Indexed Universal Life (IUL) insurance is a unique financial product that combines the benefits of life insurance with a cash value component linked to a stock market index. This type of policy offers flexibility and potential growth, making it an appealing option for many investors. However, it also comes with its own set of challenges and risks. In this article, we will explore the advantages and disadvantages of IUL insurance policies in detail, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

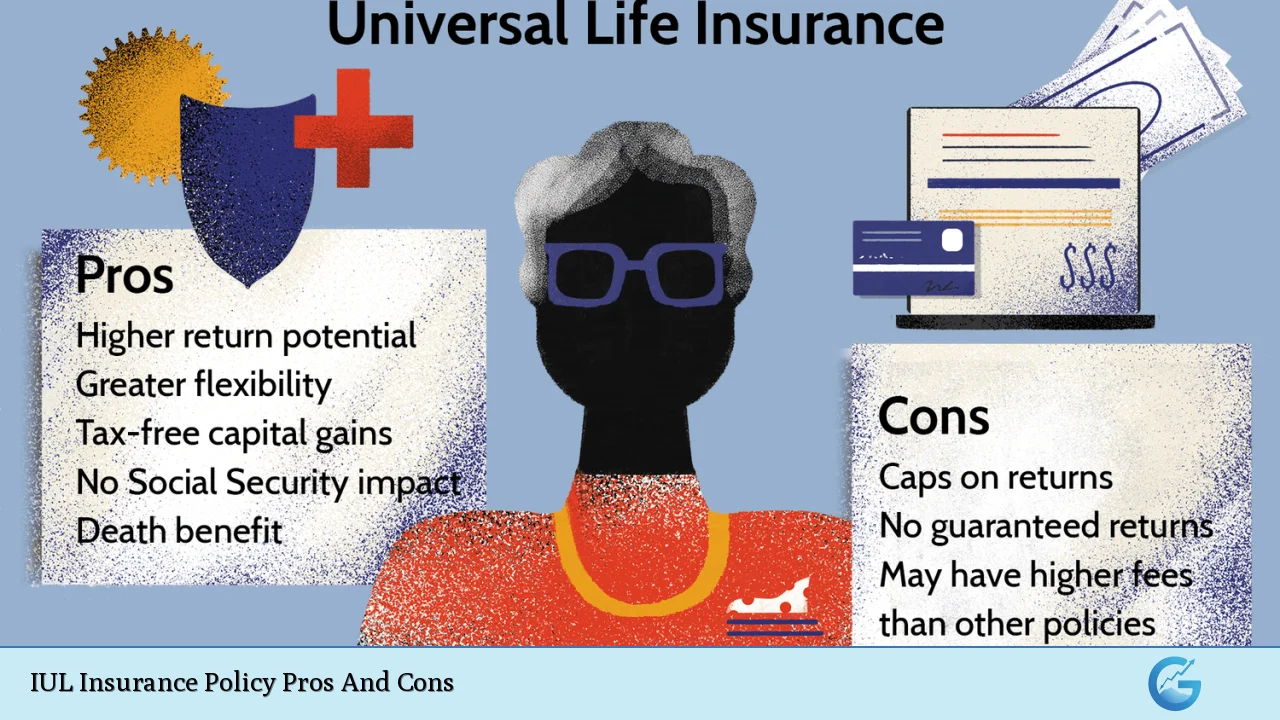

Advantages and Disadvantages of IUL Insurance

| Pros | Cons |

|---|---|

| Potential for higher returns linked to market performance | No guaranteed returns; returns can be capped |

| Flexible premium payments | Can be more expensive than term life insurance |

| Tax-deferred growth of cash value | Complexity in understanding policy mechanics |

| Access to cash value through loans or withdrawals | Market risk exposure can affect cash value growth |

| Downside protection with minimum interest rates | Surrender charges can apply if the policy is canceled early |

| No impact on Social Security benefits from withdrawals | Long-term commitment required for optimal benefits |

| Death benefit guarantees for beneficiaries | Potentially high fees and costs associated with the policy |

| Ability to adjust death benefit amounts as needed | Returns may underperform compared to other investment options |

Potential for Higher Returns Linked to Market Performance

One of the most significant advantages of IUL insurance is its potential for higher returns. The cash value of an IUL policy grows based on a stock market index, such as the S&P 500. This means that when the market performs well, the cash value can increase significantly.

