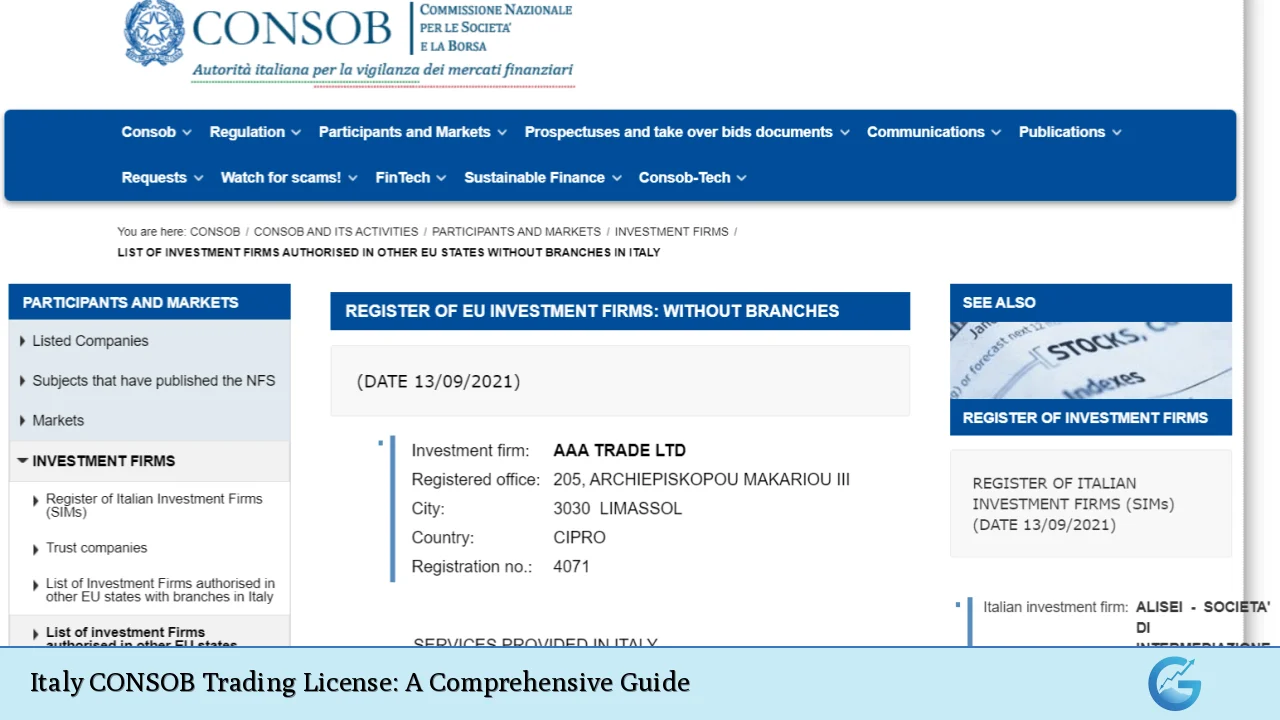

The Italian financial market is regulated by the Commissione Nazionale per le Società e la Borsa (CONSOB), which plays a crucial role in overseeing trading activities and issuing licenses to brokers and financial institutions. This comprehensive guide will explore the intricacies of obtaining a CONSOB trading license, its requirements, and the implications for traders and financial service providers in Italy.

| Aspect | Description | Importance |

|---|---|---|

| Regulatory Body | CONSOB (Commissione Nazionale per le Società e la Borsa) | Primary financial regulator in Italy |

| License Types | Investment Firm, Crowdfunding Service Provider, etc. | Determines the scope of permitted financial activities |

| Application Process | Submission of detailed documentation and meeting specific criteria | Critical for obtaining authorization to operate in Italy |

Understanding CONSOB and Its Role

CONSOB, established in 1974, is the governmental authority responsible for regulating the Italian securities market. Its primary objectives include:

- Ensuring transparency and correct behavior in financial markets

- Protecting investors and savers

- Promoting the efficiency and competitiveness of the Italian financial system

For traders and financial institutions looking to operate in Italy, understanding CONSOB’s role is crucial. The regulator sets the standards for market conduct, oversees trading activities, and issues licenses to qualified entities.

Technical Details:

CONSOB operates under the framework of the European Securities and Markets Authority (ESMA) and implements EU directives such as MiFID II. This ensures that Italian financial regulations are in line with broader European standards.

User Experience:

Many traders report that CONSOB’s strict oversight provides a sense of security when trading in Italian markets. However, some find the regulatory requirements challenging to navigate, especially for smaller firms or individual traders.

Recommendations:

Before pursuing a CONSOB trading license, thoroughly research the specific requirements for your intended financial activities. Consulting with legal experts familiar with Italian financial regulations can be invaluable in navigating the process.

Types of CONSOB Trading Licenses

CONSOB offers various types of licenses depending on the nature of financial activities a company intends to undertake. The main categories include:

- Investment Firm License

- Crowdfunding Service Provider License

- Asset Management Company License

Each license type comes with its own set of requirements and permitted activities.

