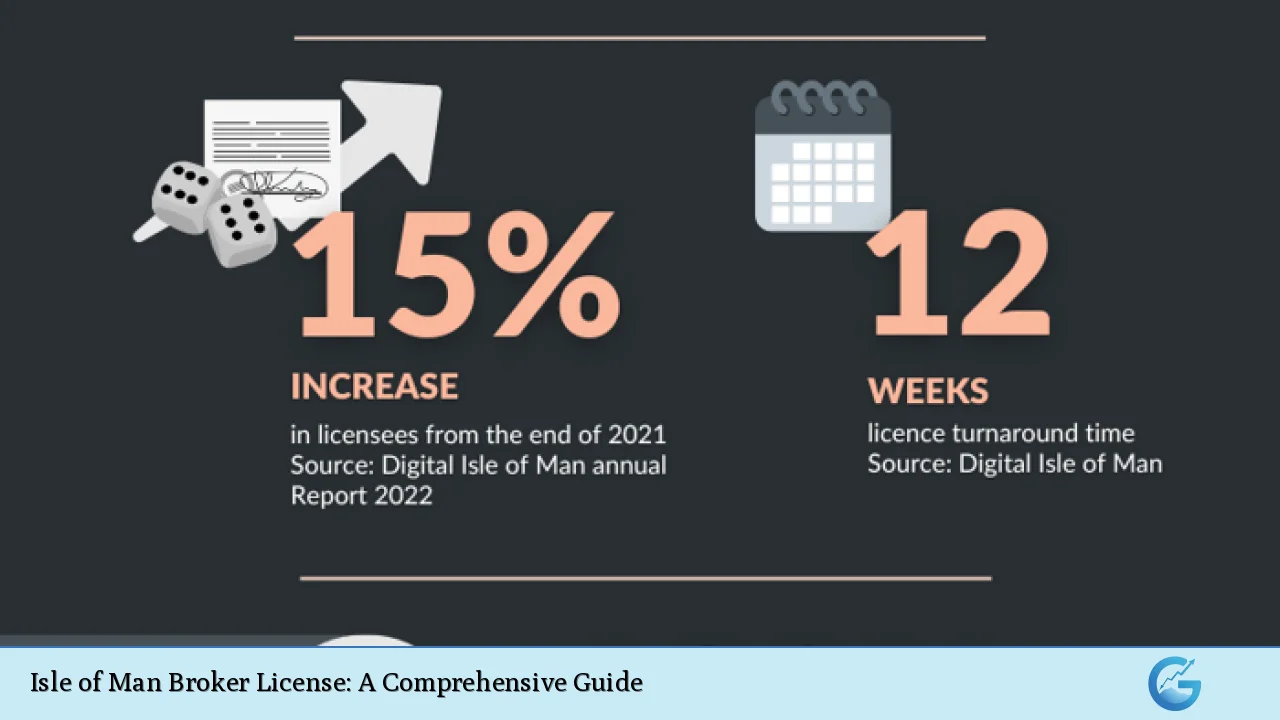

- How long does it take to obtain an Isle of Man Broker License?

The process typically takes 3-6 months, depending on the completeness of the application and the complexity of the business model. - Can non-residents apply for an Isle of Man Broker License?

Yes, but the company must have a physical presence and at least two resident directors in the Isle of Man. - What is the minimum capital requirement for an Isle of Man Broker License?

For a Class 2 Investment Business license, the typical minimum is £100,000, but this can vary based on the specific activities. - Are there any restrictions on the types of financial instruments that can be traded?

The license allows for a wide range of instruments, but specific restrictions may apply based on the exact license class and conditions. - How often does the IOMFSA conduct inspections of licensed brokers?

The frequency varies, but licensees can expect regular on-site inspections, typically every 1-3 years, with additional off-site monitoring.