- Market-Linked Growth: The growth potential is tied directly to market performance, allowing for potentially higher returns than traditional whole or universal life policies.

- Crediting Floor: Most IUL policies include a minimum interest rate (often 0% or 1%), which protects against losses during poor market conditions.

However, it’s essential to note that while there is potential for high returns, these are not guaranteed.

No Guaranteed Returns; Returns Can Be Capped

While the opportunity for higher returns is appealing, one of the downsides of IUL policies is that they do not guarantee these returns.

- Caps on Growth: Insurers typically impose caps on how much the cash value can grow in a given year. For instance, if the index increases by 15%, your return might be capped at 10%.

- Market Performance Variability: Depending on how the market performs, your returns could be lower than expected or even stagnate during downturns.

This uncertainty can make it challenging for policyholders to rely on IULs as a stable investment vehicle.

Flexible Premium Payments

Another advantage of IUL insurance is its flexibility regarding premium payments. Unlike whole life insurance policies that require fixed premiums, IULs allow policyholders to adjust their payments based on their financial situation.

- Adaptability: This flexibility can be particularly beneficial during times of financial hardship or unexpected expenses.

- Customizable Contributions: Policyholders can increase or decrease their premium payments within certain limits, allowing them to manage their cash flow effectively.

Despite this flexibility, it’s crucial to ensure that premiums are paid consistently to maintain the policy’s benefits.

Can Be More Expensive Than Term Life Insurance

While IUL policies offer flexibility, they often come with higher costs compared to term life insurance.

- Cost Structure: The premiums for IULs cover not only the cost of insurance but also administrative fees and investment components.

- Long-Term Financial Commitment: If your primary goal is affordable life insurance coverage, term policies may provide better value without the complexities associated with IULs.

Understanding these costs upfront is vital before committing to an IUL policy.

Tax-Deferred Growth of Cash Value

IUL policies offer tax advantages that can be attractive for those looking to grow their wealth over time.

- Tax-Deferred Accumulation: The cash value grows on a tax-deferred basis, meaning you won’t pay taxes on gains until you withdraw them.

- Tax-Free Loans: Withdrawals taken as loans against the cash value are generally tax-free, providing a potential source of income in retirement without immediate tax implications.

This feature makes IULs appealing for long-term financial planning strategies.

Complexity in Understanding Policy Mechanics

Despite their benefits, IUL policies are often more complex than traditional life insurance products.

- Difficult Mechanics: Understanding how cash value is tied to stock market indices and how caps and floors work can be challenging for many consumers.

- Need for Financial Literacy: Potential buyers should have a solid grasp of financial concepts to navigate these complexities effectively.

This complexity may deter some individuals from considering an IUL as part of their financial strategy.

Access to Cash Value Through Loans or Withdrawals

IUL policies allow policyholders to access their accumulated cash value through loans or withdrawals.

- Financial Flexibility: This feature provides liquidity that can be useful during emergencies or significant life events.

- Impact on Death Benefit: However, it’s important to remember that any loans taken will reduce the death benefit if not repaid, which could impact beneficiaries negatively.

Careful consideration should be given before accessing cash value to ensure it aligns with long-term financial goals.

Market Risk Exposure Can Affect Cash Value Growth

While IULs provide some downside protection through minimum interest rates, they still expose policyholders to market risks.

- Performance Dependency: The growth potential is directly tied to market performance; if the index performs poorly over time, so does your cash value growth.

- Comparative Risk Levels: Compared to traditional universal life insurance policies which are less risky, IULs carry more risk but less than variable life policies that invest directly in stocks and bonds.

Understanding this risk profile is crucial when evaluating whether an IUL fits your investment strategy.

Downside Protection With Minimum Interest Rates

One significant advantage of IUL policies is their built-in downside protection through minimum interest rates.

