Land contracts, also known as contracts for deed or installment sale agreements, are alternative financing arrangements where the seller finances the purchase of a property for the buyer. This type of agreement allows buyers to make payments directly to the seller until the total purchase price is paid off, at which point the seller transfers the title to the buyer. While land contracts can provide unique opportunities for both buyers and sellers, they also come with distinct risks and challenges. Understanding these pros and cons is essential for anyone considering this type of transaction.

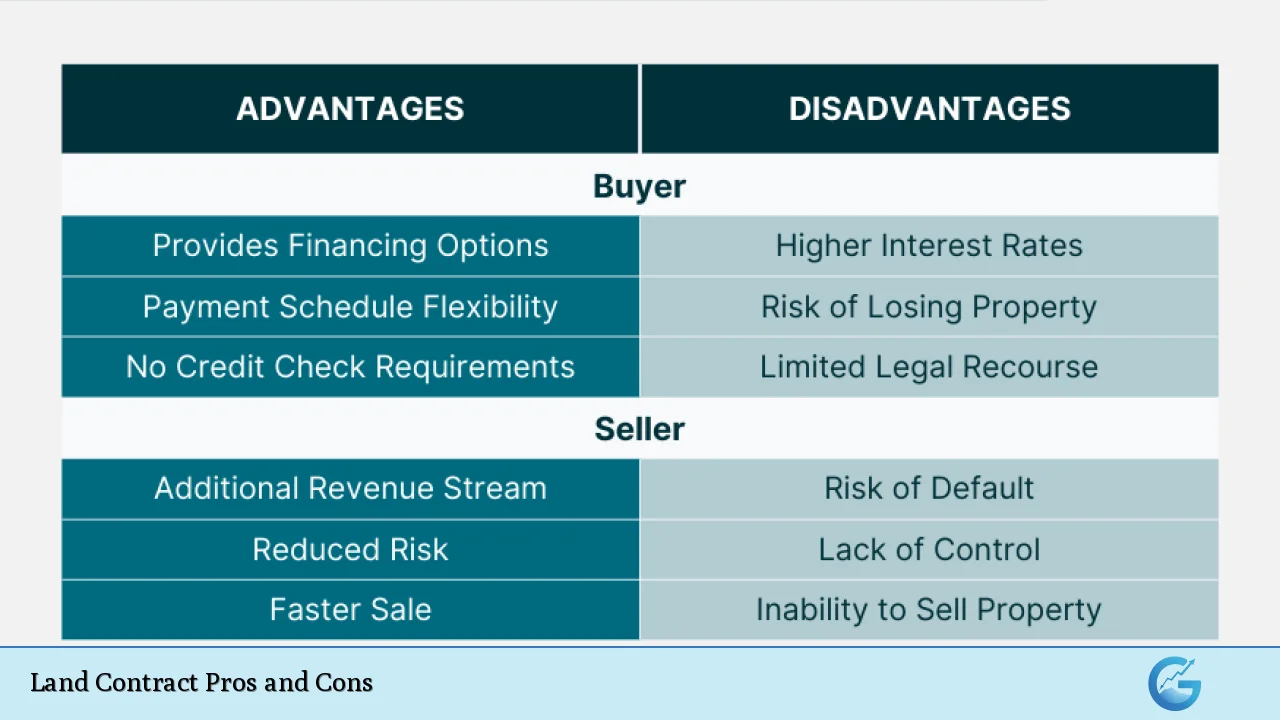

| Pros | Cons |

|---|---|

| Easier access to financing for buyers | Higher interest rates compared to traditional mortgages |

| Flexibility in negotiating terms | Risk of losing property if payments are not made |

| Lower closing costs | Limited legal protections for buyers |

| Faster closing process | Seller retains title until contract is fulfilled |

| Potential tax benefits for sellers | Complex legal documentation and potential disputes |

| Steady income stream for sellers | Potential difficulties in enforcing contract terms |

| Avoidance of traditional lender requirements | Buyers may have less recourse in case of disputes or defaults |

| Opportunity to sell property “as-is” | Buyers may face challenges in property maintenance responsibilities |

Easier Access to Financing for Buyers

One of the primary advantages of land contracts is that they provide easier access to financing, especially for buyers who may not qualify for traditional mortgages due to poor credit history or lack of a substantial down payment.

- No Credit Check Required: Buyers are often not subjected to rigorous credit checks, making it easier for those with less-than-perfect credit to secure a property.

- Flexible Down Payment Options: Sellers can negotiate down payment amounts, which may be lower than what banks typically require.

- Direct Negotiation: Buyers can directly negotiate terms with sellers, allowing for customized payment plans that fit their financial situation.

Flexibility in Negotiating Terms

Land contracts allow both parties to establish their own terms without the constraints imposed by traditional lenders.

- Tailored Payment Plans: Buyers and sellers can agree on payment schedules, interest rates, and other contract details that suit their needs.

- Adjustable Interest Rates: Sellers may offer competitive rates based on their assessment of the buyer’s financial situation.

- Customizable Contract Length: The duration of the contract can be negotiated, providing flexibility in how long payments will be made.

Lower Closing Costs

Land contracts typically incur lower closing costs compared to traditional real estate transactions.

- No Lender Fees: Since there are no banks involved, buyers save on origination fees and other lender-related costs.

