Deciding whether to lease or buy a car is a significant financial decision that can impact your budget, lifestyle, and long-term financial health. Each option comes with its own set of advantages and disadvantages, making it essential to analyze both thoroughly. This article aims to provide a comprehensive overview of the pros and cons of leasing versus buying a car, focusing on how these choices relate to broader financial principles relevant to individuals interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Lower monthly payments | No ownership at the end of the lease |

| Access to newer models frequently | Potential mileage restrictions |

| Lower upfront costs | Fees for excess wear and tear |

| Warranty coverage during lease term | Long-term costs may exceed buying |

| No hassle of selling the vehicle later | Customization limitations |

| Tax benefits for business use | Complex lease agreements and terms |

| Predictable monthly expenses | Potential penalties for early termination |

| Less depreciation risk | Possible high insurance costs due to leasing terms |

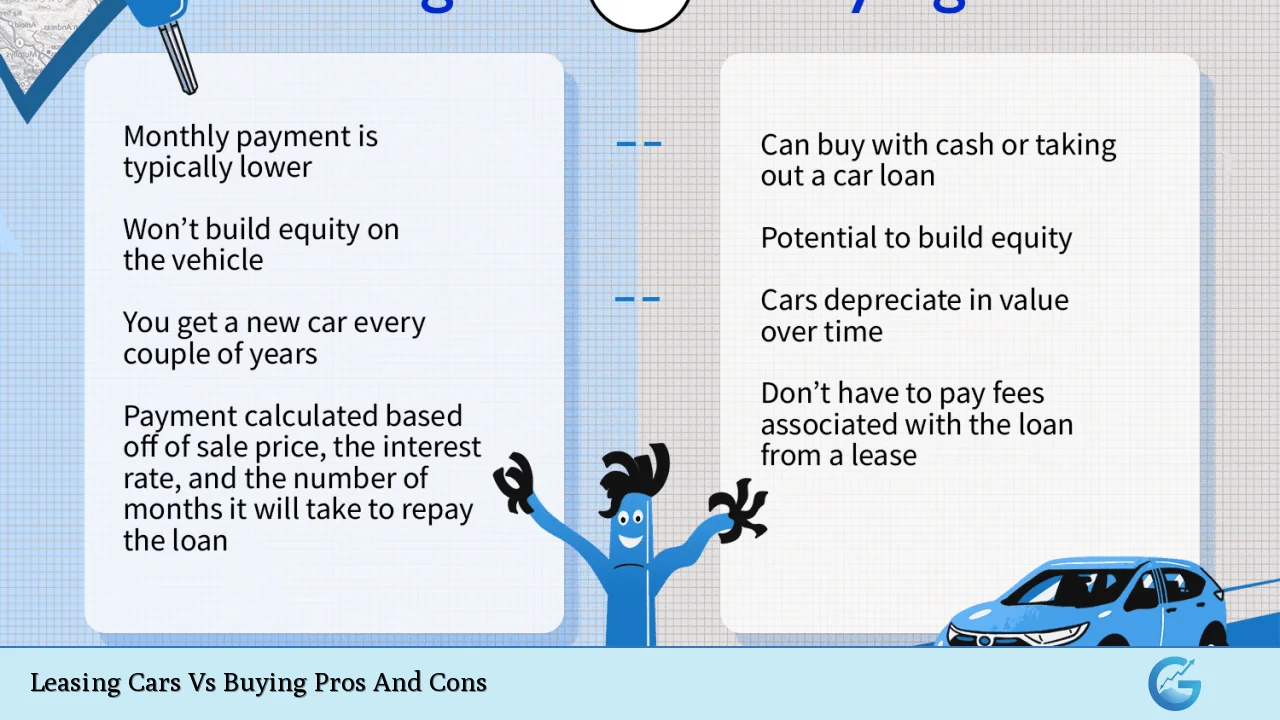

Lower Monthly Payments

One of the most attractive aspects of leasing a car is the lower monthly payment compared to buying.

- Affordability: Leasing allows you to drive a more expensive vehicle than you might be able to afford if you were purchasing it outright.

- Cash Flow Management: Lower payments can help maintain better cash flow, which is crucial for individuals managing multiple investments or expenses.

No Ownership at the End of the Lease

While leasing offers lower payments, it does not lead to ownership.

- No Asset Accumulation: At the end of the lease term, you must return the vehicle without any equity built up.

- Long-Term Financial Implications: For those looking to build assets over time, leasing may not align with their financial goals.

Access to Newer Models Frequently

Leasing allows individuals to drive new cars every few years.

- Latest Technology: Leasing means you can take advantage of the latest automotive technology and safety features without committing long-term.

- Avoiding Older Models: This is particularly appealing in industries where having reliable and modern transportation is essential.

