Life insurance has long been regarded primarily as a safety net for families, ensuring financial security in the event of an untimely death. However, many policies, particularly permanent life insurance types, also incorporate an investment component that can serve as a financial tool for wealth accumulation. This dual function raises questions about whether life insurance is a viable investment strategy. In this article, we will explore the pros and cons of using life insurance as an investment vehicle, providing a comprehensive analysis for those interested in finance, crypto, forex, and money markets.

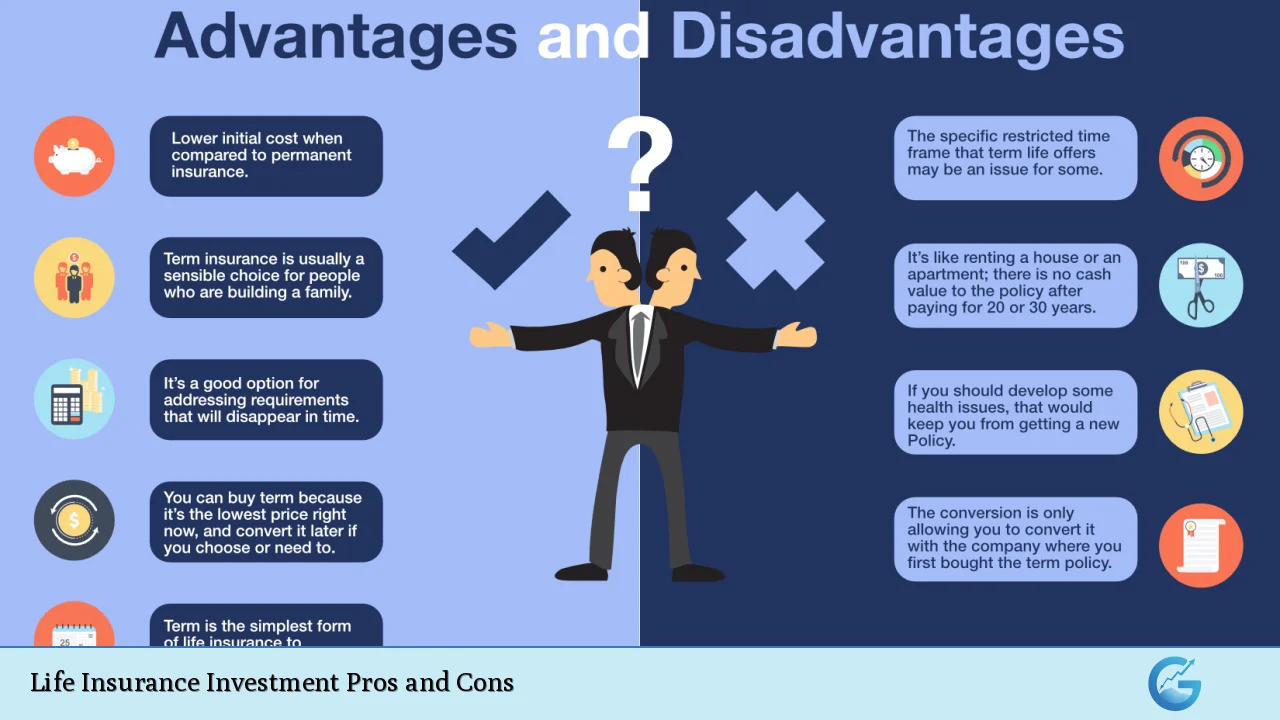

| Pros | Cons |

|---|---|

| Tax-deferred growth on cash value | Higher premiums compared to term life insurance |

| Guaranteed lifelong coverage | Complex policy structures and terms |

| Access to cash value during the policyholder’s lifetime | Potentially lower returns than traditional investments |

| Tax-free death benefit for beneficiaries | Fees and commissions can reduce overall returns |

| Flexible premium payments in some policies | Possibility of policy lapse if premiums are not maintained |

Tax-Deferred Growth on Cash Value

One of the most significant advantages of permanent life insurance policies is the tax-deferred growth of the cash value component.

- Tax Benefits: The cash value accumulates without immediate tax implications, allowing for potentially greater growth over time compared to taxable accounts.

- Financial Flexibility: Policyholders can access this cash value through loans or withdrawals, providing a source of funds for emergencies or investments.

However, it is crucial to note that withdrawals beyond the total premiums paid may incur taxes.

Guaranteed Lifelong Coverage

Permanent life insurance offers lifelong coverage as long as premiums are paid.

- Security for Beneficiaries: This ensures that beneficiaries will receive a death benefit regardless of when the policyholder passes away.

- Peace of Mind: Knowing that your loved ones will be financially secure can provide significant emotional comfort.

On the downside, this guarantee comes at a cost; premiums are typically higher than those for term life insurance.

Access to Cash Value During the Policyholder’s Lifetime

The ability to access cash value during one’s lifetime can be a compelling reason to consider life insurance as an investment.

