Leasing a vehicle has become an increasingly popular option for individuals and businesses alike, particularly in a fast-paced financial landscape where flexibility and cost-effectiveness are paramount. This arrangement allows consumers to drive a new vehicle without the long-term commitment of ownership, making it an attractive alternative to buying. However, like any financial decision, leasing comes with its own set of advantages and disadvantages that potential lessees must consider carefully. This article will delve into the pros and cons of leasing vehicles, providing a comprehensive overview to help you make an informed decision.

| Pros | Cons |

|---|---|

| Lower monthly payments | No ownership of the vehicle |

| Access to newer models | Potential mileage restrictions |

| Worry-free maintenance | Fees for excess wear and tear |

| No resale hassle | Long-term costs can be higher |

| Tax benefits for businesses | Limited customization options |

| Fixed costs for budgeting | Early termination penalties |

| Inclusion of road tax in payments | Potential credit score impact |

| Flexibility in contract terms | Complexity of lease agreements |

Lower Monthly Payments

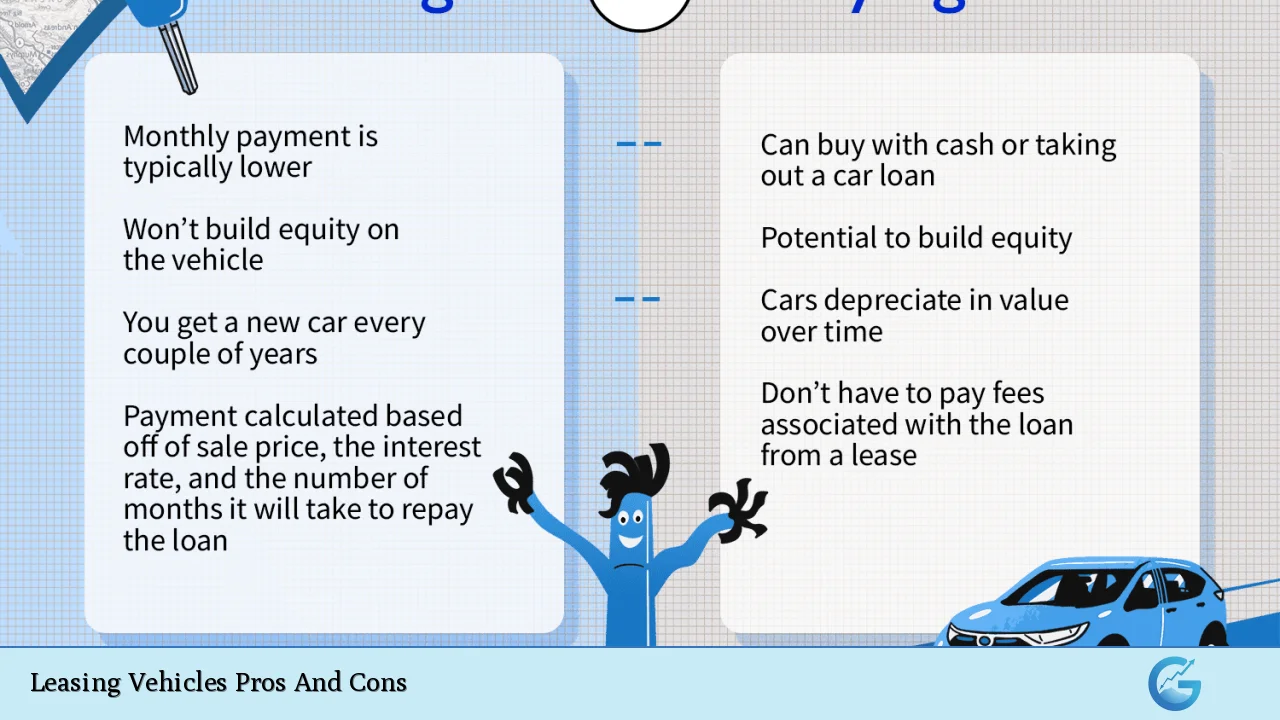

One of the most significant advantages of leasing a vehicle is the lower monthly payments compared to financing a purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term rather than its full purchase price. This means that lessees can often afford to drive more expensive or luxurious vehicles than they might be able to if they were buying outright.

- Affordability: Lower payments allow for better cash flow management.

- Budgeting: Fixed monthly payments make it easier to plan finances.

Access to Newer Models

Leasing allows individuals to drive a new car every few years, keeping them up-to-date with the latest technology and safety features. This is particularly appealing to those who prioritize having the newest models.

- Latest Features: Regular access to advanced technology and improved fuel efficiency.

- Brand Loyalty: Leasing can foster brand loyalty as consumers may prefer newer models from the same manufacturer.

Worry-Free Maintenance

Many lease agreements include maintenance packages that cover routine services and repairs, which can alleviate concerns about unexpected expenses.

- Warranty Coverage: Most leased vehicles are under warranty for the duration of the lease, reducing repair costs.

- Predictable Expenses: Knowing that maintenance is covered helps in budgeting overall vehicle costs.

No Resale Hassle

At the end of a lease term, lessees simply return the vehicle without worrying about selling it or dealing with depreciation.

- Convenience: Eliminates the stress associated with selling a used car.

- Time-Saving: No need to advertise or negotiate sales prices.