Potential Mileage Restrictions

Leases often come with mileage limits that can restrict your driving habits.

- Standard Limits: Most leases allow for 10,000 to 15,000 miles per year. Exceeding this limit can result in costly penalties.

- Impact on Usage: If you rely on your vehicle for extensive travel or work purposes, this could be a significant drawback.

Lower Upfront Costs

Leasing typically requires less money upfront than buying.

- No Large Down Payment: Many leases require little or no down payment, making it easier for individuals to get into a new car without substantial initial investment.

- Budget-Friendly Options: This can be particularly beneficial for those managing tight budgets or looking to allocate funds elsewhere in their finances.

Fees for Excess Wear and Tear

While leasing avoids some maintenance issues, it can also lead to additional fees.

- Condition Expectations: Leased vehicles must be returned in good condition; otherwise, you may incur charges for excessive wear and tear.

- Financial Planning: It’s essential to factor these potential costs into your overall budget when considering leasing.

Warranty Coverage During Lease Term

Most leases coincide with the manufacturer’s warranty period.

- Reduced Repair Costs: Since most repairs are covered under warranty during the lease term, this can lead to lower overall maintenance expenses.

- Peace of Mind: This aspect alleviates concerns about unexpected repair bills that can arise with older vehicles.

Long-Term Costs May Exceed Buying

Though leasing offers short-term savings, it may not be cost-effective over time.

- Cumulative Payments: Over several lease cycles, total payments may exceed what you would have spent if you bought a car and kept it long-term.

- Financial Strategy Consideration: For those focused on long-term financial health, purchasing might be more advantageous.

No Hassle of Selling the Vehicle Later

At the end of a lease term, returning the vehicle is straightforward.

- No Resale Anxiety: You avoid the complications associated with selling a used car, such as depreciation concerns and finding buyers.

- Simplified Transition: This makes leasing appealing for those who prefer simplicity in their vehicle management.

Customization Limitations

Leased vehicles often come with restrictions on modifications.

- Standardization Requirements: You typically cannot make significant changes to a leased vehicle without permission from the leasing company.

- Personalization Restrictions: For individuals who enjoy customizing their vehicles, this could be a significant disadvantage.

Tax Benefits for Business Use

Leasing can offer tax advantages for business owners.

- Deductible Expenses: If used for business purposes, lease payments may be tax-deductible as business expenses.

- Financial Incentives: This can enhance cash flow management and reduce overall tax liabilities for self-employed individuals or business owners.

Complex Lease Agreements and Terms

Leasing contracts can be intricate and difficult to navigate.

- Understanding Terms: It’s crucial to fully understand all aspects of a lease agreement before signing. Misunderstandings can lead to unexpected costs.

- Legal Considerations: Engaging with a financial advisor or legal expert may be necessary to ensure clarity on obligations and rights under the lease agreement.

Predictable Monthly Expenses

Leasing provides predictable monthly payments that assist in budgeting.

- Fixed Costs: Knowing your payment amount each month aids in financial planning and helps avoid surprises.

- Budget Stability: This predictability is especially beneficial for those managing multiple financial commitments or investments in volatile markets like crypto or forex.

Less Depreciation Risk

Leasing mitigates concerns related to vehicle depreciation.

- No Immediate Value Loss: When you lease, you don’t bear the immediate depreciation hit that comes with buying a new car.

- Financial Safety Net: This aspect can provide peace of mind in uncertain economic climates where asset values fluctuate significantly.

In conclusion, choosing between leasing and buying a car involves weighing various factors that align with your financial goals. Leasing offers lower upfront costs and monthly payments but lacks ownership benefits. Conversely, buying provides long-term asset accumulation but requires higher initial investment. Understanding these pros and cons will empower you to make an informed decision that suits your lifestyle and financial strategy effectively.

Frequently Asked Questions About Leasing Cars Vs Buying

- Is it cheaper to lease or buy a car?

The cheaper option depends on your financial situation; leasing generally has lower monthly payments but does not build equity. - What happens at the end of a car lease?

You return the vehicle; you may have options to purchase it or lease another vehicle. - Can I customize my leased car?

No significant modifications are typically allowed without permission from the leasing company. - Are there mileage limits on leased cars?

Yes, most leases have mileage restrictions; exceeding them incurs additional fees. - What are common fees associated with leasing?

You may face charges for excess mileage, wear and tear beyond normal limits, or early termination. - Can I deduct lease payments on my taxes?

If used for business purposes, lease payments may be deductible as business expenses. - What should I consider before leasing?

You should evaluate your driving habits, budget constraints, and whether you prefer ownership. - How do I decide between leasing and buying?

Consider your long-term financial goals, driving needs, and how often you want a new vehicle.