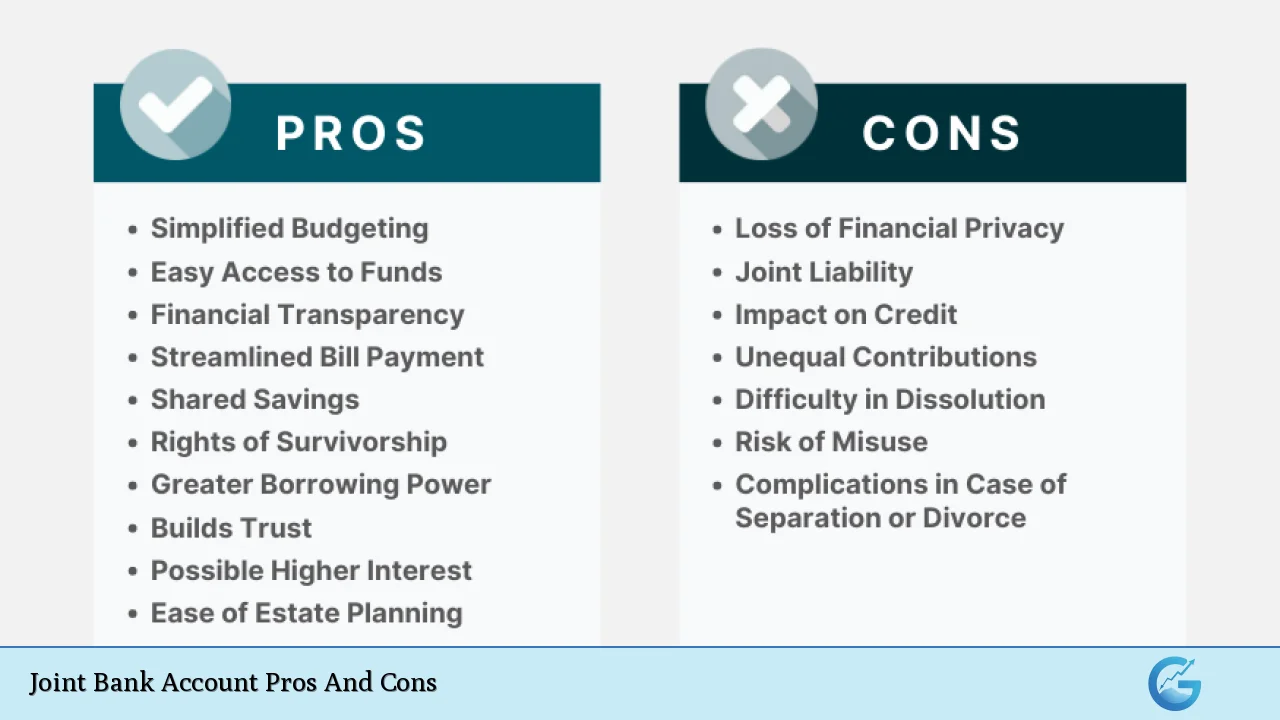

Opening a joint bank account is a significant financial decision that can have lasting implications for individuals and couples alike. These accounts are typically shared between two or more people, allowing them to manage their finances collectively. While joint accounts can simplify bill payments and foster transparency in financial matters, they also come with potential drawbacks such as lack of privacy and shared responsibility for debts. This article explores the various pros and cons of joint bank accounts, providing a comprehensive overview to help individuals make informed decisions.

| Pros | Cons |

|---|---|

| Facilitates easier management of shared expenses | Lack of control over spending by co-holders |

| Promotes transparency and accountability | Potential for conflicts over financial decisions |

| Simplifies the process of handling finances in emergencies | Risk of one partner’s debt affecting the other |

| Encourages open communication about finances | Loss of financial independence and privacy |

| Can help achieve common financial goals more effectively | Complications during separation or divorce |

| Potential for higher FDIC insurance coverage | Shared liability for fees and overdrafts |

Facilitates Easier Management of Shared Expenses

One of the primary advantages of a joint bank account is that it simplifies the management of shared expenses. Couples or partners can pool their resources to cover:

- Rent or mortgage payments

- Utility bills

- Groceries

- Joint leisure activities

This collective approach eliminates the need to track who paid what, reducing the potential for misunderstandings or disputes over money.