- Loan Options: Policyholders can take out loans against their cash value for various needs without undergoing credit checks.

- Supplementing Retirement Income: This feature can be particularly beneficial in retirement when additional income may be required.

However, any outstanding loans will reduce the death benefit if not repaid, which could leave beneficiaries with less financial support than intended.

Tax-Free Death Benefit for Beneficiaries

Life insurance provides a significant advantage in estate planning due to its tax-free death benefit.

- Estate Planning Tool: This feature allows individuals to pass on wealth without incurring estate taxes on the death benefit amount.

- Financial Security: Beneficiaries receive the full amount without deductions, ensuring they have adequate funds to manage expenses after the policyholder’s death.

Despite these benefits, it is essential to consider how other assets in an estate may be taxed differently, which could affect overall financial planning.

Flexible Premium Payments in Some Policies

Certain permanent life insurance policies offer flexibility in premium payments.

- Adjustable Premiums: Some policies allow policyholders to adjust their premium payments based on changing financial circumstances or needs.

- Customization Options: This adaptability can help individuals manage their budgets while still maintaining coverage.

However, it is important to understand that failing to pay premiums can lead to policy lapse or reduced benefits, which could jeopardize the intended financial security.

Higher Premiums Compared to Term Life Insurance

While permanent life insurance offers numerous benefits, one of its most significant drawbacks is its cost.

- Affordability Issues: The higher premiums associated with permanent policies can strain budgets, especially in the early years when cash flow may be tighter.

- Cost vs. Benefit Analysis: For many individuals, particularly younger ones or those with limited disposable income, purchasing term life insurance and investing the difference elsewhere may provide better overall returns.

Complex Policy Structures and Terms

Life insurance investment products can be complex and difficult to understand fully.

- Understanding Terms: The intricacies involved in different types of policies (whole life, universal life, variable life) require careful consideration and understanding of terms and conditions.

- Need for Professional Guidance: Many individuals may need assistance from financial advisors or insurance agents to navigate these complexities effectively.

This complexity can deter potential investors who might prefer more straightforward investment options.

Potentially Lower Returns Than Traditional Investments

While life insurance policies offer some investment features, they often yield lower returns compared to traditional investment vehicles like stocks or mutual funds.

- Investment Performance: The cash value growth rates are generally conservative and may not keep pace with inflation or market performance over time.

- Opportunity Cost: Individuals who invest heavily in life insurance may miss out on higher returns available through other investment avenues such as retirement accounts or brokerage accounts.

It is essential for investors to weigh these potential returns against their overall investment strategy and risk tolerance.

Fees and Commissions Can Reduce Overall Returns

Life insurance products often come with various fees and commissions that can impact overall returns significantly.

- Impact on Cash Value Growth: High fees associated with policy management and agent commissions can diminish the cash value accumulation over time.

- Transparency Issues: Many consumers are unaware of these costs when purchasing policies, leading to dissatisfaction later when they realize their expected returns are not being met.

Understanding all associated costs upfront is crucial for making informed decisions regarding life insurance investments.

Possibility of Policy Lapse If Premiums Are Not Maintained

Another disadvantage of life insurance investment is the risk of policy lapse if premiums are not consistently paid.

- Loss of Coverage: If a policyholder fails to make premium payments on time, they risk losing coverage altogether.

- Reduced Benefits: Lapsed policies typically result in forfeited benefits that were intended for beneficiaries or as part of retirement planning strategies.

This risk highlights the importance of maintaining a budget that accommodates ongoing premium payments while balancing other financial commitments.

In conclusion, investing in life insurance presents both advantages and disadvantages that must be carefully considered. While it offers unique benefits such as tax-deferred growth and guaranteed coverage, it also poses challenges like higher costs and complex structures. Individuals interested in integrating life insurance into their financial strategies should conduct thorough research and consult with financial professionals to ensure alignment with their long-term goals.

Frequently Asked Questions About Life Insurance Investment Pros and Cons

- What types of life insurance are best for investment?

The best types for investment purposes are whole life and universal life policies due to their cash value components. - Can I access my cash value without penalties?

You can withdraw from your cash value but must consider potential tax implications if you exceed your total premium payments. - Is term life better than whole life?

This depends on individual needs; term offers lower premiums but no cash value accumulation compared to whole life. - Are there tax advantages with life insurance investments?

Yes, both cash value growth and death benefits are generally tax-deferred or tax-free under certain conditions. - How does inflation affect cash value growth?

If cash value growth does not outpace inflation rates, the purchasing power of accumulated funds may diminish over time. - What happens if I stop paying my premiums?

If premiums are not maintained, your policy may lapse, resulting in loss of coverage and benefits. - Can I borrow against my policy?

You can borrow against your cash value; however, unpaid loans will reduce your death benefit. - Is investing in life insurance worth it?

This varies by individual; those seeking lifelong coverage with a savings component might find it beneficial compared to those focused solely on investments.