Leasing is a popular financing option that allows individuals and businesses to use assets without the burdens of ownership. This method is commonly utilized for vehicles, equipment, and real estate, providing flexibility and financial advantages. However, it also comes with its own set of challenges and limitations. Understanding the pros and cons of leasing is crucial for making informed decisions in finance, particularly in sectors like automotive, equipment procurement, and commercial real estate. This article explores the various advantages and disadvantages of leasing, offering insights into how it affects cash flow, asset management, and overall financial strategy.

| Pros | Cons |

|---|---|

| Lower Initial Costs | No Ownership or Equity |

| Flexible Terms | Potential for Higher Long-Term Costs |

| Access to Latest Technology | Restrictions on Usage |

| Tax Benefits | Penalties for Early Termination |

| Easier Maintenance Management | Limited Customization Options |

| Improved Cash Flow Management | Potential for Additional Fees |

| Predictable Monthly Payments | Risk of Obsolescence |

| No Depreciation Concerns | Limited Control Over Asset Disposal |

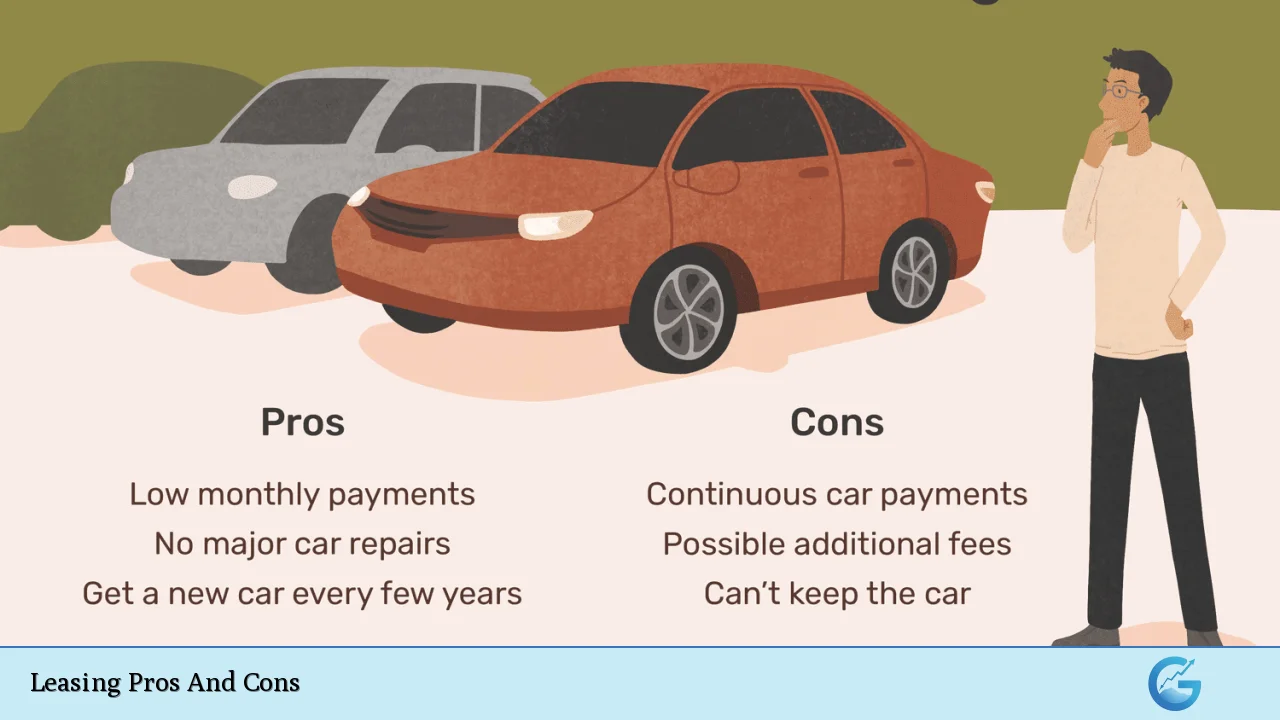

Lower Initial Costs

One of the most significant advantages of leasing is the lower initial costs associated with it.

- Minimal Down Payment: Leasing typically requires a smaller down payment compared to purchasing an asset outright.

- Lower Monthly Payments: Monthly lease payments are often lower than loan payments for buying an asset, making it easier to manage cash flow.

This aspect makes leasing particularly attractive for individuals or businesses looking to conserve capital while still accessing necessary assets.

No Ownership or Equity

On the flip side, leasing means you do not own the asset.

- No Asset Accumulation: At the end of a lease term, you have no ownership stake or equity in the asset.

- Continuous Payments: Leasing can lead to a cycle where you continuously make payments without ever owning anything.

This lack of ownership can be a disadvantage for those who prefer building equity over time.

Flexible Terms

Leasing agreements often come with flexible terms that can be tailored to fit specific needs.

- Customizable Agreements: Lease terms can often be negotiated to suit the lessee’s requirements regarding duration and payment structure.

- Easier Upgrades: Businesses can frequently upgrade their leased assets without significant financial strain.

This flexibility is advantageous for companies that require adaptability in their operations.

Potential for Higher Long-Term Costs

While leasing may seem cost-effective initially, it can become more expensive over time.

- Cumulative Payments: Over the duration of multiple leases, total payments may exceed the cost of purchasing an asset outright.

- Ongoing Financial Commitment: Continuous leasing can lead to an indefinite financial commitment without any return on investment.

