Indexed Universal Life (IUL) insurance is a unique financial product that combines life insurance coverage with the potential for cash value growth linked to a stock market index. This dual benefit makes IUL policies attractive to those looking for both protection and investment opportunities. However, like any financial product, IULs come with their own set of advantages and disadvantages. This article will explore the strengths and weaknesses of IUL life insurance, providing a comprehensive overview for potential investors in finance, crypto, forex, and money markets.

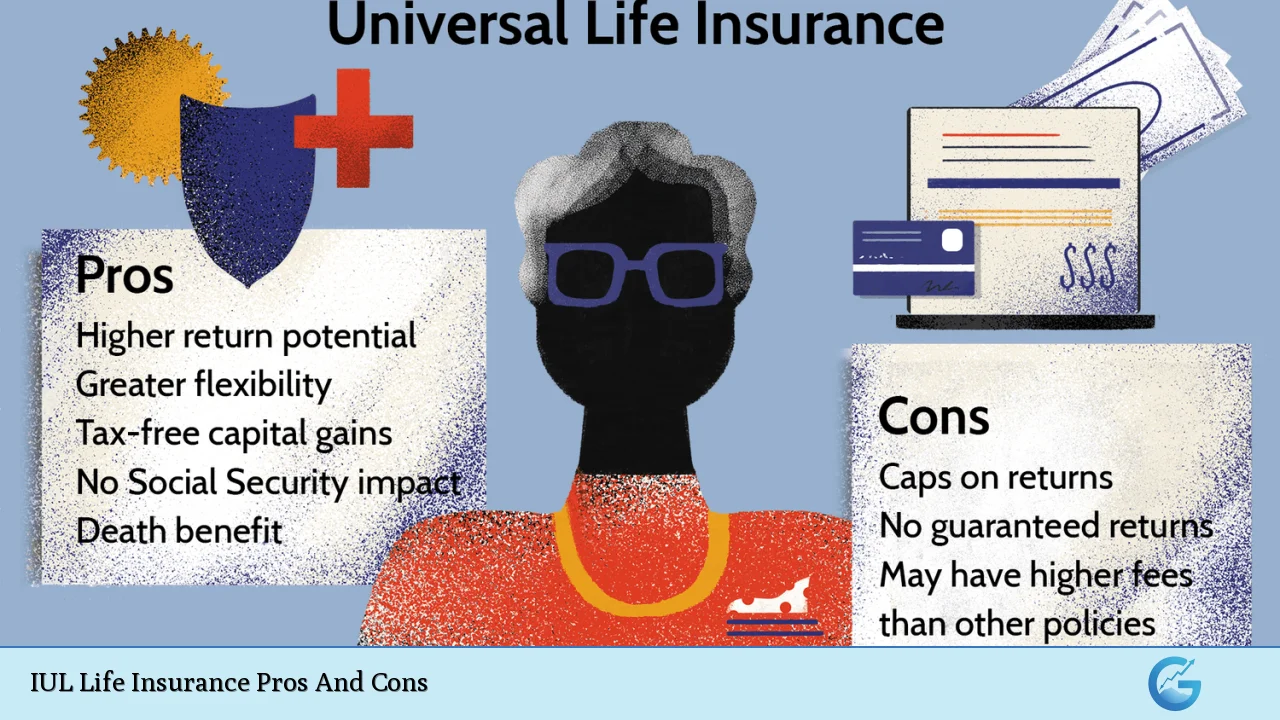

| Pros | Cons |

|---|---|

| Potential for higher returns linked to market performance | Returns are capped, limiting growth potential |

| Flexible premium payments and death benefits | Complex structure requiring careful management |

| Tax-deferred cash value growth | Market volatility can impact cash value accumulation |

| Access to cash value through loans or withdrawals | Higher fees compared to traditional life insurance policies |

| Downside protection with guaranteed minimum interest rates | Requires active management to maintain performance |

| No impact on Social Security benefits when withdrawing funds | Potential for lower returns in poor market conditions |

| Death benefit is generally tax-free for beneficiaries | Policy may lapse if premiums are not maintained properly |

Potential for Higher Returns Linked to Market Performance

One of the most appealing aspects of IUL insurance is its potential for higher returns compared to traditional life insurance policies. The cash value component of an IUL policy earns interest based on the performance of a selected stock market index, such as the S&P 500. This means that when the index performs well, policyholders can see significant growth in their cash value.

- Market-Linked Growth: Cash value grows when the index performs positively.

- Crediting Floor: Most IULs offer a minimum interest rate (often around 0% or 1%), ensuring that even in a down market, the cash value does not decrease.

Flexible Premium Payments and Death Benefits

IUL policies provide flexibility in both premium payments and death benefits, allowing policyholders to adjust their contributions based on their financial situation.

- Adjustable Premiums: Policyholders can change their premium amounts within certain limits, making it easier to adapt to changing financial circumstances.

