Life insurance is a crucial financial instrument that provides peace of mind and financial security for families in the event of an untimely death. However, the way in which life insurance is structured can significantly affect its benefits and implications for beneficiaries. One common strategy is placing life insurance policies in trust. This article explores the pros and cons of life insurance in trust, providing a comprehensive overview for individuals interested in finance, including those involved in crypto, forex, and money markets.

Understanding Life Insurance in Trust

When a life insurance policy is placed in trust, the ownership of the policy is transferred to a trust, which is managed by a trustee on behalf of the beneficiaries. This arrangement can have significant implications for how the policy’s death benefits are handled and distributed.

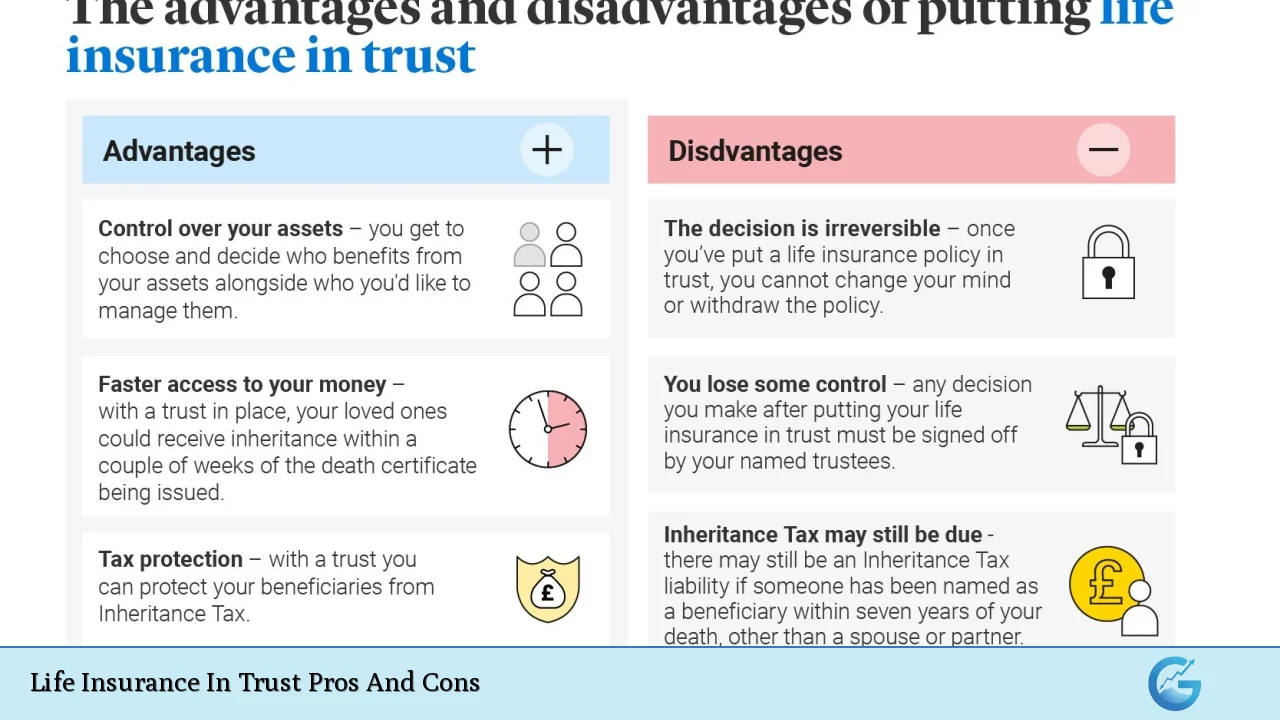

The primary motivations for putting life insurance into a trust often include:

- Avoiding probate: The assets held in trust do not go through the probate process, allowing beneficiaries to receive funds more quickly.

- Reducing estate taxes: By removing the policy from the insured’s estate, beneficiaries may avoid substantial inheritance tax liabilities.

- Control over distribution: The grantor can specify how and when beneficiaries receive their payouts.

However, these advantages come with potential drawbacks that warrant careful consideration.

| Pros | Cons |

|---|---|

| No inheritance tax on payouts | Loss of control over the policy |

| Quicker payouts to beneficiaries | Legal and tax implications |

| Protection from creditors | Costs associated with setting up the trust |

| Flexibility in distribution terms | Complexity and potential for errors |

| Potential government benefit protection for beneficiaries | Irrevocability of certain trusts |

Advantages of Life Insurance in Trust

No Inheritance Tax on Payouts

One of the most significant advantages of placing life insurance in trust is that it can help beneficiaries avoid inheritance tax. When a life insurance policy is owned by an individual, its value is included in their estate upon death. If the total value exceeds a certain threshold (e.g., $13.61 million federally in 2024), it may be subject to a 40% inheritance tax. By transferring ownership to a trust, the policy’s value is excluded from the estate, allowing beneficiaries to receive the full payout without tax deductions.