- Reduced Legal Fees: While legal documentation is still necessary, the absence of a complex mortgage process can lower overall expenses.

Faster Closing Process

The closing process for land contracts can be significantly quicker than that of conventional mortgages.

- Streamlined Transactions: Without needing to go through a lender’s underwriting process, transactions can close much faster.

- Immediate Access: Buyers often gain quicker access to properties, which can be advantageous in competitive markets.

Potential Tax Benefits for Sellers

Sellers may benefit from favorable tax treatment when utilizing land contracts.

- Spread Capital Gains Tax: By receiving payments over time instead of a lump sum, sellers can potentially reduce their immediate tax burden.

- Steady Income Stream: Regular payments can provide a reliable income source while deferring tax liabilities associated with a full sale.

Steady Income Stream for Sellers

Land contracts offer sellers a consistent income stream from monthly payments made by buyers.

- Investment Income: This arrangement can be particularly appealing for sellers looking to generate passive income from their property investments.

- Higher Selling Price Potential: Sellers might command higher prices due to the financing options available through land contracts.

Avoidance of Traditional Lender Requirements

Land contracts eliminate many traditional lender requirements, making them appealing for both parties.

- No Bank Involvement: This allows buyers who might struggle with bank requirements to still purchase property effectively.

- Less Bureaucracy: The absence of traditional lending processes simplifies the transaction and reduces the time spent on paperwork.

Higher Interest Rates Compared to Traditional Mortgages

Despite their advantages, land contracts often come with higher interest rates than conventional loans due to increased risk assumed by the seller.

- Risk Premium: Sellers may charge higher rates because they are taking on more risk by financing the sale themselves.

- Long-Term Costs: Over time, buyers may end up paying more in interest compared to what they would pay through a traditional mortgage.

Risk of Losing Property if Payments Are Not Made

One significant disadvantage for buyers is the risk of losing both their property and any payments made if they default on the contract.

- Forfeiture Risk: If a buyer fails to meet payment obligations, they could lose all rights to the property without recourse.

- No Equity Protection: Unlike traditional mortgages where equity might be protected during foreclosure processes, land contract buyers have fewer protections against loss.

Limited Legal Protections for Buyers

Buyers often face fewer legal protections compared to those purchasing through traditional mortgage channels.

- Unclear Legal Rights: Without standardization in land contracts, buyers might not fully understand their rights or responsibilities under the agreement.

- Potential Disputes: The lack of regulatory oversight increases the likelihood of disputes regarding contract terms or obligations.

Seller Retains Title Until Contract Is Fulfilled

In a land contract arrangement, sellers retain legal title until all payments have been completed by the buyer.

- Equitable Title Only: Buyers hold an equitable interest but do not obtain full ownership rights until the contract is satisfied.

- Implications for Insurance and Maintenance: This arrangement can complicate issues related to property insurance and maintenance responsibilities during the contract period.

Complex Legal Documentation and Potential Disputes

The legal framework surrounding land contracts can be intricate and lead to misunderstandings between parties involved.

- Need for Legal Expertise: Both buyers and sellers should seek legal advice when drafting or reviewing contracts to ensure clarity and protection against future disputes.

- Documentation Risks: Poorly drafted agreements may result in significant legal challenges later on if terms are ambiguous or unenforceable.

Potential Difficulties in Enforcing Contract Terms

Enforcing terms laid out in a land contract can be challenging if disputes arise between buyers and sellers.

- Limited Recourse Options: Buyers may find it difficult to pursue legal action if they believe terms have been violated due to fewer consumer protections compared to traditional loans.

- Seller’s Burden in Foreclosure Situations: If a buyer defaults, sellers must navigate complex foreclosure processes which may not always favor them under state laws governing land contracts.

In conclusion, land contracts present both significant advantages and notable disadvantages. They offer unique opportunities for buyers who may struggle with conventional financing while providing sellers with potential benefits such as steady income streams and favorable tax treatment. However, it is crucial that both parties fully understand their rights and obligations under these agreements.

Engaging with knowledgeable real estate professionals or legal advisors is highly recommended before entering into any land contract arrangement. This ensures that both parties are well-informed about potential risks and safeguards against common pitfalls associated with this type of real estate transaction.

Frequently Asked Questions About Land Contracts

- What is a land contract?

A land contract is an agreement where a buyer makes payments directly to a seller over time until they complete payment for a property. - Who holds title during a land contract?

The seller retains legal title until all payments are completed; however, the buyer has equitable rights during this period. - Are there risks involved with land contracts?

Yes, risks include higher interest rates, potential loss of property upon defaulting on payments, and limited legal protections. - Can I negotiate terms in a land contract?

Yes, one of the benefits is that both parties can negotiate payment terms, interest rates, and other conditions. - How does foreclosure work in a land contract?

If a buyer defaults on payments, sellers may initiate foreclosure proceedings similar to those used in traditional mortgage defaults. - What happens if I want to sell my property under a land contract?

Sellers can sell their property “as-is” under a land contract without needing extensive repairs or renovations. - Are there tax benefits associated with land contracts?

Sellers may benefit from spreading capital gains taxes over time rather than paying them all at once from a lump-sum sale. - What should I include in a land contract?

A comprehensive agreement should outline sales price, down payment amount, payment schedule, interest rate, duration of contract, and default provisions.