- Safety Net: Even in a declining market, your cash value will not decrease below a certain level due to this safety net feature.

- Peace of Mind: This aspect can provide peace of mind for those concerned about market volatility affecting their investments negatively.

However, while this protection exists, it does not eliminate all risks associated with market fluctuations.

Surrender Charges Can Apply If the Policy Is Canceled Early

A notable disadvantage associated with IUL policies is the presence of surrender charges.

- Early Withdrawal Penalties: If you decide to cancel your policy within a certain period (usually several years), you may incur surrender charges that reduce your cash value significantly.

- Long-Term Commitment Required: This aspect reinforces the need for a long-term commitment when investing in an IUL policy since early withdrawals can lead to substantial losses.

Being aware of these charges is essential when considering an IUL as part of your financial portfolio.

No Impact on Social Security Benefits from Withdrawals

Withdrawals from an IUL policy do not affect Social Security benefits, which can be advantageous for retirees looking for additional income sources.

- Retirement Income Strategy: This feature allows retirees to access funds without reducing their Social Security payments, providing greater financial flexibility during retirement years.

However, it’s important to manage withdrawals carefully to avoid depleting the death benefit intended for beneficiaries.

Long-Term Commitment Required for Optimal Benefits

To maximize the benefits offered by an IUL policy, policyholders must commit long-term.

- Investment Horizon: The longer you hold the policy and continue making premium payments, the more significant your cash value growth will likely be due to compounding interest over time.

- Strategic Planning Needed: Those considering an IUL should evaluate their long-term financial goals and ensure they align with this commitment before proceeding with such an investment strategy.

Understanding this requirement helps set realistic expectations regarding the performance and utility of an IUL policy over time.

Potentially High Fees and Costs Associated With the Policy

IUL policies often come with various fees that can affect overall performance and returns.

- Cost Breakdown: These fees may include administrative costs, cost-of-insurance charges, and additional rider costs if added benefits are included in the policy.

- Impact on Returns: High fees can erode potential gains from market-linked growth and should be thoroughly understood before committing funds into an IUL policy.

Being informed about these costs ensures better decision-making regarding whether an IUL aligns with your financial objectives.

Returns May Underperform Compared to Other Investment Options

Finally, while IULs offer unique benefits, they may not always outperform other investment vehicles like mutual funds or ETFs.

- Comparative Analysis Needed: Investors should compare potential returns from an IUL against traditional investment options before deciding where to allocate funds.

- Risk vs Reward Consideration: Understanding how much risk you are willing to accept versus expected returns will help determine if an IUL fits within your broader investment strategy effectively.

Evaluating all available options ensures informed decisions aligned with individual financial goals and risk tolerance levels.

Frequently Asked Questions About IUL Insurance Policy

- What is Indexed Universal Life (IUL) insurance?

IUL insurance combines life insurance coverage with a cash value component linked to a stock market index. - What are the main advantages of IUL insurance?

The main advantages include potential higher returns linked to market performance and flexible premium payments. - Are there guaranteed returns with an IUL?

No, while there is potential for high returns based on market performance, there are no guarantees; returns may be capped. - Can you access cash value in an IUL?

Yes, policyholders can access cash value through loans or withdrawals. - What happens if you stop paying premiums?

If premiums are not paid consistently, the policy may lapse or incur penalties. - How does tax treatment work with IULs?

The cash value grows tax-deferred; withdrawals taken as loans are generally tax-free. - What are surrender charges?

Surrender charges are penalties applied if you cancel your policy early within a specified period. - Is an IUL suitable for everyone?

No, due diligence is required; individuals should assess their long-term financial goals and risk tolerance before investing in an IUL.

In conclusion, Indexed Universal Life (IUL) insurance offers both advantages and disadvantages worth considering carefully. While it provides opportunities for growth linked to market performance alongside flexible payment options and tax benefits, it also presents complexities and risks associated with market fluctuations and costs. Before deciding whether an IUL fits into your financial strategy—especially if you’re engaged in finance-related investments—it’s essential to weigh these factors thoroughly against your personal circumstances and objectives.