Technical Details:

The Investment Firm License, for instance, allows companies to provide investment services and activities as defined under MiFID II. This can include executing orders on behalf of clients, dealing on own account, and providing investment advice.

User Experience:

Firms that have obtained CONSOB licenses report enhanced credibility in the Italian market. However, the ongoing compliance requirements can be resource-intensive, particularly for smaller operations.

Recommendations:

Carefully assess your business model and long-term goals before applying for a specific license type. Consider starting with a more limited license and expanding as your business grows and you become more familiar with the Italian regulatory landscape.

Application Process for a CONSOB Trading License

Obtaining a CONSOB trading license involves a rigorous application process. Here’s an overview of the key steps:

- Pre-application consultation with CONSOB

- Preparation and submission of the application form and supporting documents

- CONSOB review and assessment

- Addressing any queries or requests for additional information

- Final decision by CONSOB

Technical Details:

The application must include detailed information about the company’s structure, business plan, risk management procedures, and compliance frameworks. CONSOB typically takes 9-12 months to process applications, including preparation time.

User Experience:

Many applicants find the process time-consuming and complex. However, those who successfully obtain a license often report that the thorough vetting process ultimately strengthens their operational framework.

Recommendations:

Engage with experienced legal and financial advisors familiar with CONSOB requirements early in the process. Prepare a comprehensive and well-structured application to minimize delays and requests for additional information.

Key Requirements for CONSOB Authorization

To obtain CONSOB authorization, applicants must meet several key requirements:

- Minimum capital requirements

- Robust governance structure

- Comprehensive risk management framework

- Adequate technological infrastructure

- Qualified personnel with relevant expertise

Technical Details:

The minimum capital requirement varies depending on the license type and scope of activities. For investment firms, it can range from €50,000 to €730,000 or more, depending on the services offered.

User Experience:

Meeting these requirements can be challenging, especially for startups or smaller firms. However, companies that successfully implement these standards often find they are better positioned for long-term success and stability.

Recommendations:

Conduct a thorough gap analysis of your current operations against CONSOB requirements. Develop a detailed plan to address any shortfalls well in advance of submitting your application.

Ongoing Compliance and Reporting Obligations

Obtaining a CONSOB license is just the beginning. License holders must adhere to strict ongoing compliance and reporting obligations, including:

- Regular financial reporting

- Maintaining adequate capital levels

- Ongoing risk management and internal control assessments

- Compliance with anti-money laundering (AML) and know your customer (KYC) regulations

Technical Details:

CONSOB requires licensed entities to submit detailed reports on their financial position, risk exposures, and compliance status. The frequency and depth of these reports vary depending on the license type and the firm’s activities.

User Experience:

While many firms find the ongoing compliance requirements demanding, they also acknowledge that these standards help maintain the integrity of the Italian financial market and protect investors.

Recommendations:

Invest in robust compliance management systems and consider appointing a dedicated compliance officer to ensure ongoing adherence to CONSOB regulations. Regularly review and update your compliance procedures to keep pace with evolving regulatory requirements.

Implications for Forex and Cryptocurrency Trading

The CONSOB trading license has significant implications for firms offering forex and cryptocurrency trading services in Italy:

- Forex brokers must obtain appropriate CONSOB authorization to operate legally in Italy.

- Cryptocurrency exchanges and service providers are subject to increasing scrutiny and may require specific licenses depending on their activities.

Technical Details:

CONSOB has issued warnings about unauthorized forex and crypto platforms operating in Italy. Licensed entities must comply with strict client money protection rules and leverage limits set by ESMA.

User Experience:

Traders report feeling more secure when using CONSOB-licensed platforms, but some find the restrictions on leverage and product offerings limiting compared to less regulated markets.

Recommendations:

For forex and crypto firms looking to enter the Italian market, carefully assess the regulatory landscape and consider partnering with established local entities to navigate the licensing process more effectively.

In conclusion, obtaining a CONSOB trading license is a complex but crucial step for financial institutions looking to operate in the Italian market. While the process can be challenging, the benefits of enhanced credibility and access to one of Europe’s significant financial markets make it a worthwhile endeavor for many firms. By thoroughly understanding the requirements, preparing meticulously, and committing to ongoing compliance, companies can successfully navigate the CONSOB licensing process and thrive in the Italian financial landscape.

FAQs

- How long does it take to obtain a CONSOB trading license?

The process typically takes 9-12 months, including preparation time and CONSOB’s review period. - What are the minimum capital requirements for a CONSOB license?

Capital requirements vary by license type, ranging from €50,000 to €730,000 or more for investment firms. - Can foreign companies obtain a CONSOB trading license?

Yes, foreign companies can apply, but they may need to establish a local presence in Italy. - Is a CONSOB license valid throughout the EU?

While it allows for passporting rights, additional requirements may apply in other EU countries. - How often do CONSOB-licensed firms need to report to the regulator?

Reporting frequency varies, but most firms must submit detailed reports at least quarterly.