Latvia, a member of the European Union since 2004, has become an attractive destination for businesses looking to establish their presence in the financial sector. The country’s strategic location, favorable business environment, and robust regulatory framework make it an ideal choice for obtaining trading licenses. This comprehensive guide will explore the intricacies of acquiring a trading license in Latvia, focusing on forex, finance, and cryptocurrency markets.

| License Type | Issuing Authority | Key Requirements |

|---|---|---|

| Forex License | Financial and Capital Market Commission (FCMC) | – Minimum capital: €730,000 – Detailed business plan – AML/CFT policies – Fit and proper management |

| Investment Firm License | Financial and Capital Market Commission (FCMC) | – Minimum capital: €50,000 – €730,000 (depending on services) – Professional indemnity insurance – Sound corporate governance – Risk management procedures |

| Cryptocurrency Exchange License | State Revenue Service | – Registration with the Enterprise Register – AML/CFT compliance – Security measures for asset protection – Customer due diligence procedures |

Forex License in Latvia

Obtaining a forex license in Latvia is a crucial step for businesses looking to operate in the foreign exchange market within the European Union. The Financial and Capital Market Commission (FCMC) is the primary regulatory body responsible for issuing and overseeing forex licenses in Latvia.

Detailed Requirements:

- Minimum initial capital of €730,000

- A comprehensive business plan outlining the company’s strategy, target market, and financial projections

- Robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) policies

- A team of qualified professionals with relevant experience in the forex industry

- Adequate risk management and internal control systems

- Secure IT infrastructure and data protection measures

Application Process:

- Prepare all necessary documentation, including the application form, business plan, and supporting documents.

- Submit the application to the FCMC along with the required fee.

- Undergo a thorough review process, which may include interviews with key personnel.

- Address any additional inquiries or requests for information from the FCMC.

- Receive the decision on the license application (typically within 6-12 months).

User Experiences:

Many forex brokers have found the Latvian licensing process to be more streamlined compared to other EU jurisdictions. The FCMC is known for its professionalism and clear communication throughout the application process. However, applicants should be prepared for a rigorous due diligence process and potential requests for additional information.

Recommendations:

- Engage with local legal and financial advisors familiar with the Latvian regulatory landscape.

- Ensure all documentation is meticulously prepared and translated into Latvian if necessary.

- Be prepared to demonstrate a strong commitment to compliance and risk management.

- Consider establishing a physical presence in Latvia to strengthen your application.

Investment Firm License in Latvia

For businesses looking to offer a broader range of financial services, including investment advice, portfolio management, and securities trading, an investment firm license is required. This license is also issued by the FCMC and allows firms to operate across the European Union under the MiFID II framework.

Key Requirements:

- Initial capital requirements ranging from €50,000 to €730,000, depending on the scope of services offered

- A detailed operational program outlining the firm’s organizational structure, internal control mechanisms, and risk management procedures

- Professional indemnity insurance

- Fit and proper assessment of board members and key function holders

- Adequate systems and procedures for safeguarding client assets

Technical Considerations:

- Implement robust IT systems capable of handling complex financial transactions and reporting requirements

- Develop comprehensive compliance monitoring tools to ensure adherence to MiFID II regulations

- Establish secure data storage and backup systems to protect sensitive client information

User Insights:

Investment firms operating under a Latvian license have reported positive experiences with the regulatory environment. The FCMC is known for its proactive approach to supervision and willingness to engage in constructive dialogue with licensed entities. However, firms should be prepared for ongoing compliance obligations and regular reporting requirements.

Best Practices:

- Conduct a thorough gap analysis to identify any areas of non-compliance with MiFID II requirements

- Invest in continuous training and development for staff to ensure they remain up-to-date with regulatory changes

- Establish strong relationships with local service providers, including auditors and legal counsel

- Regularly review and update internal policies and procedures to reflect evolving regulatory expectations