Quicker Payouts to Beneficiaries

Life insurance policies held in trust typically allow for faster access to funds compared to those that go through probate. The probate process can take months or even years, delaying financial support for loved ones during a difficult time. With a trust, once the necessary documentation (such as a death certificate) is provided, trustees can quickly distribute funds according to the terms set forth in the trust agreement.

Protection from Creditors

Another benefit of placing life insurance in trust is that it can protect the proceeds from creditors. If an individual has outstanding debts at the time of their death, creditors may attempt to claim against any assets within their estate. However, funds held within a properly structured trust are generally shielded from these claims, ensuring that beneficiaries receive their intended inheritance.

Flexibility in Distribution Terms

Trusts offer flexibility regarding how and when payouts are made. For instance, a grantor can stipulate that funds be distributed only when beneficiaries reach a certain age or achieve specific milestones (like graduating from college). This control can be particularly beneficial if beneficiaries are minors or if there are concerns about their financial management skills.

Potential Government Benefit Protection for Beneficiaries

For beneficiaries who receive government benefits (like Medicaid), having life insurance proceeds held in trust can help maintain their eligibility. By carefully structuring distributions—such as avoiding direct cash payments for necessities—trusts can provide financial support without jeopardizing access to critical benefits.

Disadvantages of Life Insurance in Trust

Loss of Control Over the Policy

One significant downside of placing life insurance into a trust is that it often results in loss of control over the policy. Once ownership is transferred to a trust, the grantor cannot unilaterally make changes or withdraw the policy without trustee approval. This irrevocability means careful consideration must be given before establishing such arrangements.

Legal and Tax Implications

Setting up a life insurance trust involves navigating complex legal and tax considerations. There may be ongoing administrative responsibilities associated with managing the trust, including filing tax returns if applicable. Additionally, if not properly structured or maintained, there could be unintended tax consequences that negate some of the intended benefits.

Costs Associated with Setting Up the Trust

Creating a life insurance trust typically incurs costs related to legal fees and possibly ongoing trustee fees. Depending on complexity, establishing an irrevocable life insurance trust (ILIT) could cost several thousand dollars. While some insurers offer assistance with setting up trusts at no charge, others may require professional services that add to overall expenses.

Complexity and Potential for Errors

The process of establishing and managing a life insurance trust can be complicated. Misunderstanding terms or failing to comply with legal requirements could lead to errors that invalidate the trust or create unexpected tax liabilities. It’s essential for individuals considering this option to seek professional advice from estate planning attorneys or financial advisors who specialize in trusts.

Irrevocability of Certain Trusts

Many trusts established for life insurance purposes are irrevocable—meaning they cannot be altered once set up. This lack of flexibility can pose challenges if personal circumstances change or if there’s a need to adjust beneficiary designations or other terms due to evolving family dynamics or financial situations.

Conclusion

Life insurance in trust presents both significant advantages and notable disadvantages that must be carefully weighed by individuals considering this option as part of their estate planning strategy. On one hand, it offers benefits like avoiding inheritance tax, ensuring quicker payouts, protecting assets from creditors, and providing control over distributions. On the other hand, potential drawbacks include loss of control over policy changes, legal complexities, associated costs, and irrevocability issues.

Ultimately, whether placing life insurance into a trust is appropriate will depend on individual circumstances and goals. Consulting with financial advisors or estate planning professionals is highly recommended to tailor solutions that best meet one’s unique needs while minimizing risks.

Frequently Asked Questions About Life Insurance In Trust

- What happens if I die shortly after putting my life insurance policy into a trust?

If you die within three years after transferring your policy into an irrevocable trust, its value may still be included in your taxable estate. - Can I change my mind after putting my life insurance into a trust?

Generally speaking, once an irrevocable life insurance trust is established, you cannot make changes without trustee consent. - How do I choose trustees for my life insurance trust?

Select individuals who are trustworthy and capable of managing finances; consider professional trustees if necessary. - Are there any tax benefits associated with putting my life insurance into a trust?

Yes, it can help reduce or eliminate estate taxes by keeping the policy’s value outside your taxable estate. - What types of trusts can hold life insurance policies?

The most common types are irrevocable life insurance trusts (ILITs) and revocable living trusts. - How quickly can my beneficiaries access funds from a life insurance policy held in trust?

Payouts are typically available within weeks after providing necessary documentation like a death certificate. - Can I use my life insurance policy as collateral for loans if it’s in a trust?

This depends on the terms set forth by your trustee; usually such arrangements require trustee approval. - Is setting up a life insurance trust complicated?

Yes, it involves legal complexities; seeking professional guidance is advisable.