Indexed Universal Life (IUL) insurance policies have gained popularity as a financial tool for retirement savings. These policies combine life insurance with a cash value component that can grow based on the performance of a stock market index, such as the S&P 500. This unique structure offers potential benefits like tax-deferred growth and flexible premium payments, but it also comes with significant drawbacks, including complexity and high costs. Understanding the pros and cons of IULs is essential for anyone considering them as part of their retirement strategy.

| Pros | Cons |

|---|---|

| Potential for market-linked growth | Complexity and high costs |

| Tax-deferred growth and tax-free withdrawals | Impact on death benefit |

| Flexibility in premium payments | Caps on returns and participation rates |

| Permanent life insurance coverage | Loan interest and potential policy lapse |

| No impact on Social Security benefits | Limited investment options |

Potential for Market-Linked Growth

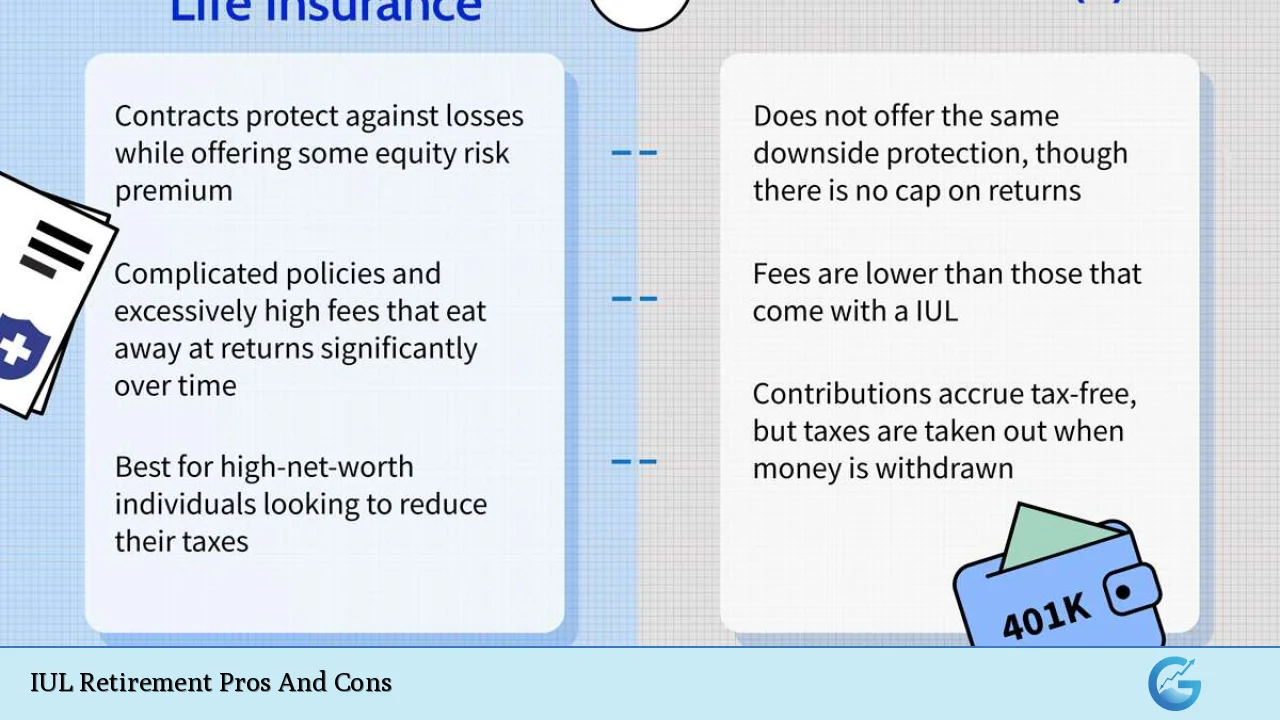

One of the primary advantages of IUL policies is their potential for cash value growth linked to a market index. This allows policyholders to benefit from market upswings while providing a safety net during downturns due to guaranteed minimum interest rates.

- Market Upside: If the selected index performs well, the cash value can increase significantly, providing a hedge against inflation and enhancing retirement savings.

- Downside Protection: IULs typically include a floor rate (often 0%) that protects against losses in poor market years.

Tax-Deferred Growth and Tax-Free Withdrawals

IUL policies offer tax advantages that can be particularly beneficial during retirement.

- Tax-Deferred Accumulation: The cash value grows without being subject to income taxes until it is withdrawn, allowing for potentially larger growth over time.

- Tax-Free Loans: Withdrawals from the cash value are generally treated as loans, which are not taxed as income. This can provide a tax-efficient source of income during retirement.

Flexibility in Premium Payments

IUL policies are designed with flexibility in mind, making them appealing for individuals whose financial situations may change over time.