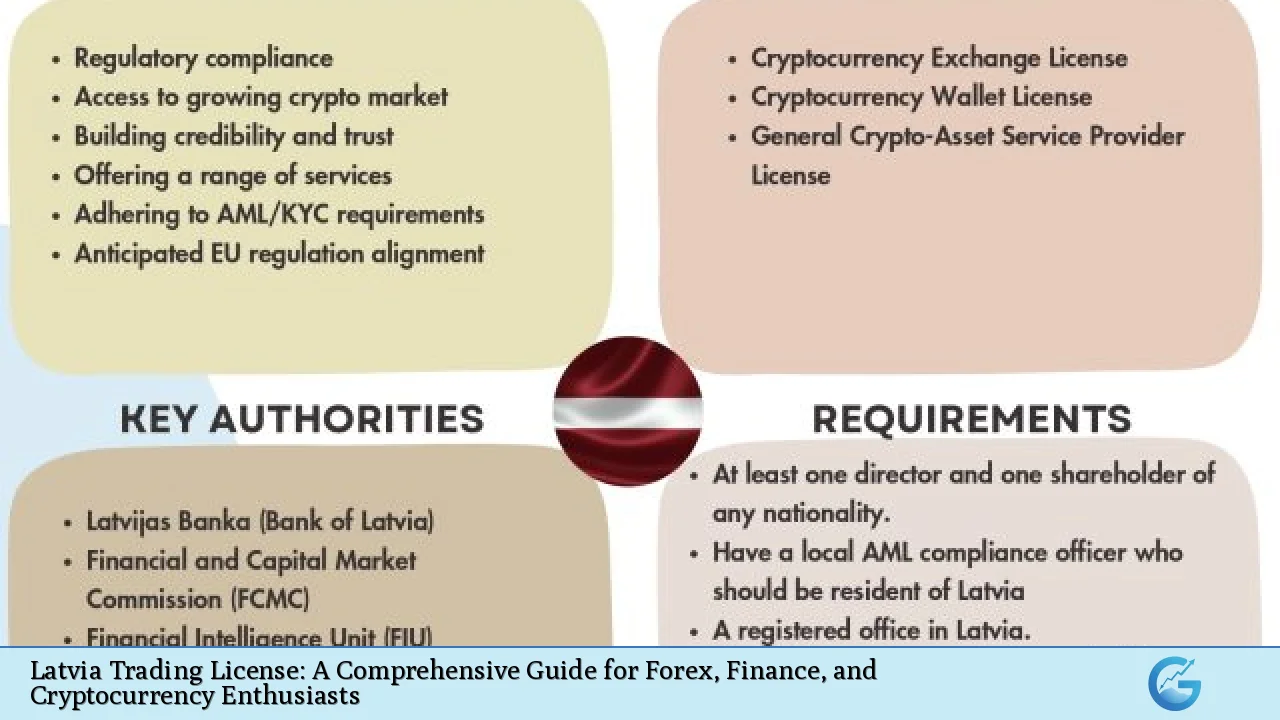

Cryptocurrency Exchange License in Latvia

As the cryptocurrency market continues to evolve, Latvia has positioned itself as a forward-thinking jurisdiction for crypto-related businesses. The State Revenue Service oversees the licensing and registration of cryptocurrency exchanges in Latvia.

Licensing Requirements:

- Registration with the Latvian Enterprise Register as a legal entity

- Implementation of robust AML/CFT policies tailored to the unique risks associated with cryptocurrencies

- Appointment of an AML compliance officer with relevant experience in the crypto industry

- Secure storage solutions for both fiat currencies and cryptocurrencies

- Comprehensive customer due diligence and transaction monitoring procedures

Technical Infrastructure:

- Implement multi-signature wallets and cold storage solutions for crypto assets

- Develop real-time transaction monitoring systems capable of detecting suspicious activities

- Establish secure API connections with reputable liquidity providers

- Implement strong cybersecurity measures, including regular penetration testing and vulnerability assessments

User Experiences:

Cryptocurrency exchanges operating under Latvian licenses have reported a balanced regulatory approach that promotes innovation while maintaining high standards of consumer protection. The State Revenue Service has shown a willingness to engage with industry participants and adapt regulations to the rapidly evolving crypto landscape.

Strategic Considerations:

- Stay informed about upcoming regulatory changes, particularly those related to the EU’s Markets in Crypto-Assets (MiCA) regulation

- Develop strong relationships with local banks to ensure stable fiat currency banking services

- Consider obtaining additional certifications, such as ISO 27001 for information security management, to enhance credibility

- Engage with local crypto communities and industry associations to stay abreast of market developments and regulatory trends

In conclusion, Latvia offers a compelling proposition for businesses seeking to obtain trading licenses in the forex, finance, and cryptocurrency sectors. The country’s robust regulatory framework, coupled with its strategic location within the European Union, provides a solid foundation for companies looking to expand their operations in these dynamic markets. By carefully navigating the licensing requirements and leveraging local expertise, businesses can position themselves for success in the competitive world of financial services and digital assets.

FAQs

- How long does it typically take to obtain a trading license in Latvia?

The process usually takes 6-12 months, depending on the license type and completeness of the application. - Can non-EU residents apply for a Latvian trading license?

Yes, non-EU residents can apply, but additional documentation and due diligence may be required. - Are there any ongoing capital requirements for licensed entities in Latvia?

Yes, licensed entities must maintain minimum capital requirements and submit regular financial reports to the regulator. - Can a Latvian trading license be used to operate in other EU countries?

Yes, under EU passporting rules, firms can provide services across the EU with a Latvian license. - What are the key challenges in maintaining a trading license in Latvia?

Ongoing compliance with evolving regulations and maintaining adequate risk management systems are the primary challenges.