Tax Benefits for Businesses

For business owners, leasing can offer significant tax advantages. The IRS allows businesses to deduct lease payments as a business expense, which can lead to substantial savings.

- Depreciation Deductions: Businesses can deduct both depreciation and financing costs.

- Cash Flow Management: Lease payments can be more easily managed as operational expenses.

Fixed Costs for Budgeting

Leasing typically involves fixed monthly payments that do not fluctuate throughout the term of the lease. This predictability is beneficial for personal and business budgeting.

- Financial Planning: Easier to allocate funds when costs are stable.

- Avoiding Surprises: Reduces anxiety about fluctuating expenses associated with ownership.

Inclusion of Road Tax in Payments

Many leasing agreements include road tax (Vehicle Excise Duty) within the monthly payment structure, simplifying financial management for lessees.

- Simplicity: One less bill to manage each month.

- Cost Transparency: Clear understanding of total monthly expenses related to vehicle use.

Flexibility in Contract Terms

Leasing contracts often allow for customization based on individual needs, such as mileage limits and duration of the lease. This flexibility can cater specifically to personal or business requirements.

- Tailored Agreements: Choose terms that best fit your driving habits and financial situation.

- Options for Renewal: Many leases offer options to purchase or renew at the end of the term.

No Ownership of the Vehicle

A significant downside of leasing is that at no point does the lessee own the vehicle. This lack of ownership means that all payments contribute only toward usage rather than equity in an asset.

- Asset Limitation: Lessees cannot sell or trade-in their vehicle for value at lease end.

- No Long-term Investment: Unlike purchasing, leasing does not build equity over time.

Potential Mileage Restrictions

Most leases come with mileage limits (typically around 10,000 to 15,000 miles per year). Exceeding these limits can result in hefty fees at the end of the lease term.

- Driving Limitations: May not be suitable for individuals who drive long distances regularly.

- Extra Costs: Fees for excess mileage can add up quickly if not monitored closely.

Fees for Excess Wear and Tear

Lessee responsibilities often include maintaining the vehicle’s condition. Any damage beyond normal wear and tear may incur additional fees upon returning the vehicle.

- Costly Repairs: Lessees may face unexpected charges for minor damages or excessive wear.

- Condition Standards: Understanding what constitutes “normal” wear is crucial to avoid penalties.

Long-Term Costs Can Be Higher

While leasing may seem cheaper initially due to lower monthly payments, over time it can become more expensive than buying a car outright, especially if one continues leasing indefinitely.

- Cumulative Payments: Continual leasing leads to ongoing payments without ever owning an asset.

- Higher Total Cost: Over many years, leasing multiple vehicles may exceed the cost of purchasing one vehicle outright.

Limited Customization Options

Leased vehicles must generally remain in their original condition without modifications. This restriction can be frustrating for those who wish to personalize their cars.

- Modification Restrictions: Lessees cannot alter vehicles without incurring fees or penalties upon return.

- Standardization: Limited ability to make a leased car feel uniquely yours may deter some buyers from leasing options.

Early Termination Penalties

Ending a lease before its term concludes usually results in significant penalties. Lessees should be aware of these potential costs before signing an agreement.

- Financial Burden: Early termination fees can be substantial and should be considered carefully when planning finances.

- Contractual Obligations: Understanding all terms before entering into an agreement is essential to avoid unexpected costs later on.

Potential Credit Score Impact

Leasing often requires a credit check, which means individuals with poor credit may find it challenging to secure favorable terms or even qualify at all.

- Credit Requirements: High credit scores are typically necessary for good leasing deals, limiting options for those with lower scores.

- Financial Flexibility: Poor credit can restrict access not only to leases but also affect other financial opportunities like loans or mortgages.

In conclusion, leasing vehicles presents both compelling advantages and notable disadvantages that require careful consideration. The decision ultimately hinges on individual financial circumstances, driving habits, and personal preferences regarding vehicle ownership.

Those who prioritize lower monthly payments and access to new technology may find leasing particularly appealing. Conversely, individuals who prefer long-term investment in assets or those who drive extensively might lean towards purchasing a vehicle outright. Understanding these dynamics will empower consumers to make informed choices that align with their financial goals and lifestyle needs.

Frequently Asked Questions About Leasing Vehicles Pros And Cons

- What are the main advantages of leasing a vehicle?

The main advantages include lower monthly payments, access to newer models every few years, worry-free maintenance coverage, and no resale hassle. - What are some common disadvantages associated with leasing?

The disadvantages include no ownership at the end of the lease term, potential mileage restrictions leading to extra fees, and higher long-term costs compared to buying. - Can businesses benefit from leasing vehicles?

Yes, businesses can benefit from tax deductions on lease payments as well as predictable budgeting due to fixed monthly costs. - Are there mileage limits on leased vehicles?

Most leases come with mileage limits; exceeding these limits typically incurs additional charges. - What happens if I want to terminate my lease early?

If you terminate your lease early, you will likely face significant penalties which could include paying off remaining lease payments. - Is there any flexibility in lease agreements?

Yes, many leases offer customizable terms such as contract length and mileage allowances tailored to individual needs. - How do I know if leasing is right for me?

Consider your driving habits, budget constraints, and whether you prefer owning an asset versus enjoying newer models periodically. - What should I watch out for when leasing?

You should watch out for hidden fees related to excess wear and tear, mileage overages, and ensure you fully understand your contractual obligations before signing.