Promotes Transparency and Accountability

Joint accounts foster an environment of transparency, as both parties have equal access to account information. This visibility can lead to better financial habits, as individuals are less likely to overspend when they know their partner can see their transactions. Additionally, it encourages accountability, as both parties are responsible for monitoring spending.

Simplifies the Process of Handling Finances in Emergencies

In times of emergency, having a joint account can be invaluable. If one partner becomes incapacitated or passes away, the other has immediate access to funds without needing to navigate complex legal processes. This accessibility can provide peace of mind during stressful times.

Encourages Open Communication About Finances

Sharing a bank account necessitates discussions about financial goals, budgeting, and spending habits. This dialogue can strengthen relationships by ensuring both parties are aligned on their financial objectives and aware of each other’s priorities.

Can Help Achieve Common Financial Goals More Effectively

Joint accounts are particularly useful for achieving shared financial goals, such as saving for a vacation, purchasing a home, or planning for retirement. By pooling resources, couples can reach these milestones more quickly than they might individually.

Potential for Higher FDIC Insurance Coverage

In the United States, joint accounts may qualify for increased FDIC insurance coverage. Each account holder is insured up to $250,000 per depositor per institution. Therefore, if two people hold a joint account, it could be insured up to $500,000, providing additional security for larger balances.

Lack of Control Over Spending by Co-Holders

A significant disadvantage of joint accounts is the lack of control over how funds are spent by co-holders. If one partner has different spending habits or makes impulsive purchases, it can strain the relationship and lead to financial difficulties. This lack of control can be particularly concerning if one partner is less financially responsible.

Potential for Conflicts Over Financial Decisions

With both parties having equal access to the account, disagreements may arise regarding spending decisions. For instance, if one partner wants to save for a vacation while the other prefers to spend on entertainment, this could lead to conflicts that affect the relationship.

Risk of One Partner’s Debt Affecting the Other

If one partner has significant debts or poor credit history, this could impact both individuals when they share a joint account. Creditors may pursue funds from the joint account to settle debts incurred by one partner, potentially leaving the other partner financially vulnerable.

Loss of Financial Independence and Privacy

Sharing an account means sacrificing some degree of financial independence. Each partner will have visibility into all transactions made on the account, which can limit personal spending discretion. This lack of privacy may deter individuals from making personal purchases or surprises without alerting their partner.

Complications During Separation or Divorce

In the unfortunate event that a relationship ends, dividing shared finances can become complicated and contentious. Disputes may arise over how much each party contributed or who gets what portion of the remaining funds in the account. This situation can add emotional stress during an already difficult time.

Shared Liability for Fees and Overdrafts

Both partners are equally responsible for any fees incurred on the joint account. If one partner overspends or fails to maintain sufficient funds in the account leading to overdraft fees, both individuals will face consequences regardless of who made the transaction that caused the issue.

In summary, while joint bank accounts offer several advantages such as easier management of shared expenses and enhanced transparency between partners, they also come with notable disadvantages including potential conflicts over spending and loss of financial independence. Individuals considering opening a joint bank account should weigh these pros and cons carefully based on their unique circumstances and relationship dynamics.

Frequently Asked Questions About Joint Bank Accounts

- What is a joint bank account?

A joint bank account is a financial account shared between two or more individuals that allows all parties equal access to manage funds. - Who should consider opening a joint bank account?

Couples sharing expenses, family members managing household finances together, or business partners needing shared access may benefit from a joint bank account. - What happens if one person wants to close a joint account?

If one party wishes to close the account, it typically requires agreement from all parties involved unless specified otherwise in the account agreement. - Can I have both a joint and individual bank account?

Yes! Many people choose to maintain separate individual accounts alongside their joint accounts for personal expenses. - How does liability work with joint bank accounts?

All co-holders share equal responsibility for any debts incurred on the account; this includes overdraft fees or any negative balances. - Can creditors access funds in a joint bank account?

Yes, creditors may claim funds from a joint account if one co-holder has outstanding debts. - What should I discuss with my partner before opening a joint account?

You should discuss your financial goals, spending habits, budgeting strategies, and how you plan to manage contributions to avoid future conflicts. - Is there an age requirement for opening a joint bank account?

Generally, all parties must be at least 18 years old; however, minors may also be added with parental consent depending on the bank’s policies.

In conclusion, while joint bank accounts can streamline financial management and promote transparency among partners or family members, they require careful consideration due to potential risks involved. Open communication about finances is essential before committing to this arrangement.