Understanding this potential long-term cost is vital when considering leasing versus buying.

Access to Latest Technology

Leasing provides access to newer technologies without the burden of ownership.

- Stay Updated: Lessees can take advantage of the latest advancements in technology by upgrading at the end of each lease term.

- Reduced Obsolescence Risk: This is particularly beneficial in fast-paced industries where technology evolves rapidly.

However, this benefit comes with the trade-off of not having control over the asset once the lease ends.

Restrictions on Usage

Leasing agreements often come with specific restrictions that can limit how an asset is used.

- Mileage Limits: For vehicles, leases typically impose mileage limits, with fees incurred for exceeding them.

- Usage Restrictions: Certain leases may restrict modifications or alterations to the asset, limiting operational flexibility.

These restrictions can be a significant drawback for businesses that require extensive use or customization of their assets.

Tax Benefits

Leasing can offer various tax advantages that make it financially appealing.

- Tax Deductions: Lease payments are often fully tax-deductible as business expenses, which can reduce taxable income.

- Depreciation Benefits: Unlike purchased assets, leased assets do not require depreciation accounting on the lessee’s books.

These benefits can enhance cash flow management and overall financial strategy.

Penalties for Early Termination

Ending a lease agreement prematurely can lead to significant penalties.

- Financial Penalties: Most leases include clauses that impose fees for early termination, which can be costly.

- Commitment Issues: This creates a potential risk if business needs change unexpectedly during the lease term.

Understanding these penalties is essential when evaluating leasing options against potential future business changes.

Easier Maintenance Management

Leasing often simplifies maintenance responsibilities for lessees.

- Maintenance Included: Many lease agreements include maintenance services as part of the contract, reducing operational burdens.

- Predictable Costs: This arrangement allows businesses to budget more effectively without worrying about unexpected repair costs.

However, this advantage may come at a higher overall cost compared to managing maintenance independently on owned assets.

Limited Customization Options

Leased assets typically come with restrictions on customization and modifications.

- Standardized Equipment: Lessees may have limited options when it comes to tailoring equipment or vehicles to specific operational needs.

- Compliance Issues: Any modifications may need prior approval from the lessor, complicating operational flexibility.

This limitation can hinder businesses that thrive on unique operational setups or branding requirements.

Improved Cash Flow Management

Leasing allows businesses to manage their cash flow more effectively by spreading out payments over time.

- Predictable Expenses: Fixed monthly payments help businesses forecast expenses accurately.

- Capital Preservation: Leasing conserves capital that can be allocated toward other investments or operational needs.

This aspect makes leasing an attractive option for startups and growing companies looking to maintain liquidity while acquiring necessary assets.

Potential for Additional Fees

While leasing offers many benefits, there are also potential additional fees that lessees should consider.

- Wear-and-Tear Charges: Lessees may face charges for excess wear and tear beyond normal usage limits.

- Administrative Fees: Some leases include hidden administrative fees that can add up over time if not accounted for upfront.

Being aware of these potential costs is crucial for accurate financial planning when considering leasing options.

Risk of Obsolescence

In rapidly evolving industries, leased assets may become obsolete quickly due to technological advancements.

- Dependence on Lessor’s Offerings: Lessees rely on lessors to provide updated models or technology options at the end of their lease term.

- Market Changes: If market demands shift significantly during a lease period, lessees might find themselves stuck with outdated equipment or vehicles until they can renegotiate terms or upgrade options become available.

Understanding this risk is vital for companies in tech-driven markets where staying current is critical for competitiveness.

Limited Control Over Asset Disposal

At the end of a lease term, lessees have limited control over what happens next with the asset.

- Return Obligations: Lessees must return leased items in good condition or face additional fees.

- No Ownership Rights: Unlike purchased assets that can be sold or repurposed, leased items revert fully to the lessor without any residual value accruing to the lessee.

This lack of control can be frustrating for businesses looking to maximize their investment in equipment or vehicles over time.

In conclusion, leasing presents both significant advantages and notable drawbacks. It offers lower initial costs, access to modern technology, flexible terms, and potential tax benefits. However, it also entails risks such as lack of ownership equity, potential long-term costs exceeding purchase prices, restrictions on usage and customization options, and penalties associated with early termination. Businesses and individuals must carefully weigh these factors against their specific needs and financial situations before deciding whether leasing is the right choice for them.

Frequently Asked Questions About Leasing Pros And Cons

- What are the main advantages of leasing?

The primary advantages include lower initial costs, predictable monthly payments, access to newer technology without ownership burdens, and potential tax deductions. - What are some disadvantages associated with leasing?

The main disadvantages include lack of ownership equity, potential long-term costs being higher than purchasing outright, restrictions on usage and customization options. - How does leasing affect cash flow management?

Leasing helps improve cash flow management by spreading out payments over time and allowing businesses to preserve capital for other investments. - Are there tax benefits related to leasing?

Yes, lease payments are generally tax-deductible as business expenses which can reduce taxable income. - What happens if I exceed my mileage limit on a leased vehicle?

If you exceed your mileage limit on a leased vehicle, you will incur additional fees based on your lease agreement. - Can I customize a leased asset?

Customization options are typically limited in leased agreements; any modifications usually require approval from the lessor. - What are penalties for early termination of a lease?

Most leases impose financial penalties if terminated early which could lead to unexpected costs. - Is leasing more suitable for businesses than individuals?

This depends on individual circumstances; however, many businesses find leasing beneficial due to cash flow considerations while individuals may prefer ownership.