- Adjustable Premiums: Policyholders can adjust their premium payments based on their current financial capabilities, allowing for underpayment or skipped payments without immediate penalties.

- Death Benefit Adjustments: The death benefit can also be modified according to changing needs, providing additional financial security.

Permanent Life Insurance Coverage

An IUL policy provides lifelong coverage as long as premiums are paid, offering peace of mind that loved ones will receive a death benefit.

- Long-Term Security: This aspect is crucial for individuals looking for both investment growth and life insurance protection.

- Estate Planning Benefits: The death benefit can be structured to avoid probate, ensuring that beneficiaries receive funds quickly and efficiently.

No Impact on Social Security Benefits

The cash value accumulation from an IUL policy does not count towards Social Security earnings thresholds, allowing retirees to supplement their income without affecting their benefits.

- Supplemental Income: Policyholders can take loans against their cash value without reducing Social Security payments, providing an additional layer of financial flexibility during retirement.

Complexity and High Costs

Despite the advantages, IUL policies are often criticized for their complexity and associated costs.

- Understanding the Product: The mechanics of how cash value grows based on index performance can be difficult to grasp for many consumers. This complexity may lead to misunderstandings about how the product works.

- High Fees: IULs typically come with higher premiums than other forms of life insurance due to administrative fees, cost of insurance, and surrender charges. These costs can significantly reduce overall returns on investment.

Impact on Death Benefit

Taking loans or making withdrawals from the cash value can have adverse effects on the death benefit provided by the policy.

- Reduced Benefits: If loans are not repaid, the outstanding balance will be deducted from the death benefit, potentially leaving less for beneficiaries.

- Estate Planning Concerns: This reduction could impact overall estate planning goals if not managed carefully.

Caps on Returns and Participation Rates

While IULs offer market-linked growth potential, they also impose limits that can restrict overall gains.

- Cap Rates: Many IUL policies impose caps on how much interest can be credited to the cash value. For example, if an index returns 10% but has a cap of 5%, only 5% will be credited.

- Participation Rates: These rates determine what percentage of an index’s performance is credited to the policy. A participation rate of 50% means that if the index increases by 8%, only 4% will be added to the cash value.

Loan Interest and Potential Policy Lapse

Borrowing against an IUL’s cash value can lead to complications if not managed properly.

- Interest Accumulation: Loans taken against the policy accrue interest, which must be repaid; otherwise, it will reduce both cash value and death benefit.

- Risk of Lapse: If premiums are not maintained or if loans exceed cash value, there is a risk that the policy could lapse, resulting in loss of coverage and accumulated benefits.

Limited Investment Options

Unlike traditional investment accounts where individuals have broad choices regarding where to allocate funds, IUL policies limit investments to specific indices set by the insurer.

- Restricted Growth Potential: This limitation may hinder potential returns compared to other investment vehicles like stocks or mutual funds where investors have more control over their portfolios.

- Lack of Dividends: Unlike some whole life insurance policies that pay dividends based on company performance, IULs typically do not offer dividends, which could enhance overall returns.

In conclusion, Indexed Universal Life insurance presents both opportunities and challenges as a retirement planning tool. While it offers market-linked growth potential, tax benefits, flexibility in premiums, and permanent coverage, it also comes with complexities that require careful consideration. High costs and possible impacts on death benefits must be weighed against personal financial goals and risk tolerance. Consulting with a qualified financial advisor is essential before committing to an IUL policy to ensure it aligns with your long-term objectives.

Frequently Asked Questions About IUL Retirement Pros And Cons

- What is an Indexed Universal Life (IUL) insurance policy?

An IUL is a type of permanent life insurance that combines a death benefit with a cash value component linked to stock market indices. - What are the main advantages of using an IUL for retirement?

IULs offer potential market-linked growth, tax-deferred accumulation, flexible premium payments, permanent life coverage, and no impact on Social Security benefits. - What are some disadvantages of IUL policies?

The main drawbacks include complexity, high costs associated with premiums and fees, caps on returns, impact on death benefits from withdrawals or loans, and limited investment options. - Can I access my cash value in an IUL policy?

Yes, you can access your cash value through tax-free loans or withdrawals; however, these may reduce your death benefit if not repaid. - How do caps affect my returns in an IUL?

Caps limit how much interest you can earn based on index performance; even if the index performs well beyond this cap, your gains will be restricted. - Is it advisable to use an IUL as my primary retirement savings vehicle?

An IUL should not be considered a standalone retirement plan; it is best used in conjunction with other retirement savings options like 401(k)s or IRAs. - What happens if I fail to pay my premiums?

If you do not maintain sufficient premium payments or if loans exceed your cash value, your policy may lapse. - Are there any tax implications when withdrawing from an IUL?

Withdrawals are generally treated as loans and are tax-free unless they exceed your total contributions into the policy.