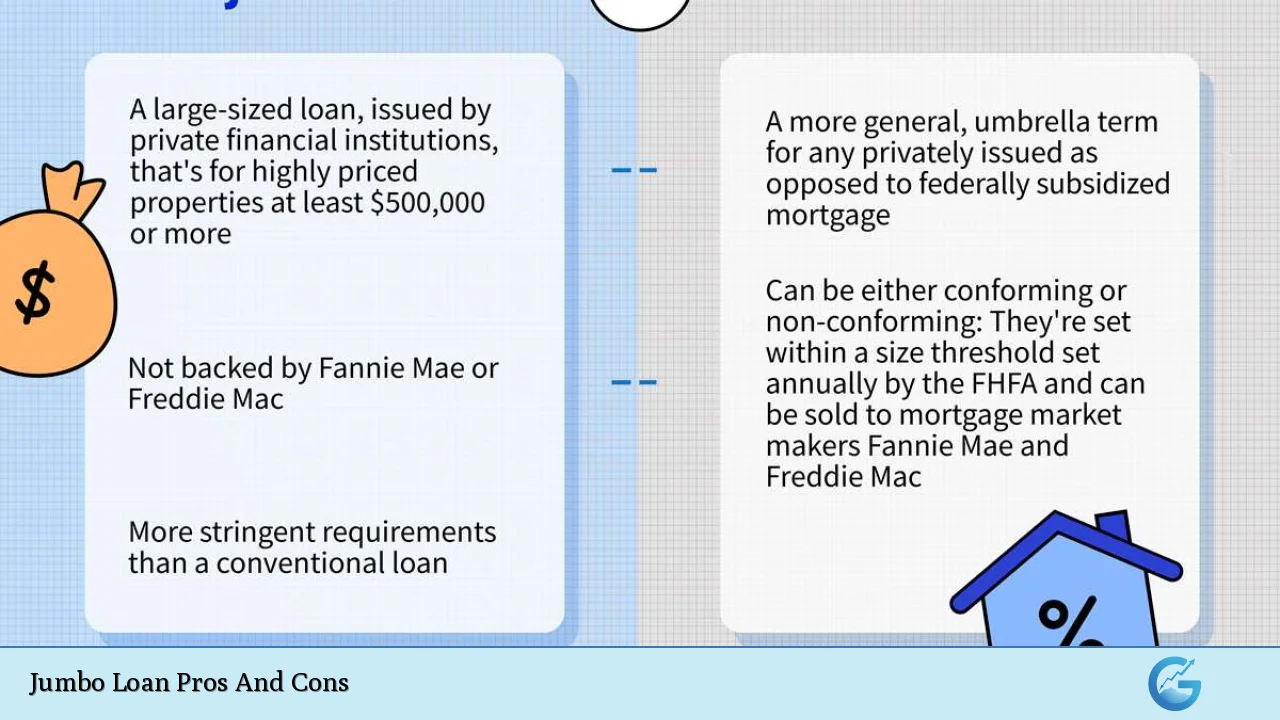

Jumbo loans are a critical financial tool for individuals looking to purchase high-value properties that exceed the conforming loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac. As the housing market continues to evolve, the demand for jumbo loans has surged, particularly in high-cost areas where real estate prices can skyrocket. This article delves into the advantages and disadvantages of jumbo loans, providing a comprehensive overview for potential borrowers and investors interested in finance, real estate, and related markets.

| Pros | Cons |

|---|---|

| High loan amounts available | Stricter qualification requirements |

| Flexible loan options | Higher down payment requirements |

| Competitive interest rates | Higher closing costs |

| No private mortgage insurance (PMI) required in some cases | Cash reserves required for approval |

| Financing for multiple property types | Potentially higher interest rates compared to conforming loans |

| Opportunity to build equity faster with shorter terms | Market volatility risks impacting property value |

High Loan Amounts Available

One of the most significant advantages of jumbo loans is their ability to provide substantial financing for high-value properties.

- Access to larger funds: Jumbo loans allow borrowers to access amounts typically ranging from $1 million to over $3 million, depending on the lender and property location.

- Ideal for luxury purchases: This financing option is particularly beneficial for buyers in high-cost areas or those seeking luxury homes that exceed conventional loan limits.

Flexible Loan Options

Jumbo loans offer a variety of options tailored to meet diverse financial needs.

- Customizable terms: Borrowers can choose from various repayment options, including fixed-rate mortgages or adjustable-rate mortgages (ARMs), allowing for flexibility in managing monthly payments.

- Adaptability: This flexibility can be crucial for individuals with specific financial strategies or those expecting changes in their income.

Competitive Interest Rates

Despite being nonconforming loans, jumbo loans can offer competitive interest rates.

- Market-driven rates: Interest rates on jumbo loans have become increasingly competitive, sometimes even lower than those of conforming loans, especially for borrowers with excellent credit scores.

- Potential savings: For financially stable borrowers, this can translate into significant savings over the life of the loan.

No Private Mortgage Insurance (PMI) Required in Some Cases

In contrast to conventional loans that often require PMI when the down payment is less than 20%, some jumbo loans do not have this requirement.