- Customizable Death Benefit: The death benefit can be increased or decreased according to the policyholder’s needs, providing tailored coverage.

Tax-Deferred Cash Value Growth

The cash value in an IUL policy grows on a tax-deferred basis, meaning that policyholders do not pay taxes on gains until they are withdrawn. This feature makes IULs attractive for long-term financial planning.

- Tax Advantages: Policyholders can take tax-free loans against the cash value without triggering immediate tax liabilities.

- Retirement Income Potential: The cash value can serve as a source of retirement income, providing financial support during retirement years.

Access to Cash Value Through Loans or Withdrawals

IUL policies allow policyholders to access their accumulated cash value through loans or withdrawals. This liquidity can be beneficial for various financial needs.

- Financial Flexibility: Policyholders can use the cash value for expenses such as education costs or medical bills without penalty.

- Loan Options: Loans taken against the cash value are generally tax-free but must be repaid with interest to avoid reducing the death benefit.

Downside Protection With Guaranteed Minimum Interest Rates

IUL policies typically include features that protect against significant losses in poor market conditions.

- Guaranteed Minimum Interest Rate: Even if the market performs poorly, the policyholder’s cash value is protected by a minimum interest rate.

- Annual Reset Feature: Gains are locked in annually, ensuring that previous gains are not lost in subsequent years.

No Impact on Social Security Benefits When Withdrawing Funds

Withdrawals from an IUL policy do not affect Social Security benefits, making it an attractive option for retirees who want to maintain their benefits while accessing funds.

- Retirement Planning Tool: This feature allows retirees to manage their income streams without jeopardizing their Social Security payments.

Higher Fees Compared to Traditional Life Insurance Policies

One of the main drawbacks of IUL insurance is that it often comes with higher fees than other life insurance products.

- Cost Structure: The complexity of IULs means that they typically have higher administrative fees and costs associated with managing the investment component.

- Impact on Returns: These fees can erode overall returns, especially if the market does not perform well.

Market Volatility Can Impact Cash Value Accumulation

While IULs offer potential for growth linked to market performance, this also introduces risk.

- Market Fluctuations: If the index underperforms, the growth of the cash value may be lower than expected.

- Investment Risk: Although there is downside protection through guaranteed floors, significant market downturns can still affect overall performance.

Requires Active Management to Maintain Performance

IUL policies require ongoing management and monitoring to ensure they perform as intended.

- Policy Adjustments: Policyholders may need to adjust premiums or death benefits regularly based on market conditions and personal financial situations.

- Professional Guidance Recommended: Engaging with a financial advisor can help navigate these complexities effectively.

Potential for Lower Returns in Poor Market Conditions

Despite offering higher return potentials during favorable market conditions, poor performance in the underlying index can lead to disappointing results.

- Capped Growth Potential: While gains are possible, they are capped at a certain level which limits upside potential during strong market rallies.

- Risk Assessment Necessary: Investors should carefully consider their risk tolerance before committing to an IUL policy.

Policy May Lapse If Premiums Are Not Maintained Properly

Maintaining an IUL policy requires consistent premium payments; failure to do so may result in policy lapse.

- Surrender Charges: Early withdrawals or insufficient premiums may incur surrender charges that reduce cash value significantly.

- Long-Term Commitment Needed: Policyholders must commit long-term to avoid negative consequences associated with lapsing coverage.

In conclusion, Indexed Universal Life (IUL) insurance offers a unique blend of life insurance protection and investment opportunities. While it provides several advantages such as potential for higher returns, flexibility in premium payments, and tax-deferred growth, it also carries risks including market volatility and higher fees. It is essential for individuals considering an IUL policy to weigh these pros and cons against their personal financial goals and risk tolerance. Consulting with a qualified financial advisor can provide valuable insights tailored to individual circumstances and help navigate this complex product effectively.

Frequently Asked Questions About IUL Life Insurance

- What is Indexed Universal Life Insurance?

IUL is a permanent life insurance policy that combines a death benefit with a cash value component linked to stock market performance. - How does cash value grow in an IUL?

The cash value grows based on the performance of a selected stock index while having a guaranteed minimum interest rate. - Can I access my cash value?

You can access your cash value through loans or withdrawals; however, these may reduce your death benefit. - What are the tax implications of an IUL?

The growth in cash value is tax-deferred until withdrawn; loans taken against it are generally tax-free. - Are there risks associated with IUL?

Yes, risks include market volatility affecting cash value growth and potentially lower returns compared to traditional policies. - Can my premiums increase over time?

Yes, premiums may vary based on age and changes in your policy structure. - Is there any downside protection?

IUL policies typically include guaranteed minimum interest rates that protect against significant losses. - Do withdrawals affect my Social Security benefits?

No, withdrawals from an IUL do not impact Social Security benefits.