- Cost savings: This absence of PMI can lead to lower monthly payments and overall cost savings for borrowers.

- Financial flexibility: Without PMI, borrowers can allocate funds towards other investments or expenses.

Financing for Multiple Property Types

Jumbo loans are versatile and can be used for various property types.

- Investment opportunities: They can finance primary residences, vacation homes, and investment properties, providing flexibility for real estate investors.

- Diverse portfolio: This capability allows borrowers to diversify their real estate portfolios without needing multiple smaller loans.

Opportunity to Build Equity Faster with Shorter Terms

Choosing a shorter term for a jumbo loan can lead to quicker equity accumulation.

- Equity benefits: Borrowers who opt for 15 or 20-year terms may find they build equity faster compared to traditional 30-year mortgages.

- Future financial options: This increased equity can provide opportunities for future borrowing against the home or selling at a profit.

Stricter Qualification Requirements

While jumbo loans offer many advantages, they come with stringent qualification criteria that potential borrowers must meet.

- Higher credit score needed: Typically, lenders require a credit score of at least 700 or higher, which may limit access for some buyers.

- Income verification: Borrowers must demonstrate substantial income and financial stability through documentation such as W-2 forms and bank statements.

Higher Down Payment Requirements

Jumbo loans often necessitate larger down payments compared to conventional mortgages.

- Typical down payment range: While some lenders may accept down payments as low as 10%, many require at least 20% or more of the home’s purchase price.

- Affordability challenge: This requirement can pose challenges for buyers who may not have sufficient savings readily available.

Higher Closing Costs

The closing costs associated with jumbo loans can be significantly higher than those of conforming loans.

- Cost percentage: Closing costs typically range from 2% to 5% of the total loan amount, leading to substantial out-of-pocket expenses at closing.

- Financial planning necessity: Buyers need to factor these costs into their overall budget when considering a jumbo loan.

Cash Reserves Required for Approval

Lenders often require borrowers to maintain cash reserves equivalent to several months’ worth of mortgage payments as part of the approval process.

- Financial cushion: This requirement ensures that borrowers have sufficient funds available in case of financial emergencies or income disruptions.

- Increased scrutiny: The necessity for cash reserves adds another layer of scrutiny during the underwriting process, making it essential for borrowers to prepare adequately.

Potentially Higher Interest Rates Compared to Conforming Loans

While jumbo loans can offer competitive rates, they may also carry higher interest rates due to increased risk factors associated with larger loan amounts.

- Risk assessment by lenders: Lenders view jumbo loans as riskier investments; therefore, they might charge higher interest rates compared to conforming loans under certain conditions.

- Market fluctuations impact rates: Borrowers should be aware that market conditions can affect interest rates on jumbo loans significantly more than on conforming loans.

Market Volatility Risks Impacting Property Value

Investors using jumbo loans must consider the potential risks associated with market volatility and property values.

- Value fluctuations: Properties financed through jumbo loans may experience greater fluctuations in value during economic downturns, which could lead to negative equity situations where the mortgage exceeds the property’s worth.

- Long-term implications: This risk necessitates careful consideration and planning by buyers looking at high-value investments in uncertain markets.

In conclusion, while jumbo loans offer significant advantages such as high borrowing limits and flexible options tailored for luxury real estate purchases, they also come with notable disadvantages including stricter qualification criteria and potentially higher costs. Understanding both sides will equip potential borrowers with the knowledge needed to make informed decisions about their financing options. For those financially prepared and seeking high-value properties, a jumbo loan may be an excellent choice; however, it is crucial to weigh these pros and cons carefully against personal financial situations and market conditions before proceeding.

Frequently Asked Questions About Jumbo Loans

- What is a jumbo loan?

A jumbo loan is a type of mortgage that exceeds conforming loan limits set by Fannie Mae and Freddie Mac. It is typically used for purchasing high-value properties. - What are the typical requirements for a jumbo loan?

To qualify for a jumbo loan, borrowers generally need a credit score above 700, a low debt-to-income ratio, substantial income documentation, and cash reserves covering several months’ mortgage payments. - Are interest rates on jumbo loans higher?

Jumbo loan interest rates can be higher than those on conforming loans due to increased risk but have become increasingly competitive in recent years. - Can I use a jumbo loan for investment properties?

Yes, jumbo loans can be used to finance various property types including primary residences, vacation homes, and investment properties. - What is the minimum down payment required for a jumbo loan?

The minimum down payment typically starts at around 10%, but many lenders require at least 20% depending on borrower qualifications. - Do I need private mortgage insurance (PMI) with a jumbo loan?

Some jumbo loans do not require PMI even if the down payment is less than 20%, which can save borrowers money. - How long does it take to get approved for a jumbo loan?

The approval process for a jumbo loan is similar in duration to that of conventional mortgages, typically taking around 25–30 days after submitting all necessary documentation. - What happens if I default on my jumbo loan?

If you default on your jumbo loan, lenders may pursue foreclosure just like with any other mortgage; however, due to larger amounts involved, it may have more significant financial implications.